Can I Still Withdraw From My 401k Without Penalty In 2021

Although the initial provision for penalty-free 401k withdrawals expired at the end of 2020, the Consolidated Appropriations Act, 2021 provided a similar withdrawal exemption, allowing eligible individuals to take a qualified disaster distribution of up to $100,000 without being subject to the 10% penalty that would

How Do I Cash Out My 401k After I Quit

You just need to contact the administrator of your plan and fill out certain forms for the distribution of your 401 funds. However, the Internal Revenue Service may charge you a penalty of 10% for early withdrawal, subject to certain exceptions.

Roll It Over Into Your New Companys 401

If you value the simplicity of having all of your retirement assets in one placeor you prefer the offerings of your new employers planyou can roll your old 401 into your next jobs 401. Your old and new 401 providers will probably have forms you can submit for an easy transfer between providers. If your old provider issues you a check to give to your new provider, make sure you deposit it into your new account within 60 days. Otherwise, you may be subject to the same taxes and penalties youd face if youd cashed out the account.

Also Check: When Leaving A Job What To Do With 401k

What Happens To My 401k If I Get Fired Or Laid Off

Getting laid off or fired can be a scary experience. Make sure all of your financial bases are covered, including your 401k.

If youve been let go or laid off, or even if youre worried about it, you might be wondering what to do with your 401k after leaving your job.

The good news is that your 401k money is yours, and you can take it with you when you leave your old employer. Whether that means rolling it over into an IRA or a new employers 401k plan, cashing it out to help cover immediate expenses, or simply leaving it in your old employers 401k while you look into your options, your money isnt going anywhere.

Employee And Employer Contributions Stop

When youre let go, you will typically lose access to your employer-sponsored benefits, including your workplace retirement plan. While youll still be able to access your retirement account, neither you nor your employer will be able to make additional contributions to it. Additionally, if your company offered a match that required vesting, you wont keep any money that hadnt matured before your exit date.

Also Check: How Is 401k Paid Out

Changing Employers And A 401 K

A change of company might mean you change your 401 k too. Try to find out how long that company can hold your 401k after you leave. We encourage you to discuss this matter with your new employer. It’s important that you take your old 401 k into consideration when you look for a new place of work. You may also want to choose your new employer based on the kind of retirement plan is on offer.

Making The Numbers Add Up

Put simply, to cash out all or part of a 401 retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial hardship . Whatever the circumstance though, if you choose to withdraw funds early, you should prepare yourself for the possibility of funds becoming subject to income tax, and early distributions being subjected to additional fees or penalties. Be aware as well: Any funds in a 401 plan are protected in the event of bankruptcy, and creditors cannot seize them. Once removed, your money will no longer receive these protections, which may expose you to hidden expenses at a later date.

Don’t Miss: What Is Qualified Domestic Relations Order 401k

What Happens To My 401k If I Quit My Job

If you leave a job, you have the right to move the money from your 401k account to an IRA without paying any income taxes on it. If you decide to roll over your money to an IRA, you can use any financial institution you choose, you are not required to keep the money with the company that was holding your 401.

Rollover Your Retirement Savings Account Into An Ira

If you are fired or laid off, you have the right to move the money from your 401k account to an IRA without paying any income taxes on it. This is called a rollover IRA.

If you decide to roll over your money to an IRA, you can use any financial institution you choose you are not required to keep the money with the company that was holding your 401.

Ask the mutual fund company, bank or brokerage that will manage your IRA for an IRA application. Make sure your former employer does a direct rollover, meaning that they write a check directly to the company handling your IRA. If they write the check to you, they will have to withhold 20% in taxes.

Also Check: When Can You Take Out 401k Without Penalty

How To Cash Out A 401 After Quitting

You may follow this type of action plan for your 401 when you quit your job:

If your new employer offers a 401 plan, check your eligibility and enroll yourself.

Once enrolled, get the funds and investments in your old account directly transferred to your new account. You can opt for a direct administrator-to-administrator transfer through simple documentation to avoid potential taxes and penalties.

Instead of direct transfer, you can also cash out your old account and deposit the proceeds in your new account within 60 days of cashing out. That way, you dont have to pay income tax on the amount of the withdrawal .

You must start taking 401 distributions after you turn 70 ½ years old and you are not working anymore. However, unlike traditional plans, in a new retirement plan with your current employer, you cannot be forced to take the required minimum distributions even after you reach the age of 70 ½.

If your new employer does not have a 401 plan or you do not like the plan your new employer has, you may roll over your old 401 account to an IRA. The rollover process is like the process of rolling over to a new account. You can either get it done directly through your plan administrator or take out the proceedings and deposit them in your IRA within 60 days.

