Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Risks Of Taking Out A 401 Loan

Before deciding to borrow money from your 401, keep in mind that doing so has its drawbacks.

You may not get one. Having the option to get a 401 loan depends on your employer and the plan they have set up. A 2020 study from retirement data firm BrightScope and the Investment Company Institute says that 78 percent of plans gave participants the option to borrow based on 2017 data. So you may need to seek funds elsewhere.

You have limits. You might not be able to access as much cash as you need. The maximum loan amount is $50,000 or 50 percent of your vested account balance, whichever is less.

Old 401s dont count. If youre planning on tapping into a 401 from a company you no longer work for, youre out of luck. Unless youve rolled that money into your current 401 plan, you wont be able to use it.

You could pay taxes and penalties on it. If you dont repay your loan on time, the loan could turn into a distribution, which means you may end up paying taxes and bonus penalties on it.

Youll have to pay it back more quickly if you leave your job. If you change jobs, quit or get fired by your current employer, youll have to repay your outstanding 401 balance sooner than five years. Under the new tax law, 401 borrowers have until the due date of their federal income tax return to repay in such circumstances.

Borrowing Against 401k Answer:

While securities based lines of credit may be an easy way to access extra cash, it is important to recognize that the IRS rules dont allow you to pledge your 401k assets as collateral for a personal loan.

Instead of using a 401 account as collateral, you can borrow the money that you need from the 401 account if the Solo 401k plan documents allow for 401k participant loans.

The maximum amount that the plan can permit as a loan is the greater of $10,000 or 50% of your vested account balance, or $50,000, whichever is less.

For example, if your Solo 401k brokerage account at Fidelity has an account balance of $40,000, the maximum amount that you can borrow from the account is $20,000. There are important technical requirements that apply to Solo 401k participant loans including specific documentation & repayment requirements. Therefore, dont just take the funds out of your Fidelity brokerage account but be sure to coordinate the loan with your Solo 401k plan provider in advance.

For more on the Solo 401k loan requirements, click HERE.

Recommended Reading: Can I Roll A 401k Into A Roth Ira

Who Should Withdraw From Their 401 Early

Just because you qualify for a hardship-related withdrawal doesnt mean you should take one without weighing all your other options.

The experts we spoke with were all in agreement that withdrawing from your 401 shouldnt be your first move. However, they also indicated that if youre truly in need, then you should take advantage of the CARES Acts allowances.

It should be a last resort option. People shouldnt get carried away and start using their 401 assets just because they can, Pfau says.

What Are Some Alternatives To A 401 Loan

When cash is tight, borrowing from your 401 plan and paying yourself interest may seem like a good idea. But before you borrow, weigh all your options. Here are a few.

Don’t Miss: Why Choose A Roth Ira Over A 401k

Make The Best Decision For You

When it comes to deciding what to do with an old 401 or 403, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary, so it’s important to find out the rules your former employer has, as well as the rules at your new employer.

Also, do compare the fees and expenses associated with the accounts you’re considering. If you find the comparison confusing or overwhelming, speak with a financial professional to help with the decision.

When To Borrow From Your 401

Only borrow from your 401 when no other reasonable loan rates are available and only if the situation is dire.

Vacations are ruled out. So are 50-inch 4K TVs, shopping sprees and any form of consumerism that might be considered excessive. There are, however, emergencies or dead-end scenarios when a 401 loan may be your best or only option.

If youre suffering a medical setback and need cash fast, your 401 may be a good place to look. You may even qualify for a hardship withdrawal. In this case you wont have to pay the loan back, but youll still have to pay income taxes, plus the 10% early withdrawal fee.

The qualifications for hardship withdrawal differ from plan to plan. Check with your employer to see what yours may cover.

If youre looking at your 401 as a way out of debt, youre looking in the wrong direction. Debt is often the result of undisciplined spending or an unforeseen emergency like job loss or medical setback. Its rarely a one-time purchase that sends the consumer into financial despair.

