Option : Leave Your Money Where It Is

Usually, if your 401 has more than $5,000 in it, most employers will allow you to leave your money where it is. If youve been happy with your investment options and the plan has low fees, this might be a tempting offer. Before you decide, compare your old plan with any retirement plans offered at your new job or with an IRA of your own.

Your new employer-sponsored plan might have more limitations on it than your previous plan or other available options. Maybe there are fewer investment choices/options. Maybe it doesnt have an employer match or higher management fees. So youll want to look closely.

Also consider how often you tend to stay at jobs. If you change jobs every few years, you could end up with a trail of 401 plans at all the different places youve worked. Consolidating might be easier in the long run.

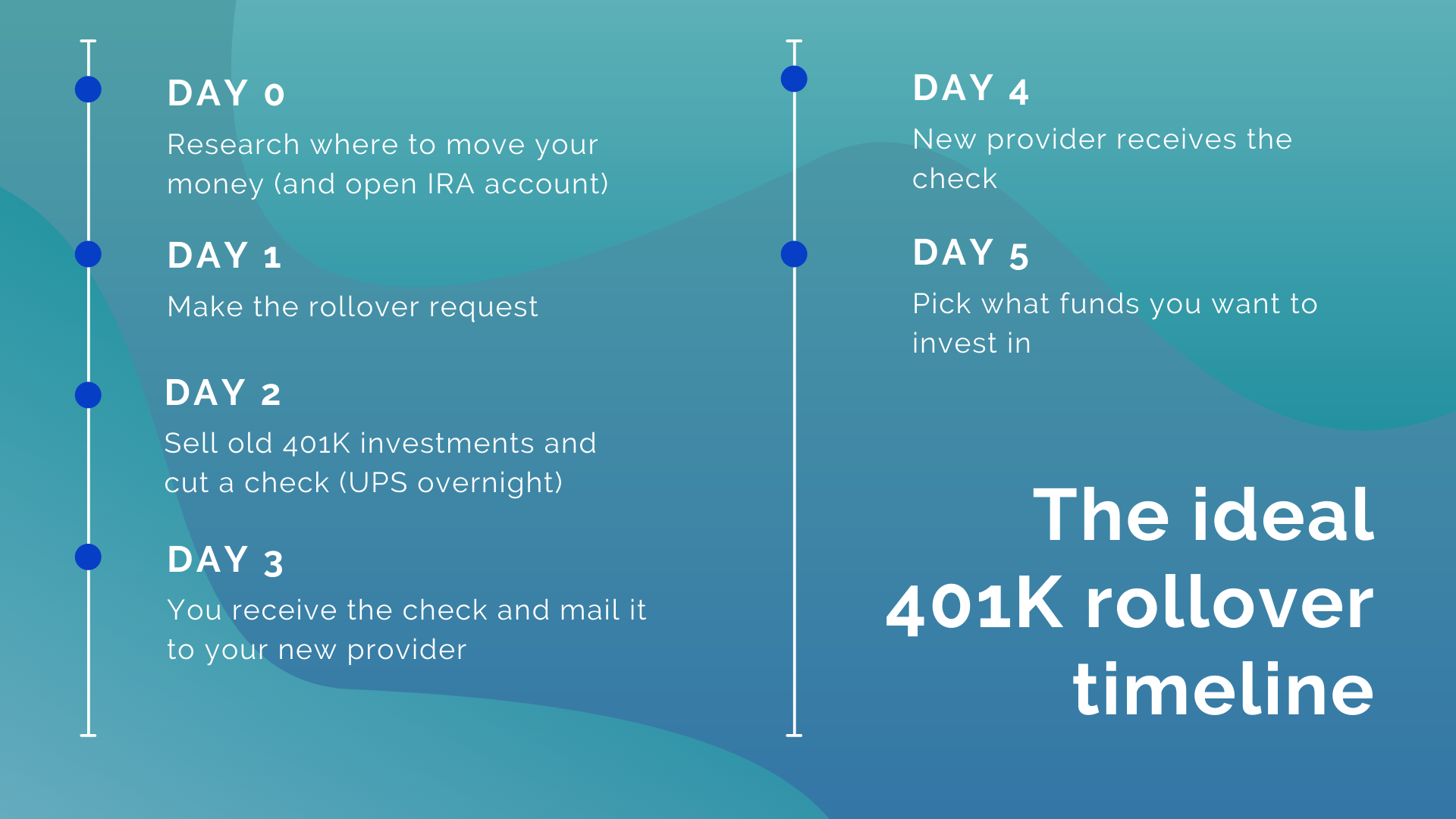

Look Out For Your Check In The Mail And Deposit Into Your New Account

ADP will only distribute your 401 funds directly to you, using the mailing address they have on file for your account. Once you get the check, its then up to you to deposit that check with your new IRA provider.

