You May Be Able To Leave Your Account With Your Former Employer At Least Temporarily

Changing jobs is stressful, even in the best of circumstances. If youve lost a job and are scrambling for re-employment, youre likely focused on that. But eventually you will need to figure out what to do with your 401.

If your balance is $5,000 or more, you can leave the money right where it is, giving you time to decide the best course of action for you. In this case, youre under no obligation to move your money.

What you should do right away, regardless of the 401 balance in your old plan, and as early as your first day at the new job, is to sign up for your new companys 401 plan. Even if your new employer has an automatic opt-in feature that does not kick in for one to three months and if you rely on that, rather than taking the initiative you can miss 30 to 90 days of contributions and matching funds, Bogosian advises.

After six months, youve got a handle on the job, know youre going to stay and have some experience with your new plan. Youre now in a better position to compare your last 401 plan with this new one, including the diversity of the investments and the costs.

But what happens if the balance in your old 401 is less than $5,000? Your former employer may force you out of the plan by placing your funds in an IRA in your name or cashing you out and sending you a check.

Leave The Money In Your Former Employers 401

Many companies will let former employees stay invested in their 401 plan indefinitely if there is at least $5,000 in the account. However, if there is less than $5,000 in your account, your old company can cash you out of the account .

In any case, unless your former employers plan has outstanding investment options or unique benefits, leaving your 401 behind rarely makes sense. According to the Bureau of Labor Statistics, the average U.S. worker changes jobs 12 times throughout a career.

Youre Making Life More Complicated

Every 401k has its own specific rules, its own options, its own statements, its own online protocols, its own beneficiary forms, etc. Keeping separate 401k accounts means you have to keep up to date on all the particulars of each plan. Thats just adding more bureaucratic misery on top. Deciding what happens to your 401k when you quit your job is hard enough on its own. If you find that properly managing one account is challenging, think about how much more difficult managing several will be.

It will be almost impossible to maintain a consistent investment strategy across multiple 401ks at multiple providers. For example, lets say that you decide a 50%/50% split between stocks and bonds is ideal for your portfolio. If you have multiple 401k accounts, youll need to make sure that each of them is split 50%/50% to maintain that allocation across the entire portfolio. And what happens if one account has grown to the point where its 60%/40%, and another has become 30%/70%. If the values of those accounts are significantly different, it becomes a nightmare to determine what to sell and what to buy in each account in order to attain the 50%/50% split in our example.

See our blog post on Stocks and Bonds Diversification.

Recommended Reading: Can I Take From My 401k To Buy A House

Rolling Investments Into Your New Employers 401

If you are starting a job with a new employer you may have the option of opening a new 401. You may roll over the investments of your previous employer’s plan into your new 401. A lot probably depends on how happy you are with the previous plan’s choice of investments and fees.

Or you may simply want to keep all of your 401 investments in one place. As you wont be able to make any new contributions to your previous employers plan some people prefer not having to worry about a second 401 and most likely with a different administrator.

Most employers will want you to serve a minimum number of days before being eligible for a matched contribution 401. Once your new plan is open you can check that you are allowed to perform rollover.

The best way to do this is to ask the administrator of your old 401 to transfer the funds directly into your new plan. This type of transfer is known as a direct transfer, from the custodian of your old plan to the custodian of your new plan.

It also helps you avoid any possible penalties from the IRS, which might consider it an early distribution otherwise. Another way of rolling over your 401 is the indirect transfer. In this case, you receive a check directly from your previous employer’s 401.

Another drawback of this method is that your previous employer will be obligated to hold back 20 percent of federal income tax and any state taxes.

Your Questions Answered: What Happens To 401k When You Quit

Are you planning to leave your job? While you must have your reasons, there are some considerations you need to make when you quit your job. If you’re in the US, one of the most important things for you to consider is how it might impact your 401 k. 401 k plans are generally connected to your employer. If you leave your job or get a new employer, you may need to get a new 401 k plan as well. A 401 k connects part of your income to financial institutions. These institutions use this portion of the funds you earn for the purpose of investment. Part of the profits from this investment then goes back into your account. It’s a gradual and stable way for you to generate income until retirement.

