The Basics Of 401 Withdrawal Taxes

If you are wondering whether your 401 withdrawals are taxed, the short answer is yes your 401 distributions are likely taxable.

This may come as a surprise, because there is some confusion around how retirement accounts work. People often refer to retirement accounts like 401s as tax-advantaged, or tax-deferred. This means investments within your 401 or IRA grow tax-free. Unlike taxable investment accounts, you wont be charged income tax or capital gains tax as your 401 account grows each year.

As an example, if you earn $1,500 before taxes per paycheck, and you contribute $300 of that money to your 401, then you will only be taxed on $1,200. For reference, 401 account holders can contribute up to $19,500 in 2021 , and $26,000 for those 50 and older.

This tax advantage, however, changes once an account holder starts receiving distributions from the 401. As you pull money out, youll owe income taxes on the funds. Some 401 plans will automatically withhold 20% or so of your account to pay for taxes. Youll want to check with your plan provider to see how your particular 401 works.

Wondering when you can start cashing out? Once you reach age 59.5 you can withdraw money from your 401. If you dont need the money yet, you can wait until you reach age 72 to withdraw funds. However, once you reach 72, its no longer a choice to withdraw from your 401, its mandatory. The IRS has defined required minimum distributions for certain retirement accounts, including 401s.

Rollover To A Traditional Ira

If you are simply withdrawing funds from a 401 and transferring them to another retirement account, you can opt for a direct rollover. A direct rollover moves retirement money directly from one retirement account to another, and it does not have a tax implication. You can also choose an indirect rollover, where the plan sponsor sends you a check with your 401 balance. You must then deposit the funds to a 401 or IRA within 60 days, failure to which the amount will be considered a distribution for tax purposes.

Why Are There So Many Vanguard Mutual Funds Available As Investments In The New Plan

Vanguard is well known for their low cost funds. Morningstar did a study called Fees Matter. They found that expenses are a much better predictor of future returns than past performance. As an investor, there are three elements that you can control in the 401 plan: the amount of risk you can afford to take, the amount you save, and the fees of the funds you select. The passively managed S& P 500 Index has outperformed 80% of actively managed funds over a 20-year period primarily because of the low fees charged. For example, the SSgA S& P 500 Index fund in the typical Slavic401k plan costs only 0.05% to own. The Trustee of the plan elected to include many low cost funds as options for you to invest in.

You May Like: Who Has The Best 401k Match

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

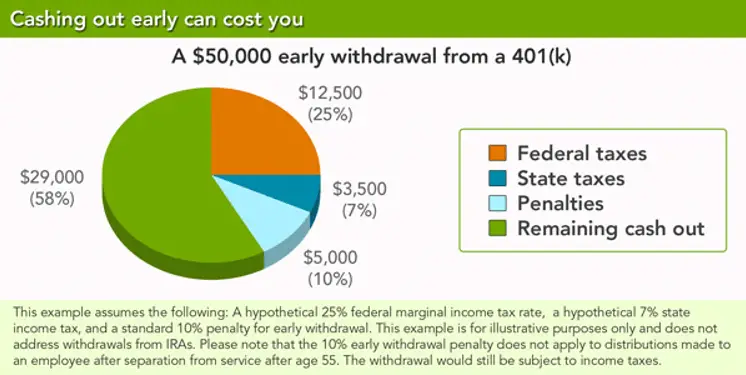

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

- Taking a coronavirus-related withdrawal: There are special rules in place in 2020 allowing a penalty-free withdrawal of up to $100,000 if you’re experiencing hardships related to the coronavirus.

Circumstances When You Can Withdraw From A 401k If You Have An Outstanding Loan

Each 401 plan has different rules on 401 loans and 401 withdrawals. If your employerâs 401 plan allows employees to tap into their retirement money, you may be required to provide some proof to document that you are in an urgent financial need to get approved. The approval process is rigorous since allowing frivolous withdrawals puts the 401 plan at risk of losing its tax-favored status.

