Federal Deposit Insurance Corporation

The FDIC is designed to protect peoples money held in banks through FDIC insurance. Bank account holders have federal protection for assets up to $250,000 in any given FDIC-insured institution.

The FDIC not only provides this insurance for account holders against potential bank failure, it also maintains records of merged or failed institutions, and the owners of those accounts. Going to the FDIC website, use the bank find tool to search institutions. If funds were unclaimed for an extended period of time, they may be held in the state controllers office. The FDIC offers links to free search tools administered by the National Association of Unclaimed Property Administrators.

You May Like: How To Manage 401k Investments

How To Invest 401 Money

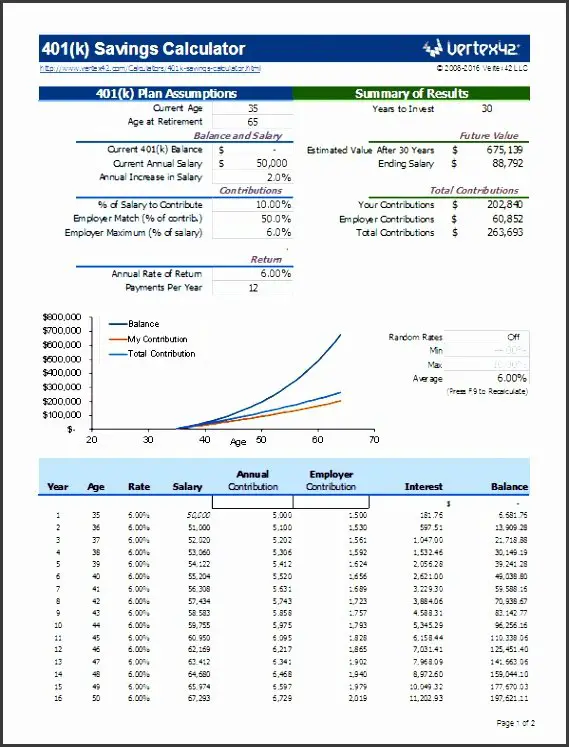

Youll also need to decide how to invest your 401 money. One option, which most 401 plans offer, is target-date funds. You pick a fund with a calendar year closest to your desired retirement year the fund automatically shifts its asset allocation, from growth to income, as your target date gets nearer.

These funds also have model portfolios you can choose from and online tools to help you assess how much risk you want to take. You can also decide which fund choices would match up best with your desired level of risk.

