Advantages Of Roth 401s

One big advantage of a Roth 401 is the lack of an income limit, meaning people with high incomes can still contribute. This pairs well with the Roth 401s higher contribution limits. Participants in the plans can contribute an annual maximum of $19,500, with an additional $6,500 catch-up contribution if they turn 50 by the end of the year, for 2020 and 2021.

Unlike Roth IRAs, Roth 401s do not have an income limit, allowing high-wage earners to contribute to one.

Another advantage to Roth 401s is those matching contributions. Employers are even offered a tax incentive to make them. There is a hitch, though. Because employers are matching your contribution with pretax dollars, and the Roth is funded with post-tax dollars, those matching funds and their earnings will be placed in a regular 401 account. That means you will pay taxes on this moneyand its earningsonce you start taking distributions.

A third advantage is the ability to take a loan from a Roth 401. You can borrow up to 50% of your account balance or $50,000, whichever is smaller. However, if you fail to pay back the loan as per the terms of the agreement when you take the money out, it could be considered a taxable distribution.

Roth Ira Income Limits

The Roth IRA income limits are different for 2020 versus 2021. How much you can contribute to a Roth IRA depends, in part, on how much you earned in that year. In other words, the contribution amount allowed can be reduced, or phased out, until it’s eliminated, depending on your income and filing status for your taxes .

2020

For individuals filing taxes as single, you could make a full contribution to a Roth if your income was less than $124,000. Your contributions would be reduced or phased out if your income was between $124,000 and $139,000. If you earned more than $139,000, you couldn’t make any contributions to a Roth IRA.

If you were married filing jointly, you could make a full contribution to a Roth if your income was less than $196,000. Your contributions would be reduced or phased out if your income was between $196,000 and $206,000. If you earned more than these IRS-imposed limits, you couldnt contribute to a Roth IRA.

2021

For individuals with a tax filing status of single, you can make a full contribution if your income is below $125,000. The income phase-out range has been increased to $125,000 to $140,000.

If you’re a married couple filing jointly, for 2021, full contributions are allowed if you make less than $198,000, while the income phase-out range is $198,000 to $208,000.

What Is A 401k

A 401k is an employer-sponsored retirement plan and the most frequently used option these days to fund retirement. A 401k is only offered through an employer and not something you can sign up for at any brokerage firm.

Once you enroll in a 401k, you select a percentage of your paycheck to be directly deposited into your 401k account.

You can choose 1% or 100% of your paycheck, as long it stays under the annual minimum of $18,500 . Note these figures are for 2018 and may change in future years.

This money is pre-tax, which means contributions have not been taxed yet. Theyre directly taken from your paycheck before taxes are applied, lowering your taxable income.

That may allow you to contribute more than if the contributions came from post-tax income.

Once you reach retirement age you can then withdraw from your 401k, but your withdrawals will be taxed. This can be a positive scenario in the future as it is based on the assumption that you will be in a lower tax bracket at retirement age.

The one downside? The maximum amount you can contribute is $19,500 as of 2021 . Sorry high-income earners, there are no upper-income brackets at this time.

Also Check: Does Mcdonald’s Offer 401k

Roth 401 Early Withdrawals

You can withdraw funds from your Roth 401 early without meeting the conditions listed abovethese withdrawals are non-qualified distributions. If youre not 59 ½, or you havent waited five years after making your first contributions, or you dont qualify for a hardship withdrawal, you may have to pay income taxes and a 10% IRS tax penalty on somebut not allof the amount you take out.

Heres the tricky part: Early withdrawals must include both contributions and earnings, prorated based on the ratio of contributions to earnings in the account. Consider a Roth 401 with a balance of $20,000$16,000 of which are contributions and $4,000 of which are earnings. Any early withdrawal from this account would therefore comprise 80% contributions and 20% earnings.

If our theoretical account holder took an early withdrawal, the 80% portion of the withdrawal that came from contributions would be free of tax and not subject to the 10% penalty. But the 20% portion comprising earnings would be taxed as regular income, and subject to a 10% tax penalty.

