Option #: Roll Over Your Old 401 To Your New Employers Plan

If your new employer offers a 401 plan, then you have the option to essentially transfer the balance of any 401 account tied to a previous employer into the 401 account you open with your new employer. These balance transfers are known as rollovers, where you roll the balance of your old account into your new one. And, these rollovers are far more financially prudent than the previous two options we explored above.

When you roll your old balance into your new 401 account, all of your funds stay completely intactno taxes, no fees, nothing. That money is free to continue growing tax-free, and any funds you roll over dont count towards the annual 401 contribution limit . That means you can continue making contributions to your new 401 account regardless of the size of the balance that you roll over from your old one, which is great for building wealth over the long term.

There are a couple instances where rolling money from an old 401 into a new one might make more sense than simply rolling it into an IRA .

Rolling your old 401 balance into your new one isnt a bad option by any means, and youll have to make that call based on your own individual financial situation.

Theres one more option youll want to consider, however, and that is:

What Happens To A 401 After You Leave Your Job

After you allow your job, there are a number of choices on your 401. You could possibly go away your account the place its. Alternatively, chances are youll roll over the cash from the previous 401 into both your new employers plan or an individual retirement account . You can too take out some or the entire cash, however there might be severe tax penalties.

Be sure to grasp the particulars of the choices obtainable to you earlier than deciding which path to take.

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

Read Also: What Percent Should You Put In 401k

You Can Keep Your Plan With Your Old Employer

The first thing you need to decide is what to do with the money in your old plan. Option one is simple: you can leave where it is, in your former employer’s plan.

The major advantage of leaving it there is that you don’t have to do anything and your account can stay where it is. The disadvantage is that you may be charged some of the fees that the company usually pays for but doesn’t cover for ex-employees.

Also worth considering here is whether you left your old job on good or bad terms.

What Happens When You Withdraw From Your 401 Early

You could pay a 10 percentIRS penalty for removing your retirement funds before you reach age 59.5. This penalty also applies to indirect rollovers that are not completed within the 60-day window allowed by the IRS since they are treated as an early distribution. However, you may access your retirement funds before age 59.5 years only in certain limited circumstances.

The IRS allows an early retirement option, but you must take equal and substantial withdrawals from your retirement account based on your life expectancy at the age at which you start taking those withdrawals. These withdrawals must continue until you reach age 59.5 or for at least five years, whichever is longer.

If your employer is one of those companies with the best retirement plans around and allows you to have a 401, take advantage of it. The tax advantages the account offers will enable you to build wealth for retirement to be financially independent when you stop working. And if you stop working for that employer, you dont have to worry about your funds. You can always take them with you.

References

Recommended Reading: How To Check If You Have A 401k

Roll It Into A New 401 Plan

The pros: Assuming you like the new plans costs, features, and investment choices, this can be a good option. Your savings have the potential for growth that is tax-deferred, and RMDs may be delayed beyond age 72 if you continue to work at the company sponsoring the plan.

The cons: Youll need to liquidate your current 401 investments and reinvest them in your new 401 plans investment offerings. The money will be subject to your new plans withdrawal rules, so you may not be able to withdraw it until you leave your new employer.

Option #: Leave Your 401 Account With Your Former Employer

Your first option is as simple as it gets: Do nothing.

Theres nothing stopping you from simply leaving your money where it is inside your current 401 account and letting it sit. As we covered above, your 401 account is portable, so it remains yours even if you leave the employer its tied to. And while this isnt the worst option you could choose , it does come with a few notable disadvantages.

Fund Availability

The first disadvantage of leaving your funds inside your old 401 account has to do with the lack of low cost, high quality funds available for you to invest in.

Many companies rely on third party administrators to run their 401 plans for them, which tend to have relationships with other mutual fund companies that want their funds to be featured in the plans. Often, these plan administrators will offer to manage a companys entire 401 program either for free or at a very low cost. Thats great for the employer, but theres a catch: the way they make money is through the high fees and sales commissions that go along with the funds available in the plan. Unsuspecting employees will think their money is being invested wisely, when in reality, its being subjected to onerous fees that are being kicked back to the plan administrators.

Difficulty of Managing Your Portfolio

Maintaining Financial Discipline

Also Check: Where Can I Get A 401k Plan

Plan Options When You Leave A Job

If you have an employer-sponsored 401, you will likely be faced with four options when you leave your job.

- Stay in the existing employers plan

- Move the money to a new employers plan

- Move the money to a self-directed retirement account

- Cash out

Before deciding, here are a few things to consider with each option.

Plan Your Retirement With Your 401 K

If you haven’t already, it’s crucial that you start to plan your retirement as soon as possible. Financial security is a vital part of having a healthy and happy retirement. The aim of having a 401 k in the first place is that it gives you freedom from work and acts as a nest egg. You might be working hard now, but you want to be able to truly enjoy your golden years. Having the proper retirement plans in place is the easiest way to ensure this. If you start planning to retire well before the time comes, you should be in a very strong position financially.