How Much Can I Contribute

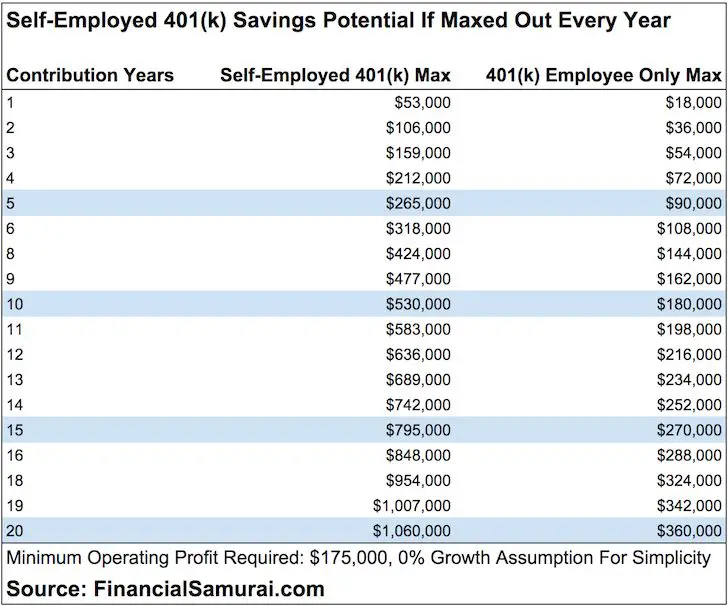

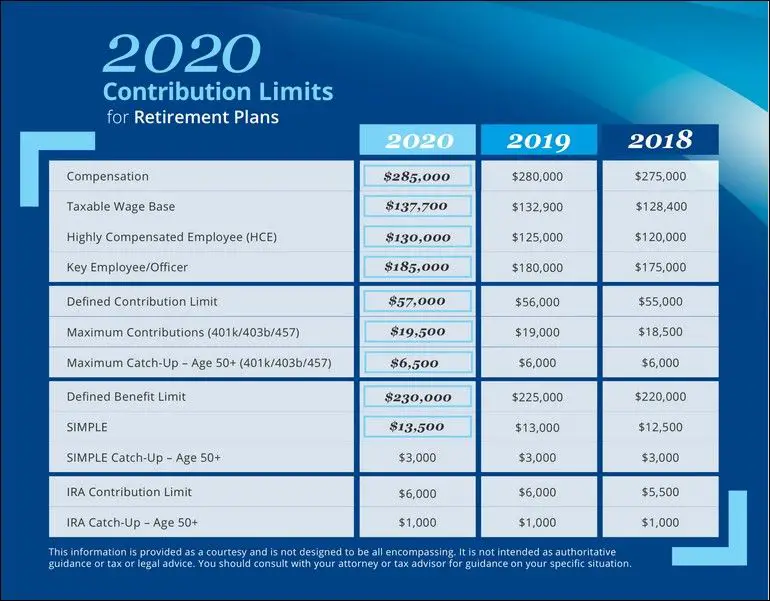

Another good reason to take advantage of a 401 match is that it allows you to exceed the annual 401 maximum contribution limits set by the IRS. For 2020 and 2021, you can contribute up to $19,500 of pretax income to a 401. If you are 50 or older, you can contribute another $6,500 in what are called catch-up contributions.

When including employer contributions, the maximum amount you can contribute in 2020 is the lesser of $57,000 for participants 49 or younger or 100% of the participants compensation. In 2021, the limit is $58,000 for participants 49 or younger .

You May Like: Can I Sign Up For 401k Anytime

Read Also: How To Use Your 401k In Retirement

Us Department Of Labor

Even if your former employer abandoned its retirement plan, your money isnt lost forever. The U.S. Department of Labor maintains records for plans that have been abandoned or are in the process of being terminated. Search their database to find the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Also Check: How To Pull Money From 401k

Follow These 2 Tips To Prevent This Issue

You May Like: How To Switch 401k To Ira

Take Advantage Of Catch

Catch-up contributions allow investors over age 50 to increase their retirement savingswhich is especially helpful if theyre behind in reaching their retirement goals. Individuals over age 50 can contribute an additional $6,500 for a total of $26,000 for the year. Putting all of that money toward retirement savings can help you truly max out your 401.

As you draw closer to retirement, catch-up contributions can make a difference, especially as you start to calculate when you can retire. Whether you have been saving your entire career or just started, this benefit is available to everyone who qualifies.

And of course, this extra contribution will lower taxable income even more than regular contributions. Although using catch-up contributions may not push everyone to a lower tax bracket, it will certainly minimize the tax burden during the next filing season.

Look Through Unclaimed Property Databases

You can also search the National Registry of Unclaimed Retirement Benefits Opens in new window to find plans under your name.

Once you find one account, you can potentially spot a few more, as theres a possibility you have multiple plans hosted by the same company. The other accounts should come up as you log into the management companys website.

Don’t Miss: What Is The Max You Can Put In A 401k

I Cant Find My 401 Now What

Editorial Note: The content of this article is based on the authors opinions and recommendations alone and is not intended to be a source of investment advice. It may not have not been reviewed, commissioned or otherwise endorsed by any of our network partners or the Investment company.

Were all chasing the almighty dollar, but sometimes we leave behind a few hard-earned ones along the way.

In fact, billions of dollars are left in forgotten 401 plans in the United States that are waiting to be claimed by their rightful owners.

If youre in search of your old 401, here are some tips on how you can track it down.

What Is A Good 401 Contribution

Your ideal 401 contribution depends on several factors. If your employer offers a match, your first priority should be to contribute enough to get the full match. From there, you may want to max out a tax-free retirement account such as a Roth IRA before you finish maxing out your 401. If you’re able to do all three of these, it can help you get the most out of your investments.