These rules provide additional flexibility to withdraw money from your Roth 401 in times of need and possibly pay fewer penalties that you would for a similar early withdrawal from a Traditional 401. However, its not a good idea to give up your hard-earned retirement savings and earnings in tax penalty payments, and early withdrawals from retirement accounts should always come last in a long list of alternatives.

Vs Roth : Which One Is Better

11 Minute Read | September 27, 2021

If youve heard of a Roth 401, you may be wondering how different it really is from a traditional 401. We get it, 401s can be confusing! While these two types of 401 accounts have some similarities, they also have some pretty huge differences.

Access to a Roth option is becoming more and more common, so youre in the majority if you have this option at work. Just over the last five years, the number of plans offering a Roth 401 option has increased by 32%. As of 2021, about 3 out of 4 workplace retirement plans now offer a Roth optionwhich is great news for you!1

And guess what? Younger savers are starting to take advantage of this new option. Millennials are the most likely group to contribute to their Roth 401 at work.2

If you can contribute to a Roth and traditional 401 at work, which one should you choose? Lets dig into some of the differences between these options so you can make the best decision.

You May Like: How Do You Rollover Your 401k To A New Employer

Your Current Income Status

If your annual salary is less than $107,000 or $72,000 , then you should probably choose a Roth IRA.

On the other hand, if your annual salary is higher than either of those values, you might lean towards a 401 because contributions will be taxed when withdrawn and only up to $17,500 can be contributed to a Roth IRA.

K Vs Roth Ira Comparative Table

| Basis | ||

|---|---|---|

| Contributions made form salary deferrals. | Contributions made are from post-tax income. | |

| Distribution | Distributions are taxable as per the tax slab of the person at the time of withdrawal. | Distributions are not taxable and hence allows the entire corpus to be available at the disposal of the investor. |

| Usage | It is beneficial for those who want to minimize their current tax payments and hence deferring the tax during their retirement when they will fall in lower tax brackets due to lesser income during retirement as compare to present income. | It is beneficial for those who want to minimize tax payments during retirement. Also, it also useful as an instrument for those who want to leave tax-free assets for their heirs. |

You May Like: Can You Roll A 401k Into A Roth

How Soon Do You Plan On Retiring

If your goal is to retire earlier, then the Roth IRA might be a better choice for you because it has a lower contribution limit.

On the other hand, if you want to retire later and will need every penny in your retirement fund, then go with a 401 because money can grow faster as well as be tax-free.

Now that you know the factors to consider when choosing between a Roth IRA and 401, hopefully, it will be easier for you to make an informed decision about which one is right for you.

Best Roth Ira Brokers

As I mentioned, to enroll in a 401k with your employer is simple. But a Roth IRA requires more work on your end and is one of the main reasons I think people dont take advantage of this retirement vehicle.

In reality, it doesnt take long to find a provider, set up deductions and start saving for your future. Here are the best IRA providers, in my opinion:

Recommended Reading: Should I Invest In 401k

Both The Roth 401 And The Roth Ira Can Help You Reach Your Retirement Goals Each Has Its Advantages And Disadvantages

Roth 401s and Roth IRAs are retirement savings accounts that allow you to contribute with after-tax dollars and take tax-free withdrawals in retirement. They are an alternative to traditional 401s and traditional IRAs, both of which allow pre-tax contributions but require you to pay tax on withdrawals.

