In This Article You’ll Learn

Who is this for? Anyone that hopes to one day retire would benefit from understanding the difference between Roth 401ks and Roth IRAs, and how to navigate them both to your greatest advantage.

Maybe youre here because you just started a new job and your employer offers a Roth 401 option. Perhaps youre self-employed and are looking into starting your own Roth IRA. Or maybe youre in the tech industry and keep hearing about the mega backdoor Roth 401.

Whatever reason youre reading this, its always a good idea to plan for the future. When you hear people use terms like traditional,after-tax,pre-tax, and Roth, its easy to get lost and feel like its complicated. The reality is, its not that complicated once you get the terminology down and understand how each option works.

It does get a bit more complicated when you start analyzing your unique situation and goals and try to choose the best financial plan. The good news is there are plenty of professionals that can walk you through that, and help you make needed adjustments with your Roth 401 and Roth IRA decisions, and beyond.

In this article, were going to break down Roth 401s, Roth IRAs, and everything related. When youre finished, youll have the information you need to be an informed participant when designing your retirement plan with your financial advisor.

How Does A Roth 401 Work

The Roth 401 has been around since 2006 and is designed as a hybrid of the traditional 401 and the Roth IRA.

Like a traditional 401, a Roth 401 is employer sponsored. An employer establishes the plan, chooses the investment options, and then offers the plan to individual workers. The main difference between the two types is how the tax advantages work. A Roth 401 can be beneficial if you expect your tax bracket to be higher in retirement.

There are exceptions, of course. In order to withdraw funds tax-free, you’ll need to be at least 59 ½, and you must have had the account for five years or more. This rule applies to all Roth accounts.

There are also rules regarding contributions. For 2021, you can contribute as much as $19,500 per year, plus an additional $6,500 if you’re 50 or older.

Quick tip: With a Roth 401, you’re required to start taking distributions from your plan by age 72. If you want to avoid these minimum distributions, a Roth IRA may be a better fit.

