How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

The Hardship Withdrawal Option

A hardship withdrawal can be taken without a penalty. For example, taking out money to help with economic hardship, pay college tuition, or fund a down payment for a first home are all withdrawals that are not subject to penalties, though you still will have to pay income tax at your regular tax rate. You may also withdraw up to $5,000 without penalty to deal with a birth or adoption under the terms of the SECURE Act of 2019.

A hardship withdrawal from a participants elective deferral account can only be made if the distribution meets two conditions.

- It’s due to an immediate and heavy financial need.

- It’s limited to the amount necessary to satisfy that financial need.

In some cases, if you left your employer in or after the year in which you turned 55, you may not be subject to the 10% early withdrawal penalty.

Once you have determined your eligibility and the type of withdrawal, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but once all the paperwork has been submitted, you will receive a check for the requested fundsone hopes without having to pay the 10% penalty.

Make Sure That Youre Eligible

The general rule of thumb is that you established your 401 as a full-time employee from a previous employer, or you are more than 59.5 years old. Other eligibility requirements can vary, depending on the type of retirement plan you have, such as a Roth IRA, 403, 457 and Thrift Savings Plan .

Please note, the rules dictating eligibility to move a 401 to an IRA arent always crystal clear and can vary from person to person. If you are confused or unsure of your own eligibility, please contact BitIRA today for a complimentary consultation.

We have a team of IRA Specialists, who are well-versed in the rules of 401-to-Bitcoin IRA rollovers. If you make a bitcoin investment for your SDIRA, they can assist you with the entire transfer process to make it quick and easy. However, please note that there is no obligation for you to take any action after your consultation.

Here are the three steps to take to convert your 401 savings into bitcoin:

You May Like: How Do I Cash Out My 401k After Being Fired

Diversify To Protect Your 401k From A Market Crash

There is no foolproof strategy that will keep your portfolio safe. However, you can mitigate your risks with basic moves like diversification.

The first strategy for protecting your nest egg is diversification. To explain, put your money in several places, so you do not lose everything.

For instance, invest in different stocks and U.S. Treasury Bonds. An example of basic diversification is 20% tech stocks, 20% finance stocks, and 20% energy stocks.

In addition, invest in several good dividend stocks so you will have money coming in. A great rule to follow is to have at least 50% of your 401K funds in dividend stocks.

Finally, having part of your funds outside of stocks will keep part of your money from a crash. Simply, having 20% of your funds in C.D.s or Bonds can ensure you will have cash.

Good diversification can be provided by using the Portfolio Correlation Functionality in Stock Rover.

|

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy. Stock Rover is our #1 rated stock investing tool for: Get Stock Rover Premium Plus Now & Get My “LST Beat the Market System” Included or Read the In-Depth Stock Rover Review & Test. |

How Many Vacation Days Do Bank Of America Employees Get

Bank of Americas PTO and Vacation policy typically gives 20-30 days off a year. Paid Time Off is Bank of Americas 2nd most important benefit besides Healthcare when ranked by employees, with 28% of employees saying it is the most important benefit.

Recommended Reading: How Many Loans Can I Take From My 401k

Fidelity Funds Are Renowned For Their Managers Stock

Fidelity celebrates good stock picking. The firm holds a contest every year for its portfolio managers: They get 60 seconds to pitch one idea, and the best pitch wins a dinner for four. The best performer after 12 months also wins dinner.

Maybe thats why many of the best Fidelity funds stand up so well in our annual review of the most widely held 401 funds.

Here, we zero in on Fidelity products that rank among the 100 most popular funds held in 401 plans, and rate the actively managed funds Buy, Hold or Sell. A total of 22 Fidelity funds made the list, but seven are index funds, which we dont examine closely because the decision to buy shares in one generally hinges on whether you seek exposure to a certain part of the market.

Actively managed funds are different, however. Thats why we look at the seven actively managed Fidelity funds in the top-100 401 list. We also review seven Fidelity Freedom target-date funds as a group as they all rank among the most popular 401 funds. And we took a look at Fidelity Freedom Index 2030 it has landed on the top-100 roster for the first time, and while its index-based, active decisions are made on asset allocation.

