If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Learn: The Best 401k Companies

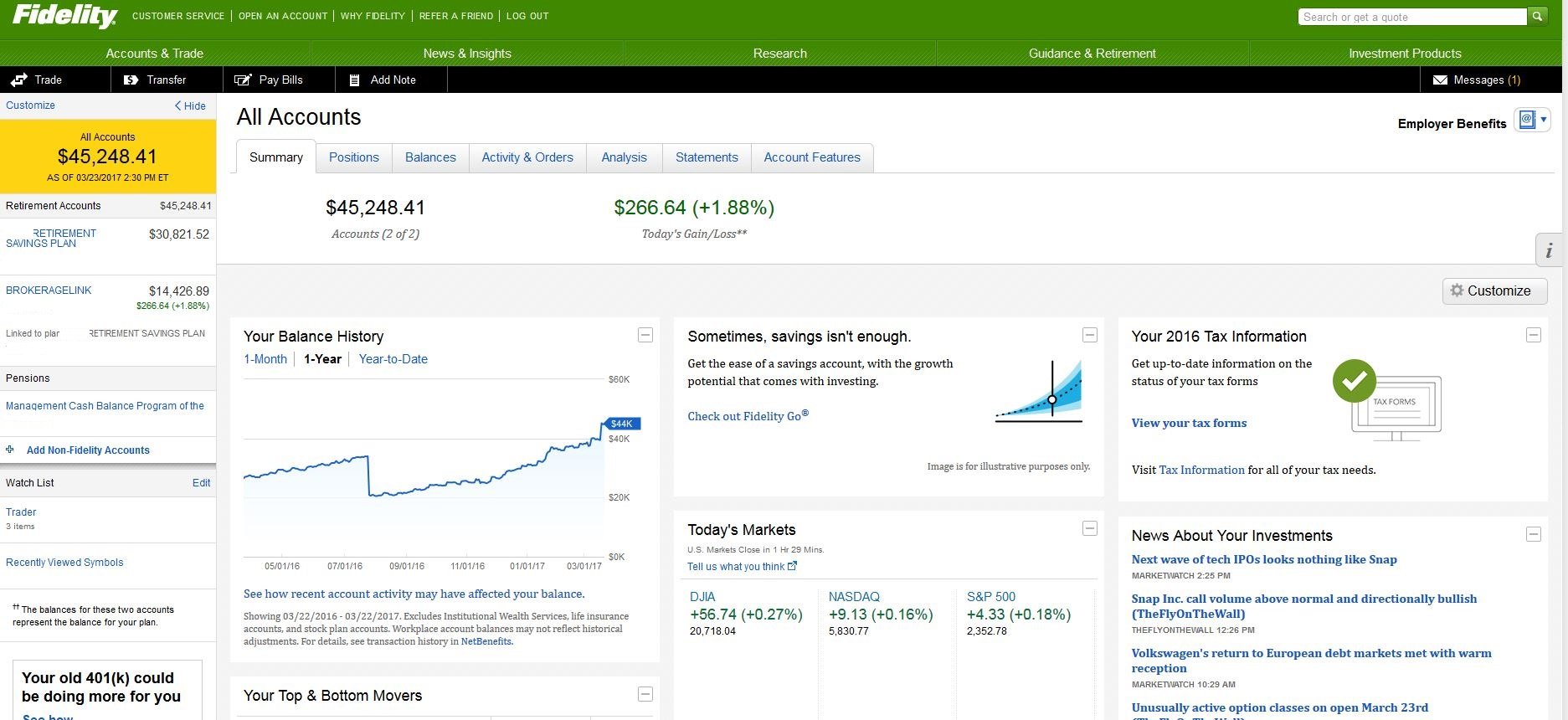

What Different Kinds Of Account Statements Does Fidelity Provide

Statements on single accounts show:

- Account details, including an account summary, income summary, contributions and distributions, realized gain and loss from sales, holdings, and transaction details for the time period covered by the report

- Links to Fidelity’s portfolio analysis and portfolio review tools

- Fidelity contact information

Consolidated statements include a summary section, which treats the accounts included in the report as a portfolio. The summary section displays information on changes in portfolio value, value by account, income summary, and commission level.

In a consolidated statement, the account details section is broken out by account. In some cases, the volume of information about the included accounts can become quite large. To avoid long loading times, the consolidated statement may link to separate pages for each included account’s details.