Take the time to come up with plans for your retirement while you still have a job. These plans don’t have to be concrete. All you have to do is get an idea of how your retirement may look financially. Then you can plan distributions from your 401 k, as well as any investments you may want to investigate.

Also Check: Can I Cancel My 401k And Cash Out

What Happens To Your 401k When You Leave A Job

Unfortunately, many people choose not to make a decision about what to do with their 401k funds. Instead, they simply leave the funds behind in their former employers 401k plan. Most plans allow former employees to leave funds in their account if the account contains more than $5,000. If theres less than $5,000 in the account, the plan sponsor may issue the former employee a check in order to close out the account.

While leaving money behind in a former employers 401k might be the easiest thing to do, its not always the best option. People often fail to monitor accounts held at former employers as closely as they should the money becomes out of sight, out of mind. This problem can worsen if an individual ends up leaving money behind in several different former employers 401ks.

Also, the main benefit of a 401k plan is an employer match if the company offers one. Once you leave a job where you have a 401k, you no longer receive the match. And there are better investment vehicles out there 401k plans tend to have high fees, limited investment options, and strict withdrawal rules. So if youre no longer receiving the match, its usually best not to leave your assets languishing in an old 401k.

How To Move Your Defined Benefit Pension Plan If You Leave A Job

Breaking ties with an old job is often enjoyable, sometimes bittersweet, and other times just plain bitter. If you have a defined benefit pension, breaking ties can also be complicated. What happens to your pension plan when you leave a company before you’re ready to retire? Will you get the money, and what should you do with it? Are there tax consequences you need to consider?

There was a time when some folks wouldnt consider leaving a job with a defined benefit pension, but people change jobs much more frequently than in the past, and the types of benefits employers provide have changed. If a better offer comes along before retirement, its up to you to decide what to do with the pension you have accumulated.

Recommended Reading: How To Rollover Fidelity 401k To Vanguard

Leave The Money In Your Former Employers 401

Many companies will let former employees stay invested in their 401 plan indefinitely if there is at least $5,000 in the account. However, if there is less than $5,000 in your account, your old company can cash you out of the account .

In any case, unless your former employers plan has outstanding investment options or unique benefits, leaving your 401 behind rarely makes sense. According to the Bureau of Labor Statistics, the average U.S. worker changes jobs 12 times throughout a career.

If you leave a 401 plan behind at each job, you will have to sort through a trail of plans to figure out what you have at retirement. Additionally, you risk overpaying for too many unnecessary investments.

To be sure, if you have been through a layoff and are not sure of your next move, keeping your 401 funds with a former employer may make sense in the short-term.

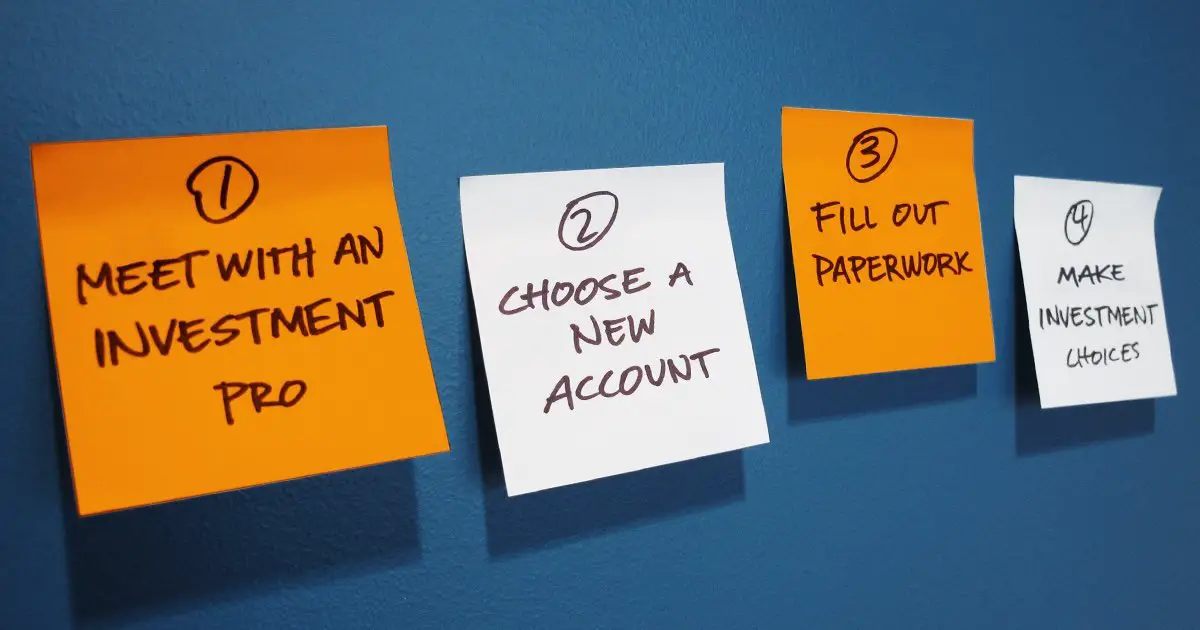

How To Do A Rollover

The mechanics of rolling over 401 plan are easy. You pick a financial institution, such as a bank, brokerage, or online investing platform, to open an IRA with them. Let your 401 plan administrator know where you have opened the account.