This story is meant to help savers make good choices among the funds available in their 401 plan. It is written with that perspective in mind. Look for our reviews of other big fund firms in the 401 world, which currently include Vanguard, and will soon include American Funds and T. Rowe Price.

More People Than Ever Are Investing 401 Savings In Bitcoin

Here are seven reasons why.

Before you can take advantage of these rollover benefits, there are specific details you need to know, and three steps you must take.

Don’t Miss: Can You Use 401k To Buy Investment Property

Eligibility And Procedures For Cash Withdrawals And Loans

Following is information on when you may qualify for a loan from your U-M retirement plans, when you may qualify for a cash withdrawal, and the procedures to request a loan or cash withdrawal.

-

Loans may be available from your retirement accounts as follows:

-

Basic Retirement Plan No loans are available at any time.

-

403 SRA You may borrow from your 403 SRA at any time, for any reason, regardless of whether your employment is active or terminated. However, loans are not available from TIAA once you have retired or terminated employment from U-M.

-

457 Deferred Compensation Plan You may borrow from your 457 Deferred Compensation Plan account at any time, for any reason, regardless of whether your employment is active or terminated. However, loans are not available from TIAA once you have retired or terminated employment from U-M.

To arrange for a 403 SRA or 457 Deferred Compensation Plan loan, contact TIAA or Fidelity and request a loan application. University authorization is not needed to take a loan.

Read Also: Can I Buy Individual Stocks In My 401k

You Can Leave Your Money Where It Is

If you have more than $5,000 in your 401k, you can leave it in your old employers 401k plan and even if you have less than that, they still might let you leave the money where it is, but you should ask. If you have less than $5,000, your employer has the option to make you take a distribution, but not all employers will exercise that right.

This is the simplest option, and its the one many people choose when theyre fired suddenly. You usually cant plan for a job loss, so you might not even have time to decide what to do with your 401k money before you get fired or laid off. And you might need some time to process the layoff for a while before you even get around to worrying about the money in your retirement plan.

Well, you might ask, how long do I have to rollover my 401k from a previous employer? Thats a good question. If you want to do a direct rollover, in which your former employer writes a check directly to your new employer for deposit into your new employers 401k plan, you can pretty much wait as long as you want.

However, if you want to do an indirect rollover, where you cash out the money and then deposit it into another tax-advantaged account yourself, you have 60 days from the time you cash out to deposit the money into another such tax-advantaged account, like an IRA. If youre planning to roll over the money into another 401k, you want to avoid this option, since your old employer will be required to withhold 20% from your payout for taxes.

Also Check: What Is The 401k Retirement Plan

Traditional Rollover Sep And Simple Iras

If you are considering a withdrawal from one of these types of IRAs before age 59½, it will be considered an early distribution by the IRS.

In many cases, you’ll have to pay federal and state taxes. There may also be a 10% penalty unless you are using the money for exceptions such as a first-time home purchase, birth or adoption expense , qualified education expense, death or disability, health insurance , and some medical expenses. A 25% penalty may apply if you take a distribution within the first 2 years of opening a SIMPLE IRA.

If any of these situations apply to you, then you may need to fill out specific IRS forms. Always consult your tax advisor about your specific situation.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Recommended Reading: What Is The Difference Between 401k And 403b

Cares Act 401 Early Withdrawals

The CARES Act contains a provision allowing those who are under age 59 ½ to take a distribution from their retirement plan while working, waiving the 10% penalty that would normally be associated with this type of distribution.

The distributions are still subject to income taxes, but these taxes can be spread over a three-year period. You can re-contribute some or all of the money taken via this route over a three-year period and avoid some or all of these taxes.

These distributions require that you document that COVID-19 has impacted you or a family member. This means that you or a family member has contracted the virus or that you or a family member has been financially impacted by COVID-19 in ways that might include a job loss or reduced income. For a 401 plan, the ability to take these distributions is not automatic, your employer needs to adopt this as a provision of the plan.