There are a few ways you can deposit your check depending on the provider:

- Mobile deposit the easiest option is to check your providers mobile app to see if they have a mobile deposit option. Not all providers provide this option but its worth checking. Mobile deposits are the quickest option and typically take 3-5 business days to show up in your account.

- Deposit in person at a local branch if your provider has a physical branch near by, you can also deposit the check in person. Checks deposited in person typically take 3-5 business days to show up in your account.

- Send the check by mail you can also send the check by mail to the provider using the address you previously looked up. Funds that are mailed can take up to 15 business days to show up in your account.

Move The 401 To Your New Employers 401

If you change companies, its typically no problem to rollover your old retirement plan into your new employers 401. With a little bit of paperwork, the old plan administrator can simply shift the contents of your account directly into the new plan account with a direct transfer. This custodian-to-custodian transaction is not considered taxable.

Another option is to elect to have your balance distributed to you in check format, which you can then deposit into your new 401 account within 60 days, without paying the income tax. If you are a sole proprietor, freelancer, or entrepreneur, you may also consider setting up your own Solo 401 for yourself at this point. If you are in the middle of a lawsuit or worry about future claims against your assets, leaving your money in a 401 is going to offer better protection against liquidation.

Recommended Reading: How To Find Out If Someone Has A 401k

How To File An Hsa Rollover

You report HSA rollovers on IRS Form 8889. On line 14b, you should fill out the total amount you rolled over or transferred from any eligible account into an HSA account. You should also record the total amount of distributions you made during the tax year, including the HSA rollover, on line 14a.

Of course these days, the best tax software can make this process seamless.

Can You Be Required To Roll Over Your 401

Sometimes you have no choice in the matter. You might be required to roll over your 401 if:

You dont meet a minimum balance requirement. For example, if you have less than $5,000 in your 401, your employer can require you to roll your 401 into a different account.

Your old employer changes 401 providers. Depending on your company, your account may not be rolled over and your existing provider may not continue service. If your account is rolled over, the new provider might have requirements you cant meet, or they might not provide the services you want.

Read Also: Can I Buy 401k Myself

What Is A Direct Rollover

A direct rollover is a qualified distribution of eligible assets from a qualified plan, 403 plan, or a governmental 457 plan into a traditional IRA, qualified plan, 403 plan, or a governmental 457 plan.

A direct rollover can also be a distribution from an IRA to a qualified plan, 403 plan or a governmental 457 plan. A direct rollover effectively allows a retirement saver to transfer funds from one retirement account to another without penalty and without creating a taxable event.

Choose Your New Investments

Whether the money goes into your new 401k plan or an IRA, it comes in as cash, and you need to decide on the investments you want to make. Work with your new fund manager or set it up yourself by opening a brokerage window, which lets you invest in a variety of bonds, mutual funds and stocks. If thats not an option, choose an index fund. Most S& P 500 options provide an average return of five to seven percent over 25 years.

Also Check: How Do I Find My Old 401k Account

Contact Your Current Plan Administrator And New Plan Administrator

The easiest 401 rollover option is to get your old plan administrator to transfer your balance directly to your new account. This is called a direct 401 rollover, and it frees you from having to worry about tax consequences or early withdrawal penalties.

Speak with your new plan provider about getting an account number, then provide the information to your current 401 administrator. Theyll take care of the rest.

Be aware that not every plan administrator will perform a direct 401 rollover. In this case, the plan administrator cuts you a check for the balance, and its up to you to send the funds to your new 401 plan provider. You have just 60 days to redeposit the balance in your new plan. Otherwise its treated as an early withdrawal that incurs a penalty and income tax liabilities.

You May Be Paying Hidden Fees

There are all sorts of fees that go into effect when you open a 401, including recordkeeping fees, maintenance fees, and fund fees. Expressed in a percentage, these fees inform the expense ratio of a plan.

