Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

If Youre Thinking Of Quitting Your Job

Timing is important here. If your company offers matching contributions, dont walk away and leave that money on the table. Check your plans vesting schedule to see whether working longer will let you vest more in your employer contributions. Also, find out when matching contributions are deposited into your account. Some companies make the deposit every pay period some only once a year. If you leave before that years contribution is made, youll lose it. *

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Don’t Miss: Do Employers Match Roth 401k

How The Rollover Is Done Is Important Too

Whether you pick an IRA for your rollover or choose to go with your new employer’s plan, consider a direct rolloverthats when one financial institution sends a check directly to the other financial institution. The check would be made out to the bank or brokerage firm with instructions to roll the money into your IRA or 401.

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your employer is required by the IRS to withhold 20% for taxes. As if that wouldn’t be bad enoughyou only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401 or IRA. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, you’d have to come up with the 20% that was withheld and put it into your new account.

If you’re not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money but you may also owe a 10% penalty if you’re under age 59½ because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401.

Look For Contact Information

If you don’t know how to contact your former employer perhaps the company no longer exists or it was acquired or merged with another company see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you don’t have an old 401 statement handy or yours doesn’t tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement account’s tax return, known as Form 5500. That will most likely have contact information for your 401’s plan administrator.

Read Also: How To Make More Money With My 401k

What Are Your Options For Old Retirement Plans

You generally have four options for dealing with money thats in an employer-sponsored retirement account when youre no longer working at the company:

- Leave the money where it is: Although you might not be able to contribute to the account any longer, you may be able to leave the money in your former employers plan. Sometimes, you may need to meet a minimum account balance to qualify, such as $200 for a TSP or $5,000 for some 401s.

- Transfer funds to a new employer-sponsored plan: If you have a new job with a company that sponsors a retirement plan, you may be able to roll over the money into your new employers plan. When this is an option, compare the previous and new plans fees, terms, and investment options to see which is best.

- Roll over to an individual retirement account: You can also move the money into an individual retirement account . An IRA may give you more control as you can choose where to open the account and invest in a wider range of funds. Its also fairly easy to move from one IRA to another as the account isnt tied to your employer. However, IRAs could have more fees, especially if you dont have a lot of assets and dont qualify for lower-cost investment funds.

- Cash out: You can also take the money out of retirement accounts completely. But unless youre 59½ or older , you may need to pay a 10 percent early withdrawal penalty in addition to income taxes on the money.

Contact Your Old Employer

Your first step should be to contact your former employer. The human resources department should have a record of your account. If your account was rolled over to an IRA for your benefit, your former employer should be able to give you information about the institution holding the IRA funds. If your account is still in the companys retirement plan, your former employer can provide you with distribution forms to receive your money.

Don’t Miss: What Are Terms Of Withdrawal 401k

Our Take: Start Planning Now

If you have an old 401k plan or are about to leave a job where you contributed to a 401k, give some thought now to how you will handle the money in your account. A rollover IRA is the best option for most people, but a financial advisor can help you determine whats right for your specific situation.

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Any reference to the advisory services refers to Personal Capital Advisors Corporation, a subsidiary of Personal Capital. Personal Capital Advisors Corporation is an investment adviser registered with the Securities and Exchange Commission . Registration does not imply a certain level of skill or training nor does it imply endorsement by the SEC.

Move Your Old 401 Assets Into A New Employers Plan

You have the option to avoid paying taxes by completing a direct, or “trustee-to-trustee,” transfer from your old plan to your new employer’s plan, if the employer’s plan allows it.

It can be easy to pay less attention to your old retirement accounts, since you can no longer contribute. So, transferring old 401 assets to your new plan could make it easier to track your retirement savings.

You also have borrowing power if your new retirement plan lets participants borrow from their plan assets. The interest rate is often low. You may even repay the interest to yourself. If you roll your old plan into your new plan, youll have a bigger base of assets against which to borrow. One common borrowing limit is 50% of your vested balance, up to $50,000. Each plan sets its own rules.

