What Happens If You Contribute Too Much To Your 401

If your 401 contributions exceed the limits above, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. Earnings still grow tax-deferred until you withdraw them.

If you realize you contributed too much to your 401, notify your HR department or payroll department and plan administrator right away. During a normal year, you have until your tax filing deadlineusually April 15to fix the problem and get the money paid back to you.

Excess deferrals to a 401 plan will have to be withdrawn and returned to you. Your human resources or payroll department will have to adjust your W-2 to include the excess deferrals as part of your taxable income. If the excess deferrals had any earnings, you will receive another tax form that you must file the following tax year.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Mega Back Door Roth Solo 401k Contribution Limit Question:

Yes and see the following.

- The overall limit in 415C applies on a per employer basis Provided that the employers are unrelated.

- This limit is applied without consideration of contributions made to a plan sponsored by an unrelated employer

- The elective deferral limit in 402G applies only to elective deferrals and does not impact after-tax contributions

- Here is an Example:

- For 2021, an individual contributes $19,500 of the elective deferrals to a 401 plan sponsored by his W-2 employer & additional matching and profit-sharing contributions are made up to the limit of $58,000

- Individual has an S-corp side business with no employees that generates self-employment income greater than $58,000.

- The individual can contribute after-tax contributions up to $58,000 to the solo 401 sponsored by side business and subsequently convert the voluntary after-tax funds to a Roth IRA or to the Roth Solo 401k.

Also Check: How Do I Find Out Where My Old 401k Is

Contribute To A Roth Ira

The Roth IRA is the peanut butter to the 401s jellythey just go better together! The beautiful thing about the Roth IRA, which stands for individual retirement account, is that it lets you enjoy tax-free growth and tax-free withdrawals in retirement. Tax-free . . . dont you just love the sound of that?

In 2021, you can put up to $6,000 into a Roth IRA .6 Sticking with our example above, maxing out your Roth IRA and investing $6,000 into your account brings your total retirement savings for the year to $9,750 . . . just a little bit short of your retirement savings goal.

So what are we going to do with the remaining $1,500? Its time to send you back . . . back to the 401!

Treatment Of Excess Deferrals

You have an excess deferral if the total of your elective deferrals to all plans is more than the deferral limit for the year. Notify your plan administrator before April 15 of the following year that you would like the excess deferral amount, adjusted for earnings, to be distributed to you from the plan. The April 15 date is not tied to the due date for your return.

Excess withdrawn by April 15. If you exceed the deferral limit for 2020, you must distribute the excess deferrals by April 15, 2021.

- Excess deferrals for 2020 that are withdrawn by April 15, 2021, are includable in your gross income for 2020.

- Earnings on the excess deferrals are taxed in the year distributed.

The distribution is not subject to the additional 10% tax on early distributions.

Excess not withdrawn by April 15. If you don’t take out the excess deferral by April 15, 2021, the excess, though taxable in 2020, is not included in your cost basis in figuring the taxable amount of any eventual distributions from the plan. In effect, an excess deferral left in the plan is taxed twice, once when contributed and again when distributed. Also, if the entire deferral is allowed to stay in the plan, the plan may not be a qualified plan.

Reporting corrective distributions on Form 1099-R. Corrective distributions of excess deferrals are reported to you by the plan on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