Read Also: How Much Should I Have In My 401k At 55

Fidelity 401k Loan Everything You Need To Know

For many when starting their new job thought of participating in a 401k plan was exciting. A place to store thousands and thousands of dollars, safe and secure, awaiting retirement. Then life happened. The transmission went out. Your son broke his arm. The tree fell onto the house. And that was just last month! Now what? Well, you invade the 401k, of course. But, as a wise man once said, It is characteristic of wisdom not to do desperate things. So, before we do desperate things, lets look at some of the pros and cons of taking out a fidelity 401k loan.

If You Default On Your 401 Loan You’ll Owe A Penalty

If you do not pay your 401 loan back as required, the defaulted loan is considered a withdrawal or distribution and thus subject to a 10% penalty applicable to early withdrawals made before age 59 1/2. That’s potentially a huge cost, especially when you also consider the loss of the potential gains your money would have made had you left it invested.

The penalty for defaulted loans still applies to COVID-19 related loans taken under the CARES Act’s special rules applicable in 2020. This can be confusing, as the CARES Act also altered the rules for withdrawals, enabling you to take a coronavirus-related distribution from your 401 in 2020 without incurring the customary 10% tax penalty. Unfortunately, if you default on your 401 loan, it doesn’t convert to a penalty-free withdrawal, even if you would have been entitled to one in 2020.

Also Check: Can You Roll A Traditional 401k Into A Roth Ira

Early Withdrawals Less Attractive Than Loan

One alternative to a 401 loan is a hardship distribution as part of an early withdrawal, but that comes with all kinds of taxes and penalties. If you withdraw the funds before retirement age youll typically be hit with income taxes on any gains and may be assessed a 10 percent bonus penalty, depending on the nature of the hardship.

You can also claim a hardship distribution with an early withdrawal.

The IRS defines a hardship distribution as an immediate and heavy financial need of the employee, adding that the amount must be necessary to satisfy the financial need. This type of early withdrawal doesnt require you to pay it back, nor does it come with any penalties.

A hardship distribution through an early withdrawal covers a few different circumstances, including:

- Certain medical expenses

- Some costs for buying a principal home

- Tuition, fees and education expenses

- Costs to prevent getting evicted or foreclosed

- Funeral or burial expenses

- Emergency home repairs for uninsured casualty losses

Hardships can be relative, and yours may not qualify you for an early withdrawal.

This type of withdrawal doesnt require you to pay it back. But its a good idea to avoid an early withdrawal, if at all possible, because of the serious negative effects on your retirement funds. Here are a few ways to sidestep those hefty levies and keep your retirement on track.

What Happens If You Leave Your Job

When you take out a loan from a 401, you may have no intention of leaving your current employer. But if you receive a better job offer, or are laid off or otherwise leave, you could be required to pay the loan back in full or face some serious tax consequences.

Employees who leave their jobs with an outstanding 401 loan have until the tax-return-filing due date for that tax year, including any extensions, to repay the outstanding balance of the loan, or to roll it over into another eligible retirement account. That means if you left your job in January 2020, you would have until April 15, 2021 when your 2020 federal tax return is due to roll over or repay the loan amount. Prior to the Tax Cuts and Jobs Act of 2017, the deadline was 60 days.

If you cant repay the loan, your employer will treat the remaining unpaid balance as a distribution and issue Form 1099-R to the IRS. That amount is typically considered taxable income and may be subject to a 10% penalty on the amount of the distribution for early withdrawal if youre younger than 59½ or dont otherwise qualify for an exemption.

Unfortunately, this worst-case scenario isnt rare. A 2014 study from the Pension Research Council at the Wharton School of the University of Pennsylvania found that 86% of workers in the sample who left their jobs with a loan outstanding eventually defaulted on the loan.

