Understanding Early Withdrawal From A 401

The method and process of withdrawing money from your 401 will depend on your employer and the type of withdrawal you choose. Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It’s really a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available. If it is, then you should check the fine print of your plan to determine the type of withdrawals that are allowed or available.

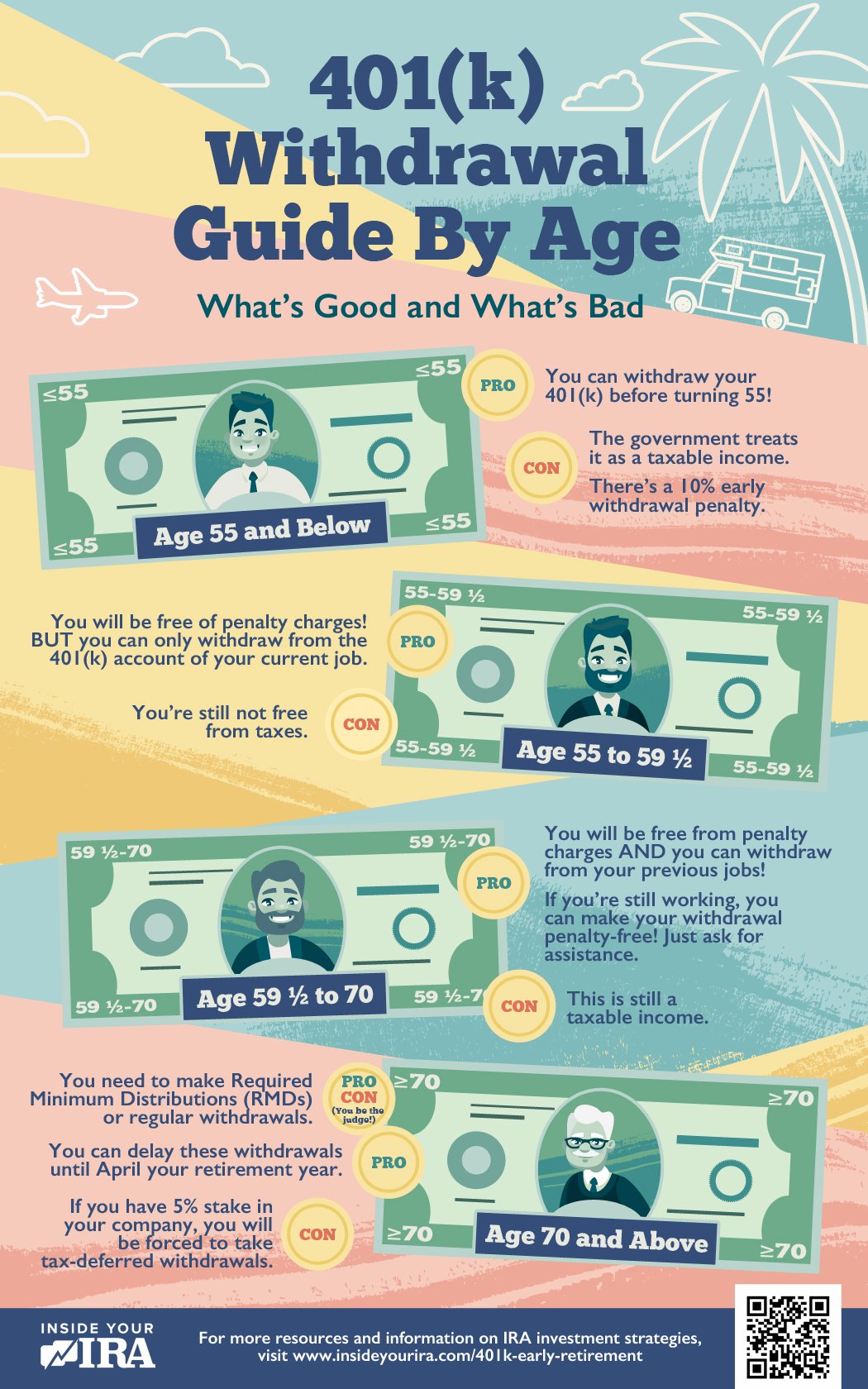

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay normal income taxes on the withdrawn funds. For a $10,000 withdrawal, once all taxes and penalties are paid, you will only receive approximately $6,300. There are some non-penalty options to consider, however.