Recommended Reading: How To Take Out A Loan Against 401k

Retirement Isnt Freebut Your 401 Match Is

Many of us herald this time of year as the arrival of summer, the end of the school year and seemingly longer days with more sunlight. Yet June is also a great time to check in with your employer-sponsored retirement plan.

Are you leaving free money on the table? In addition to offering the potential for free money through a match, employer-sponsored retirement plans can give you significant tax advantages.

Here are four steps to get the most out of your retirement savings.

Read Also: Should I Open A 401k

Put Contributions Into A Roth

You may be able to put your after-tax contributions into a designated Roth account to ensure tax-free withdrawals during retirement. That is, as long as you wait until age 59½ to withdraw, and you make your first contribution at least five years before then.

There are two ways you can roll after-tax contribution dollars into a Roth account:

-

In-plan conversion: If your job offers an in-plan conversion, you can convert all or some of your 401 into a Roth. You have to pay taxes on the amount you convert, but like with a Roth IRA, your withdrawals in the future would be tax-free. Some plans have an auto-convert feature that automatically converts your after-tax contributions into your Roth.

-

In-service withdrawal: If your employer offers in-service distributions or withdrawals, you can do a mega backdoor Roth. This is when you roll after-tax contributions into a Roth IRA outside of your retirement plan.

If your employer doesnt offer in-plan conversions or in-service distributions on your 401 plan, you might consider asking what your options are for withdrawing money and putting it into an IRA. Make sure to ask about the rules associated with withdrawing money from your 401 and any potential penalties.

Don’t Miss: When To Start A 401k Plan

Retirement Plan Fees And Expenses

This section shows a detailed breakdown of fees that were directly debited from your account during the period.

These were listed in the above example chart as Plan Administrative Expenses. This is your share of expenses that everyone in your plan pays.

These normally include day-to-day costs to run the plan, such as legal, accounting, and trustee and recordkeeping costs.

Not all of the 401 fees you are paying are easy to find.

Sometimes, it takes a little more research to understand your true costs in your 401 plan.

As you can see in the disclosure in the fine print below, there may be other expenses paid directly from the investment options you have to choose from, such as revenue sharing agreements, 12b-1 fees, and sub-transfer agent fees.

There are some additional fees that come from the funds themselves.

These fees are called expense ratios.

A quick definition: expense ratios are the total percentage of fund assets used for administrative, management, advertising , and all other expenses.

For example, the 2030 target date fund expense ratio is 0.43% basis points, versus Vanguards Institutional Index expense ratio of 0.04% basis points. The expense ratio of the 2030 target date fund here is 10 times that of the Vanguard Fund.

How does the difference relate to you in terms of actual dollars?

Lets say you had $100,000 invested in both the 2030 target date fund example with an expense ratio of 0.43% and the Vanguard Fund with an expense ratio of 0.04%.

Why Does California Have An Unclaimed Property Law

The Unclaimed Property Law was passed to protect consumers. It prevents businesses with unclaimed property from keeping your money and using it as business income. The law provides California citizens a single source, the State Controllers Office, to check for unclaimed property that may be reported by businesses from around the nation and enables the State to return property, or the net proceeds from any legally required sale of the property, to its rightful owner or their heirs.

Don’t Miss: Can I Take Money Out Of My Fidelity 401k

How To Reclaim Your Retirement Plan With A Previous Employer

- Retirement Planning

- How to Reclaim Your Retirement Plan with a Previous Employer

Millions of Americans accidentally or unknowingly leave money in retirement plans with previous employers. According to a study by the National Association of Unclaimed Property Administrators, Americans lost track of more than $7.7 billion in retirement savings in 2015.

If you’ve left a retirement plan with a previous employer, not to worry. Here are 6 tips you can follow to reclaim your money.

Check Your Pension Easily With Pensionbee

PensionBee is a leading online pension provider. Log into your BeeHive anywhere and from any device to check your balance, and see whether youre on target to reach your retirement saving goal.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice.

Last edited: 25-02-2022

Recommended Reading: Is An Annuity The Same As A 401k

Recognize The Tax Advantages

In addition to potentially offering free money through a match, employer-sponsored retirement plans can give you significant tax advantages.