You May Like: Should I Do Roth Or Traditional 401k

What Is The Maximum 401k Employer Match Contribution For 2020

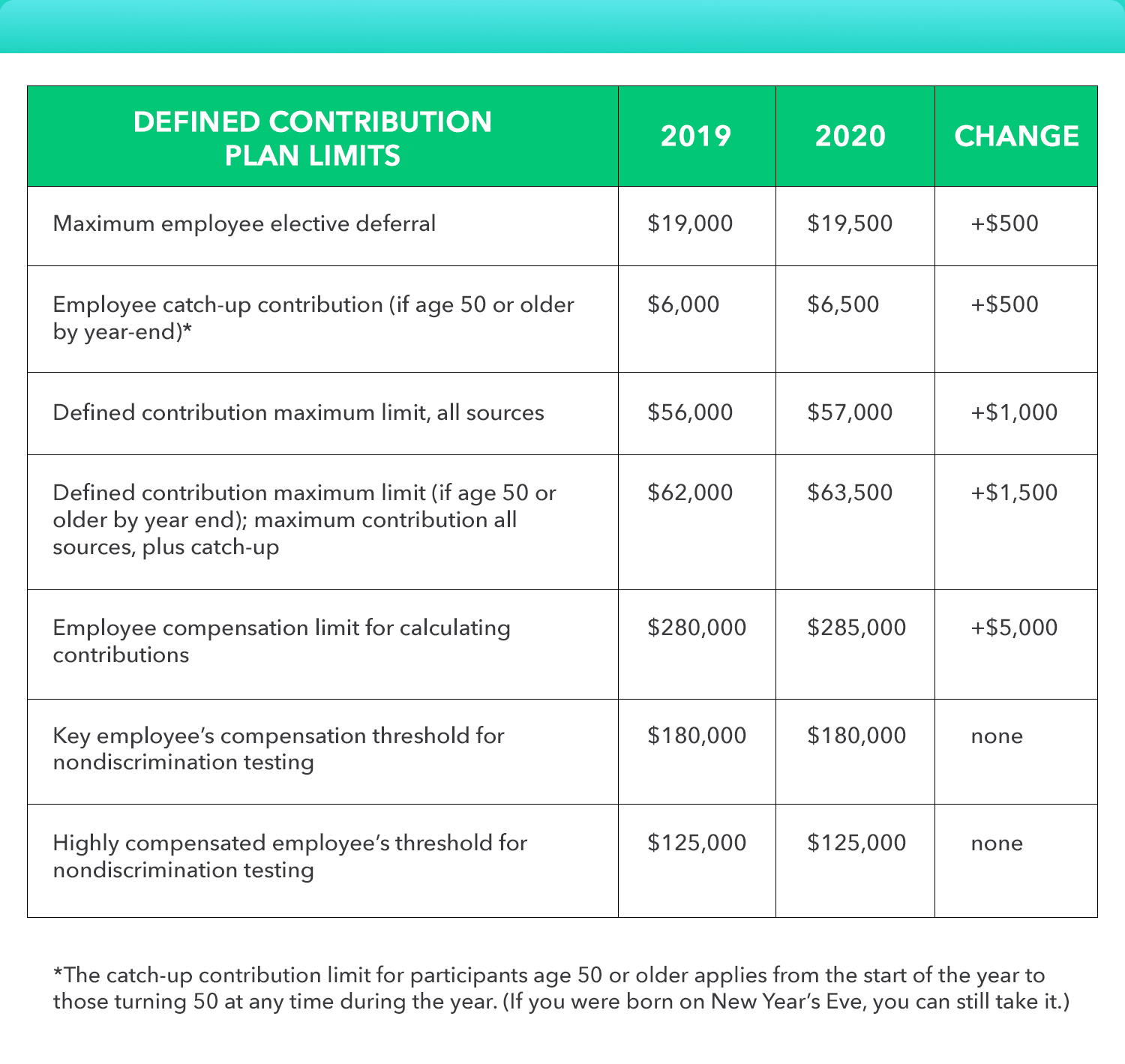

Employee 401 contributions for 2020 can increase by $500 to $19,500, while the combined employer and employee contribution limit rises by $1,000 to $57,000, the IRS announced on Nov. 6, 2019. For participants ages 50 and over, the additional catch-up contribution limit will rise to $6,500, up by $500.