Employers may cover those fees until you leave the company. Once youre gone, that cost might shift to you without you even realizing it.

Fees matter: When you pay a fee on your 401, youre not just losing the cost of the fee youre also losing all the compound interest that would grow along with it over time. The sooner you roll your plan over, the more you could potentially save.

Read Also: Should I Roll Over 401k To Ira

Make Sure Your Ira Is Being Invested Appropriately

Remember there are two goals of rolling over an old 401 into an IRA the first is to consolidate your 401 assets, and the second is to grow those assets by allocating them into investments that will increase in value over time.

Your very last step in executing a rollover is to make sure that second goal is being met and that the funds in your IRA are being appropriately invested. If you chose an automated IRA then this should happen automatically. Thats because as soon as your funds arrive theyll be allocated into a portfolio that was created for you during the sign-up process for your new IRA account. You should still log in and check to make sure thats the case, but usually theres nothing more for you to do.

If you choose a self-directed account then youll have to invest the money yourself. Often the simplest option is to purchase a target-date retirement fund this is an investment vehicle that puts your money into a combination of higher-risk, higher-return stocks and lower-risk, lower-return bonds. The exact mix changes as you age so that you have more stocks when youre younger and less as you get older: because stocks generate higher returns but are more volatile we should own more of them early on when we can withstand their fluctuations in order to achieve their higher long-term returns.

Otherwise you can assemble a portfolio on your own by making trades.

Its Not A Good Idea To Roll Over

It is easy to cash out your account, but it is also costly. The tax you owe will be deducted from your check by your employer at a rate of 20 percent.

In addition to the federal, state, and local taxes, you will also have to pay the 10 percent early withdrawal penalty. It could cost over half of what your account is worth.

There were reasonable returns and fees with the old plan, so you may want to consider leaving it.

In the future, you can move your 401 or IRA to a different plan. If you still have money in your 401 plan, you probably wont be allowed to make further contributions or borrow from it. You might also have to pay higher fees for non-active employees.

Cashing out your 401 balance below $1,000 will not be allowed however, you can roll it over to an IRA if it exceeds $1,000.

Read Also: How To Get Your 401k Out

Changing Jobs The Ins And Outs Of A 401 Rollover

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If you’ve decided to leave your current job for another, you will need to decide what to do with the money that you have invested in your current company’s 401 plan. Options typically include leaving it where it is, rolling it over to a new employer’s plan, or opting for an IRA rollover.

If you are about to change jobs, here’s what you need to know about rolling over your funds into a new employer’s 401 plan and the ins and outs of other options.

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

Read Also: Can I Move My 401k To A Different Company

Open Your Account And Find Out How To Conduct A Rollover

After youve found a brokerage or robo-advisor that meets your needs, open your IRA account. Once its open, you can begin the process for rolling over your 401 money into the account.

Each brokerage and robo-advisor has its own process for conducting a rollover, so youll need to contact the institution for your new account to see exactly whats needed. Youll want to follow their procedures exactly. If youre rolling over money into your current 401, contact your new plan administrator for instructions on what to do.

For example, if the 401 company is sending a check, your IRA institution may request that the check be written in a certain way and they might require that the check contains your IRA account number on it.

Again, follow your institutions instructions carefully to avoid complications.

How Long Do I Have To Deposit The Check

You should deposit the check you get right away. Even if the check is made out to your IRA provider , you should try to do it within 60 days of receiving it.

Get a prepaid envelope sent directly to your door with a tracking number! Start a rollover with Capitalize and well send you a prepaid priority mail envelope with detailed instructions to make sure your rollover is transferred successfully. Get started

Also Check: How To Transfer 401k When Changing Jobs

Indirect Rollovers Can Be Complicated To Manage

With an indirect rollover, you receive a check for the balance of your account that is made payable to you. That might sound good, but as a result, you are now responsible for getting it to the right place. You have 60 days to complete the rollover process of moving these assets to your new employer’s plan or an IRA.

If you dont complete the rollover within this 60-day window, you will owe income taxes on the amount you failed to roll over. If you’re under 59 1/2, you will also face a 10% penalty tax. Indirect rollovers can be made once a year.

Your old employer is required to withhold 20% from your distribution for federal income tax purposes. To avoid being taxed and penalized on this 20%, you must be able to get enough money from other sources to cover this amount and include it with your rollover contribution.