Some of the circumstances when you could withdraw money from your 401 plan if you have an unpaid loan include:

Roll Over 401 If You Have an Outstanding Loan

If you terminate employment with an outstanding 401 loan, you can rollover the money to an IRA or new employerâs 401. As long as the loan repayment was in good standing, the employer will rollover your retirement money net of the outstanding 401 loan. You will have until the tax due date to pay off the 401 loan balance.

For example, assume that you have a $50,000 vested 401 balance, including an outstanding 401 loan of $15,000. If you quit your job and request the plan sponsor to rollover the retirement savings to your new IRA, the plan sponsor will reduce the vested 401 balance by the $15,000 outstanding loan, and disburse the remaining $35,000 to your IRA. You will then have until the tax due date to come up with the $15,000 outstanding loan, after which you can rollover the $15,000 401 balance to your IRA.

Cash out 401 with an Outstanding Loan

Take a Second loan with an Outstanding Balance

Tags

Don’t Miss: Can I Move Money From 401k To Roth Ira

Why Does Slavic401k Reimburse All Revenue Paid By The Funds

Also Check: How To Open A Solo 401k

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived.

Read Also: When You Leave A Job Do You Get Your 401k

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early-withdrawal penalties if you are under 59 1/2 .

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

Also Check: How To Find 401k From Former Employer

What Is The Rule Of 55

Your 401 account is likely one of the most valuable assets you have, so it’s essential to know when and how you can access it. These accounts are intended to fund your retirement, and as such you can access them penalty-free when you reach age 59½. In most cases, taking money out of your 401 before then will cost you a pretty penny: Early withdrawals come with a 10% penalty.

There are a few exceptions, however, and one of them could help you if you want or need to retire early. The Rule of 55 is an IRS provision that allows you to withdraw funds from your 401 or 403 without a penalty at age 55 or older. Read on to find out how it works.

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

Read Also: Can I Transfer My Ira To My 401k

Alternatives To Rule Of 55 Withdrawals

The rule of 55, which doesnt apply to traditional or Roth IRAs, isnt the only way to get money from your retirement plan early. For example, you wont pay the penalty if you take distributions early because:

- You become totally and permanently disabled.

- You pass away and your beneficiary or estate is withdrawing money from the plan.

- Youre taking distributions to pay deductible medical expenses that exceed 7.5% of your adjusted gross income.

- Distributions are the result of an IRS levy.

- Youre receiving qualified reservist distributions.

You can also avoid the 10% early withdrawal penalty if early distributions are made as part of a series of substantially equal periodic payments, known as a SEPP plan. You have to be separated from service to qualify for this exception if youre taking money from an employers plan, but youre not subject to the 55 or older requirement. The payment amounts youd receive come from your life expectancy.

What You Should Do Instead To Pay Off Your Credit Card Debt

In hindsight, Nitzsche says he would have handled his credit card debt differently, such as reaching out to the specific issuers to inquire about a financial hardship plan or participating in a debt management plan through a credit counselor.

He also recommends using balance transfer credit cards, which allow qualifying cardholders to move their credit card balances from one card to the next.

If you have credit card debt, this could be a good option as long as you have a plan to pay off the transferred balance within the card’s introductory no-interest period , otherwise you accrue more interest on top of that debt.

The Citi Simplicity® Card that offers 0% APR for the first 12 months on new purchases and 21 months for balance transfers . To qualify for these longer interest-free periods, you will most likely need to have good or excellent credit, but there are options available for fair credit as well.

The Aspire Platinum Mastercard® is one where applicants with fair or good credit may qualify, but the balance transfer period is shorter at only six months. After the intro period, there’s a relatively low variable APR of 9.65% to 18.00%.

Note that depending on your credit, you may not get approved for a credit limit high enough to cover the full balance of your debt. And while there are some balance transfer cards with no fee, most usually require a 2% to 5% fee .