Ira Contribution Limit For 2020

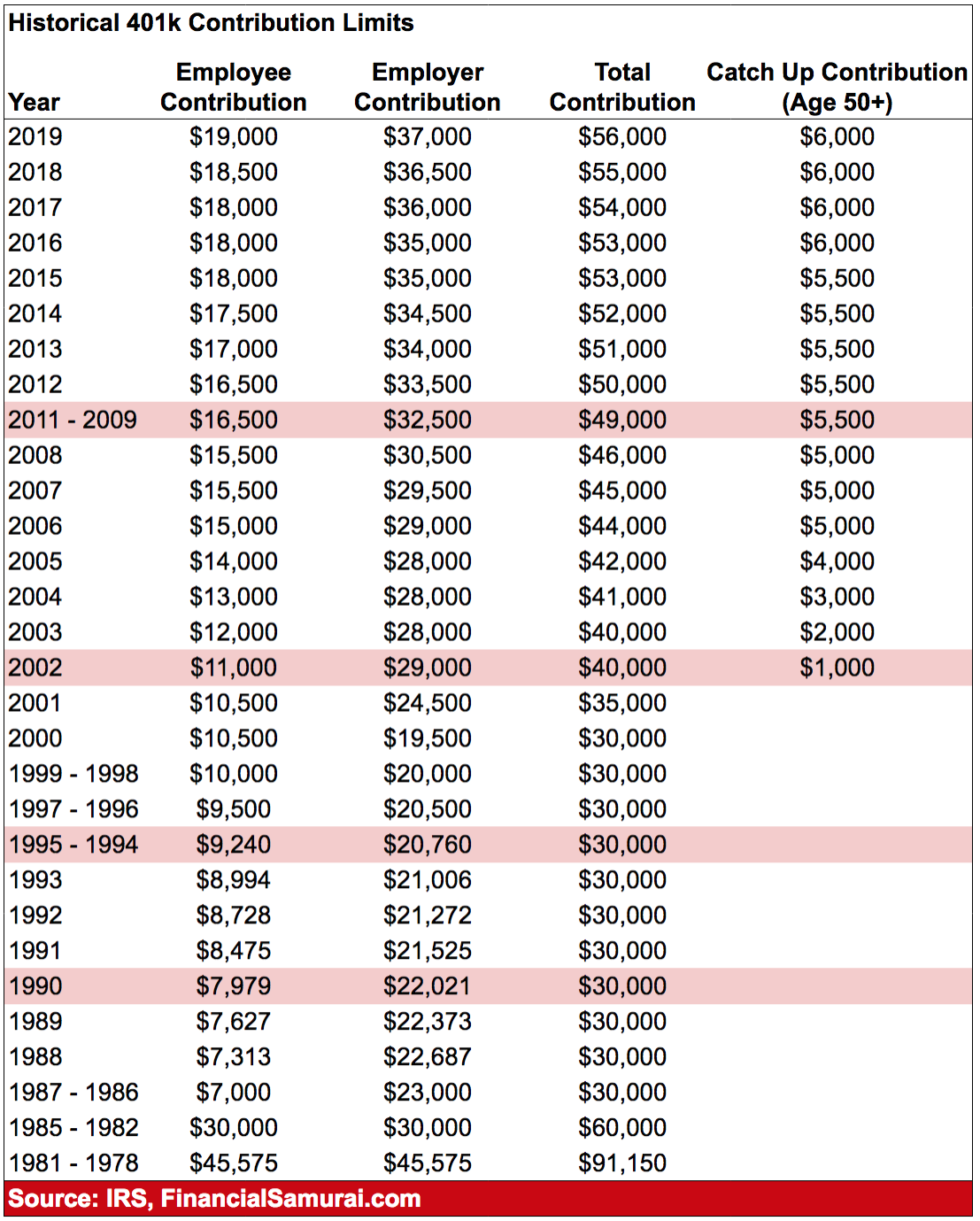

Here is a table showing historical limits. As you can see, each year the total contribution limit goes up slightly to account for inflation and increases wages.

|

Year |

|

|

$40,000.00 |

$1,000.00 |

A note about this table: as an employee, you are not able to contribute more than $19,500 of your annual salary to your 401k if you are under 50 years old. If you are older than 50, however, the government enables you to make larger savings contributions.

This policy is intended to accelerate savings from people closer to retirement age.

Employers could contribute up to $57,000 in 2020 in 2021 that amount has risen to $58,000 .

Recommended Reading: What Happens To Your 401k When You Switch Jobs

Roth 401 Retirement Savings Tips

Advice for maximizing your Roth 401 account:

- Max out your contributions. For each year that you’re able, aim to hit the $19,500 limit.

- Once you turn 50, add another $6,500 to that limit annually while you continue to work.

- If your employer offers to match your contributions up to a certain amount, be sure to invest at least that much in your Roth 401 each month. It’s free money, after all.

Continue Reading

Cola Increases For Dollar Limitations On Benefits And Contributions

The tax law places limits on the dollar amount of contributions to retirement plans and IRAs and the amount of benefits under a pension plan. IRC Section 415 requires the limits to be adjusted annually for cost-of-living increases.

- Limits by plan type , SEP, SIMPLE IRA, 403, 457, defined benefit)

- 2022 cost-of-living adjustments for pension plans and retirement-related items

- COLA Table PDF for prior years’ dollar limitations and Internal Revenue Code references.

| IRAs |

|---|

Recommended Reading: How To Invest My 401k Money

Choosing Investments Within A Plan

Generally, 401 plans offer several options in which to invest contributions. Such options generally include mutual funds that may invest in stocks for growth, bonds for income, or money market investments for protection of principal. This flexibility may help lower investment risk by diversifying a portfolio amongst different types of classes, manager styles, investment styles, and economic sectors.