For viewing convenience, you can hide the information in a section by clicking the gold minus sign to the left of the section’s title. You can always show the information again by clicking the gold plus sign to the left of the section’s title.

Processing Solo 401k Loan Question:

I received the rollover check from John Hancock for my former employer 401k and will go into the local Fidelity Investments office tomorrow to deposit the check into the new brokerage account that you helped me set up for the self-directed solo 401k that you provide. I would like to make sure I understand the process to create a solo 401k participant loan against the balance. I think you all create the paperwork. Whats the method to move the loan amount from the fidelity account into my personal checking account. Do I just use the fidelity transfer functionality, get a check drafted or ?

Also, I will be rolling over an IRA account as well. Am I limited to 1 loan or can I take out a second loan against the additional amount?

Read Also: How To Get My 401k Early

How Do I Print An Account Document

For better quality, we recommend you print account documents in PDF format, which requires Adobe® Reader®.

- To view and print the PDF version of a statement, tax form, trade confirmation, or account record, click the PDF link associated with the document. Then click the Print icon in the browser window’s PDF toolbar, or select Print from the browser’s File menu.

What If I Don’t See My Account Documents Online

If you do not see account documents under your Social Security Number , Tax Identification Number , or Username, it may be that:

- Your SSN is not listed as an owner on the account. Only owners of an account, and persons given authority to view the account by the owner, can view statements, confirmations, and tax documents online.

- You had no reportable information on your account.

- Your document is not yet available online or the document may no longer be available online.

- You chose to view Prospectuses/Reports by a specific account, and you do not own the mutual fund you’re looking for in that account. Try selecting another account, or view all accounts.

- You are trying to view Prospectuses/Reports for mutual funds you do not own. Most prospectuses and financial reports are available online from Investment Products > Mutual Funds.

- You are trying to view interested party statements and your SSN is not listed on your interested party profile.

- You may have an account which is not eligible for online documents.

For account documents not available online, contact a Fidelity representative at 800-544-6666 or for annuity accounts 800-634-9361.

You May Like: How Can I Get Access To My 401k

Can I Add Or Remove Accounts From The Report I’m Viewing

Yes. You can customize the statement you’re currently viewing to include other accounts by clicking the Add or Remove Accounts link near the top of the statement. The accounts must share the same statement start and end date. You must select at least one eligible account to view a statement.

Adding or removing accounts this way changes the set of accounts that appears on your statement for the current viewing only. You can also permanently group the accounts that appear on your statements.

Note: this option is not currently available for your annuity accounts.

What Is A 401 Anyway

Simply put, a 401 is a type of retirement plan offered through your workplace. If your employer offers a 401 plan it makes a lot of sense to participate in it as soon as possible. Here are a few reasons why:

There’s a bit more to it, but that may be all you need to know to get going. If you’re interested in learning more, review the documents provided by your employer. They’ll include more details about your specific plan.

Read Also: How Does A 401k Work When You Change Jobs

My Account Indicates I Need To Activate It What Is This Account

We may need to gather additional information, confirmation and agreement from you before your account is active, or accessible, online. Currently, there are two types of accounts which commonly need to be activated:

- A Rollover IRA established by a former employer to hold non-Roth retirement plan assets

- A Roth IRA established by a former employer to hold Roth source retirement plan assets

Rollover IRA or Roth IRAs

If your Rollover IRA or Roth IRA was established for you by the plan sponsor of your former employer’s retirement savings plan, you must activate your account before you can transact.

Eligible assets rolled over to your Rollover IRA or Roth IRA were deposited in the default Core position of your new Fidelity IRA. Once your IRA is activated, you can invest your assets in mutual funds or other securities. The Fidelity Brokerage Retirement Account Customer Agreement, located in the Agree to Terms section of the online activation process, has more information.

A Rollover IRA is a type of Individual Retirement Account specifically designated to hold assets from employer-sponsored retirement plans like 401s, 403s, or defined benefit pension plans. With a Rollover IRA, your retirement savings remain invested tax-deferred. The rollover of your retirement assets from your former employer’s plan to this Rollover IRA is not a taxable event.

Have An Old Retirement Account You Have Options

Do you have more than one retirement account? If you’re changing jobs or have changed jobs in the past, it’s time to make a choice on what to do with that old account. Several options are available to you:

Don’t Miss: Is Spouse Entitled To 401k In Divorce In Ny

What Are The Different Ways I Can View Account Documents Online

You can view monthly and quarterly account statements, year-end investment reports, interested party statements, trade confirmations, tax forms, and account records as PDFs for better print quality .

