Pros And Cons Of A Roth Conversion

Your current income tax rate, your expected future tax rate, and the anticipated rate of return on your investments all factor in to whether a conversion is a good, or bad, idea for you. These might not be easy determinations to make. Fortunately, there are many calculators available online to assist you.

The most critical issue might be whether you have the money available to pay the taxes that will come due. If you have to use any of the money you took out of your tax-deferred account to pay the taxes, this might be a strong indication that a Roth conversion might not be appropriate right now. Youre just giving the IRS a portion of your retirement savings before you have to.

-

You can take the tax hit for withdrawing from a tax-deferred plan now if you anticipate that your tax rate will be higherand result in more taxes dueif you withdraw the money when you retire.

-

Your investment will grow tax-deferred in the Roth IRA, which can result in some significant savings if you still have some time to go before retirement.

-

Youll take a significant tax hit in the short term if youre in a higher tax bracket now than you expect to be when you retire.

-

Youll defeat the purpose of retirement savings if you use any of the conversion money to pay the tax bill, rather than reinvesting it in a Roth account.

The Difference Between A Roth Ira And Tax Sheltered Accounts

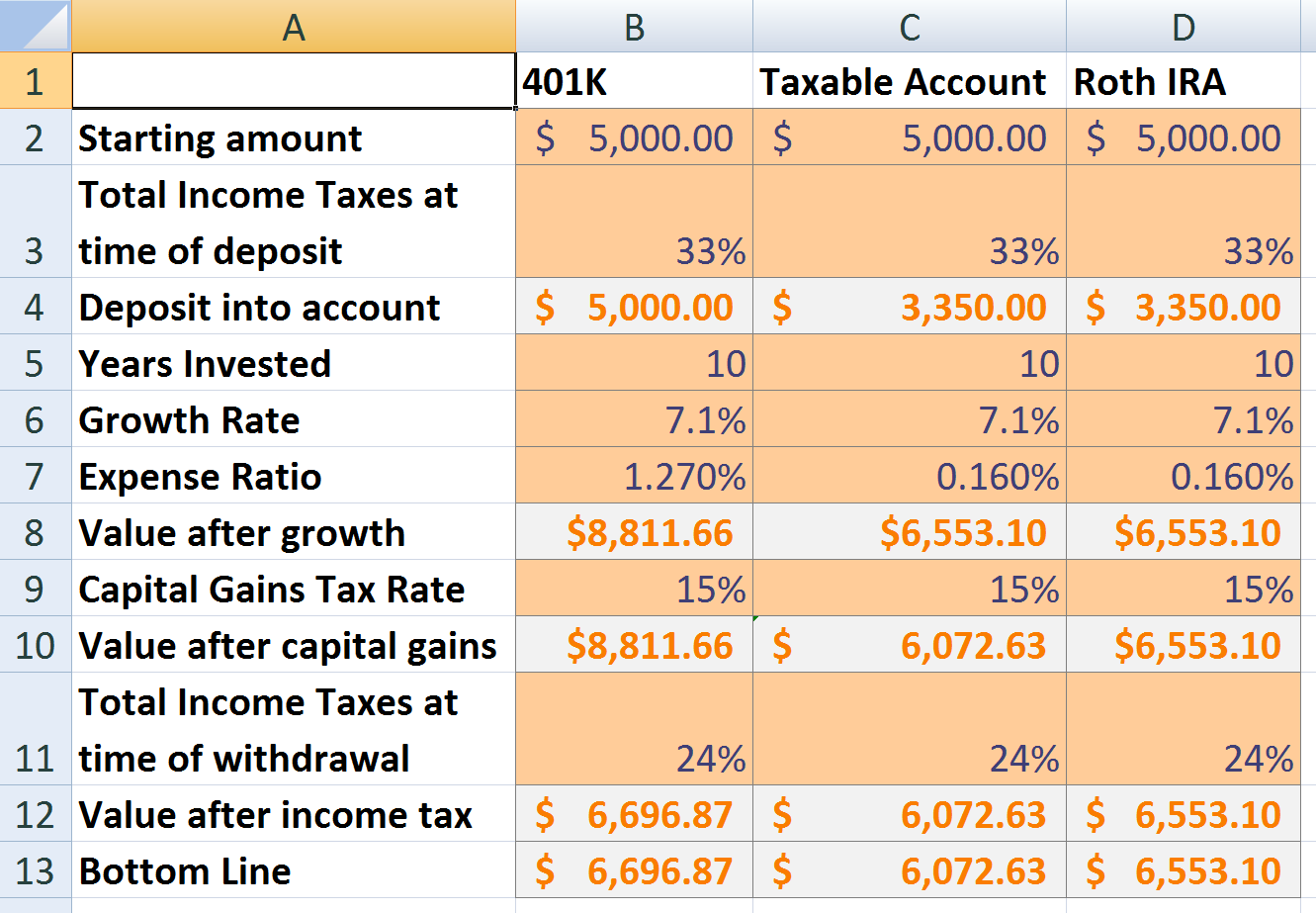

Roth IRAs are already taxed investment accounts. This means the money you put into the account has already had taxes taken out, so when you withdraw from the roth in the future you do not need to pay tax.

In contrast, 401k and traditional IRA account contributions are not taxed by federal income tax . You will pay taxes when money is withdrawn in the future. In the meantime, you receive a tax break for contributions you make each year.

Converting Roth 401 To Roth Ira

Rolling over your Roth 401 into a Roth IRA can be beneficial because of greater investment flexibility with an IRA. Typically, individual IRA accounts have wider investment options than Roth 401. Sometimes your options in a 401 are limited to mutual funds or a few different index funds.

The 5-Year Rule

One thing to keep in mind is the 5-year rule. If you roll a Roth 401 to a Roth IRA, its the time clock on the Roth IRA that counts. For example, imagine youve had a Roth 401 for 10 years and a Roth IRA for five years. If you roll your Roth 401 to that Roth IRA the clock is reset to the time youve had the Roth IRA. In this case, its five years, so youre good. If that Roth IRA was only active for three years, then youd need to wait two more years before you could withdraw earnings tax-free.

Recommended Reading: Can You Transfer Money From 401k To Bank Account

When You Should Consider Converting A 401 To A Roth Ira