Read Also: Should I Borrow From My 401k

How Long Do You Have To Repay A 401 Loan

Generally, you have up to five years to repay a 401 loan, although the term may be longer if youre using the money to buy your principal residence. IRS guidance says that loans should be repaid in substantially equal payments that include principal and interest and that are paid at least quarterly. Your plan may also allow you to repay your loan through payroll deductions.

The CARES Act allows plan sponsors to provide qualified borrowers with up to an additional year to pay off their 401 loans.

The interest rate youll pay on the loan is typically determined by the plan administrator based on the current prime rate, but it and the repayment schedule should be similar to what you might expect to receive from a bank loan. Also, the interest isnt paid to a lender since youre borrowing your own money, the interest you pay is added to your own 401 account.

When You Can Borrow

Once you pull money out of your plan, those dollars no longer benefit from long-term market returns.

If you have a pool of emergency funds, it’s best to use that money first. If you’re managing debt, it’s even better to build that repayment into your budget.

Even your boss wants you to keep your hands off your retirement plan savings.

That said, here are three extreme cases that may warrant a 401 loan.

You have an immediate emergency.“Say that you need to meet the deductible on your high-deductible health-care plan, and you have no money in your health savings account,” said Aaron Pottichen, president of retirement services at CLS Partners in Austin, Texas.

He is referring to the tax-advantaged health savings account that individuals may use to cover qualified medical expenses. It’s also known as an HSA.

You have an urgent cash need, but your credit precludes you from obtaining a competitive interest rate. Ask yourself what you can repay in five years.

You need to pay off high-interest debt that’s hampering your long-term financial goals. This is the case if the interest rate on your 401 is lower than what your creditor is offering you.

“If you’re in ‘pay down debt mode,’ it’s all about what’s your cheapest interest rate and how fast can you get the debt down,” said Pottichen.

Don’t Miss: Should I Get A 401k

Making A 401 Withdrawal For A Home

Compared to a loan, a withdrawal seems like a much more straightforward way to get the money you need to buy a home. The money doesn’t have to be repaid and you’re not limited in the amount you can withdraw, which is the case with a 401 loan. Withdrawing from a 401 isn’t as easy as it seems, though.

The first thing to understand is that your employer may not even allow withdrawals from your 401 plan due to age. If they do allow employees to tap 401 funds early, you may have to prove that you’re experiencing a financial hardship before they’ll allow a withdrawal. Under the IRS rules, consumer purchases generally don’t fit the hardship guidelines.

You may be able to withdraw funds from a 401 plan that you’ve left behind at a previous employer and haven’t rolled over to your new 401. This, however, is where things can get tricky.

If you’re under age 59 1/2 and decide to cash out an old 401, you’ll owe both a 10% early withdrawal penalty on the amount withdrawn and ordinary income tax. Your plan custodian will withhold 20% of the amount withdrawn for taxes. If you withdraw $40,000, $8,000 would be set aside for taxes upfront, and you’d still owe another $4,000 as an early-withdrawal penalty.

How Borrowing From Your 401 Works

Most 401 programs let you set up a loan all on your own, without any assistance, via the website you use to handle other 401 tasks, such as changing your contribution amounts and allocating your savings to different investment funds.

Setting up the loan is as simple as finding the loan page on the 401 site and specifying the amount you want to borrow. The online form won’t let you borrow more than you’re entitled to, and interest rate and payroll deduction payments based on a standard five-year repayment period will be calculated automatically.

Once you authorize the loan, the amount of the loan will likely be included with your next paycheck .

If you have any questions about the process, you’ll find an option for contacting fund administrators on the webpage.