- To view a monthly or quarterly account statement, year-end investment report, interested party statement, trade confirmation, tax form or account record, click the PDF link next to the document you want to view.

- To view a tax form in the comma-separated values format, click the CSV link next to the document you want to view. Note: if the size of the CSV file exceeds 64,000 rows, you will need to use a 2010 version of Microsoft Excel to open it.

You should view monthly or quarterly account statements, year-end investment reports, interested party statements, trade confirmations, tax forms, and account records as PDFs for better print quality and to ensure completeness of the information provided. The PDF version of your monthly/quarterly account statement is your regulatory required statement and will contain complete statement details. The HTML version is an online format and may exclude some of the information found in the PDF.

Monthly and quarterly account statements, and prospectuses/reports are also available to view as web pages.

- To view a monthly or quarterly account statement, click the HTML link next to the document you want to view.

- To view a prospectuses or report, click the date link associated with the document you want to view.

If You Are Under 59 1/2

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resort. Not only will you pay tax penalties in many cases, but youre also robbing yourself of the tremendous benefits of compound interest. This is why its so important to maintain an emergency fund to cover any short-term money needs without costing yourself extra by making a 401k early withdrawal.

However, life has a way of throwing you curveballs that might leave you with few to no other options. If you really are in a financial emergency, you can make a withdrawal in essentially the same way as a normal withdrawal. The form is filled out differently, but you can find it on Fidelitys website and request a single check or multiple scheduled payments.

If you jump the gun, though, and start making withdrawals prior to the age of 59 1/2, youve essentially broken your pact with the government to invest that money toward retirement. As such, youll pay tax penalties that can greatly reduce your nest egg before it gets to you. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal, which is on top of the normal income tax assessed on the money. If youre already earning a normal salary, your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty, making it a very pricey withdrawal.

Know: The Best Roth IRA Accounts

Also Check: How To Increase 401k Contribution Fidelity

How Do I Save An Account Document To My Computer

For better print quality, we recommend that you save account documents in PDF format, which requires Adobe® Reader®.

- To view and save the PDF version of a statement, tax form, trade confirmation, or account record, click the PDF link associated with the document. Then click the Save icon in the browser window’s PDF toolbar, or select Save from the browser’s File menu. Choose a location and provide a name for the file with a .PDF extension .

Take Your First Step Confidently

Starting down the path to saving for your retirement may be easier than you think: Begin by enrolling in your 401, 403, or other available workplace savings plan. That’s it. You don’t have to be a financial guru. It won’t take long at all to set up.

Taking that first step to enroll is important for a number of reasons. The earlier you start saving, the more time your money has to grow. That’s called compounding, and it can really help you reach your retirement savings goals. See the illustration on the right.

You’ll also gain a sense of achievement and maybe even some momentum to take the next step, whether it’s getting back on track after an event in your life has slowed your savings, or creating a plan for living out your dreams in retirement.

No matter where you are in life, know that you can take steps toward retirement confidently with the knowledge and tools you’ll find from Fidelity.

Also Check: Can I Move My 401k To An Ira

What Is The Purpose Of The My Notes Feature On The Statements And Trade Confirmation Pages Within Fidelitycom

The “My Notes” feature on your Statement and Trade Confirm pages allows you to associate your own notes regarding your account or confirmation statements. By clicking on “Add” or “Edit” within the My Notes column for the Statement/Trade Confirmation date chosen. You may enter a note of up to 100 characters. Each note is associated to a specific statement or trade confirmation. While these notes are not intended to be communications to Fidelity, they are covered under Fidelity’s Privacy Policy, and you should not include any notes that are confidential, personal or contain sensitive information. All questions or inquiry to Fidelity, should be addressed to Contact Us.

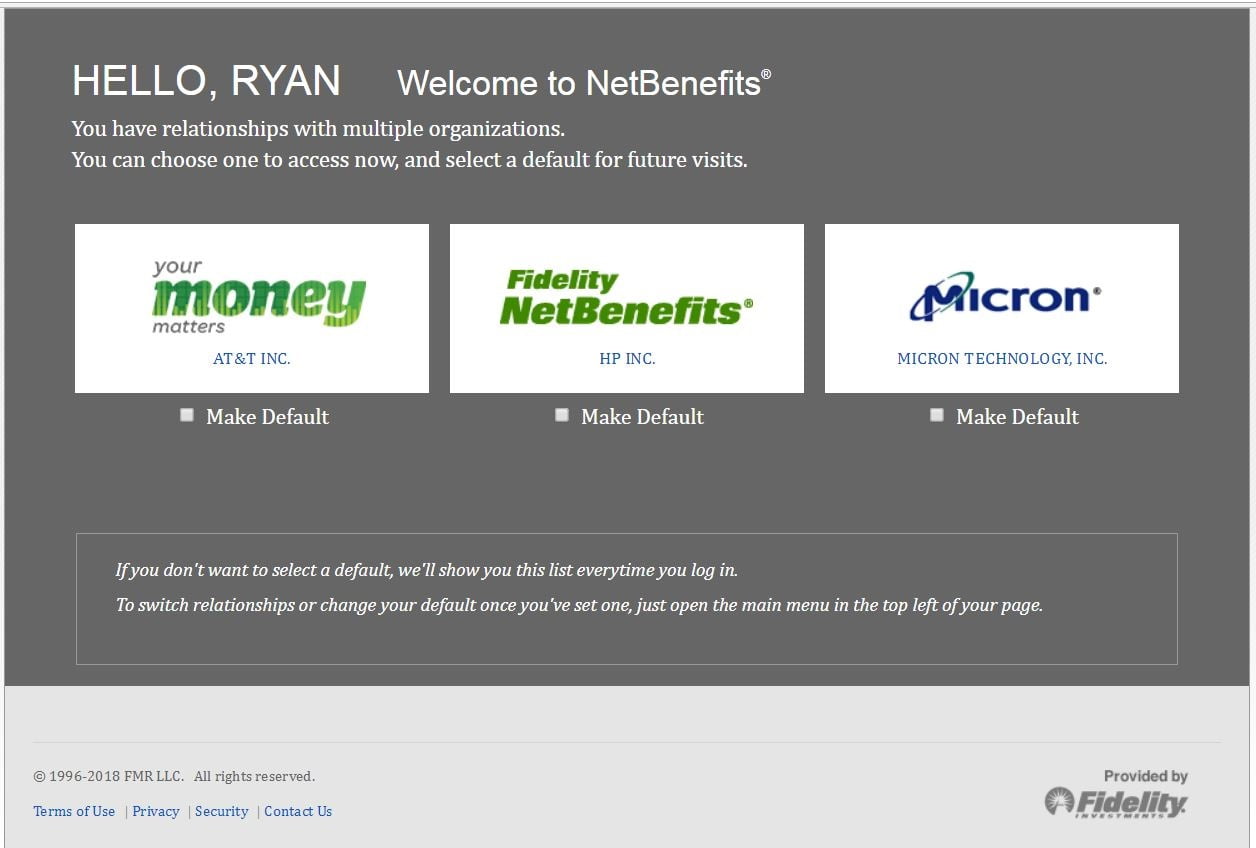

Rollover Existing Fidelity Solo 401k/keogh/psp: Question:

Yes your existing solo 401k with Fidelity Investments would get restated to our solo 401k plan which allows for 401k participant loans and investing in alternative investments such as real estate. We would then fill out new Fidelity brokerage account forms so that Fidelity can open a new brokerage account for the self-directed solo 401k that we offer. Note that Fidelity will not simply re-title the existing account. They require new brokerage forms. Subsequently, we would prepare an internal Fidelity transfer form to have Fidelity internally transfer the existing solo 401k equity holdings and cash to the new brokerage account for the self-directed solo 401k. You will then receive a checkbook in the mail from Fidelity for the new solo 401k for placing your alternative investments, and/or you can process the investments via wire.

Also Check: How Many Loans Can I Take From My 401k

How Do I Consolidate My Statements So I Only Receive One Statement Per Month Or Quarter

If you have multiple accounts and receive multiple statements, individual statements appear separately online. In some cases, Fidelity may automatically consolidate some of your eligible statements. You can also consolidate your eligible statements by completing the Consolidate Accounts into a Household Relationship form. This allows you to specify which accounts you would like to see on one statement. You can find this form under Related Links on the Statements page .

Note: your annuity accounts are not available for consolidation with your other personal investing accounts.

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

Recommended Reading: How Do You Withdraw Money From A 401k