If you anticipate your tax bracket being higher in retirement due to required minimum distributions or other sources of income, then it may make sense to pay income tax now while you are in a lower tax bracket.

Another reason to convert to a Roth is when you have a sizable pool of tax-free Roth assets relative to your tax-deferred retirement accounts. The tax benefits of a Roth IRA are most significant in this case. If your Roth IRA savings are only 5% or 10% of your entire retirement savings, it may not be enough to justify the loss of tax deferral.

Keep this in mind as an isolated conversion of relatively small dollar value may not make a material impact on your overall wealth. A financial plan can help you weigh whether maintaining tax-deferred growth is a better strategy to maximize your wealth.

Your 401 Lets You Move Your After

If your plan doesnt allow in-service withdrawals to a Roth IRA or in-plan rollovers to a Roth 401, then your opportunity to do the mega backdoor Roth is delayed until you leave your job. If thats the case, you might want to reconsider this strategy.

The point is to get as much money into the Roth as soon as possible to get as much tax-free growth as soon as possible.

Ideally, executing the mega backdoor Roth means throwing all of your after-tax savings into your after-tax bucket contribution limit). Then, youre almost immediately getting your money out of that bucket and into either a Roth IRA or Roth 401 before it starts accruing investment earnings. Thats because if left in the after-tax bucket, youre going to eventually owe tax on those earnings. But once that money is in a Roth, your money grows tax-free.

The point is to get as much money into the Roth as soon as possible to get as much tax-free growth as soon as possible. If your after-tax contributions accumulate investment earnings, the IRS has said its OK to split up that money, by rolling your after-tax contributions into a Roth IRA and the investment earnings into a traditional IRA. That means your contributions will still grow tax-free, and your investment earnings will grow tax-deferred youll pay income taxes when you take them out in retirement.

Read Also: What Is The Minimum 401k Distribution

What About The Roth 401k

If your employer offers a Roth 401k and you were savvy enough to take part, the path to a rollover will be much easier. When youre converting one Roth product to another, there is simply no need for a conversion. You would simply roll the Roth 401 directly into the Roth IRA with the help of your plan provider.

Roll Your 401 by Following These Steps

Reasons You Should Not Convert A 401 To A Roth Ira

There are a few reasons you shouldnt convert your 401 to a Roth IRA. If you dont have the cash on hand to pay the estimated tax due, then you should consider rolling over to a traditional IRA instead. Using money from your Roth IRA to pay the tax has been shown to make workers worse off in the long run.

Again, the main reason to convert to a Roth is the assumption that your tax rate will be higher in retirement. If you are in the highest marginal tax bracket now, theres a good chance your tax rate will be lower in retirement.

Also Check: Where Can I Find My 401k Balance

Your Company May Offer A Roth Option

Many companies have added a Roth option to their 401 plans. After-tax money goes into the Roth, so you won’t see the immediate tax savings you get from contributing pretax money to a traditional plan. But your money will grow tax-free. account.)

For 2021, you can stash up to $19,500 a year, plus an extra $6,500 a year if you’re 50 or older, into a Roth 401. Contributions must be made by December 31 to count for the current tax year, and the limit applies to the total of your traditional and Roth 401 contributions. A Roth 401 is a good option if your earnings are too high to contribute to a Roth IRA.

How Willing Are You To Be Strategic About How You Use Your Investment Accounts Later In Life

This is where I reach the same conclusion that I reached in my most recent Roth/Traditional discussion.

The important thing is controlling how you draw down your own funds in retirement.

Remember how we talked many paragraphs ago about how a reader asked why she wouldnt convert it now while the account is small instead of later when its big?

The fundamental flaw with that question is that it ignores the reality of how 401 conversions to Roth dollars actually happen later in life.

You May Like: How To Get The Money From Your 401k

Should You Convert To A Roth 401

If your company allows conversions to a Roth 401, you’ll want to consider two factors before making a decision:

A Conversion May Lead To More Taxes

When you convert a traditional IRA or traditional 401 that has used pre-tax contributions or IRA), youll end up with a tax bill. Youre recognizing that contribution as income, and you must pay taxes on it the taxes you didnt pay when it went into the account.

If you convert a Roth 401 into a Roth IRA, you skip the tax hit, because theyre both after-tax accounts. However, any employer match in a Roth 401 is technically held in a traditional 401, meaning that portion of the account cannot be converted without incurring some taxes.

Read Also: How To Lower 401k Contribution Fidelity

A Roth Ira Can Be A Great Way To Save For Retirement Since The Accounts Have No Required Minimum Distributions And You Withdraw The Money Tax

Tax-free income is a dream of every taxpayer. And if you save in a Roth account, it’s a reality. Roths are the youngsters of the retirement savings world. The Roth IRA, named after the late Delaware Sen. William Roth, became a savings option in 1998, followed by the Roth 401 in 2006. Creating a tax-free stream of income is a powerful retirement tool. These accounts offer big benefits, but the rules for Roths can be complex.

Here are 11 things you must know about utilizing a Roth IRA as part of your retirement planning.

Taxpayers Can Now Take Tax Free Jump From 401k To Roth Ira

Moving your retirement money around just got easier. In a conciliatory move for taxpayers, the IRS has issued new rules that allow you to minimize your tax liability when you move 401 funds into a Roth IRA or into another qualified employer plan. The situation arises when you have a retirement account through your employer that includes both pre-tax and after-tax funds. When you leave the company and want to move your money, allocating these retirement funds to new plans becomes tricky.

The new allocation rules take effect beginning in 2015, but taxpayers can choose to apply them to distributions beginning on September 18, 2014, the date the new rules were released by the IRS.

Under the old rules, you would have to pro-rate distributions and rollovers separately between pre-tax and after-tax amounts according to a set formula. This resulted in payment of tax on a pro rata share of pre-tax funds. The new rules allow you to do the allocations yourself within certain limits. You now can choose to move pre-tax money into a traditional IRA and after-tax money into a Roth IRA. If you moved pre-tax amounts into a Roth IRA, you would have to pay tax on the rollover because Roths can only be funded with after-tax money. Now you can direct pre-tax dollars to one account and after-tax dollars to another to avoid tax liability.

Lets look at an example.

Smart Planning

Also Check: Can I Borrow From My 401k To Start A Business

One: Roll Over Your 401 To A Traditional Ira

Contributions to your 401 plan were pre-tax. This means your employer deducted them from your taxable salary when reporting your income to the IRS. Same goes for any employer matches. So you have yet to pay taxes on any contributions and on any accrued earnings.

Traditional individual retirement accounts are also tax-advantaged. The difference, of course, is that individuals rather than employers send their contributions to their financial institutions and claim the deduction when filing their taxes. So like 401 balances, the money in an IRA is tax-deferred. You wont owe taxes on it until you retire and start taking distributions.

This is why rolling over your 401 to a traditional IRA is fairly straightforward. Its an apples-to-apples transaction.

Can I Pay The Taxes From My Conversion From The Retirement Funds

While it is possible, it generally does not make sense to use the retirement assets to pay the taxes. If you are under age 59 1/2, the amount distributed to pay taxes may be subject to an IRS 10% additional tax for early or pre-59 1/2 distributions . Plus, those funds would no longer be potentially growing tax-free within the Roth IRA. Its suggested you use assets outside of retirement accounts to pay any taxes resulting from the conversion.

Also Check: What Happens To Your 401k When You Die

Consider Converting Over A Period Of Years

Experts such as Victor advise careful planning to minimize the tax hit that comes with a conversion. Individuals could space the conversion out over many years rather than convert the full amount in one year. By doing so, they may be able to avoid jumping up to a higher tax bracket and paying more on each incremental dollar of converted money.

Are The Income Eligibility Limits Still In Place To Make An Annual Contribution To A Roth Ira

Yes. The income limits for annual contributions are still in effect, so its possible to take advantage of a Roth conversion but not be eligible to make an annual contribution. Since there are no income eligibility limits for conversions, however, one common strategy is to make a non-deductible contribution to a Traditional IRA then convert it to a Roth IRA. This may not be an appropriate strategy if you have other Traditional, SEP, or SIMPLE IRA balances, as the pro-rata rule would apply. Please consult a tax advisor to see if this strategy would work for you.

Read Also: How Do I Invest In My 401k

Roth Ira Withdrawal Rules

If you do decide to withdraw funds from your Roth IRA, there are rules to follow to avoid taxes and penalties.

Because there’s no tax deduction for Roth contributions, you can retrieve that money at any time free of taxes and penalties, regardless of age.

But for earnings to be tax- and penalty-free, you have to pass a couple of tests. First, you must be 59 1/2 or older. You will get hit with a 10% early-withdrawal penalty and taxes if you take out earnings before you hit that age. And you must have had one Roth open for at least five years. If you are 58 and opening your first Roth IRA in 2021, you can tap earnings penalty-free at age 59 1/2, but you won’t be able to tap earnings tax-free until 2026.

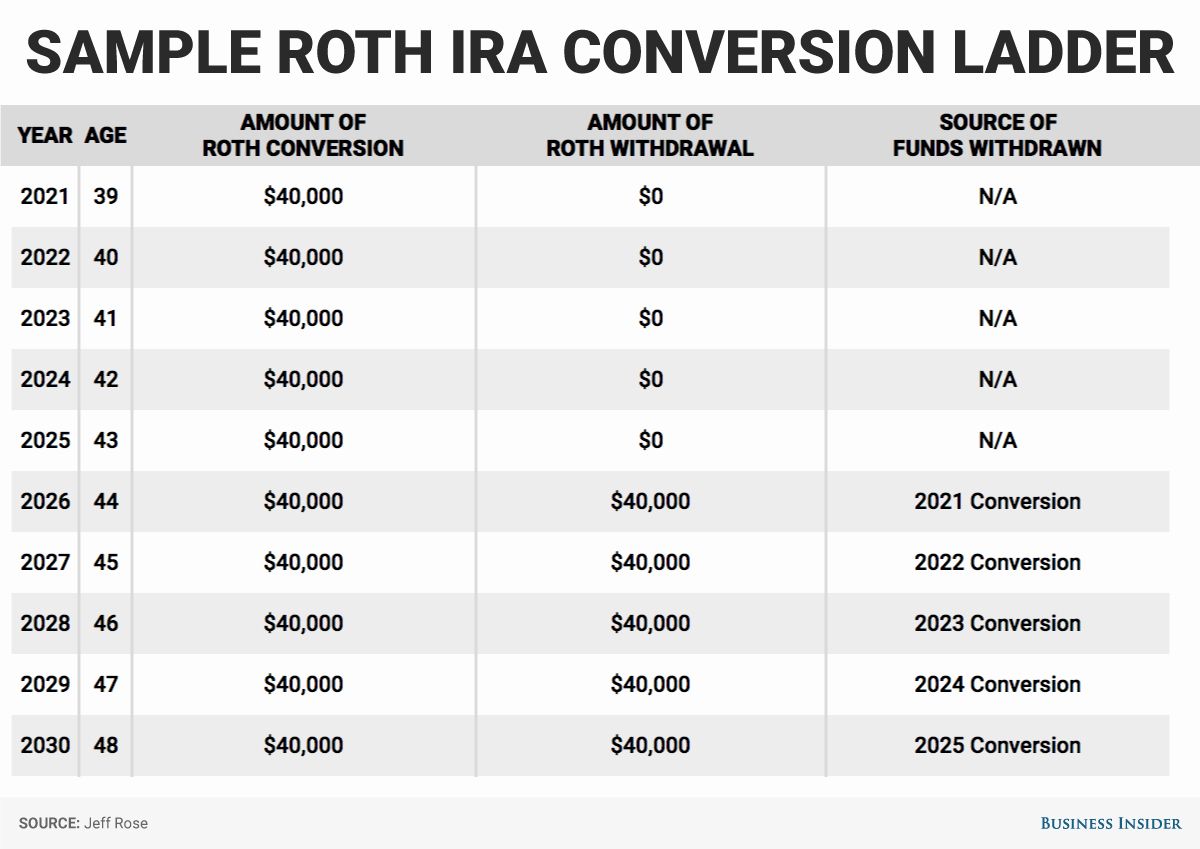

If you make a conversion, you must wait five years or until you reach age 59 1/2 before you can withdraw the converted amount free of the 10% penalty. The clock for that five years starts on January 1 of the year that you make the conversion. You could make the conversion late in a year, meaning you only have to wait closer to four years before you can touch earnings without penalty.

Each conversion has its own five-year holding period. So if a young account owner does one conversion in 2020 and a second conversion in 2021, the amount from the first conversion can be withdrawn penalty-free starting in 2025 and the amount from the second starting in 2026.

Roth 401k Conversions Are Not The Same As Roth Ira Conversions

There is a key difference between a Roth 401k conversion and a Roth IRA conversion though. With a Roth IRA conversion you can back out of your decision any time before your taxes are due.

This can be a very handy for tax savvy investors. Lets use Johnny again from our previous example .

In addition to his 401k at work, lets assume that Johnny has $100,000 in a traditional IRA. In November, he decides hes going to convert the entire balance to a Roth IRA.

If Johnny is in the 25% tax bracket, hed owe $25,000 on the conversion. Lets also assume that the stock market takes a tumble in March before Johnnys taxes are due.

He can actually recharacterize the conversion and back out of his decision. If his account falls 20% after the market correction, this would make a lot of sense. Rather than owing $25,000 , he could postpone the conversion until the following year when his account has a lower balance. If his account stayed level after the 20% drop, this would be a tax bill of $20,000 .

This is a handy move for Roth IRA conversions, but isnt allowed in Roth 401k conversions.

You May Like: How Much In 401k To Retire

Opinion: Why You Should Ditch Plans To Convert Your 401 To A Roth Ira

- Print icon

- Resize icon

When I talked recently with Ted Benna, the man often credited with inventing the 401 plan, the subject turned to the vexed issue of Roth and traditional IRAs.

With Roths you get a tax break only when you withdraw the money. With traditional IRAs you get the break up-front, in the year you contribute. Few topics seem to be as controversial among the saving public as the debate over which is better.

And at the risk of inciting another flame war, Benna thinks Roths are nowhere near as good as theyre made out to be. He believes traditional IRAs are likely to prove much better for most people.

Thats partly because most of us are likely to face lower tax rates in retirement than we do while were working, so a tax break then will be worth less than one today.

Thats one reason why Benna is skeptical of the widely used argument that you should get a Roth IRA because income tax rates are likely to be much higher in the future than they are now. People were saying that back in the late 1990s, when the Roth was first created, he points out. Instead income tax rates are way lower.

But he also fears that Roth investors may end up getting hosed by the government. Hes worried that politicians may end up taxing Roth withdrawals, at least for some, in the future. I dont trust the politicians, he says.

If that happens, anyone with a Roth will effectively be taxed twice: Once when they put money in, and then when they take it out.