How Much Should I Invest In A Roth 401

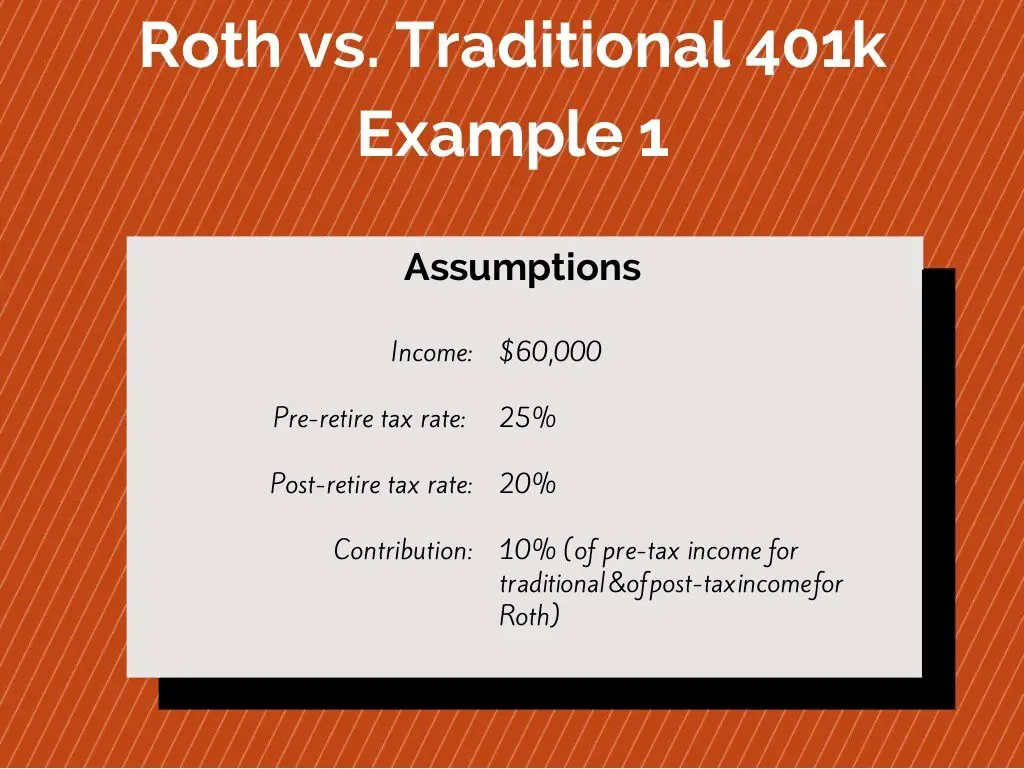

We recommend investing 15% of your income into retirement savings. If you have a Roth 401 at work with good mutual fund options, you can invest your entire 15% there. Lets say you make $60,000 a year. That means you would invest $750 a month in your Roth account. See? Investing for the future is easier than you thought!

Read Also: How Much Do You Need In 401k To Retire

How Much Should You Save To Buy A House

This is exactly what you need to save to buy a house with a down payment. Your down payment can range from a percentage to 20 percent of the total home value, depending on your creditworthiness, mortgage interest and current amount. Closure of costs. moving costs. Payments of mortgage loans. Repair and service. emergency fund.

Be Smart With Your 401

Opening a 401 is a smart step on the road to a comfortable retirement, but it’s not quite as simple as signing some papers and setting aside a percentage of your paycheck. You have to understand the rules, choose your investments wisely, and continue to maintain your plan for as long as you own it. If you do that, you can feel confident that you’re giving yourself the best shot at a secure retirement.

Also Check: What Are Terms Of Withdrawal 401k

Design Your Own Portfolio

If youre going to design your own investment portfolio within your Roth IRA, its important to pick investments based on your comfort level and your time horizon to retirement. Many people put more of their investments into bonds as they get older because bonds are more stable than stocks. On the other hand, stocks historically have produced higher returns over the long term, so theres a trade-off.

New rules of thumb suggest keeping a sizable portion of stocks in your portfolio even as you get older. Thats because people are living longer, often have lower retirement savings, and may face increased medical expenses.

Many experts recommend buying two to six mutual funds or ETFssome made up of stocks and others of bondsand keeping a small percentage of your account in cash or cash equivalents, such as money market funds.

Look for funds that have expense ratios of less than 0.5%. That fee is in addition to the fees you may pay the bank or brokerage for the account itself.

Talk To Hr About Enrolling In Your 401

If you’re interested in opening a 401, talk with your employer to learn about how your company’s plan works. Some employers automatically enroll employees and withhold a default amount of their paychecks, which you can change yourself at any time. You can also opt to stop contributing to the plan if you’re not interested in doing so right now.

Other companies require participants to declare their desire to participate in the 401. You’ll have to fill out paperwork saying that you’d like to contribute to the plan and how much money you’d like to set aside initially. You can always change this later.

You’ll also need to choose your beneficiary — the person you’d like to inherit your 401 if you die — when you sign up. Usually you choose a primary beneficiary and a secondary, or contingent, beneficiary who will inherit the 401 if the primary beneficiary is deceased or doesn’t want the money.

Don’t Miss: Can You Pull From 401k To Buy A House

What Are The Contribution Levels And Limits Of A Solo Roth 401

The savings inside of a Solo Roth 401 are made up of both employee and employer contributions. In this case, the employer is the employee. That is the definition of self-employed. When contributing to a Solo 401 as the employee, you are allowed up to $19,500 or 100% of compensation for tax year 2020 .1

Employers with Solo 401 plans or Solo Roth 401 plans can make a profit-sharing contribution of up to 25% of eligible compensation, capped at a total of $57,000 for both employer and employee contributions in 2020. Over age 50 catch-up contributions are in excess of the $19,500 and $57,000 caps.

Heres one place where the tax distinction between the Solo 401 and Solo Roth 401 comes into play. In a Solo 401, the only option is tax-deductible, or pre-tax, savings. By contrast, the Solo Roth 401 offers two options. The doctor mentioned above could opt for traditional, tax-deductible savings or exercise the Roth featurepay taxes today and not be concerned with paying taxes in the future, possibly at a higher rate. Roth savings are often referred to as post-tax savings with tax-free growth and tax-free withdrawals. While its nice to have both options, he would probably be wise to take the Roth route due to the restrictions on the employer contribution described below. This would also allow him to diversify his retirement savings from a tax perspective.