Before deciding upon taking an early withdrawal from your 401, find out if your plan allows you to take a loan against it, as this allows you to eventually replace the funds. You may also want to consider alternative options for securing financing that could hurt you less in the long run, such as a small personal loan.

K Withdrawal Rules: How To Avoid Penalties

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

How Do You Withdraw Money From A 401 After Retirement

To withdraw money from your 401 after retirement, you’ll need to contact your plan administrator. Depending on your company’s rules, you may be able to take your distributions as an annuity, periodic or non-periodic withdrawals, or in a lump sum. Your plan administrator will let you know which options are available to you. You can typically have funds deposited into an account or have your plan send you a check.

Recommended Reading: What Is The Difference Between 401k And 403b

What Is The Tax On 401 Withdrawls After 65

Putting money aside in a 401 during your working years is one of the most effective ways to accumulate wealth for your retirement years. But accumulating that money is only half of the battle. The other half is devising a strategy that allows you to meet your daily living expenses while minimizing your taxes. Understanding how 401 withdrawals impact your taxes makes devising such a strategy a lot easier.

How To Avoid The Early Withdrawal Penalty

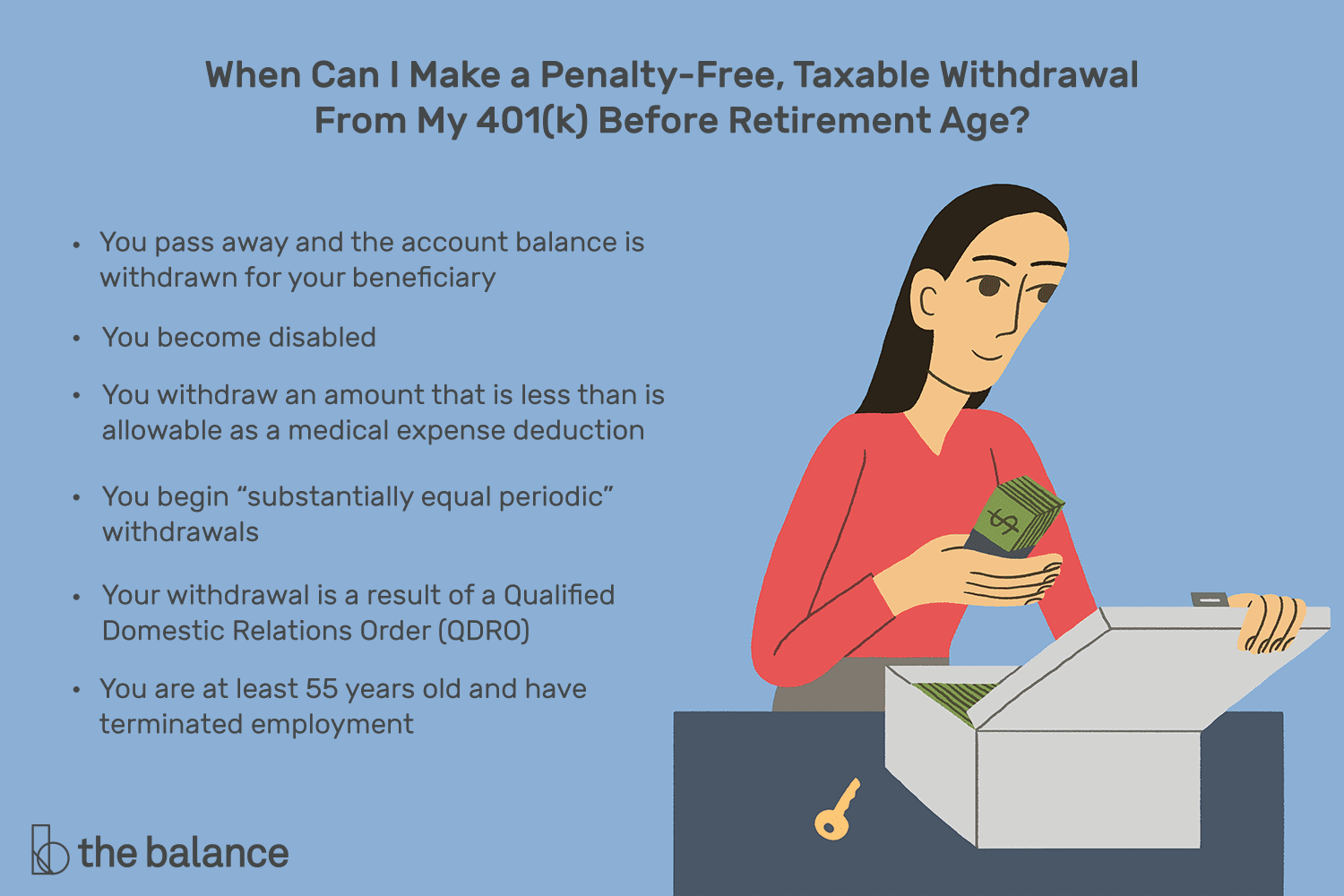

There are a few exceptions to the age 59½ minimum. The IRS offers penalty-free withdrawals under special circumstances related to death, disability, medical expenses, child support, spousal support and military active duty, says Bryan Stiger, CFP, a financial advisor at Betterments 401.

If you dont meet any of those qualifications, you arent entirely out of luck, though. Youve got a couple of options that may let you make penalty-free withdrawals, if youre slightly younger than retirement age or plan your withdrawals methodically.

If youre between age 55 and 59 ½ and you lose your job, the IRS will allow you to withdraw from your 401 plan penalty-free. This is called the Rule of 55, and it applies to everyone within this age group who loses a job, no matter whether youre fired, laid off or voluntarily quit. Stiger says. To qualify for the Rule of 55, the 401 you hope to take withdrawals from must be at the company youve just parted ways with. Note that the Rule of 55 does not apply to IRAs.

There is also the Substantially Equal Periodic Payment exemption, or an IRS Section 72 distribution, say Stiger. With SEPP you can take substantially equal payments from your 401 based on life expectancy. Unlike the Rule of 55, you may use SEPPs to tap an IRA early.