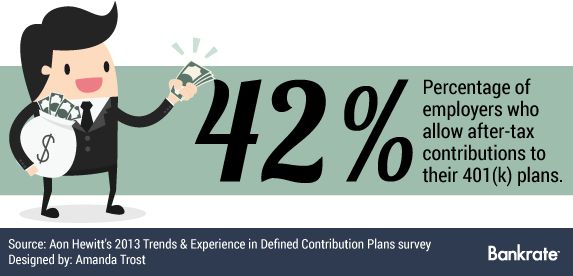

Cashing Out A 401 Is Popular But Not So Smart

Intellectually, consumers know that cashing out retirement accounts isnt a smart move. But plenty of people do it anyway. As discussed, you may be forced out of your former plan based on your account balance, but that doesnt mean you should cash the check and use it for non-retirement related purposes. In the long run, your financial future will be better served by rolling the money over into an IRA or if applicable, your new employers 401 plan.

A 2020 survey by Alight, a leading provider of human capital and business solutions, found that 4 out of 10 people cashed out their balances after termination between 2008 and 2017. About 80 percent of those who had an account balance of less than $1,000 cashed out, while 62 percent who had balances between $1,000 and $5,000 did the same.

Based on historical rates of return, a $3,000 cash out at age 24 leads to a $23,000 difference , in your projected account balance at age 67, so even a small amount of money invested into a retirement vehicle today can make a big difference in the long run.

Don’t Miss: Why Cant I Take Money Out Of My 401k

The Age 55 Exemption Applies Only To The Date Employment Endednot When You Begin Taking Distributions

This is important for those entering retirement early. For example, if you retired from Company ABC at age 50, you would still be subject to the penalty tax if you take distributions at age 55. Since your employment ended before the year in which you turned 55, youd have to wait until age 59 ½ for penalty-free withdrawals.

Leave The Account Alone

If your 401 investment balance is more than $5,000, most plans allow you to just leave it where it is. This is often the simplest choice. If you dont urgently need the money, leaving your 401 account alone allows it to continue growing from investment gains.

It may make sense to roll over the 401, though, if youre paying high fees for the management of the account where it is, or if you want more control over how your money is invested.

If the account balance is less than $5,000, your old company may also opt to distribute the money to you. Then its largely on you to roll it over into a new retirement account if you want to avoid having to pay taxes on it nowand possibly a penalty.

Also Check: Can I Manage My Own 401k

Things You Can Do With 401 After Leaving Your Job

Many employers offer 401s as a way to help employees save for retirement. When you leave your job, you’ll need to decide what to do with your 401. Depending on what you do once you leave your job, you have several options. In this article, we describe four options you have when deciding what to do with 401 when you leave a job.

You Can Leave Your Money Where It Is

If you have more than $5,000 in your 401k, you can leave it in your old employers 401k plan and even if you have less than that, they still might let you leave the money where it is, but you should ask. If you have less than $5,000, your employer has the option to make you take a distribution, but not all employers will exercise that right.

This is the simplest option, and its the one many people choose when theyre fired suddenly. You usually cant plan for a job loss, so you might not even have time to decide what to do with your 401k money before you get fired or laid off. And you might need some time to process the layoff for a while before you even get around to worrying about the money in your retirement plan.

Well, you might ask, how long do I have to rollover my 401k from a previous employer? Thats a good question. If you want to do a direct rollover, in which your former employer writes a check directly to your new employer for deposit into your new employers 401k plan, you can pretty much wait as long as you want.

However, if you want to do an indirect rollover, where you cash out the money and then deposit it into another tax-advantaged account yourself, you have 60 days from the time you cash out to deposit the money into another such tax-advantaged account, like an IRA. If youre planning to roll over the money into another 401k, you want to avoid this option, since your old employer will be required to withhold 20% from your payout for taxes.

Read Also: Can I Take 401k Money To Buy A House

What Determines How Long A Company Can Hold Your 401 After Leaving A Job

The retirement money you have accumulated in your 401 is your money. This gives you the freedom to change jobs without worrying that your savings may get lost in the process. The money can stay in your employerâs retirement plan for as long as you want, but there are certain cases when an employer may force a cash out or rollover the funds into another retirement account.

These factors may determine how long an employer can hold your 401 money after you leave the company:

Compare Old And New Life And Disability Coverage And Fill Any Gaps

- Life insurance: You may be able to contribute to a group life insurance policy through your employer, with the premiums deducted from your paycheck.

- Disability income insurance: First, find out if you have any disability coverage, and if you do, how much of your income it covers. Most plans will cover about 60% of your income that equals significantly less take-home pay after taxes .