How Does A Roth 401 Affect My Paycheck

A lot of people are hesitant to begin a Roth 401 because they are worried about how it will affect their take-home pay. At a minimum, its always recommended to contribute up to your employers match even if you are focused on getting out of debt or saving for a new home. This is essentially free money.

There is no getting around that your contributions will directly affect your take-home pay. The contributions are made with after-tax dollars. But remember, the future earnings in your Roth 401 are not taxable. This can end up paying off big time once you hit retirement.

Also Check: What Should I Invest In 401k

Choose What Type Of Investor You Are

There are several types of investors, and most people shift from one type to another over time. Just because youre a day trader today doesnt mean you wont become a long-term investor at some point. The primary types of investors are as follows:

Day Trader: As the name implies, a day trader buys and sells securities in a single day. As a day trader you might buy and then sell a security on the same day, or sell short and then buy a security on the same day.

Long-Term Investor: A long-term investor will intend to hold a security or other asset for at least a year and usually longer.

Mutual Fund Investor: A mutual fund investor specializes in you guessed it mutual funds. For many people, this is the ideal route to go as mutual funds are easily managed.

A Forex Trader: If you decide to skip the stock market and instead look into a foreign currency exchange, youll be whats called a forex trader. Forex is a global market where currency is bought and sold. You have to know what youre doing, however, as forex trading can be risky.

Municipal Bond Investor: Municipal bond investors dabble in debt securities issued by states, cities, towns, counties and U.S. territories to finance projects such as schools and highways. These are typically low-risk investments, provided you buy them from a reliable company or directly from a government entity.

Should You Convert Your Traditional 401 Into A Roth 401

7 Minute Read | September 27, 2021

Over the past few years, you might have received an email from your companys human resources department introducing a new retirement savings plan option: the Roth 401.

More and more companiesespecially large onesare adding Roth options to their 401 plans. In fact, seven out of 10 employers now offer this option to their employees.1 If the Roth 401 is on the table at your workplace, thats great news for you!

But if you now have a Roth 401 option, youre probably wondering what to do with your existing 401. Is converting an existing 401 to a Roth the way to go? Or should you just leave it alone?

There are some things to keep in mind before you make this decision, so lets dive in.

You May Like: Can I Rollover 401k To Ira While Still Employed

What Is A Roth 401 And How Does It Work

The Roth 401 is normally a feature within a traditional 401, sometimes called a designated Roth account. You can think of it as a bucket of funds that’s separate from your traditional 401 contributions.

The deposits you make to a designated Roth account are not tax-deductible. However, the qualified withdrawals you make in retirement are tax-free. You won’t pay taxes on your investment earnings from year to year, either. Basically, you fulfill your tax burden on these funds at the start when you deposit after-tax money into the account.