What Are The 401 Contribution Limits For 2021

7 Minute Read | September 27, 2021

Do you know what simple step most millionaires took to help them build their wealth? Believe it or not, they didnt roll the dice on flashy investment trends or inherit most of their seven-figure net worth. Nope! More than anything else, they put money in their 401.

Thats right! According to the National Study of Millionaires, eight out of 10 millionaires invested in their companys 401 plan. They put money into their accounts month after month, year after year, until one day they looked up and their net worth was in the seven figures. And if they can do it, you can too!

One of the amazing things about a 401 is that it lets you put thousands of dollars away each year for retirement. So if youre one of the millions of Americans with access to a 401, dont take it for granted!

But just how much can you put into your 401 in 2021? Lets take a look.

401 Contribution Limits For 2021

| The 401 contribution limit is $19,500. |

| The 401 catch-up contribution limit for those age 50 and older is $6,500. |

| The limit for employer and employee contributions combined is $58,000. |

| The 401 compensation limit is $290,000. |

Read Also: Can I Roll Over My 401k To An Ira

Heres The Maximum You Can Save In Your 401 Plan In 2021

- Next year, workers can defer up to $19,500 into a 401 plan at work, plus $6,500 if theyre aged 50 and over. Those levels are unchanged from 2020.

- In 2021, you can contribute up to $6,000 to a traditional or Roth individual retirement account. Add in an extra $1,000 if youre 50 and over. These limits are also unchanged from 2020.

- Got a high deductible health plan? Contribute up to $3,600 in your health savings account next year if you have self-only coverage. That number goes up to $7,200 for family plans. Add $1,000 if youre over 55.

If you’re signing up for next year’s workplace benefits, now is the best time to develop a strategy for increasing your savings.

Benefits season also happens to coincide with the annual IRS release of the 2021 maximum contribution limits for certain tax-advantaged accounts, including your 401 plan, individual retirement account and healthcare flexible spending accounts.

Uncle Sam updates these figures around this time each year to reflect inflation.

Be aware that while these maximum amounts may be something for savers to strive for, they’ll need to balance their long-term savings goals with daily cash needs.

You don’t want to shortchange your emergency fund so that you can squirrel away a few more dollars in your 401 plan.

“Being able to contribute the maximum is a fantastic place to be, but most people aren’t there,” said Dave Stolz, CPA and chair of the American Institute of CPAs’ personal financial specialist committee,

Types Of 401 Contributions That The Irs Allows

Many 401 plans allow you to put money into your plan in all of the following ways:

- 401 pretax contributions: Money is put in on a tax-deferred basis. That means that it’s subtracted from your taxable income for the year. Youll pay tax on it when you withdraw it.

- Roth 401 contribution : Money goes in after taxes are paid. All of the gain is tax-free you pay no tax when you withdraw it.

- After-tax 401 contributions: Money goes in after taxes are paid, which means that it won’t reduce your annual taxable income. But you will not pay taxes on the amount when you withdraw it. You might have tax due, at your ordinary income-tax rate, on any interest that’s accumulated tax-deferred on the amount. You can avoid this by rolling over the sum into a Roth IRA.

Also Check: How Long Does A 401k Rollover Take

Historical 401 Contribution Limit

Every year, the IRS sets the maximum 401 contribution limits based on inflation . There are actually multiple limits, including an individual contribution, an employer contribution, and an age 50+ catch-up contribution.

If you’re currently working at a company with a plan, we highly suggest familiarizing yourself with its mechanics and any matching funds. Contributing to your 401 is an excellent way to help set yourself up for retirement.

What is the 401 contribution limit in 2021?

The 2021 401 individual contribution limit matches the limit in 2020 an up to $19,500. In 2021, employers can contribute up to $38,500, up from a limit of $37,500 in 2020 that’s a total of $58,000 in 2021 .

If you are 50 years old or older, you can also contribute up to $6,500 in “catch-up” contributions on top of your individual and employer contributions.

This is up from $19,000, $56,000, and $6,500, respectively, in 2019 contribution limits.