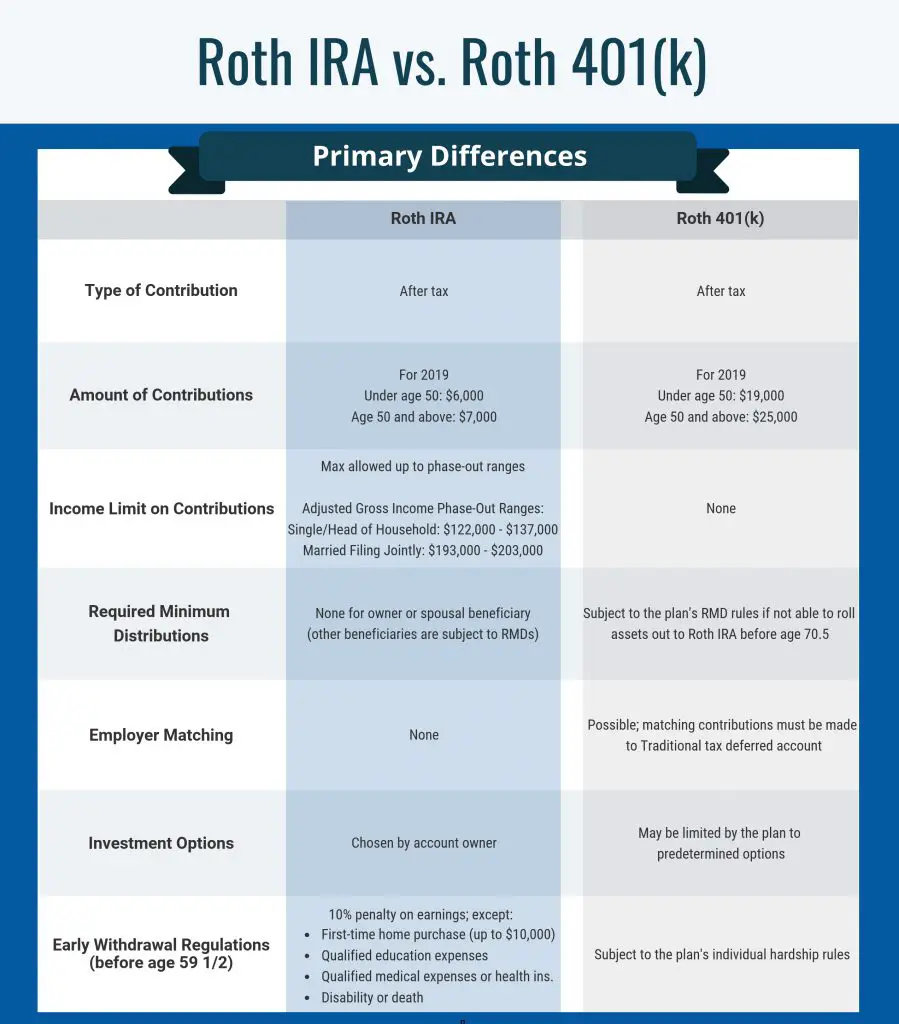

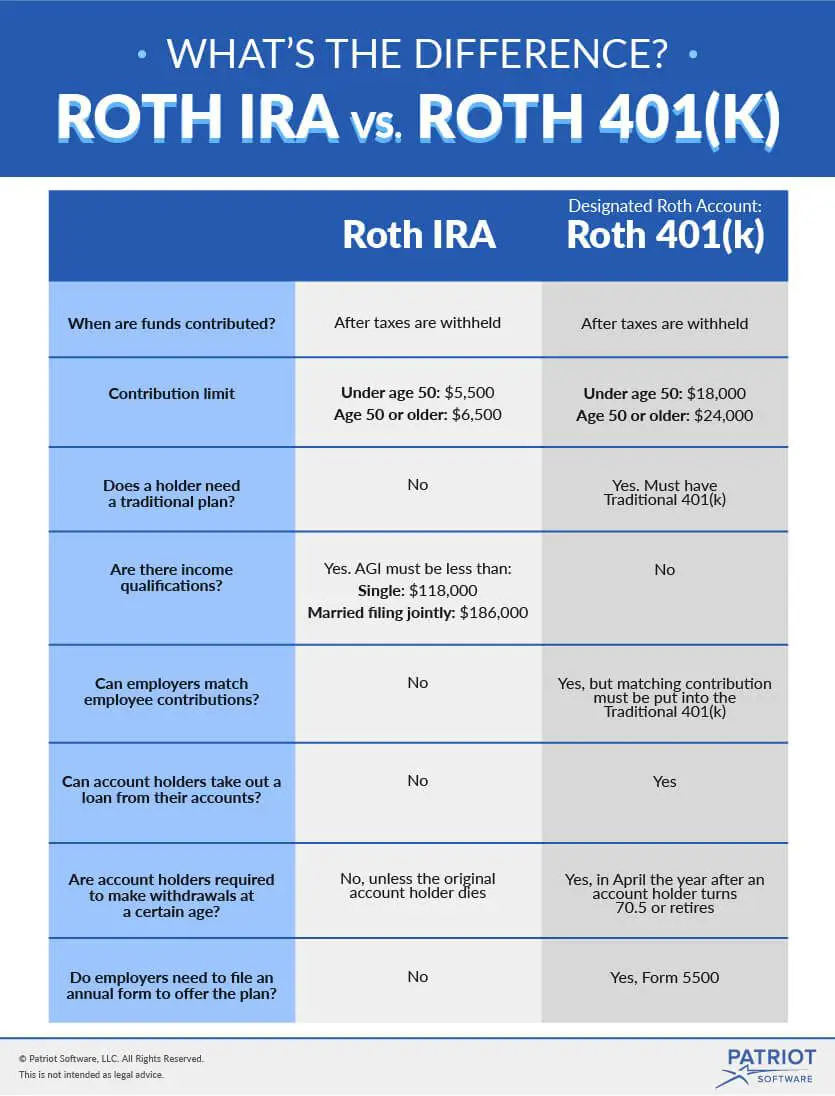

While both Roth accounts make it possible to defer taxes until retirement, there are some important differences between a Roth 401 and a Roth IRA:

- Required minimum distributions: Roth 401s require you to begin taking money out at age 72, while Roth IRAs do not have required minimum distributions .

- Eligibility: Because of income limits, higher earners cannot contribute to Roth IRAs.

- Individual/employer accounts: Roth 401s are administered by employers, while Roth IRAs are opened by individuals.

- Contribution limits: Roth 401s have higher contribution limits than Roth IRAs.

Vs Roth Ira: An Overview

Both 401s and Roth IRAs are popular tax-advantaged retirement savings accounts that differ in tax treatment, investment options, and employer contributions. Both accounts allow your savings to grow tax-free.

Contributions to a 401 are pre-tax, meaning they are deposited before your income taxes are deducted from your paycheck. However, when in retirement, withdrawals are taxed at your then-current income tax rate. Conversely, there is no tax savings or deduction for contributions to a Roth IRA. However, the contributions can be withdrawn tax-free when in retirement.

In a perfect scenario, youd have both in which to put aside funds for retirement. However, before you decide, there are several rules, income limits, and contribution limits that investors should be aware of before deciding which retirement account works best for them.

Read Also: What Should I Invest In 401k

Should I Contribute To A 401 Or An Ira First

If your company offers a 401 with a company match then it will be in your best interest to put enough money in your 401 to get the maximum match. A company matching program is one of the major benefits of a 401. This is essentially collecting free money. Once that match is maxed out then you can decide to max out your IRA for the year. After that is maxed out then you can return to your 401 and resume your contributions there. Please note that employer contributions are not part of the 401 annual contribution limit.

If your employer doesnt offer a company match then you should consider starting with a traditional IRA or a Roth IRA. This way you will avoid the administrative fees that some 401s charge. Once you have reached the IRA contribution limit for that year then you could contribute to a 401 for the pre or post-tax benefits.

If You Can Double Dip

If you have a 401, are eligible for a Roth IRA, or can deduct contributions to a traditional IRA, and you can afford itit may be worth investing in both. Often, saving now means more moneyand financial securitydown the line. Once again, you can check our IRA calculator to see if you can double dip. Just remember that the IRA contribution limit is for the total contributed to both a Roth and traditional IRA.

The real question is not: IRA vs 401, but ratherwhich of these is the best place to put each years contributions? Both are powerful tools to help you save, and many people will use different types of accounts over their working lives.