Also Check: How Much Will My 401k Grow If I Stop Contributing

Rules About 401 Required Minimum Distributions

Again, the minimum age for RMDs was changed in recent years. Before, you had to start taking them either when you retired or when you turned 70.5. However, this age requirement still holds for anyone who turned 70.5 in 2019 or earlier. Anyone who has yet to turn 70.5 can wait until April 1 of the year after theyre 72 to start taking RMDs.

The year in which April 1 is your RMD deadline is your starting year. After the starting year, the deadline shifts to December 31. So your second year and thereafter, you must take your RMD by December 31.

If you wait until April 1 of your starting year to take your RMD, you will have to take two years worth of RMDs the same year. You should avoid this, as it will increase your income for that year, likely putting you in a higher tax bracket. If you fail to take any RMD or you dont take a large enough RMD as required by the IRS, you may have to pay a 50% penalty on the money you should have withdrawn.

Are You Still Working

You can access funds from an old 401 plan after you reach age 59 1/2 if you’re still working, but you may not have the same access to the funds at the company for which you currently work if you’ve changed jobs.

Check with your 401 plan administrator to find out whether your plan allows what’s referred to as an in-service distribution at age 59 1/2. Some 401 plans allow this, but others don’t.

Read Also: How Do I Withdraw Money From My 401k

How To Avoid The Early Withdrawal Penalty

There are a few exceptions to the age 59½ minimum. The IRS offers penalty-free withdrawals under special circumstances related to death, disability, medical expenses, child support, spousal support and military active duty, says Bryan Stiger, CFP, a financial advisor at Betterments 401.

If you dont meet any of those qualifications, you arent entirely out of luck, though. Youve got a couple of options that may let you make penalty-free withdrawals, if youre slightly younger than retirement age or plan your withdrawals methodically.

If youre between age 55 and 59 ½ and you lose your job, the IRS will allow you to withdraw from your 401 plan penalty-free. This is called the Rule of 55, and it applies to everyone within this age group who loses a job, no matter whether youre fired, laid off or voluntarily quit. Stiger says. To qualify for the Rule of 55, the 401 you hope to take withdrawals from must be at the company youve just parted ways with. Note that the Rule of 55 does not apply to IRAs.

There is also the Substantially Equal Periodic Payment exemption, or an IRS Section 72 distribution, say Stiger. With SEPP you can take substantially equal payments from your 401 based on life expectancy. Unlike the Rule of 55, you may use SEPPs to tap an IRA early.

How Do You Withdraw Money From A 401 After Retirement

To withdraw money from your 401 after retirement, you’ll need to contact your plan administrator. Depending on your company’s rules, you may be able to take your distributions as an annuity, periodic or non-periodic withdrawals, or in a lump sum. Your plan administrator will let you know which options are available to you. You can typically have funds deposited into an account or have your plan send you a check.

Recommended Reading: What Are Terms Of Withdrawal 401k

Other Options For Getting 401 Money

If you’re at least 59½, you’re permitted to withdraw funds from your 401 without penalty, whether you’re suffering from hardship or not. And account-holders of any age may, if their employer permits it, have the ability to loan money from a 401.

Most advisors do not recommend borrowing from your 401 either, in large part because such loans also threaten the nest egg you’ve accumulated for your retirement. But a loan might be worth considering in lieu of a withdrawal if you believe there’s a chance you’ll be able to repay the loan in a timely way s, that means within five years).

Loans are generally permitted for the lesser of half your 401 balance or $50,000 and must be repaid with interest, although both the principal and interest payments are made to your own retirement account. It is also worth noting that the CARES Act raises the borrowing limit from $50,000 to $100,000. If you should default on the payments, the loan converts to a withdrawal, with most of the same consequences as if it had originated as one.

401 loans must be repaid with interest in order to avoid penalties.

About two-thirds of 401s also permit non-hardship in-service withdrawals. This option, however, does not immediately provide funds for a pressing need. Rather, the withdrawal is allowed in order to transfer funds to another investment option.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Recommended Reading: How To Find Old Employer 401k