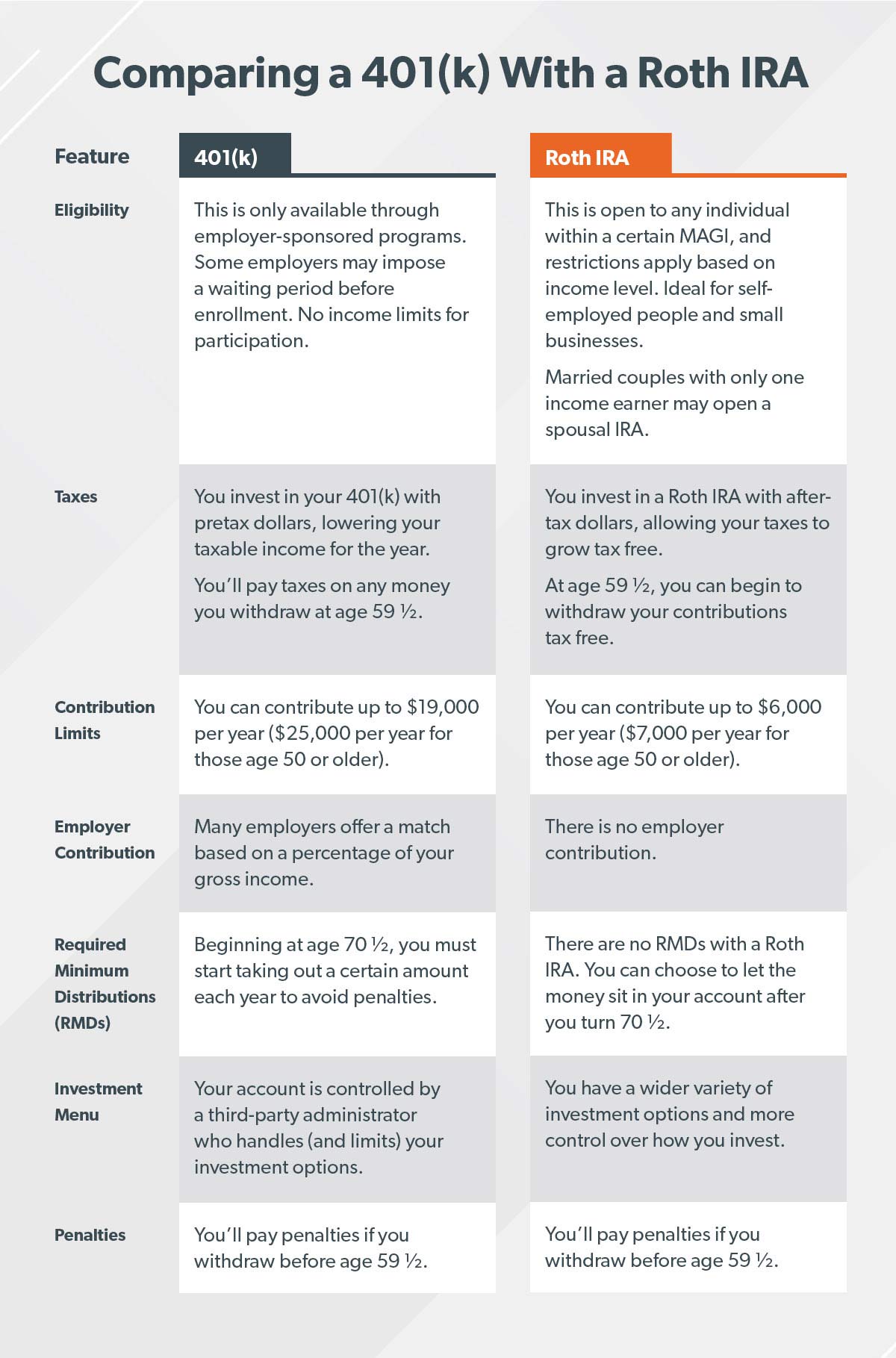

This is the same tax structure you’ll find in a Roth IRA, which is an individual retirement account that’s not tied to your employer. The Roth IRA has lower contribution limits relative to the Roth 401 and income restrictions that could prevent you from contributing anything at all. The Roth 401 doesn’t have income restrictions, which is a huge plus if your income is well into six-figure territory.

Should I Convert My Current 401 Into A Roth 401

If you already have a traditional 401 at your current job and the company just introduced a Roth 401 option, converting that 401 into a Roth might sound like a good idea. But is a conversion your best option? It depends on your situation.

The main drawback of converting a traditional 401 into a Roth 401 is the tax bill that comes with making the switch. Youre going to have to pay taxes on that money because it hasnt been taxed yet.

Lets say you have $100,000 in your traditional, pretax 401 and you want to convert the account into a Roth, after-tax 401. If youre in the 22% tax bracket, that means youd be paying $22,000 in taxes. Thats a lot of cash!

If you convert your 401 into a Roth 401, you need to have the cash on hand to cover the tax billno exceptions. Do not use money from the investment itself to pay the taxes. If you do, youll lose a lot more than $22,000. Youll also miss out on years of compound interest, which is typically about 10%. So after 30 years, a $100,000 account could grow to be $436,000 more than an account with a $78,000 starting point because of compound interest.

There are also alternatives to a 401 conversion to consider. For example, you can leave your traditional 401 alone and start putting money from your paycheck into a new Roth 401 instead. That way, you dont have to worry about taking a hit paying taxes now and still take advantage of the Roths tax-free growth later.