Your 401 k is more than retirement savings, too. For many, a 401 k account is the main insurance they have for their spouse or children in case they die before retirement. This is why you need to make sure your family is protected under your new plan by knowing what happens to your 401k when you die. Making a decision like leaving your job shouldn’t be taken lightly. This article discusses some of your options when leaving a company or employer, as well as how it can affect your distributions and taxes.

Read Also: Why Roll 401k Into Ira

You Can Roll It Over To A New Employers Plan

If youre starting a new job, you can roll over your 401k money directly into your new employers retirement plan, in most cases. Thats something to ask about during the onboarding process. You should also ask if your new company will match any of your rollover. If youre lucky, youll get even more money out of your job change.

What To Do With Your 401 When You Leave A Job

DNY59 / E+ / Getty Images

You’ve landed your dream job, or you’ve been laid off, and you’re ready to say goodbye to your current employer. But before you go, you have some decisions to make about your 401.

While there may be some guidance from human resources, is generally up to you to decide what you should do with your retirement savings when you change jobs. So, what happens to your 401k plan when you leave a job?

Don’t Miss: Am I Able To Withdraw Money From My 401k

Roll It Over Into A New Employers 401k Plan

This option assumes the new plan that the employer offers would allow you to bring the old balance into the new plan.

Pros: Like option 1, this may be a good option if the costs are low and the investment options are strong. It would also make it easier to monitor both plan balances on one statement.

Cons: Also like option 2, you may be moving your money from one high-fee, low-option plan into another high-fee, low-option plan.

How To Transfer 401 To A New Job

If you want to transfer your 401 to your new employer then you must contact both your old and new 401 plan administrator. Your new 401 plan administrator can confirm if they will accept the transfer, and can give you the details you need for the rollover. You will likely need to fill up a rollover form with your old 401 plan administrator to initiate the transfer.

Read Also: Should I Have An Ira And A 401k

Our Take: Start Planning Now

If you have an old 401k plan or are about to leave a job where you contributed to a 401k, give some thought now to how you will handle the money in your account. A rollover IRA is the best option for most people, but a financial advisor can help you determine whats right for your specific situation.

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Any reference to the advisory services refers to Personal Capital Advisors Corporation, a subsidiary of Personal Capital. Personal Capital Advisors Corporation is an investment adviser registered with the Securities and Exchange Commission . Registration does not imply a certain level of skill or training nor does it imply endorsement by the SEC.

Leave The Money In The Old 401k Account

Because of the turmoil around job changes, this has become the default option for many people, as weve discussed above. You dont have to worry about incurring withdrawal penalties or decide whether to take a lump sum distribution or annuity payments.

Pros: If the costs of the old plan are really low and the investment options are extremely good, this may be a viable option.

Cons: As weve discussed, you may be paying high fees, have restricted investment options, and lose early withdrawal options.

You May Like: How Much Will My 401k Be Worth When I Retire

Managing Taxes And Your 401k

If you want to avoid paying tax on your entire 401k or age is an issue, you can choose to roll the money into an IRA. When you roll the money from your 401k to an IRA account, you can freeze most or all tax responsibility you have. This allows you to continue using the money for investment purposes as you did before. Once you’ve reached retirement age, you can withdraw the money in your IRA and use it however you’d like.

Financial and tax advisors often recommend that you let the money stay in your IRA until you’ve reached retirement age. One reason is that the process of withdrawal can be somewhat messy and lengthy. Once you’ve started the process, you can’t go back. IRA accounts and 401k plans are subject to far less tax and regulation than regular types of investment. Unless you really need the money, you should let it stay in your IRA and use it for investment purposes. This allows you to generate a considerable quantity of passive income. Once you’ve retired, you should see the benefit of letting the money accumulate passively.