Here are a few important steps to take to successfully move assets to your new employers retirement plan so as not to trigger a tax penalty:

Step 1: Find out whether your new employer has a defined contribution plan, such as a 401 or 403, that allows rollovers from other plans. Evaluate the new plan’s investment options to see whether they fit your investment style. If your new employer doesn’t have a retirement plan, or if the portfolio options aren’t appealing, consider staying in your old employer’s plan. You could also set up a new rollover IRA at a credit union, bank, or brokerage firm of your choice.

The instructions you get should ask for this type of information:

Read Also: Can You Have Your Own 401k

First Off Dont Lose Track Of It Youd Be Surprised How Many People Forget About Their Old 401s

Recently, a Capitalize Research study revealed that Americans have left behind over $1 trillion untouched in their old 401s. This implies that millions of employees are struggling to manage their retirement savings as they move from job to job, leading to the accumulation of money in these abandoned accounts.

The 401, a tax-advantaged savings plan, has helped revolutionize the American workforce since its enactment in 1978. However, millions of dollars are left unclaimed as people change jobs, relocate and subsequently forget about their old 401s. When you lose track of a 401 at an old employer, your savings in that account stagnate, leaving an opportunity toward building a secure financial future squandered.

Even if you are contributing to a new plan with your current employer, leaving money behind in an old 401 account and forgetting about it harms your overall financial well-being, prevents you from building a cohesive financial plan and does not allow all your money to work for you and your goals in the best possible way.

Call Your Old Employer

If you suspect you have missing 401 funds or even if you’re not sure, it’s still a good idea to contact old employers and ask them to check if they’re holding your old account. Your former company will have records of you actually participating in a 401 plan.

You’ll either need to provide or confirm your Social Security number and the dates of your employment, but if you can, you’ll have found the fastest way to dig up a missing 401.

Also Check: Can You Use Your 401k To Buy Real Estate

How To Track Down That Lost 401 Or Pension

Tweet This

Can’t Find your old 401 or that old pension? Here is how to track your money down. Shutterstock

At least once every few months a long-term client brings in a retirement account statement and says, I forgot I had this retirement account. Can you help me with it? Sometimes these accounts are tiny but other times they hold a substantial amount of money. All of them are old, and havent been looked at in years. If you find yourself in this position, follow these steps to locating your 401 or other retirement accounts from previous employers.

Do you ever feel like you know you saved more for retirement than your statements indicate? Are you certain you must have forgotten about an old retirement account or pension with a previous employer? You likely arent crazy, and youre definitely not alone.

Americans lost track of more than $7.7 billion worth of retirement savings in 2015 alone by accidentally and unknowingly abandoning their 401.– USA Today, February 25, 2018

The days of graduating college, getting a corporate job and staying with the same employer until the retirement age of 65 are long gone. Today, people are jumping from job to job which often leaves a trail of old retirement accounts and even a few pensions. Because of this, a surprising number of people lose track of these old accounts. Forgetting about these accounts can really hurt your overall retirement security when you factor in compounding interest.

What happens when a 401 plan is terminated?

How To Find Previous 401k Accounts

Many employers automatically deduct 401 plan contributions directly from their employee’s paychecks. This makes it easy for an employee to forget about his 401 plan when he changes jobs or moves to another location. If you stop contributing to a 401 plan because you changed employers, the money stays in your account until you cash out the plan or transfer the money to a new 401 plan. Finding all of your old 401 plans will help to give you a clearer idea of how much money you have for your retirement nest egg.

Contact the human resources or benefits manager at all of your previous places of employment. The administrator of the 401 plan will have access to your account information. Give the administrator the required information to find your account, such as your social security number. The administrator will give you your 401 account information and all relevant contact and transfer information.

Check your personal financial files if they are available. Statements from 401 plans and old pay stubs are examples of financial files that will contain information about your old 401 accounts. Use the contact numbers on the statements to inquire about the status of your 401 accounts.

References

Don’t Miss: Can You Roll A 401k Into A Roth

What To Do Next

If your searches uncover an old 401 account in your name, your best bet is to roll the money in that account over to your current retirement savings account, be it another 401 or an IRA. Keeping all your retirement savings in one place helps you to keep track of how your investments are doing and whether or not you’re saving enough to meet your retirement goals.