Read Also: How Much Does 401k Cost Per Month

Can I Have Roth 401k And Roth Ira

Yes, current law allows you to have both. You can have a 401 plan with a Roth 401 provision and still fund a Roth IRA. You are free to do that as long as your income does not exceed the limits of making a Roth IRA contribution. That limit is $196,000 – $206,000.

In many cases, its an advantage to have both a Roth 401k and a Roth IRA. Your Roth 401 will allow for high contribution limits. This enables you to save more. When you pair that with a Roth IRA you open up wider investment options. You can make the best of the investment selections offered within your 401 plan, then expand your investing through your Roth IRA to access any investment you like.

The Ultimate Roth 401 Guide

- Alvin Carlos

Roth 401 is something that you may already know about or have been hearing a lot more about lately. There are many retirement plan options available for employees. One of these options available to many employees is a Roth 401. More employers are now offering this option to their employees and it may be a valuable option for you. In this article, we will explore Roth 401 in-depth so you can decide if its the right retirement savings plan for you.

You May Like: How Should I Invest My 401k

Can A Plan Automatically Enroll Me To Make Designated Roth Contributions If I Fail To Decline Participation

Yes, a plan can provide that your employer will automatically withhold elective deferrals from your pay unless you decline participation. If the plan has both traditional, pre-tax elective contributions and designated Roth contributions, the plan must state how the employer will allocate your automatic contributions between the pre-tax elective contributions and designated Roth contributions.

Strategies For People Who Cant Do A Mega Backdoor Roth Ira

If a mega backdoor Roth is unavailable to you, you have options:

- See if your employer offers a Roth 401

- If youre under the income limits, open a Roth

- If youre over the income limits, open a backdoor Roth

- Invest in an indexed Universal life insurance policy

Not everyone can do a mega backdoor Roth IRA, and thats okay. Theres still plenty of tax-advantaged places you can put your money. Consider a IUL policy, where youll enjoy tax-free growth and withdrawals into retirement as well.

Read Also: How To Find Out What You Have In Your 401k

How Sofi Can Help You

Need a little help with the navigation? Dont fretmost people do. Its not an easy decision, and sometimes you have to hash it out, out loud, with someone who lives and breathes this stuff. You could talk with a SoFi Financial Planner and get free, no-obligation, personalized advice on how you can maximize your Roth 401 benefits.

With a SoFi Invest account, you can easily open an IRA. How easy? It takes about five minutes or less, and you can choose automated or active investing. The choice is yours.

Open a retirement account with SoFi today.

SOIN18154

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Home Loans General Support:

- Mon-Fri 6:00 AM 6:00 PM PT

- Closed Saturday & Sunday

- Mon-Thu 8:00 AM 8:00 PM EST

- Fri 8:00 AM – 7:00 PM EST

- Closed Saturday & Sunday

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

What Are The Roth 401 Withdrawal Rules

It is important to know the withdrawal rules, otherwise, you will risk losing part of your savings to penalties and tax payments. To withdraw money from a Roth 401 tax-free, you need to follow the IRS rules for Qualified Distributions. A qualified distribution is one that is made at least 5 years after you start contributing to your Roth account, and after you are 59.5-years-old. Qualified withdrawals may also be made if you become disabled, or to your beneficiaries upon your death. This 5-year rule can often be confusing. If you open a Roth 401 and begin making contributions when you are 58-years-old, you then must wait until you are 63-years-old to begin distributions. You met the 59.5-year-old rule, but not the 5-year rule. Both must be met for the distribution to be qualified.

It is important to note that in 2020 there was a $2 trillion coronavirus emergency stimulus bill that allowed people under the age of 59.5 to withdraw up to $100,000 from traditional or Roth 401 without the 10% penalty. However, that was only valid for 2020. Penalties for those aged under 59.5 who withdraw money from their 401 accounts went back into effect on Jan 1, 2021.

You can withdraw from Roth 401 early, but you will have to pay taxes on any earnings you withdraw and you will potentially be subject to a 10% early withdrawal penalty. You can also avoid taxation on your earnings if your withdrawal is for a rollover. However, please consider these 3 reasons why you should not rollover.

Also Check: How To Get Money Out Of 401k Without Penalty