Contributions to tax-advantaged retirement accounts, such as a 401, are made with pre-tax dollars. That means the money goes into your retirement account before it gets taxed.* Plus, your contributions, any match your employer provides and any earnings in the account are all tax-deferred. That means you dont owe any income tax until you withdraw from your account, typically after you retire.

With pre-tax contributions, every dollar you save will reduce your current taxable income by an equal amount, which means you will owe less in income taxes for the year. But your take-home pay will go down by less than a dollar.

You May Like: How Do I Stop My 401k

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

Don’t Miss: How To Transfer 401k From Fidelity To Vanguard

Contact Your 401s Administrators

Your human resources department or administrator will be able to help you check your 401 balance.

You have most likely been mailed statements of your 401 accounts yearly or quarterly unless there is a different address on file.

Speak with your representative to verify that your contact information and address are up to date to prevent future lapses in correspondences.

If your 401 plan’s administrator uses an online portal, similar to your online banking platform, they can help you get set up.

Online access to your 401 is excellent in checking your 401 balance and how your funds are performing. Some 401 platforms allow you to research the various funds, as well as reallocate your investments right on the platform.

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

You May Like: What Are The Best 401k Funds To Invest In

How Does Money Get Left Behind

Very few people stay at one employer the entire length of their career.

But unlike your bank account which you may have from job to job, a 401 account is linked to your employer. It is up to you to do something about it.

When you leave your employer, the money may stay in the account for an indefinite amount of time.

However, if the company closes the 401 plan, files for bankruptcy, goes out of business or is acquired by another company, you may be forced to decide, within a short period of time.

Its possible that years will go by after you parted ways with your old job, and then youll get a letter notifying you that you need to move your 401 account, or take a distribution.

If this happens, youre much better off rolling the money into an IRA account, or transferring the money into your current companys 401 plan.

Comb Through Financial Records

Start by looking through your relatives financial records, if any of that is still available. Ideally, youre looking for statements, passbooks or correspondence regarding bank accounts that are, or might be, still open. Tax returns are good sources of information since they often include bank account details look in the interest paid section to identify the banks where savings earned interest. You can order copies of tax returns using IRS Form 4506. Include a copy of the death certificate and the fee to obtain multiple years returns.

Recommended Reading: How To Transfer A 401k Account

You May Like: How To Open A Personal 401k

Look At State Unclaimed Money Websites

While youre looking for your retirement money, you might as well check for any other lost dough. When Florida nurse Mary Pitman ran a random search on Missingmoney.com, a database maintained by the National Association of Unclaimed Property Administrators, she found $2,500 in stocks left behind when her father died.

I became a believer real quick, says Pitman, who wrote The Little Book of Missing Money to help others find lost cash. The unclaimed property administrators group also maintains unclaimed.org, which points users to databases of missing cash turned over to individual state treasuries.

Run a search based on states where you once lived or worked to find money owed to you. Most missing 401 plans wouldnt be turned over to a state, officials say, but vested company stocks, forgotten bank accounts, uncashed paychecks or utility deposits are commonly turned over to state treasuries. In 2015 alone, $7.8 billion in missing money was turned over to states, according to the NAUPA.

How To Check Your Pension Contributions

As you save for retirement, its important to check your pension contributions regularly and ensure youre on track to reach your retirement goals. You can check your National Insurance record to see how much State Pension youll receive, and you can find out the value of your private pension by checking your pension statement.

Recommended Reading: How To Check Your 401k Balance Online

Why You Should Roll Over Your Old 401 Accounts

Once you find forgotten retirement funds, you can make it easier to keep track of your money by simply rolling over your old 401 accounts into an IRA at a brokerage you already have an account with. This way you can manage your nest egg easier since all of your money is in one place.

“It’s beneficial to consolidate your accounts to reduce oversight obligations,” Cavazos says. “Having all of your funds consolidated in one account allows you to keep track of your balance and account performance.”

If you already have an existing IRA, you can roll your 401 balance into that account. Otherwise, it’s easy to open a new IRA at the big-name brokers like Charles Schwab, Fidelity, Vanguard, Betterment or E*TRADE. Rolling over your old 401 plan into an IRA gives you more control over how you invest your retirement funds since you won’t be limited to just the funds that were offered by your former employer. These large brokerages give you thousands of investment options, including mutual funds, index funds and individual stocks.