Also Check: Can I Rollover My 401k To An Existing Ira

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Should You Borrow From Your 401

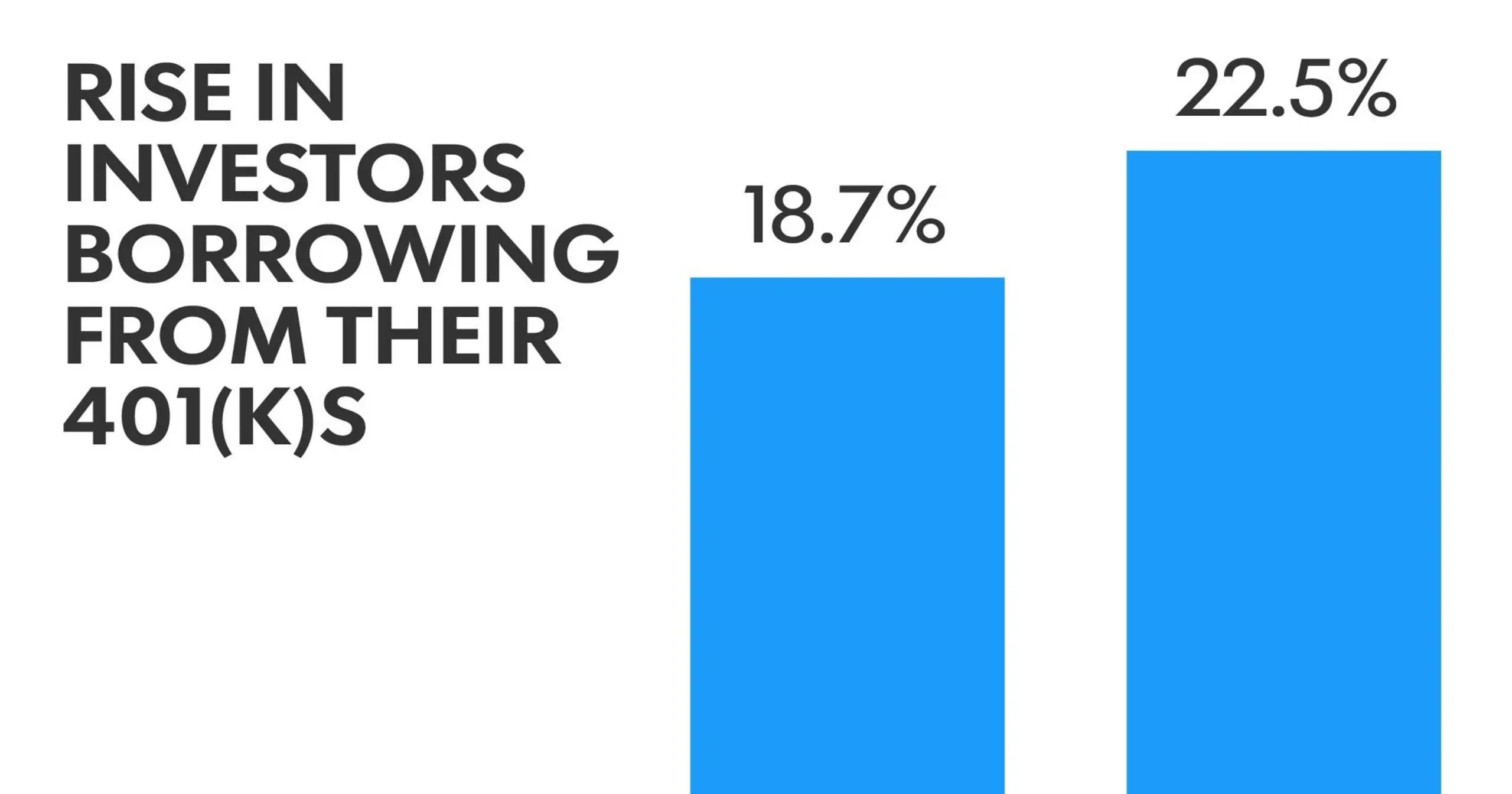

The average household with credit card debt had a balance of $7,149 in 2020. For the average household carrying credit card debt as of September 2020, this equates to an annual interest of $1,155. With the average credit card annual percentage rate sitting at 16.43%, it represents an expensive way to fund spending.1

Which leads many individuals to ask, Does it make sense to borrow from my 401 to pay off debt or to make a major purchase?2

Read Also: How To See How Much Is In My 401k