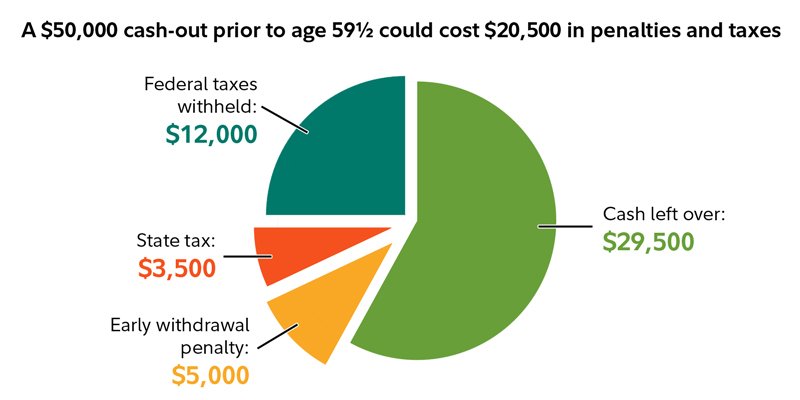

Making The Numbers Add Up

Put simply, to cash out all or part of a 401 retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial hardship . Whatever the circumstance though, if you choose to withdraw funds early, you should prepare yourself for the possibility of funds becoming subject to income tax, and early distributions being subjected to additional fees or penalties. Be aware as well: Any funds in a 401 plan are protected in the event of bankruptcy, and creditors cannot seize them. Once removed, your money will no longer receive these protections, which may expose you to hidden expenses at a later date.

Read Also: When Can I Set Up A Solo 401k

Early Withdrawal Calculator Terms & Definitions:

- 401k â A tax-qualified, defined-contribution pension account as defined in subsection 401 of the Internal Revenue Taxation Code.

- Federal Income Tax Bracket â The division at which tax rates change in the federal income tax system .

- State Income Tax Rate â The percentage of taxes an individual has to pay on their income according to the laws of their state.

- Lump-sum Distribution â The withdrawal of funds from a 401k.

- Rollover â Moving the 401k contribution to another retirement fund option, often an IRA.

- Penalties â The payment demanded for not adhering to set rules.

- Future Value Before Taxes â The value of oneâs asset at the end of the term before taxes are paid.

- Future Taxes to be Paid â The taxes that are required to be paid at the end of the term.

- Future Net Available â The amount left after taxes and penalties are deducted.

- Annual Rate of Return â The percentage earned every year by having funds in an account.

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Read Also: What Is Max Amount To Contribute To 401k

Alternatives To Cashing Out

If you want to make a more conservative decision, you can leave your money in your 401 k when you change to a different company or employer. Cashing out your 401 k isn’t a requirement, after all. If you’re happy with your old employer’s 401 k, we recommend that you leave the money where it is. You can withdraw it once you retire. This is also a great way to avoid paying excessive income tax.

You can also stretch out the time that you withdraw money from your 401 k. The funds don’t have to come out in a lump payment. A plan participant leaving an employer typically has four options , each choice offering advantages and disadvantages. You can leave the money in the former employers plan, if permitted Roll over the assets to your new employer plan if one is available and rollovers are permitted Roll over the funds to an IRA or cash out the account value. The more time between your payments, the easier it is to avoid paying extra tax on the money. This is because funds from your 401 k are considered part of your taxable estate.

How To Cash Out A 401 From A Former Employer

Cashing out a 401k from a former employer is not a difficult task. In most cases, you contact the plan administrator for the appropriate paper work, fill it out, send it to the financial institution that manages the 401k, and wait for the check to come in the mail or for the electronic transfer.

Tips

-

In order to cash out a 401 from a former employer, you will likely have to contact the plan administrator at your former place of employment and request access to the paperwork needed to withdraw your funds.

You May Like: Can You Roll A Traditional 401k Into A Roth Ira

If Im Eligible Should I Take A Distribution From My 401 Or Ira

Even with the new rules in place, its still advisable to exhaust most other resources, such as emergency funds or other easily accessible forms of savings, before tapping into your retirement accounts.

But if you are considering taking a distribution from your IRA or 401, think through the following first.