Savers Ages 50 And Older Can Put Away An Extra $6500 This Year

by Adam Shell, AARP, Updated January 11, 2021

En español | In a year of gloomy economic news, one bright spot is that workers who participate in a 401 at work can still sock away $19,500 in their workplace retirement plan.

And that’s good news: The number of companies that offer a traditional pension has dwindled, and workers are increasingly reliant on their own savings to fund their retirement. Last year, only 13 companies in the Fortune 500 offered a traditional pension, or defined-benefit plan, down from 236 companies in 1998, according to advisory firm Wilson Towers Watson. 401s, in contrast, have mushroomed. In 2018, more than 58 million American workers had a 401, or defined-contribution plan, and there were more than 580,000 401 plans offered, according to the Investment Company Institute.

A traditional 401 is a tax-advantaged retirement account that lets employees save pre-tax dollars that can grow tax-free until the funds are withdrawn in retirement. When you take distributions after the age of 59 1/2, your money will be taxed as ordinary income. However, 401 participants who start withdrawing their savings from the plan before the age of 59 1/2 will generally incur a 10 percent early withdrawal penalty.

Recommended Reading: How To Pull From 401k

How Are Excess Deferrals Treated

If you dont handle your extra contributions by Tax Day, youre going to be taxed twice: once for the year you over-contributed and again for the year your correction took place. You wont be taxed twice if you made the corrective distribution before Tax Day of the year following the year the over-contribution took place.

For example, if you made a 401 over-contribution in 2020, you have until Tax Day 2021 to make the correction to avoid getting double-taxed.

Corrective distribution is simply when you correct the over-contribution mistake. But keep in mind that if you qualify for catch-up contributions by being 50 years of age or older, your over-contributions might save you from excess deferrals. As youre settling this excess, knowing the tax laws can help.

About Robert Henderson And Lansdowne Wealth Management

Robert Henderson is the President of Lansdowne Wealth Management, an independent, fee-only advisory firm in Mystic, CT. His firm specializes in financial planning and investment management for retirement, with a special focus on the particular needs of women that are divorced or widowed. He is an Accredited Asset Management Specialist and a Certified Divorce Financial Analyst. Mr. Henderson can be reached at 860-245-5078 or . You can also view his personal finance blog, The Retirement Workshop at and the firms website at .

If you are an employee or retiree of General Dynamics, and you would like advice and direction on retirement planning or managing your GD Fidelity 401K plan, please sign up for our monthly newsletter, which provides complimentary ongoing advice, commentary, and model portfolios for those plans.

Find Us On and on

Read Also: Can I Move Money From 401k To Roth Ira

Maximum 401 Company Match Limits

To account for inflation, the employee and employer match limits for 401s fluctuate each year. Since inflation is projected to rise, the contribution maximum is increasing as well. According to the IRS, the employee contribution amount limits per year include:

- 2018: $18,500

- 2019: $19,000

- 2020: $19,500

The contribution amount employers decide to match often varies depending on the companys overall budget. The limit per year that employees and employers can contribute combined include:

- 2018: $55,000

- 2019: $56,000

- 2020: $57,000

If you have employees who are 50 years and older, they may be eligible for additional contributions to their 401 accounts, also known as catch-up contributions. Catch-up contributions remained the same in both 2018 and 2019 but increased in 2020. The limits for these additional contributions per year are:

- 2018: $6,000

Roth 401 Contribution Limits

The contribution limit for Roth 401s is much higher than those for Roth IRAs. However, Roth 401 contribution limits are the same as those for traditional 401s.

Individual Roth 401 contributions limit is $19,500 for 2021. Total contributions made by employees and employer matches to a Roth 401 are limited to $58,000.

Also Check: How Do You Know If You Have An Old 401k

Retirement Contribution Limits And Income Ranges: What To Know

If youre proactive about retirement savings or want to up your savings game this year, you may already know that retirement contribution limits stayed the same for 2021. Let’s break down what this and other recent changes can mean for your retirement plans, whether youre already saving or just getting started.

Knowing These Rules Can Save You A Lot Of Trouble With The Irs

A 401 is a tax-advantaged retirement account, so the government sets limits on how much you can contribute every year. But it also understands that inflation makes retirement more expensive over time, so it reevaluates its limits every year and sometimes raises them. Here’s an overview of all of the contribution limits the government imposes on 401s in 2020 and 2021.

Don’t Miss: What Should I Invest In 401k