You May Lose Early Withdrawal Options

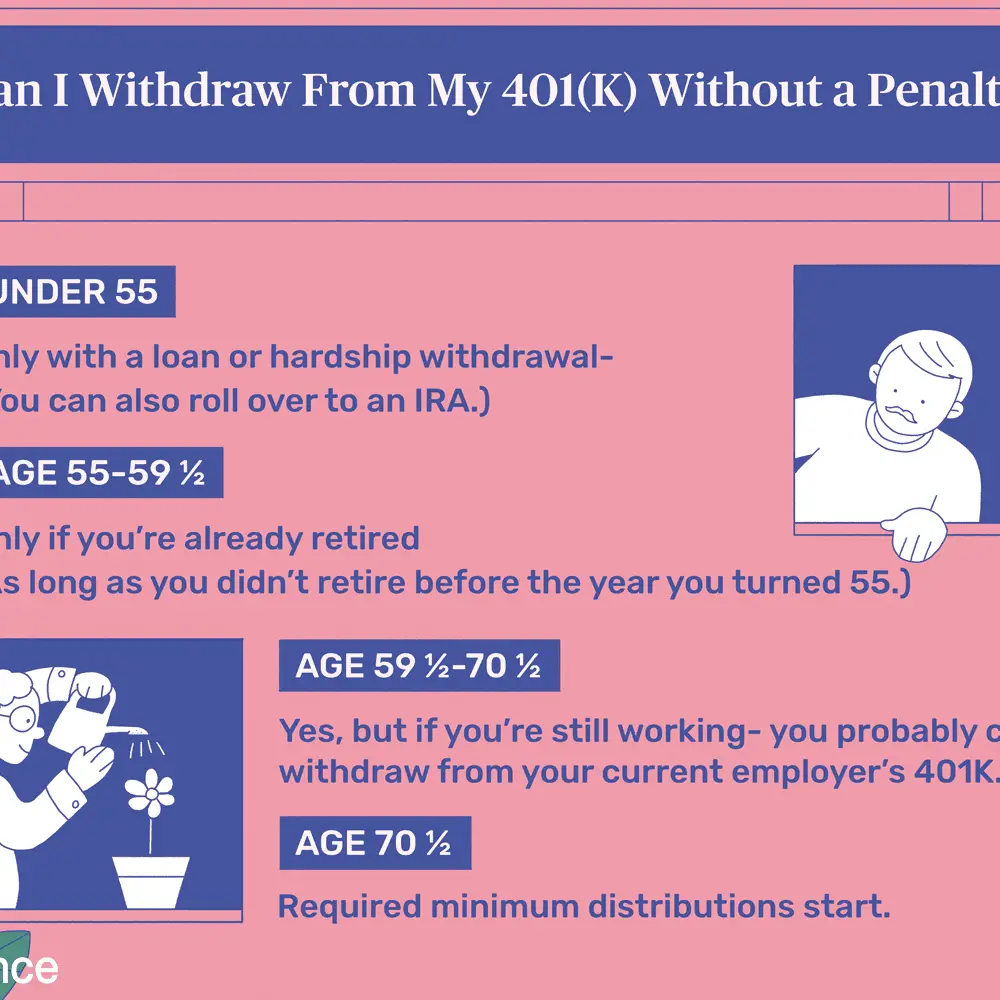

This is one of those risks you may not see until its too late. One of the many benefits of 401k plans is that they often allow employed participants an option to borrow funds or make early withdrawals. 401k plans usually provide a loan option where you can borrow from your own account without penalty or tax. But this option is only available to you if youre still employed. When you are still employed, you may be able to actually withdraw funds without penalty if youre at least 55. But once youve left employment, these options disappear.

Recommended Reading: What Happens When You Roll Over 401k To Roth Ira

The Database Isnt Slated Until 2025 What Can People Do Now

Other than hunting down contact information for your former company or the current plan administrator, theres not much people can do to find their retirement accounts.

However, later this year Vanguard and Fidelity plan to launch a so-called “auto-portability program” that allows them to find owners of lost plans of less than $5,000 that they oversee and automatically transfer the funds to their owners.

Vanguard and Fidelity joined Alight Solutions and Retirement Clearinghouse to create Portability Services Network, which will continue to add more plan administrators to the network so more people can be found and automatically reunited with their forgotten funds. Alight has already launched its program, but it remains small. When Fidelity and Vanguard join, though, the three companies together will hold records for about 40% of retirement accounts in America, Long said.

