View Important Information About Our Fees And Commissions

-

3. The standard online $0 commission does not apply to large block transactions requiring special handling, restricted stock transactions, trades placed directly on a foreign exchange, transaction-fee mutual funds, futures, or fixed income investments. Options trades will be subject to the standard $.65 per-contract fee. Service charges apply for trades placed through a broker or by automated phone . Exchange process, ADR, foreign transaction fees for trades placed on the US OTC market, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

Investors should consider carefully information contained in the prospectus, including investment objectives, risks, charges, and expenses. You can request a prospectus by calling 800-435-4000. Please read the prospectus carefully before investing.

Schwab ETFs are distributed by SEI Investments Distribution Co. . SIDCO is not affiliated with Charles Schwab & Co., Inc.

This tax information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends that you consult with a qualified tax advisor, CPA, financial planner, or investment manager. Depending on the type of account you have, there are different rules for withdrawals, penalties, and distributions. Please understand these before opening your account.

Dont Miss: What Percent To Put In 401k

Withdrawing Your Money In Cash

While getting immediate access to your money is tempting, you may face tax penalties for cashing out before age 59½. Those penalties could eat up as much as 10% of your savings.

You should consider differences in investment options, services, fees and expenses, withdrawal options, required minimum distributions, other plan features, and tax treatment. As always, you can speak with a TIAA Consultant, your tax advisor, or use Retirement Advisor to help plan for the retirement you want.

What Is A 403 Transfer

Once you leave your employer, you wonât be allowed to make further contributions to the account. You can decide to roll over the 403 balance to a qualified retirement plan such as a traditional IRA, Roth IRA, 401, or other 403 plan.

You can choose a direct trustee-to-trustee transfer without owing a penalty. However, if you opt for an indirect transfer, the 403 plan provider will send you a check, which you must deposit into another plan within 60 days. An indirect transfer may be subject to a 20% withholding tax that is deducted from the distribution.

You May Like: How To Grow My 401k Faster

Current 403b Roth Ira Rollover Rules

So what are the rules for a 403b rollover to a Roth IRA?

To perform a successful rollover, you need to do the following things

- Have an open/established Roth IRA account

- Have adjustable gross income under the IRS limits

- Move distributions from your 403b to your Roth within 60 days

- Pay taxes on rollover distributions, if necessary

Obviously, you need to have an open Roth IRA account to roll your 403b funds into. If you dont, make sure to open one prior to initiating the process.

You also need to have adjustable gross income of $100,000 or less in order to qualify for a Roth IRA rollover, although that limit soon changes, which well address in just a moment.

Any rollover distribution you receive from your 403b must be moved into your Roth IRA within 60 days of the day you receive it. Otherwise, you owe taxes and penalties on the full amount of the distribution as if you had simply withdrawn it.

And, of course, youll probably owe taxes on some, if not all, of your rollover distribution.

So lets take a closer look at some of these rules

Dont Miss: When Leaving A Company What To Do With 401k

Can I Take Money Out Of My Ira Before I Reach Retirement

Yes. And you don’t have to pay it back like you would with a loan from your employer-sponsored plan.

However, withdrawals you make before age 59½ may have consequences:

- Roth IRA: There’s a 10% federal penalty tax on withdrawals of earnings before age 59½. Withdrawals of your contributions are always penalty-free.

- Traditional IRA: There’s a 10% federal penalty tax on withdrawals of contributions and earnings before age 59½.

There are some exceptions** to the 10% penalty, so be sure to check the IRS website for details.

Read Also: Can I Roll My Ira Into My 401k

How To Transfer 403b To Vanguard

If you change jobs or retire, you may want to transfer 403 to another retirement plan. Find out how to transfer 403 to Vanguard.

If you are no longer with the employer sponsoring your 403 plan, you may consider transferring the 403 balance to Vanguard. Vanguard is one of the largest investment advisors in the United States, and it offers a wide pool of low-cost index mutual funds and exchange-traded funds. If you want to transfer your 403 to Vanguard, here are the steps you should follow.

To transfer your 403 balance to Vanguard, start by gathering information about your 403 plan. Next, open a Vanguard retirement account where you will transfer your 403 funds into. Contact your 403 plan provider and request a direct rollover you will be required to provide certain information such as mailing address, name of plan provider, Vanguard account number, etc. Once the 403 balance is transferred to Vanguard, you can allocate the rollover funds to various investment options.

Second 401 And 403 Have Limited Investment Options

Some employer plans offer fewer than ten investment options. Some offer more, but few that are low fee.

For example, there may be some index fund options that have fees under 0.3%, but Target-date fund options with expense ratios over 1%.

Since Target Date funds are the better option for hands-off investors, this can force you to choose between the right options for you and minimizing your fees.

In addition, if you want to invest in socially good funds or adopt another custom strategy, you probably wont have access through your employer plan.

Dont Miss: How To Borrow From 401k For Down Payment

You May Like: Can You Cash Out 401k To Buy A House

Compare Your Options For Rollovers And Direct Transfers

Following are overviews of your options for rollovers or direct transfers for each plan type. For details, see Eligibility and Procedures for Rollovers and Direct Transfers.

| Rollovers |

|---|

|

At age 59½ disability |

At any age |

A direct transfer allows you to move your U-M retirement savings plan accumulations between TIAA and Fidelity Investments, tax-free. Direct transfers are available to current and former employees at any age, at any time. U-M authorization is not needed for a direct transfer.

A direct transfer is different from a rollover in that it occurs between two investment companies under the same employer retirement plan. You cannot make a direct transfer to an IRA, to another employers retirement plan, or to an investment company that is not TIAA or Fidelity. Likewise, you cannot make a direct transfer between U-M plans SRA and 457 Deferred Compensation Plan accounts).

Move Money Into The Tsp

Whether youre a civilian employee, a member of the uniformed services, or a separated participant, you can move money from other eligible plans to your existing TSP account. However, you cannot open a TSP account by transferring money into it.

Things to know:

We will accept both transfers and rollovers of tax-deferred money from traditional IRAs, SIMPLE IRAs, and eligible employer plans such as a 401 or 403 into the traditional balance of your account.

We will accept only transfers of qualified and non-qualified Roth distributions from Roth 401s, Roth 403s, and Roth 457s into the Roth balance of your account. If you dont already have a Roth balance in your existing TSP account, the transfer will create one.

We will not accept Roth rollovers that have already been paid to you and will not accept transfers or rollovers from Roth IRAs.

Also Check: Can You Convert A Roth 401k To A Roth Ira

Read Also: Is Fidelity A Good 401k Provider

How To Do A 403 Rollover

Since many people work for several employers during their working years, it is fairly common for people to have several retirement plans, including 401s and 403s, they need to roll over.

If you do a direct rollover of funds into a traditional IRA account, you will avoid the mandatory 20% federal income tax withholdings assessed on retirement funds withdrawal.

You can open an IRA account at any financial institution offering this type of account. Generally, speaking, you will need to complete the 403 rollover by the 60th day following the day distribution is received.

The IRS does allow for two exceptions to the 60-day rollover rule, however. In the case of financial hardships or unforeseen circumstances, you may be allowed an exemption.

Exemptions are not guaranteed and the IRS will require proof of financial hardship, such as hospitalization or any other kind of financial crisis. Unforeseen circumstances can come in different forms, but they typically include situations where your funds are frozen in your account for some reason.

Typically, you only need to complete a signed contribution form which is required by the IRA trustee in order to roll over the funds into the IRA account. You will need to check with the specific financial institution regarding its rollover policies prior to conducting the transaction to avoid delays in processing.

Consolidating Multiple Accounts With A Rollover Ira

A rollover IRA is when you take a retirement account you already havelike a 401and roll it over into a new IRA. A rollover IRA offers a great way to consolidate multiple accounts into one IRA. Note that many types of retirement accounts, not just workplace plans, can be rolled over into an IRA.

IRAs may provide a greater variety of investment options than your workplace plan since many employer plans limit the funds in which you can invest. A rollover IRA can also provide you a view of all your retirement assets in one place.

When you consolidate1 your retirement accounts into one, it’s easier to avoid overlaps and gaps in your investment mix. You may also have access to personalized money management and investment guidance.

Also Check: How Do I Get My 401k Out

Open A Vanguard Account

If you donât have a retirement account with Vanguard, you will be required to open an account where you will transfer the 403 funds. You can open an account on Vanguard in less than 10 minutes.

If you have a 403 account at Vanguard with your current employer, you may be allowed to roll over your old 403 balance into your new 403 account for easier management. Check with your new employer if it allows this type of transfer.

If you want to access to a wide variety of investment options, you can decide to open an IRA with Vanguard. IRAs offer more benefits since they are not tied to an employer, and you can invest your retirement money in various investments like stocks, ETFs, bonds, mutual funds, and cryptocurrencies. You can open a traditional IRA if you want to keep your funds tax-deferred, or a Roth IRA if you want to keep your funds tax-free or convert from tax-deferred to tax-free.

Will You Incur Penalties For Rolling Over Your 403 Into An Ira

You will incur penalties and must pay income taxes if you wait too long to roll over an indirect transfer.

Your 403 plan will also withhold 20% of your savings for federal income taxes if you make an indirect rollover. This does not apply to direct rollovers.

If you miss the 60-day deadline to move the money into your new account with an indirect rollover, you will also have to pay a 10% penalty if you are younger than 59 1/2.

The IRS may waive the 60-day deadline if the deposit was delayed by circumstances beyond your control.

Also Check: How To Check If I Have A 401k

Rolling Over Funds From One Retirement Account To Another

I have a retirement account with my previous employer. Can I roll over those funds into my new employers 403 plan?

To maintain the simplicity of managing only one retirement account, you may be able to roll over your IRA, 401, 457, or other retirement account, into your current employers 403 account. This is called an incoming rollover and depends upon if its allowed by your current employers plan documents.

With this, the benefits of consolidating your retirement accounts, include:

- Ease of access and view of all investments.

- Possible reduced fees.

- Easier management for future beneficiaries.

Consolidating your accounts is common in the retirement industry. Contact your financial representative if you have further questions regarding this process. You may also contact NBS by phone at 1 274-0503 or by email at for questions about forms and whether incoming rollovers are allowed by your plan.

I have a 403 account. Can I transfer my funds into a different type of retirement account, such as an IRA, 401, or 457?

This may be possible, depending on which type of account you are wanting to roll over your 403 funds to, and whether it is allowed by your current employers plan documents.

The IRS has clear rollover rules which are summarized in an easy-to-navigate chart, found below, and linked to here. If you have any questions regarding this possible plan feature and whether it is allowed by your employers plan documents, please consult NBS.

Leaving The Money In Your Old 401 Can Work Against You

Even when you part ways with your employer on favorable termsand are happy with your old 401 plans rules and feesnot rolling over your vested balance to a new account can work against you. First, you can no longer contribute to your former employers 401. And based on your vested balance, your previous employer may be able to force you to take a distribution from the account.

-

If your vested balance is less than $1,000: Your employer could cash out your account and mail you a checkwhich could result in tax penalties.

-

If your vested balance is between $1,000 and $5,000: Your former employer may transfer your balance to an IRA of its choicewhich may not be the one you would choose.

More than half of 401 plans with balances between $1,000 and $5,000 are forcefully transferred to an IRA after separation from employment. According to a study conducted by the GAO in 2015, involving 19 forced-transfer contracts, forced-transfer IRAs can have typical investment returns ranging from 0.01% to 2.05% annually, which barely cover any IRA fees.

Note: If youre concerned about company securities, including stocks, bonds, or debentures that would be subject to income tax when withdrawn from your old 401, consult your plan administrator or financial advisor for tax scenarios that may help defer tax payment on the appreciation of those company securities.

You May Like: What Is Max Amount To Contribute To 401k

You Can Transfer Your 403 To A New Vendor

Sometimes this happens if you move districts or states, and the vendor you were using is not available. The only option is to start a new 403 with a new vendor, but you can transfer your old account into the new one. If youve been putting money into a 403 and you choose to transfer it, that company can charge you to move that money. Sometimes its as small as an administrative fee.

However, if youre using a 403 from an insurance company that also means its an annuity. Annuities are insurance contracts and if you break the contract ) before the end date, there are surrender charges to get out of the contract. Annuity contracts range from five to 12 years, and the surrender charges can vary wildly between companies.

How Can Paying Off Student Loan Debt Soon Help Save For Retirement

One of the more revolutionary changes included in the Secure 2.0 Act of 2022 is the option for employer plans to credit student loan payments with matching donations to 401 plans, 403 plans or Simple IRAs. Government employers will also be able to contribute matching amounts to 457 plans.

This means that people with significant student loan debt can still save for retirement just by making their student loan payments, without making any direct contributions to a retirement account. The new regulation will take effect in 2025.

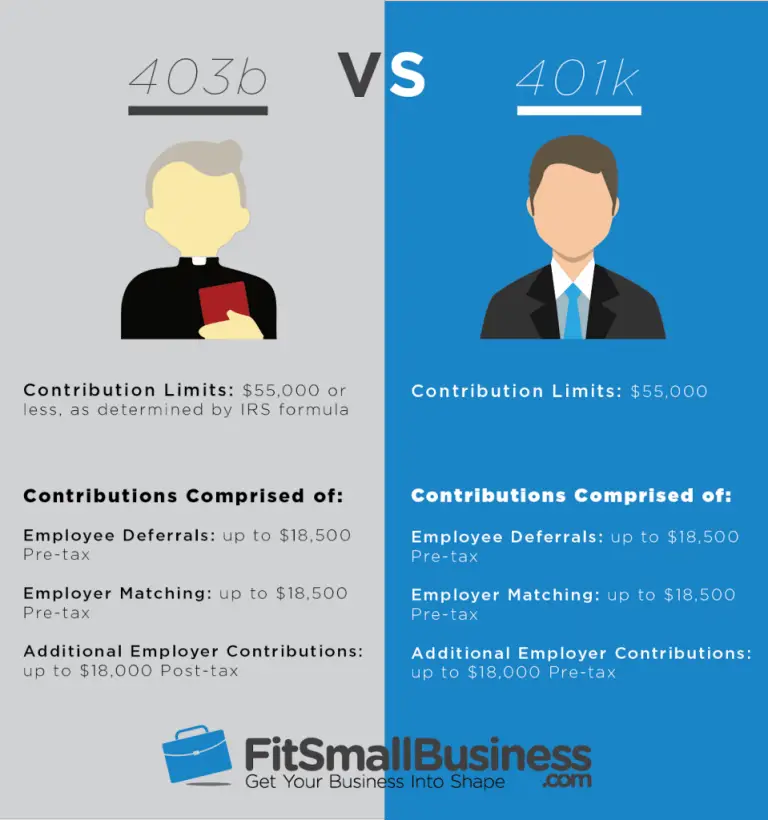

Read Also: What Is A 403b Vs 401k

How To Roll Over Your 401

LAST REVIEWED Sep 15 202213 MIN READ

The U.S. Bureau of Labor Statistics found that 2.9% of Americansthats 4.3 million peoplequit their jobs in August 2021, a record-breaking month preceded by similar statistic-shattering months that year. One year later, in August 2022, job creation was consistent, while a steady flow of people entering the workforce raised the unemployment rate.

If you’re one of the millions of workers who have changedor are considering changingjobs in the last year or so, it’s essential to take stock of your retirement savings. From understanding how vesting works to knowing the required steps of an indirect or direct rollover, this article reviews how to roll over a 401 account balance after leaving an employer.

Can You Roll Over 403 To A Roth Ira

If you have a Roth IRA, you can roll over your 403 into the IRA. However, since a Roth IRA is funded with post-tax dollars, there is a huge tax implication of rolling over 403 funds into the account.

When you convert 403 into a Roth IRA, you will owe income taxes on the conversion. Depending on the size of your 403 account, the taxes could constitute a large upfront expense. The Roth conversion can also push you to a higher tax bracket in the tax year when the rollover is executed.

There are income tax limits for Roth IRA contributions, and they can affect how much you can contribute to a Roth IRA. If your annual income falls within the IRS income limits, the amount you can contribute is reduced as you move towards the upper limits. If the annual income exceeds the upper limit, you won’t be eligible to make Roth IRA contributions. However, the Roth IRA conversion is not affected by the IRS income limits.

Don’t Miss: How To Fill Out A 401k Withdrawal Form