Also Check: How To Convert 401k To A Roth Ira

Talk With An Investment Pro About Your Roth 401

If you want to learn more about your Roth 401 or other investing options, find an investing pro in your area. A financial advisor can help you understand your investments and make confident decisions.

A do-it-yourself approach to investing is never a good idea. Even the pros work with a financial advisor! Your familys future is way too important to wing it.

Looking for a qualified investing pro? Try the SmartVestor program! Its a free way to find top-rated financial advisors near you. Start building a relationship with an investing pro who understands the financial journey youre on.

Vs Roth : How Are They Different

The biggest difference between a traditional 401 and a Roth 401 is how the money you contribute is taxed. Taxes can be kind of confusing , so lets start with a simple definition and then well dive into the details.

A Roth 401 is a post-tax retirement savings account. That means your contributions have already been taxed before they enter your Roth account.

On the other hand, a traditional 401 is a pretax savings account. When you invest in a traditional 401, your contributions go in before theyre taxed, which makes your taxable income lower.

Roth 401 vs. Traditional 401: Pros and Cons

| Contributions | Contributions are made with after-tax dollars . | Contributions are made with pre-tax dollars . |

| Withdrawals | The money you put in and its growth are not taxed. However, your employer match is subject to taxes. | All withdrawals will be taxed at your ordinary income tax rate. Most state income taxes apply too. |

| Access | If youve held the account for at least five years, you can start taking money out once you are age 59 1/2. You or your beneficiaries can also receive distributions due to disability or death. | You can start receiving distributions at age 59 1/2, no matter how long youve had your 401. You or your beneficiaries can also receive distributions due to disability or death. |

Don’t Miss: What Is The Best Fund To Invest In 401k

Which Option Is Better For You

If your 401 or 403 retirement plan accepts both traditional and Roth contributions, you have two ways to save for your retirement. Both offer federal income tax advantages.

Traditional accounts provide a tax break now. Traditional contributions are not taxed at the time of investment. Instead, taxes are paid on withdrawals, including any earnings. Getting a tax break at the time of investment will leave more money in your pocket now money that you can invest, save or spend.

Roth accounts provide a tax advantage later. Roth contributions are made with money thats already been taxed, so you wont have to pay taxes on qualified withdrawals, including earnings.

Enter your personal information to compare the results of traditional before-tax savings and Roth after-tax savings. You can click each for help.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

Future tax rates may change. The analyzer applies tax rates to all taxable income. When estimating your future tax rate, you should consider whether the amount of taxable distributions might push you into a higher tax bracket.

- STAY CONNECTED:

Can You Take A Loan From Your Roth 401

If your plan rules allow it, you can take out a loan from your Roth 401 account. The rules for 401 loans are fairly uniform once the funds are distributed, but its up to your employer to decide whether they want to offer this benefit or not. They also decide who qualifies for a 401 loan.

There are risks involved with 401 loans. If you are laid off or quit while your loan is outstanding, you will need to repay the loan by the time you file taxes the year after you left your job. Taking advantage of all the possible extensions would mean you have until October 15th of the next year to repay the loan. Otherwise, the outstanding loan balance is considered as a non-qualified early withdrawal, subject to the 10% tax penalty.

You May Like: Can I Keep My 401k After I Leave My Job

Should I Roll Over My Traditional 401 To A Roth 401

There isnt a one-size-fits-all answer when it comes to rolling over your retirement savings to a Roth account. If it makes sense for your situation, a Roth conversion is a great way to take advantage of tax-free growth on your accounts. But keep in mind that rolling over a traditional 401 means paying taxes on it now. And if youre converting a large sum all at once, it could bump you into a higher tax bracket . . . which means a bigger tax bill.

For example, if youre rolling over $100,000 and youre in the 22% tax bracket, that means you have to come up with $22,000 cash to cover the taxes. Dont pull that money out of the investment itself!

If you can pay cash for the taxes without taking money out of your nest egg and youre still several years away from retirement, it may make sense to roll it over. But before you roll over accounts, make sure to sit down with an experienced investment professional. Theyll help you understand the tax impact of rolling over your 401 and how you can be prepared for it.