There are two types of rollovers: direct and indirect. A direct rollover is when your money is transferred electronically from one account to another, or the plan administrator may cut you a check made out to your account, which you deposit. The direct rollover is the best approach.

In an indirect rollover, the funds come to you to re-deposit. If you take the money in cash instead of transferring it directly to the new account, you have only 60 days to deposit the funds into a new plan. If you miss the deadline, you will be subject to withholding taxes and penalties.

Some people do an indirect rollover if they want to take a 60-day loan from their retirement account.

Because of this deadline, direct rollovers are strongly recommended. Nowadays, in many cases, you can shift assets directly from one custodian to another, without selling anythinga trustee-to-trustee or in-kind transfer. If, for some reason, the plan administrator can’t transfer the funds directly into your IRA or new 401, have the check they send you made out in the name of the new account care of its custodian. This still counts as a direct rollover. However, to be safe, be sure to deposit the funds within 60 days.

Also Check: What Is The Max Percentage For 401k

Alternatives To Cashing Out

If you want to make a more conservative decision, you can leave your money in your 401 k when you change to a different company or employer. Cashing out your 401 k isn’t a requirement, after all. If you’re happy with your old employer’s 401 k, we recommend that you leave the money where it is. You can withdraw it once you retire. This is also a great way to avoid paying excessive income tax.

You can also stretch out the time that you withdraw money from your 401 k. The funds don’t have to come out in a lump payment. A plan participant leaving an employer typically has four options , each choice offering advantages and disadvantages. You can leave the money in the former employers plan, if permitted Roll over the assets to your new employer plan if one is available and rollovers are permitted Roll over the funds to an IRA or cash out the account value. The more time between your payments, the easier it is to avoid paying extra tax on the money. This is because funds from your 401 k are considered part of your taxable estate.

Find Out If Your 401 Plan Charges Maintenance Fees

Some plans, particularly small business plans, charge annual management fees. If your current 401 is charging you a flat fee for administration, you may want to consider alternative options that dont have this added expense.

However, a small expense may be worth paying to make sure your 401 is properly managed. For instance, blooom is a robo-advisor for 401 accounts. With blooom, you can get a free analysis of your retirement plan and for $120 per year, blooom will manage your 401. This includes regularly adjusting your portfolio, expert financial help from blooom advisors and suspicious activity alerts to protect your account. blooom even finds hidden fees that you may not know youre paying for. Blooom works with any employer sponsored retirement plan and is currently the only robo-advisor available that specifically manages 401 accounts.

Related:What to do When Your Employers Retirement Plan Sucks

You could also decide to roll the money to your new companys plan or to roll the money into an IRA. Its a good idea to evaluate a variety of factors and consult a specialist before acting.

Fees will be published on your 401 statements and in plan documents. Or, consult with your benefits department to help you locate the information.

Read Also: Can Anyone Have A 401k

Leave The Money Or Move It

Your first option for handling your retirement savings is to leave it in your former employer’s plan, if permitted. Of course, you can no longer contribute to the plan or receive any employer match.

However, while this might be the easiest immediate option, it could lead to more work in the future.

“The risk is that you are going to forget about it down the road,” said Will Hansen, executive director of the Plan Sponsor Council of America.

Basically, finding old 401 accounts can be tricky if you lose track of them.

Leave It In Your Current 401 Plan

The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, youll pay no taxes until you start making withdrawals, and youll retain the right to roll over or withdraw the funds at any point in the future.

The cons: Youll no longer be able to contribute to the plan, and the plan provider may charge additional fees because youre no longer an employee. Managing multiple tax-deferred accounts can also prove complicated. The IRS mandates required minimum distributions annually from all such accounts beginning at age 72 . Fail to calculate the correct amount across multiple accounts, and the IRS will slap you with a 50% penalty on the shortfall.

Also Check: Should I Do Roth Or Traditional 401k

Will I Have To Pay Taxes On My 401 Plan If I Quit My Job

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

If you decide to leave the company that holds your 401 plan, you have four options for dealing with your funds. The tax consequences depend on which option you choose. However, if you have borrowed from your 401 and leave your job prior to repaying the loan, the rules are different.

You Have Less Than $1000 In Your 401

If you have less than $1000 in your 401, you may request to get a lump sum payment via check. Still, if you leave the funds behind without giving any instructions to the employer, the plan administrator may force cash-out in order to close the account.

Usually, active 401 accounts incur costs to maintain, and your employer may be unwilling to bear the cost since you will no longer contribute to the plan. The employer will send you a check within 3 to 10 days of leaving the job. Once the payment is made, you have 60 days to deposit the funds into an IRA to avoid paying taxes. If you donât deposit the funds into an IRA, the payment will be considered an early withdrawal and you will pay an income tax and early withdrawal penalty.

Read Also: Can I Move Money From 401k To Ira