You May Like: What Is The Best Fund To Invest In 401k

Caveats To The 4% Rule

Several variables can make this rule of thumb either too conservative or too risky, and you might not be able to live on 4%-ish a year unless your account has a significantly large balance.

The first caveat you should consider when thinking about applying the 4% rule to your personal situation is that it calls for putting 50% each in stocks and bonds. You may not be comfortable putting that much of your retirement assets in equities, and you may want to keep at least a portion of your nest egg in cash or a money market fund.

You also might not expect to live for 30 years after retirement, either because you retired later than most people do or for some health-related reason. And you may not feel you need the almost 100% confidence level Bengen was seeking in his rule a confidence level of 75% to 90% that you won’t run out of money might be acceptable to you and may afford a more flexible withdrawal rate.

Finding A Good Withdrawal Rate

One widely used rule of thumb on withdrawal rates for tax-deferred retirement accounts states that withdrawing slightly more than 4% annually from a balanced portfolio of large-cap equities and bonds would provide inflation-adjusted income for at least 30 years.

However, some experts contend that a higher withdrawal rate may be possible in the early, active retirement years if later withdrawals grow more slowly than inflation. Others contend that portfolios can last longer by adding asset classes and freezing the withdrawal amount during years of poor performance. By doing so, they argue, “safe” initial withdrawal rates above 5% might be possible.

Don’t forget that these hypotheses were based on historical data about various types of investments, and past results don’t guarantee future performance. There is no standard rule of thumb that works for everyoneâ your particular withdrawal rate needs to take into account many factors, including, but not limited to, your asset allocation and projected rate of return, annual income targets , and investment horizon.

Also Check: Should I Keep My 401k Or Rollover To Ira

Rules About 401 Required Minimum Distributions

Again, the minimum age for RMDs was changed in recent years. Before, you had to start taking them either when you retired or when you turned 70.5. However, this age requirement still holds for anyone who turned 70.5 in 2019 or earlier. Anyone who has yet to turn 70.5 can wait until April 1 of the year after theyre 72 to start taking RMDs.

The year in which April 1 is your RMD deadline is your starting year. After the starting year, the deadline shifts to December 31. So your second year and thereafter, you must take your RMD by December 31.