To claim an old pension, you’ll need to contact the PBGC and prove your identity. After successfully claiming your pension, you’ll be able to start drawing on the benefits once you hit retirement age. If your time with the employer providing the pension was brief, you probably won’t get much — but hey, there’s no point in missing out on free money.

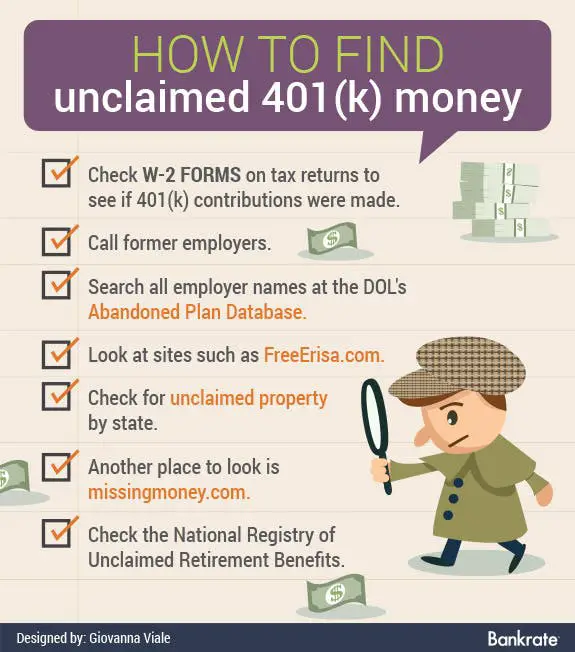

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

Recommended Reading: What Are The Best 401k Funds To Invest In

Us Department Of Labor

Even if your former employer abandoned its retirement plan, your money isnt lost forever. The U.S. Department of Labor maintains records for plans that have been abandoned or are in the process of being terminated. Search their database to find the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Make Sure You Actually Contributed

Before you go through the hassle and process of calling the HR department at your old employer, or searching through databases, its a good idea to verify that you contributed to the plan.

If you are unsure if you contributed to a 401 plan, you can check your previous year tax return and old W-2. Any contribution will be in Box 12 of the W-2.

ERISA, or the Employee Retirement Income Security Act of 1974, sets minimum standards for retirement plans, and protects retirement savings from abuse or mismanagement.

Among other things, employees are required to make annual reports

Recommended Reading: Should I Roll 401k To Ira

Handling A Previous 401k

You usually have a few options when it comes to handling a 401k from a former employer. These include leaving the 401k where it is, rolling it into a taxable or nontaxable Individual Retirement Account or transferring it to a 401k with your current employer and cashing it out. Of all your options, cashing out will cost you the most now and in the future. You will have to pay income taxes on the withdrawal along with a 10 percent early withdrawal penalty. You’ll also lose the tax benefits offered by the 401k as a qualified retirement plan.

How Many Lost 401ks And Other Retirement Accounts Are Forgotten

Think lost and forgotten retirement accounts amount to chump change? Although no one keeps data on how much retirement money gets lost or forgotten, in an interview with Bloomberg, Terry Dunne of Millennium Trust Co., made an educated guess based on government and industry data that more than 900,000 workers lose track of 401k-style, defined-contribution plans each year.

That figure doesnt include pensions. According to the Pension Benefit Guaranty Corporation, an independent agency of the U.S. government tasked with protecting pension benefits in private-sector defined benefit plans, there are more than 38,000 people in the U.S. who havent claimed pension benefits they are owed. Those unclaimed pensions total over $300 million dollars, with one individual being owed almost $1 million dollars!

Could that money belong to you?

Recommended Reading: What Is The Minimum 401k Distribution

The Early Withdrawal Penalty

If you want to withdraw money from your 401 k, you must be aware of the withdrawal penalty. This applies to you if you’re younger than age 59 when you try to withdraw funds from your retirement plan. If you want to withdraw some of your contributions from your 401 k and you’re less than age 59, heavy restrictions could apply. You could expect up to 10% of the funds to be deducted as a penalty.

There are exceptions to this rule, though. One thing to keep in mind is your personal circumstances. For example, if you have to leave your job due to illness, you can generally get access to your 401 k funds without restriction. This also applies to members of the military in many instances. If you’re unwell and have to use your 401 k funds to finance medical treatment, this is usually allowed without your contributions being penalized.