Tip: Use a job change as a chance to check the beneficiaries on life insurance and retirement accounts and update as needed. If you’re a Principal customer, you can grab a form to update beneficiaries on your account.

You May Like: Should I Use My 401k To Pay Off Debt

Millions Of People Have Been Laid Off During The Coronavirus Pandemic Bringing The United States To Its Highest Unemployment Rate Since The Great Depression

While economists expect the high unemployment rate to be short-lived, if you are among those that received a pink slip from your employer, you may be wondering what to do with your 401 plan.

A 401 is a retirement savings plan sponsored by an employer that allows you to dedicate a percentage of your pre-tax salary to the plan.

While you are employed, your access to the funds is very limited. But being laid off is a triggering event that allows you to take greater control of the funds. In this scenario, there are typically four options available to you. Lets discuss each one.

Options For Cashing Out A 401 After Leaving A Job

The amount in your 401 account, including your contribution, your employers contribution, and any earnings on your investments, belongs to you and can supplement your retirement fund. The huge amount of money accumulated in your 401 account may tempt you to cash out your plan, but its in your best interest not to do so.

Leaving your account with your old employer may not a good idea. There are chances that you may forget the account after some time. You can, instead rollover to your new employer or even set up an IRA to roll 401 funds into.

Rolling over your 401 to an IRA gives you the flexibility to invest your funds the way you want. However, in some states like California, your creditors have easier access to your IRA funds than the money kept in a 401 account. If you see any potential claim or lawsuit against you, you may want to let your funds lie in a 401 account rather than transferring into an IRA.

Alternatively, if you are eligible for the 401 plan of your new employer, you may want to roll over your old 401 to your new account. No matter where you invest, always consider minimizing the risk by diversifying your portfolio. You may never want to invest a large portion of your savings in a single company, no matter how much you trust it.

Don’t Miss: Can I Borrow From My 401k Without Penalty

What Happens To Your 401 After You Leave A Job

It’s becoming increasingly common for professionals to switch jobs several times throughout their working careers, meaning that most people have to decide what to do with 401 after leaving the job. When you switch jobs or get laid off, you have to evaluate your options on what do you with your 401 account.

After leaving your current job, you have up to 60 days to decide what happens to your retirement savings. Otherwise, your savings will be automatically transferred to another retirement account. In most cases, employers have clear guidelines indicating what you can do with your 401.

Move The Funds Into Another 401

If you have been fortunate enough to find employment and you appreciate the ease of having all your retirement assets in one place, you may want to consider moving the funds from your former employers 401 plan into your new employers 401 plan. The process usually requires forms from both employers to transfer the funds between plans. If your former plan issues a check to you, be sure to give it to your new employer within 60 days of receiving the funds. If you fail to deposit the check within 60 days, you may be subject to taxes and penalties.

Before you start the process, ensure your current employer doesnt have any eligibility requirements around participating in their 401. Some employers may require you to be in their employment a certain length of time before you are eligible to participate in the 401. If you cannot move the funds into another plan, you still have some options available to you.

You May Like: What To Do With Your 401k

What Happens To Retirement If You Get Fired

If you have a retirement plan with an employer, and are then fired from the company, that employer cant take away any money you have contributed to the retirement plan in the case of a 401. Whether or not your employer will have the ability to do this will depend on whether you are vested in the plan.

If You Get Terminated From Your Job You Have The Option Of Cashing Out Your 401 However This Is Probably Not The Smartest Move

Image source: Andrew Magill.

If you get terminated from your job, you have the ability to cash out the money in your 401 even if you haven’t reached 59 1/2 years of age. This includes any money you’ve contributed and any vested contributions from your employer — plus any investment profits your account has generated. However, you may face a 10% early withdrawal penalty from the IRS for cashing out early, so this might not be the best option. Here’s what you need to know to make an informed decision about your 401 after you’re no longer with your employer.

How to cash out and the implications of doing soThe procedure for cashing out is usually rather simple. All you need to do is contact your plan’s administrator and complete the necessary distribution paperwork. However, there are a few things you need to keep in mind, especially regarding the tax implications of cashing out.

Unless your 401 is of the Roth variety, all of the money you withdraw will be treated as taxable income, no matter how old you are or the reason for the withdrawal. So, even if you are older than 59 1/2, it’s important to consider how cashing out will affect your tax status for the year. If you have a large 401 balance, cashing out could easily catapult you into a higher tax bracket. Your plan provider will be required to withhold 20% of the amount you cash out for taxes , and will also file a form 1099-R to document the distribution.

Also Check: How To Transfer 401k Without Penalty