Open Your New Ira Account

You generally have two options for where to get an IRA: an online broker or a robo-advisor. The option you choose depends on whether you’re a “manage it for me” type or a DIY type.

-

If you’re not interested in picking individual investments, a robo-advisor can do that for you. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, all for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments and has a reputation for good customer service.

» Ready to get started? Explore best IRA accounts for 2021

Why The Roth 401k Is The Unsung Hero Of Retirement Plans

One retirement savings vehicle doesnt get the attention it deserves, according to one financial expert. The Roth 401k is the unsung hero, if you will, of your retirement plan, Sun Group Wealth Partners Managing Director Winnie Sun, especially for her clients whose No. 1 goal is to have tax-free savings in retirement.

You Get More Investment Options

In a 401 plan, your mutual fund investment options can be limited, points out Dominique Henderson, CFP, founder of DJH Capital Management.

Often you have between six and 24 fund choices in a 401, Henderson says. With an IRA, you can choose individual stocks as well as fundsand even use alternative investments. Alternative investments can include everything from real estate to bitcoin.

If you move your retirement funds into an IRA, you get a very broad menu of investment choices and more control over how your money is invested.

Recommended Reading: How Do I Transfer My 401k To A Roth Ira

A Roth 401 Rolled Into Another Roth 401

If you roll your old Roth 401 to a new Roth 401, the specific distribution rules from the new account will vary by the plan itself your new employer’s human resources department should be able to assist with this.

However, some basic conditions apply. If you decide to roll over the funds from your old Roth 401 to your new Roth 401 through a trustee-to-trustee transfer , the number of years the funds were in the old plan should count toward the five-year period for qualified distributions. However, the previous employer must contact the new employer concerning the amount of employee contributions that are being rolled over and must confirm the first year they were made.

Note, too, that the rollover generally must be complete in order for the new funds to enjoy the carryover of the time period from the old Roth 401. If an employee did only a partial rollover to the new Roth 401, the five-year period would start again. That is, you do not get credit for the period the funds were in your old Roth 401.

Before making a decision, speak to your tax or financial advisor about what may be best for you. One option could even be leaving the Roth 401 in your previous employer’s plan, depending on the circumstances and that plan’s rules.

Can I Contribute More To The Ira After My Rollover

Yes, but the amount of your contribution can’t exceed the amount of income you earned that year .

You’re also subject to annual Roth IRA limits . And those limits are reducedand gradually phase outas your modified adjusted gross income increases. Also, there are no age limits on Roth IRA contributions.

Please note: There may be special tax considerations when you combine rollover assets with new contributions in one account, otherwise known as commingling.

Yes. Effective for 2020, there is no age limit to open the IRA or contribute to it. For 2019 contributions and earlier, no contributions were allowed for years you were age 70½ or older.

Also, the amount of your contribution can’t exceed the amount of income you earned that year . In addition, you’re subject to annual traditional IRA limits .

Please note: There may be special tax considerations when you combine rollover assets with new contributions in one account, otherwise known as commingling.

You May Like: How Do I Find Previous 401k Accounts

Pros And Cons Of Rolling Over 401k To Ira

Learn the pluses and the minuses of getting all of your IRA and 401k ducks in a row.

According to the Bureau of Labor Statistics, on average, individuals between the ages of 18 and 52 may change jobs as frequently as 12 times. Some of those jobs probably came with some type of employer sponsored retirement plan such as 401k or an IRA account . When switching jobs, many people choose to rollover any accounts to their new employers plan rather than taking them as a withdrawal. When you roll over a retirement plan distribution, penalties and tax are generally deferred. So let’s look at a few of the pros and cons of consolidating them into one IRA with one institution.

Increasing The Size Of Your Ira

Moving money from a traditional IRA to a Roth IRA has a hidden but very favorable consequence: it increases the amount of money you have in your IRA. The dollar amount is the same, but the effective amount is larger. This is because the Roth IRA contains only after-tax dollars. Part of your traditional IRA will end up going to Uncle Sam when you cash out, so its almost as if you dont own the entire IRA. The better your investment performance, the more tax you end up paying. Thats not true for a Roth IRA.