Then, youll have to wait until the following year, when you can file your income tax return to actually get the withheld amount back.

Suppose the 401 or 403 from your prior employer has a balance of $100,000. If you decide to take a full distribution from that account, your prior employer must withhold 20%. That means they keep $20,000 and send you a check for the remaining $80,000.

Even if you have an extra $20,000 on hand, you still must wait until you file your income tax return to get the withheld $20,000 returnedor a portion of it, depending on what other taxes you owe and any other amounts withheld.

What Happens To Your 401 When You Leave A Job

When you leave a job, you have a few options when it comes to your 401. It depends on how much you have in your 401 when you leave and what your planâs policies are as dictated in its summary plan description. Knowing your 401 balance before leaving and having a plan ahead of time can help save you a lot of time and stress.

Read Also: How To Rollover 401k To Charles Schwab

Option : Roll It Into An Ira

If your new employer doesnt offer a 401 or you dont like their option, you can roll your 401 into an IRA.

Rolling over accounts is easier than it sounds. You may need to open an IRA at a brokerage company and sign a few papers that allow the brokerage to transfer the money into your new account. This option will help keep your balance growing tax deferred and you can continue to make tax-deferred contributions.

Need Help With Making Decisions About Rollovers

Rollovers are a big financial move and a great opportunity to get professional advice on your investment strategies.

It can be useful and reassuring to model different financial moves in the NewRetirement Planner or consult with a Certified Financial Advisor.

Did you know that NewRetirement offers flat fee advisory services? You can collaborate with a Certified Financial Planner who has taken a fiduciary oath and specializes in retirement. Your advisor will:

- Review your NewRetirement plan to quickly understand your circumstances and make sure it is set up properly.

- Help you establish goals and identify ways to strengthen your finances.

- Meet with you via phone or video call to discuss your goals and suggest ideas for how to do better.

- Provide ongoing support.

You May Like: What Is Ira And 401k

Roll The 401 Over Into An Ira

What if youre not moving to a new employer immediately or your new employer doesnt offer a 401? What if your employer requires you to put in a number of years before you become vested and eligible to participate in their 401 plan?

In these circumstances, stashing your money in an IRA with the financial institution of your choice is a freeing solution. Youll be able to choose where, how, and when you invest unless you agree to pay a broker to manage the funds for you. A direct rollover is ideal to avoid paying taxes on the amount transferred over you have 60 days to roll your 401 over into the new IRA.

What Is An Ira Rollover

An individual retirement account rollover is a transfer of funds from a retirement account into a traditional IRA or a Roth IRA. This can occur through a direct transfer or by a check, which the custodian of the distributing account writes to the account holder who then deposits it into another IRA account.

The purpose of a rollover is to maintain the tax-deferred status of those assets. Rollover IRAs are commonly used to hold 401, 403 or profit-sharing plan assets that are transferred from a former employer’s sponsored retirement account or qualified plan. Rollover IRA funds can be moved to a new employer’s retirement plan.

You May Like: How Do I Know If I Have A 401k

Move Your Old 401 Assets Into A New Employers Plan

You have the option to avoid paying taxes by completing a direct, or “trustee-to-trustee,” transfer from your old plan to your new employer’s plan, if the employer’s plan allows it.

It can be easy to pay less attention to your old retirement accounts, since you can no longer contribute. So, transferring old 401 assets to your new plan could make it easier to track your retirement savings.

You also have borrowing power if your new retirement plan lets participants borrow from their plan assets. The interest rate is often low. You may even repay the interest to yourself. If you roll your old plan into your new plan, youll have a bigger base of assets against which to borrow. One common borrowing limit is 50% of your vested balance, up to $50,000. Each plan sets its own rules.

Here are a few important steps to take to successfully move assets to your new employers retirement plan so as not to trigger a tax penalty:

Step 1: Find out whether your new employer has a defined contribution plan, such as a 401 or 403, that allows rollovers from other plans. Evaluate the new plan’s investment options to see whether they fit your investment style. If your new employer doesn’t have a retirement plan, or if the portfolio options aren’t appealing, consider staying in your old employer’s plan. You could also set up a new rollover IRA at a credit union, bank, or brokerage firm of your choice.

The instructions you get should ask for this type of information: