How You Can Fill Out The Distribution Form 401k On The Web:

By making use of SignNow’s comprehensive service, you’re able to carry out any needed edits to Distribution form 401k, generate your customized electronic signature within a couple fast actions, and streamline your workflow without the need of leaving your browser.

Create this form in 5 minutes or less

How To Cash Out A 401 From A Former Employer

Cashing out a 401k from a former employer is not a difficult task. In most cases, you contact the plan administrator for the appropriate paper work, fill it out, send it to the financial institution that manages the 401k, and wait for the check to come in the mail or for the electronic transfer.

Tips

-

In order to cash out a 401 from a former employer, you will likely have to contact the plan administrator at your former place of employment and request access to the paperwork needed to withdraw your funds.

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

Recommended Reading: How Does Company Match Work For 401k

How To Edit Text For Your Massmutual 401k Terms Of Withdrawal Pdf With Adobe Dc On Windows

Adobe DC on Windows is a must-have tool to edit your file on a PC. This is especially useful when you prefer to do work about file edit in your local environment. So, let’get started.

- Find and click the Edit PDF tool.

- Select File > Save or File > Save As to keep your change updated for Massmutual 401k Terms Of Withdrawal Pdf.

Net Unrealized Appreciation And Company Stock In A 401

If you have company stock in a 401, it could save you significant money on taxes to transfer those shares into a taxable brokerage account to take advantage of net unrealized appreciation, or NUA. NUA is the difference between what you paid for company stock in a 401 and its value now.

For example, if you paid $20,000 for company stock and its now worth $100,000, the NUA is $80,000.

The benefit of the NUA approach is that it helps you avoid paying ordinary income tax on these distributions of your own companys stock from your retirement account. That can be up to 37 percent, which is now the highest tax bracket, says Landsberg.

Instead, youll enjoy capital gains tax treatment, which even at the highest tax bracket is only 20 percent, on any appreciation. High earners, however, will be subject to a bonus 3.8 percent net investment income tax. And an NUA may be subject to a 10 percent early withdrawal tax if you move funds prior to age 59 1/2.

Landsberg says NUA makes the most sense when the difference in tax rates is higher.

Net unrealized appreciation is a very powerful tool, if used correctly, Landsberg says. So you can get creative and potentially have a pretty nice windfall if you use the NUA rules correctly.

You May Like: How To Cancel My Fidelity 401k

Number Of Months Of Disaster Payments

If this 1099-R is:

- from a pension for which you use the simplified method to calculate the taxable amount,

- and some, but not all, of the payments reported on this 1099-R are qualified disaster recovery distributions

You must enter the months your client received disaster recovery payments in Number of months of disaster recovery payments, if simplified method. Under this circumstance, two simplified method worksheets will be completed – one for the qualified disaster recovery distributions, and one for the other pension distributions. The number of months you enter will be used to calculate line 5 of both simplified method worksheets.

If this 1099-R doesn’t meet both of the above conditions, you can leave the Number of months of disaster recovery payments, if simplified method field blank.

Handling A Previous 401k

You usually have a few options when it comes to handling a 401k from a former employer. These include leaving the 401k where it is, rolling it into a taxable or nontaxable Individual Retirement Account or transferring it to a 401k with your current employer and cashing it out. Of all your options, cashing out will cost you the most now and in the future. You will have to pay income taxes on the withdrawal along with a 10 percent early withdrawal penalty. You’ll also lose the tax benefits offered by the 401k as a qualified retirement plan.

You May Like: How To Make 401k Grow Faster

Open Your Account And Find Out How To Conduct A Rollover

After youve found a brokerage or robo-advisor that meets your needs, open your IRA account. Once its open, you can begin the process for rolling over your 401 money into the account.

Each brokerage and robo-advisor has its own process for conducting a rollover, so youll need to contact the institution for your new account to see exactly whats needed. Youll want to follow their procedures exactly. If youre rolling over money into your current 401, contact your new plan administrator for instructions on what to do.

For example, if the 401 company is sending a check, your IRA institution may request that the check be written in a certain way and they might require that the check contains your IRA account number on it.

Again, follow your institutions instructions carefully to avoid complications.

How To Edit Your Massmutual 401k Terms Of Withdrawal Pdf From G Suite With Cocodoc

Like using G Suite for your work to finish a form? You can do PDF editing in Google Drive with CocoDoc, so you can fill out your PDF just in your favorite workspace.

- Integrate CocoDoc for Google Drive add-on.

- Find the file needed to edit in your Drive and right click it and select Open With.

- Select the CocoDoc PDF option, and allow your Google account to integrate into CocoDoc in the popup windows.

- Choose the PDF Editor option to move forward with next step.

Recommended Reading: Can I Buy 401k Myself

Hardship Withdrawals From Roth401 Contributions

Special tax consequences apply to hardshipwithdrawals from Roth 401 contributions. The taxation of a hardshipwithdrawal from Roth 401 contributions depends on whether or not thewithdrawal is a qualified distribution. Qualified distributions from Rothaccounts are fully excludable from gross income. To be qualified, thedistribution must be made after:

- The participant has reached age5912, become disabled, or died, and

- The Roth account has beenmaintained for at least five years.

In all other cases, the distribution isnonqualified. Nonqualified distributions are treated partly as a tax-freereturn of contributions and partly as taxable investment earnings.

If withdrawals are distributed before age5912, the taxable portion of the payment is subject to an early distribution10% tax penalty. This extra tax does not apply to the payment if theparticipant is:

- At least age 55 when separatedfrom service,

- Terminated due to disability,

- Paid in equal payments over the life expectancy of the participant or joint life expectancyof the participant and beneficiary,

- Using the payment to cover certainmedical expenses that can be deducted on a tax return, or

Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you won’t owe a penalty.

Read Also: How To Invest Money From 401k

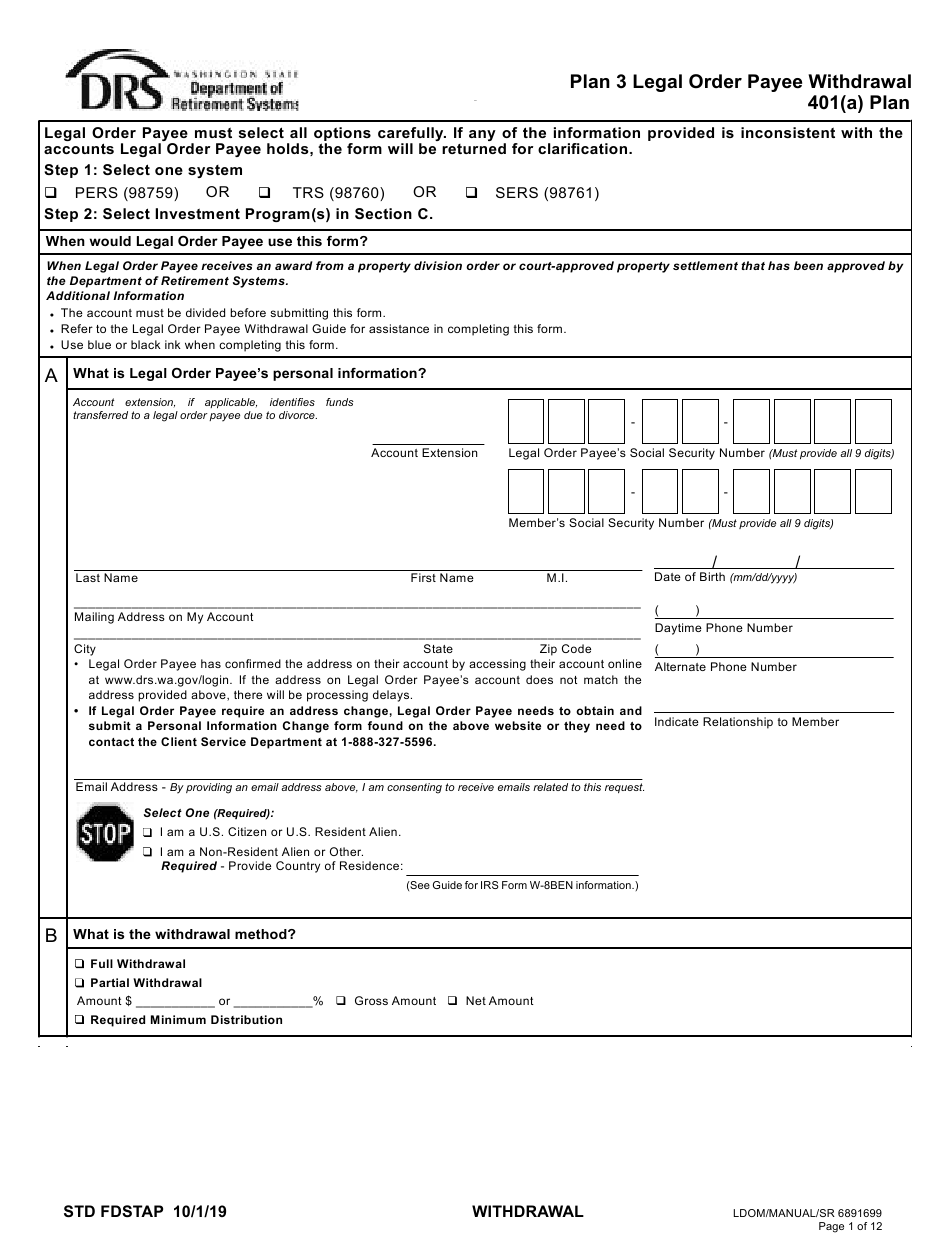

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Additional Exceptions To The Early Withdrawal Penalty

You may still qualify for an early withdrawal without an additional 10 percent penalty even if you’re younger than 55. If your 401 has an early withdrawal for any of the following reasons, you won’t need to pay the extra 10 percent:

- The 401 distribution was made to a beneficiary or your estate after your death.

- You’re totally and permanently disabled.

- You’ve left your employer and are receiving a series of “substantially equal periodic payments” over your life expectancy or your beneficiary’s life expectancy.

- Your deductible medical expenses exceed 7.5 percent of your AGI, even if you don’t itemize your deductions.

- The withdrawal was because the IRS levied your account and took the money to pay back taxes.

- You’re an individual called to active duty after September 11, 2001, for at least 180 days.

- The withdrawal was made to pay someone else under a qualified domestic relations order or

- The distribution was a dividend from an employee stock ownership plan.

Don’t Miss: What Is The Max Percentage For 401k

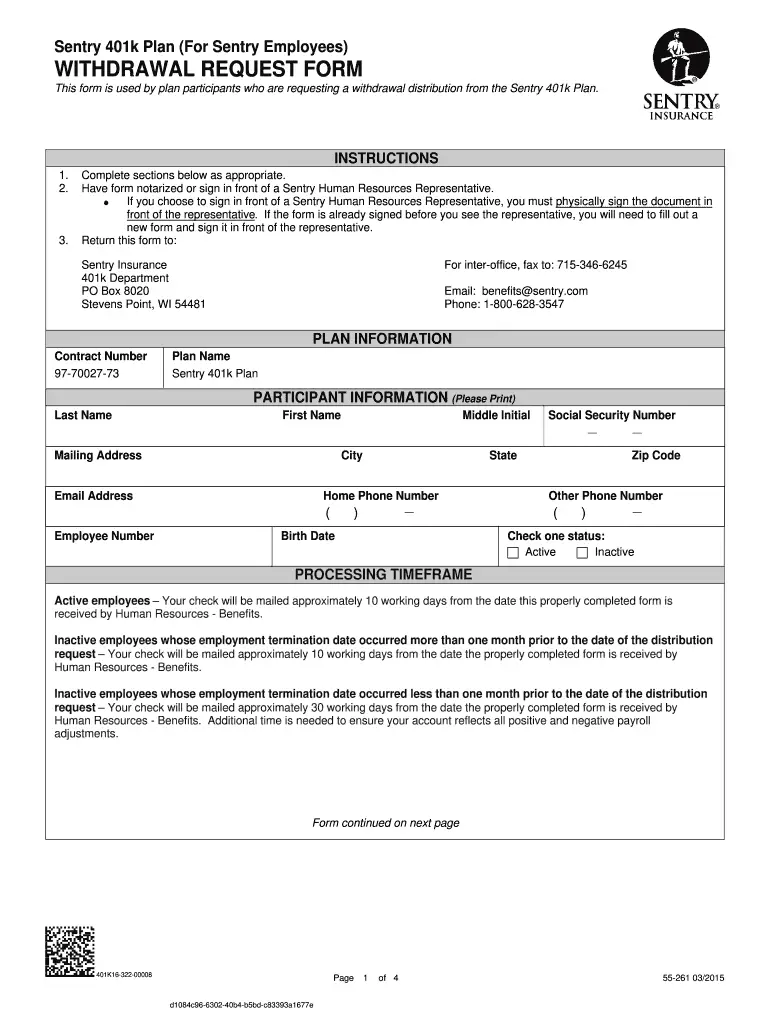

How To Make An Electronic Signature For The Distribution Form 401k Online

Follow the step-by-step instructions below to eSign your fidelity withdrawal form 401k:

After that, your 401k withdrawal form get is ready. All you have to do is download it or send it via email. signNow makes eSigning easier and more convenient since it provides users with a number of additional features like Add Fields, Invite to Sign, Merge Documents, and so on. And due to its cross-platform nature, signNow can be used on any device, personal computer or smartphone, irrespective of the operating system.

Decide What Kind Of Account You Want

Your first decision is what kind of account youre rolling over your money to, and that decision depends a lot on the options available to you and whether you want to invest yourself.

When youre thinking about a rollover, you have two big options: move it to your current 401 or move it into an IRA. As youre trying to decide, ask yourself the following questions:

- Do you want to invest the money yourself or would you rather have someone do it for you? If you want to do it yourself, an IRA may be a good option. But even if you want someone to do it for you, you may want to check out an IRA at a robo-advisor, which can design a portfolio for your needs. But do-it-for-me investors may also prefer to make a rollover into your current employers 401 plan.

- Does your old 401 have low-cost investment options with potentially attractive returns, and does your current 401 offer similar or better options? If youre thinking about a rollover to your current 401 plan, youll want to ensure its a better fit than your old plan. If its not, then a rollover into an IRA could make a lot of sense, since youll be able to invest in anything that trades in the market. Otherwise, maybe it makes sense to keep your old 401.

- Does your current 401 plan offer access to financial planners to help you invest? If so, it could make sense to roll your old 401 into your new 401. If you move money to an IRA, youll have to manage it completely and pick investments or hire someone to do so.

Recommended Reading: Can You Have A Solo 401k And An Employer 401k

Roll It Over To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it, says Michael Landsberg, CPA/PFS, member of the American Institute of CPAs Personal Financial Planning Executive Committee.

S To Take For Cashing Out A 401k

It can take several weeks to successfully cash out a 401k. You should be prepared to handle a lot of paperwork. It is important to realize that this is not a solution for fast cash and you will only get a portion of your 401k cash out. You will need to begin the process before you need the actual cash.

Don’t Miss: What Is The Difference Between A Pension And A 401k

Other Options For Getting 401 Money

If you’re at least 59½, you’re permitted to withdraw funds from your 401 without penalty, whether you’re suffering from hardship or not. And account-holders of any age may, if their employer permits it, have the ability to loan money from a 401.

Most advisors do not recommend borrowing from your 401 either, in large part because such loans also threaten the nest egg you’ve accumulated for your retirement. But a loan might be worth considering in lieu of a withdrawal if you believe there’s a chance you’ll be able to repay the loan in a timely way s, that means within five years).

Loans are generally permitted for the lesser of half your 401 balance or $50,000 and must be repaid with interest, although both the principal and interest payments are made to your own retirement account. It is also worth noting that the CARES Act raises the borrowing limit from $50,000 to $100,000. If you should default on the payments, the loan converts to a withdrawal, with most of the same consequences as if it had originated as one.

401 loans must be repaid with interest in order to avoid penalties.

About two-thirds of 401s also permit non-hardship in-service withdrawals. This option, however, does not immediately provide funds for a pressing need. Rather, the withdrawal is allowed in order to transfer funds to another investment option.

Rollovers To A Roth Account

If you withdraw from your 401 to roll over to a Roth IRA or a Roth 401, you will have to pay taxes on the rollover. Roth accounts are post-tax accounts and are intended for deposit of post-tax funds. While your regular 401 account is funded by money taken out of your paycheck before taxes, Roth accounts are funded by contributions made after taxes, so all the funds in a Roth account are not taxable since the taxes have already been paid. If you deposit a withdrawal of pretax funds into a Roth account, you’ll have to pay taxes on the withdrawal. However, because it’s a rollover, you won’t have to pay the early withdrawal penalty.

Don’t Miss: How Do I Withdraw Money From My 401k Fidelity