If you wait until April 1 of your starting year to take your RMD, you will have to take two years worth of RMDs the same year. You should avoid this, as it will increase your income for that year, likely putting you in a higher tax bracket. If you fail to take any RMD or you dont take a large enough RMD as required by the IRS, you may have to pay a 50% penalty on the money you should have withdrawn.

Early Withdrawal Age Rules Only Apply To The Assets In The 401 Plan Maintained By Your Former Employer

Assets in an IRA have their own rules regarding a penalty-free early withdrawal. In a similar vein, assets that youve rolled over from your 401 to an IRA will generally no longer be eligible for penalty-free early withdrawals unless you qualify for a different exemption . If theres a possibility you may need to tap into the savings in your 401, you may want to hold off on rolling those assets over to an IRA until you turn 59 ½.

You May Like: How Much In 401k To Retire

Remember Required Minimum Distributions

While you don’t need to start taking distributions from your 401 the minute you stop working, you must begin taking required minimum distributions by April 1 following the year you turn 72. Some employer-sponsored plans may allow you to defer distributions until April 1 of the year after you retire, if you retire after age 72, but it is not common. Keep in mind that this exception does not apply to plans you may have with previous employers that you no longer work for.

If you wait until you are required to take your RMDs, you must begin withdrawing regular, periodic distributions calculated based on your life expectancy and account balance. While you may withdraw more in any given year, you cannot withdraw less than your RMD.

The age for RMDs used to be 70½, but following the passage of the Setting Every Community Up For Retirement Enhancement Act in Dec. 2019, it was raised to 72.

Ways To Withdraw Your 401

There are several ways to go about withdrawing your money in retirement.

- Rollover your funds: Instead of keeping your money in a 401, you can roll it over into a new account to keep it growing in retirement with more investment options.

- Take regular distributions: You can contact the financial institution managing your 401 and set up periodic payments to give you a fixed stream of income, much like a paycheck. You can also opt to take the distribution as you need them, as long as you take out the minimum required amount.

- Purchase an annuity: You can also purchase an annuity to ensure a fixed stream of payments.

- Take a lump sum: This is often not recommended by financial experts, but you have the ability to take out the money all at once.

Which option you pick will depend on your financial situation and goals in retirement. A financial planner can help you develop a plan that fits your needs.

Don’t Miss: Should I Do Roth Or Traditional 401k

The Rules For Accessing Your Money Are Determined By Your Employer’s Plan

Whether you can take regular withdrawals from your 401 plan when you retire depends on the rules for your employers plan. Two-thirds of large 401 plans allow retired participants to withdraw money in regularly scheduled installments — say, monthly or quarterly. About the same percentage of large plans allow retirees to take partial withdrawals whenever they want, according to the Plan Sponsor Council of America , a trade association for employer-sponsored retirement plans.

Other plans offer just two options: Leave the money in the plan without regular withdrawals, or take the entire amount in a lump sum. ‘s summary plan description, which lays out the rules, or call your company’s human resources office.) If those are your only choices, your best course is to roll your 401 into an IRA. That way, you won’t have to pay taxes on the money until you start taking withdrawals, and you can take money out whenever you need it or set up a regular schedule.

If your company’s 401 allows periodic withdrawals, ask about transaction fees, particularly if you plan to withdraw money frequently. About one-third of all 401 plans charge retired participants a transaction fee, averaging $52 per withdrawal, according to the PSCA.

Pay Attention To Required Minimum Distributions

- The amount that you must take out each year depends on your age, life expectancy and year-end account balance. You may take out more than the minimum.

- If you have multiple retirement accounts, you must calculate RMDs separately, but you can withdraw the total amount from one or many accounts.

- Roth IRAs and most non-qualified employee-sponsored plans do not require RMDs.

- You cant rollover RMDs into another type of tax-advantaged account.

- If you are still working at 72, you can continue contributing to your traditional 401 or 403 or Roth 401 or 403. You don’t need to take an RMD until you separate from service. However, you will be required to take RMDs from any IRA you may own even if you are still working at 72.

Don’t Miss: How To Borrow Money From 401k Fidelity

Taking 401 Distributions In Retirement

The 401 withdrawal rules require you to begin depleting your 401 savings when you reach age 72.

At this point, you must take a required minimum distribution each year until your account is depleted. If you are still working for the employer beyond age 72, you may be able to delay required minimum distribution until you stop working if your plan allows this delay. The delay option is not available to you if you own 5% or more of the business.