Social Security payments:Why you may have to claim Social Security early, even if you don’t want to

Rollover Your Old 401k Money Into A New Ira

Known as a rollover IRA, this type of IRA is designed to accept the transfer of assets from a former employers 401k. If your new employer doesnt offer a 401k or youre not pleased with the plans costs or investment options, this is probably your best option because it will give you the most flexibility and control to stay on track with your retirement savings goals. In fact, this is what we generally recommend to our clients who have old 401ks. IRAs generally have more investment options, no plan fees, and greater withdrawal flexibility.

In order to execute a rollover IRA, your first step is to open a new IRA with an investment advisor or financial institution. The rollover process is similar to the one described above except that you will instruct the administrator of your former employers 401k to transfer plan assets directly into your new rollover IRA.

Conversely, you can have a check sent directly to you, but make sure that the check is made payable to your IRA custodian for benefit of your name. The former plan administrator will withhold 20% of the amount for the payment of taxes and you will have 60 days to deposit the full balance, including the 20% withheld, into your rollover IRA. Failure to deposit the entire amount into your new IRA could result in current tax liabilities plus a 10 percent penalty if youre under age 59½.

Don’t Miss: Can I Move Money From 401k To Ira

What Happens If I Have A 401 Loan But Later Lose Or Quit My Job

If you leave the company and have a loan against your 401, there are some new rules you should be aware of.

The 2018 Tax Reform law extended the repayment period for your 401 loan until the due date of your tax return, including extensions. If you were affected by COVID-19, the 2020 CARES Act provides that you may be able to delay payments due from March 27, 2020 to December 31, 2020 for up to one year.

If you dont repay the loan, the remaining amount will be treated as a taxable distribution and reported on a 1099-R. If you are also under age 59 1/2, youll pay a 10% penalty for an early distribution. If you were affected by COVID-19, the penalty for early distribution may be waived.

A plan may provide that if a loan is not repaid, your account balance can be reduced or offset by the unpaid portion of the loan. However, you can rollover the offset amount to an eligible retirement plan. You have until the due date of your tax return, including extensions, to rollover the offset amount.

When you enter your 1099-R, well calculate any additional taxes or penalties on your outstanding 401 loan balance.

Related Information:

Recommended Reading: How To Take Out My 401k

What Happens If I Cash Out My 401

If you simply cash out your 401 account, you’ll owe income tax on the money. In addition, you’ll generally owe a 10% early withdrawal penalty if you’re under the age of 59½. It is possible to avoid the penalty, however, if you qualify for one of the exceptions that the IRS lists on its website. Those include using the money for qualified education expenses or up to $10,000 to buy a first home.

Also Check: How To Move 401k To Ira Without Penalty

Income Tax And Your 401k

Unfortunately, the relationship between tax and 401k is fairly complex. There are certain penalties and taxes that may apply to your 401k if you leave, for example. If you’re under the age of 59 and leave your employer, you might be subject to an early withdrawal penalty. You may not be able to avoid these consequences if you’re less than age 59 and need to leave your workplace. If you do, you might be subject to the 10 penalty. The 10 penalty refers to a 10% charge on the money you are owed.

Once you’ve left your former employer, any money that you get paid out in distributions or into your IRA is considered part of your taxable estate. As such, it is subject to a certain type of income tax.

Tax Implications Of Cashing Out A 401 After Leaving A Job

The following are some tax rules regarding your old 401:

-

When you leave your 401 account with your old employer, you wont need to pay taxes until you choose to withdraw the funds.

-

Even when you roll over your old 401 account to your new employer, you need not pay any taxes.

-

At the time of your 401 distributions, you will be liable to pay income tax at the prevailing rates applicable for such distribution.

-

If you havent reached the age of 59 ½ years at the time of distribution, you may be liable to pay a premature withdrawal penalty of 10%, subject to certain exceptions.

-

Distributions from a designated Roth account are tax-free after you reach the age of 59 ½ years, provided your account is at least five years old.

Although legally, you have every right to liquidate your old 401 account and cash out the entire funds, doing so would reduce your savings for the retired life. Additionally, the distributions will add up to your annual taxable income.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment education, and integration with leading payroll providers.

Read Also: How To Transfer 401k To Vanguard Ira