You May Like: How Do I Add Money To My 401k

Disadvantages Of An Ira Rollover

A rollover is not for everyone. A few cons to rolling over your accounts include:

- . You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.

- Loan options are not available. The funds may be less accessible. You may be able to get a loan from an employer-sponsored 401k account, but never from an IRA.

- Minimum distribution requirements. You can generally withdraw funds without a 10% early withdrawal penalty from a 401k if you leave your employer at age 55 or older. With an IRA you generally have to wait until you are age 59 1/2 to withdraw funds in order to avoid a 10% early withdrawal penalty. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart.

- More fees. You may be responsible for higher account fees as compared to a 401k which has access to lower-cost institutional investment funds because of group buying power.

- Tax rules on withdrawals. You may be eligible for favorable tax treatment on withdrawals if your 401K is invested in company stock.

Neither State Farm nor its agents provide tax or legal advice.

Should You Roll Over Your 401 Into Another 401

There are some situations that might make an IRA rollover the wrong move for you. Heres what to consider before completing a 401 rollover.

Retirement account protection. In general, 401 accounts offer better protections from creditors than IRAs.

Rule of 55. With a 401, you can actually start withdrawing funds at age 55 penalty-free if you leave your job. You dont have that advantage when you roll your 401 to an IRA, though you can emulate it by taking subsequently equal periodic payments from your IRA

Performance. If you like your current plan, and its performing well, theres no reason to complete a rollover.

You can always choose to roll your old 401 balance into your new employers 401 plan. If you value the simplicity of having everything in one place, you like the features of the plan at your new job, or you want to maintain the legal protections of a 401, it may make more sense to roll your old 401 into a new 401.

You May Like: Can I Roll My Roth 401k Into A Roth Ira

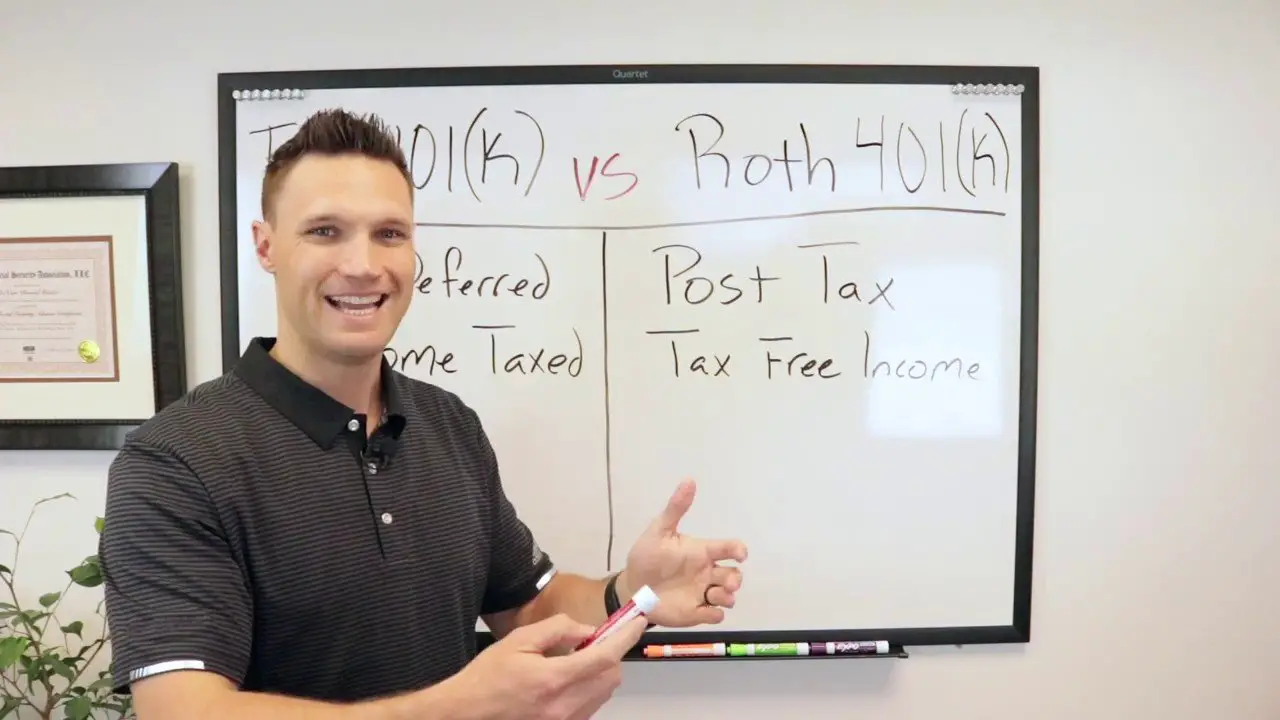

What Is A Roth 401

The Roth 401 is a workplace retirement savings account that combines the convenience of a traditional 401 with all the benefits of a Roth IRA. Its the best of both worlds!

There are some similarities between traditional 401 and Roth 401 options. Companies can offer a match through either, and these options also have a $19,500 contribution limit. But thats where the similarities end.

The biggest difference between a traditional 401 and a Roth 401 is how your contributions are taxed. When you put money into a traditional 401, youre using pretax dollars. That means the money goes into your 401 before you pay taxes on it. Those taxes are then deferred until you make withdrawals from your 401 in retirement.

On the other hand, your contributions to a Roth 401 are made with after-tax dollars, meaning you invest that money in your Roth 401 after you pay taxes on it. Its a little more expensive on the front end, but its worth it. Why? Because you get the benefit of tax-free growth on your contributions. So when you start withdrawing money in retirement, you wont have to pay a single penny in taxes.

Whenever you can make tax-free growth part of your investment strategy, do it!

There is one important thing to remember about the Roth 401: Only your contributions grow tax-free. If your company offers a match, youll have to pay taxes on retirement income from the match side of the account.

Tips For Saving For Retirement

- Having trouble figuring out how taxes fit into your retirement plan? It may be smart to work with a financial advisor on such decisions. An advisor can take a comprehensive look at your finances and identify opportunities to save on taxes and grow your nest egg. To find a financial advisor in your area, use SmartAssets financial advisor matching tool. Just answer some questions about your financial goals and situation, and the tool will pair you with up to three qualified financial advisors in your area.

- As you plan for your retirement income, you should also consider how Social Security benefits fit into the equation. Our Social Security calculator can help in this regard. Fill in your age, income and target retirement date and well calculate what you can expect in annual benefits.

You May Like: How To Rollover Fidelity 401k To Vanguard

Taxes On Earnings From After

After-tax contributions to a 401 or other workplace retirement plan get a different tax treatment than their earnings. Since youve already paid taxes on the contributions, those withdrawals are tax-free in retirement. But the IRS considers the earnings to be pre-taxso they would be treated as pre-tax and you would owe income tax when you withdraw the earnings from the plan.

Earnings in Roth IRAs, however, arent subject to income tax as long as all withdrawals from the account are qualified withdrawals. So rolling after-tax money from a workplace plan to a Roth IRA means you can avoid taxes on any future earnings.

Read Also: How Do You Take Money Out Of 401k

Sales And Capital Gains Tax Rates

Tax rates dont only apply to earned income and corporate profits. Tax rates can also apply on other occasions when taxes are imposed, including sales tax on goods and services, real property tax, short-term capital gains tax, and long-term capital gains tax. When a consumer purchases certain goods and services from a retailer, a sales tax is applied to the sales price of the commodity at the point of sale. Since sales tax is governed by individual state governments, the sales tax rate will vary from state to state. For example, the state sales tax rate in Georgia is 4%, while the tax rate in California is 6%, as of 2019.

Since additional income gained from investments is categorized as earnings, the government also applies tax rates on capital gains and dividends. When the value of an investment rises and the security is sold for a profit, the tax rate that the investor pays depends on how long s/he held the asset. The tax rate on the capital gain of a short-term investment is equal to the investors ordinary income tax. So, an individual who falls into the 24% marginal tax bracket will pay 24% on his or her short-term capital gains.

You May Like: Can I Roll A 401k Into A Roth Ira

Roth Ira Rollover Rules From 401k

As a reminder, you must generally be separated from your employer to roll your 401k into a Roth IRA. However, some employers do permit an in-service rollover, where you can do the rollover while still employed. Its permitted by the IRS, but not all employers participate.

Before January 1, 2008, you werent able to roll your 401 into a Roth IRA directly at all. If you wanted to do so you had to complete a two-step process.

However, the law changed shortly after and this option became available. Still, just because the law has made this option available doesnt mean you can definitely roll your old 401 into a Roth IRA no matter what. Unfortunately, it all depends on your plan administrator.

For example, recently I had two clients who intended to roll their old retirement plans into a Roth IRA.

One client had an old military retirement plan- Thrift Savings Plan and the other had an old state retirement plan. After helping each of them complete the required paperwork, I came across an interesting discovery.

The TSP rollover paperwork had a box you could mark if you wanted to roll over the plan into a Roth IRA . However, the state retirement plan did not give that option.

The only option was to open a traditional IRA to accept the rollover then immediately convert it to a Roth IRA. That certainly seemed like a hassle at the time, and it definitely was.

How Do I Rollover If I Receive The Check

If you receive a distribution check from your 401 rollover to a Roth IRA, then chances are good they will hold around 20% for taxes. If you want a direct 401 rollover to a Roth IRA, you may want to send that check back to your employer 401 provider and ask to be sent all of your eligible retirement distribution directly to your new Rollover IRA account .

You have 60 days upon receiving the check to get the money into the Roth IRA- no exceptions! So dont procrastinate on this one.

Also Check: How To Check My Walmart 401k

Pick An Ira Provider For Your 401 Rollover

When moving your money, you need to figure out which brokerage will provide you with the services, investment offerings and fees you need. If youre a hands-on investor who wants to buy assets beyond stocks, bonds, ETFs or mutual funds, you need to look for a custodian that will allow you to open a self-directed IRA. On the other hand, if youre more hands-off, it might make sense to choose a robo-advisor or a brokerage that offers target date funds.

You Want To Increase Your Tax Diversification

Contributions to traditional IRAs are tax-advantaged, meaning you wont pay taxes on your invested funds until you begin taking withdrawals at retirement. Roth IRAs, on the other hand, are taxed up front but offer tax-free withdrawals after age 59 ½. If youre unsure how your tax and income situation might pan out in the future, having both types of accounts a traditional IRA and a Roth IRA is a smart move in terms of diversifying your future tax exposure.

Don’t Miss: Should I Borrow From My 401k

Roth 401 To Roth Ira Conversion

Roth 401s are essentially the same as traditional 401s, except they’re funded with after-tax dollars, like the Roth IRA, instead of pre-tax dollars. The exception to this rule is employer-matched funds. These are considered pre-tax dollars even in a Roth IRA.

Because the government taxes Roth 401 and Roth IRA contributions the same way, you can roll over Roth 401 savings to a Roth IRA without paying any taxes on your Roth 401 contributions. But if the amount you’re rolling over includes employer-matched funds, these will affect your tax bill for the year.

How To Bring 401s And Iras To Canada

Ways to avoid common tax pitfalls

- 00:11

Crossing borders for work often means cross-border tax issues, especially when it comes to retirement accounts.

Moving 401s and IRAs to Canada must be done with plenty of forethought otherwise, owners could face big tax bills on both sides of the border. In a case that got accountants buzzing, CBCs Go Public reported that an Ontario couple lost almost a quarter of their U.S. retirement savings to taxes when they followed improper advice about making the transfer.

And even if clients dont want to move their money, they may be forced to. Plans have the ability to kick a participant out either due to account size or non-residency in the U.S., says Debbie Wong, a CPA and vice-president with Raymond James in Vancouver. That means Canadian residents could be out of luck.

Jacqueline Power of Mackenzie Investments in Toronto agrees. A lot of U.S. suppliers dont want to deal with Canadians anymore, she says. Weve had lots of advisors saying their clients are being essentially forced out of the U.S.

L.J. Eiben, president and CEO of Raymond James Ltd. in Vancouver, says a U.S. firm usually gives the individual 30 to 60 days to transfer out. If not done by that date, the firm will liquidate the retirement account and send the participant a cheque for the remaining proceeds minus withholding tax, penalties, et cetera.

Read Also: How Do You Max Out Your 401k