You have until April 1 of the year after you turn 72 to take your first required minimum distribution. After that, you must take a minimum amount by December 31 each year. Your 401 plan administrator will tell you how much you are required to take each year.

The amount is based on your life expectancy and your account balance. If you dont take your required minimum distribution each year, you will have to pay a tax of 50% of the amount that should have been taken but was not. If you participate in more than one employer plan, you must take a required minimum distribution from each plan.

When Can I Withdraw From My Rrsp

You can make a withdrawal from your RRSP any time1 as long as your funds are not in a locked-in plan. The withdrawal, however, is subject to withholding tax and the amount also needs to be included as income when filing your taxes.

There are situations in which tax-deferred withdrawals can be made from your RRSP. For instance: If the funds are used for the purchase of a home for the first time through the Home Buyers’ Plan or for funding education through the Lifelong Learning Plan. For each scenario, no withholding tax is paid, and the withdrawal will not be considered income .

Recommended Reading: How To Cash Out Nationwide 401k

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is permanent. While you won’t have to pay the money back, you will have to pay the taxes right away and possibly a penalty. Additionally, by pulling out money early, you’ll miss out on the long-term growth that a larger sum of money in your 401 would have yielded. A loan has to be paid back, but on the upside, if it is paid back in a timely manner, you at least won’t lose out on long-term growth.

Can The Penalty For Not Taking The Full Rmd Be Waived

Yes, the penalty may be waived if the account owner establishes that the shortfall in distributions was due to reasonable error and that reasonable steps are being taken to remedy the shortfall. In order to qualify for this relief, you must file Form 5329 PDF and attach a letter of explanation. See the instructions to Form 5329 PDF.

You May Like: Should I Rollover 401k To New Employer

How To Withdraw Money From A 401k After Retirement

Finance Writer

During your working years, you’ve probably set aside funds in retirement accounts such as IRAs, 401s, or other workplace savings plans. Your challenge during retirement is to convert those accounts into an income stream that can continue to provide adequately throughout your retirement years.

If youâre approaching the age that you want to hang your hat from working, you may be wondering how to withdraw money from your 401 after retirement. It isnât always exactly straightforward, which is why weâve broken down some of the basics of using your 401. Hereâs what you need to know.

A 401 Is One Source Of Retirement Income

Remember that a 401 on its own is not a retirement income plan. While itâs certainly a smart way to save for your future and plays an integral part in building your nest egg, a 401 is just one source of income in retirement.

A plan to create income in retirement will certainly take your 401 into consideration. But it should also include income withdrawals from other accounts like IRAs, Roth IRAs, investments, cash value built up within a whole life insurance policy and cash reserves. Your retirement plan will also include income from Social Security, and may include income from annuities and pensions. By having multiple streams of income, you can more efficiently generate retirement income by strategically leaning on different sources at different times. This approach can help you minimize taxes while balancing the need to grow your investments and generate reliable income that will last through your retirement.

Recommended Reading: Can You Convert A Roth 401k To A Roth Ira

When To Begin Taking Rmds

You are generally allowed to take penalty-free distributions starting at age 59½. However, by April 1 of the year after you reach age 72, you are required to begin taking RMDs from your IRAs.

Depending upon the terms of your 401 or other employer plan, you may be able to delay taking RMDs until April 1 of the year following the later of the year you attain age 72 or the year you retire, provided you are not a 5% or greater owner of the business. Check with your plan administrator for details.

For subsequent years, you must withdraw your RMD amount from your plans by Dec. 31 of each year. This includes the year after you turn age 72, even if you take your first withdrawal that year. NOTE: If you were born on June 30, 1949 or earlier, you were required to begin taking RMDs by April 1 following the year you reached age 70½.

For example, if you turn 72 in October 2021, your first RMD must be taken by April 1, 2022 and your second RMD must be taken by Dec. 31, 2022. Most IRA owners will take their first RMD in the year they turn 72 rather than delaying until April 1 of the next year to avoid having two taxable distributions in one year.

What you do with RMDs is generally up to you you may be able to take distributions in cash or in kind which you can then move to a non-qualified brokerage account. The amount of each year’s RMD depends on your age and the account balance at the end of the previous year.