You May Have Accumulated

There are many factors to keep in mind when considering a 401 rollover, including where you’re at in your career, your current financial status, and your tax and investment preferences. You should consider all of your options before making a decision, and can use the information provided here to help. If you decide a rollover is right for you, contact a Schwab Rollover Consultant at .

The Limitations On Retirement Plans Can Prevent You From Doing What You Want

401 plans can be an effective way that workers can save toward their retirement. However, many employees don’t like the investment choices that their employers’ 401 plans allow them to make, and they would prefer to move money out of their 401 plan accounts into an IRA in their own name. Most employer plans don’t allow employees to transfer money from a 401 account to an IRA while they’re still working, but a few do offer what are known as in-service rollovers that make that option available to a limited number of workers.

The general rule: No rollover while workingWorkers generally aren’t allowed to take money out of their 401 plan accounts while they’re still working. Limited exceptions apply for hardship withdrawals, but workers aren’t allowed to take those withdrawals and roll them over into an IRA. Similarly, money ta ken out of a 401 for uses like a first-time home purchase or educational expenses might qualify for exceptions to the 10% penalty for early withdrawals, but they don’t open the door to IRA rollovers.

If you do take a 401 withdrawal and deposit the proceeds into an IRA, the IRS will treat it as a taxable distribution followed by an IRA contribution. The distribution will be taxable and subject to an early withdrawal penalty if appropriate, and the contribution will be subject to normal IRA limitations. If you’re not allowed to make an IRA contribution in that amount, additional penalties will apply.

Background Of The One

Under the basic rollover rule, you don’t have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you can’t make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

Don’t Miss: Can I Use My 401k To Buy Investment Property

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Rollover To Another 401

If you value the simplicity of having all your retirement funds in one place, are looking to minimize account maintenance fees or want to prepare yourself to take advantage of the Rule of 55, a 401-to-401 rollover can be a good choice. By rolling over an old 401 into a plan with your new employer, you can keep everything in one place. Evaluate investment options carefully, though, to make sure there arent high fees and that the investments available work for you.

Recommended Reading: How To Take Money From 401k Without Penalty

Why Might You Consider An In

When you have a 401, you dont have maximum control over the types of assets you can hold, such as mutual funds, stocks, and bonds. You typically have a limited menu of options.

Through an in-service rollover, transferring some or all of your 401 funds to a personal IRA can open up more options for your assets. For instance, you might be able to put money into alternative assets like precious metals . A bonus is that you usually can keep contributing to your employers 401 after youve moved funds to an IRA.

Furthermore, an in-service rollover enables your personal financial advisor to provide more hands-on help since at least some of your assets are in an IRA that you control and not in an employer-sponsored 401 that could come with strings attached.

Plus, some 401 plans have annual fees with their options that are way above average. If youre stuck in one of those, you can minimize your costs by rolling your 401 money into an IRA with a lower-cost fund company, explains Rick Salmeron, a certified financial planner.

On top of that, you might be permitted to make tax-free withdrawals from an IRA that you wouldnt be able to make from a 401.

With your funds in an IRA, you are the account owner and have more control over your assets, free from the restrictions your employer-sponsored plan can impose, Salmeron adds.

Us Tax Treatment Of A Qualified 401 Vs International Funds

The big difference between Stateside 401s and international funds is the U.S. tax treatment. The U.S. offers special tax treatment on what they classify as qualified retirement plans. The qualified means it meets certain requirements in the Internal Revenue Code Section 401. A few examples you may be familiar with are:

Most foreign retirement plans and foreign pensions are not considered qualified plans, and may even be classified as PFICs, or passive foreign investment companies .

If you do choose to transfer funds from a U.S. Qualified Plan to a foreign retirement plan, it will be neither be tax free nor will it count as a qualified rollover. This means moving your 401 to an international fund will result in U.S. tax liability and possibly the 10% penalty for an early withdrawal.

In addition, whatever contributions you make to your international retirement plan likely wont be tax-deductible, and you may have to pay U.S. taxes on the plans yearly gains.

There is some good newsthe U.S. maintains tax treaties with other countries outlining special tax treatment of some pensions and retirement plans. So, if you have a foreign pension in the U.K., Canada, Germany, the Netherlands, or Belgium, youve got a tax treaty that basically allows your foreign pension to be taxed the same as a U.S. retirement plan.

You May Like: How To Close Out Your 401k

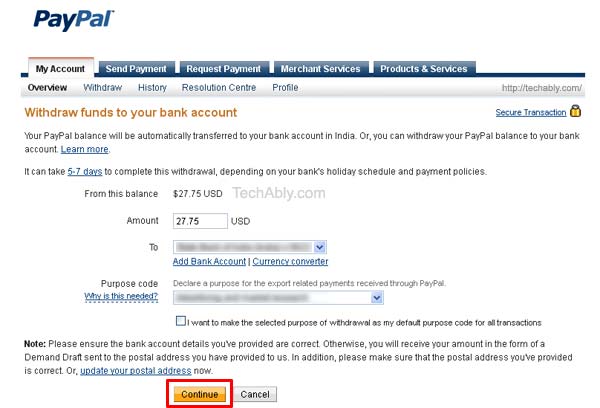

How Do I Complete A Rollover

You Prefer Convenience Over Control

Perhaps you opened an IRA with the intention of putting together a diverse portfolio and actively managing your investments. However, youre now finding that you dont have the time or energy to devote to your portfolio and feel that youre in over your head. Rolling over your IRA to a 401 and giving up some control may better fit your needs as an investor.

Don’t Miss: How To Find Out If I Have An Old 401k

How To Bring 401s And Iras To Canada

Ways to avoid common tax pitfalls

- 00:11

Crossing borders for work often means cross-border tax issues, especially when it comes to retirement accounts.

Moving 401s and IRAs to Canada must be done with plenty of forethought otherwise, owners could face big tax bills on both sides of the border. In a case that got accountants buzzing, CBCs Go Public reported that an Ontario couple lost almost a quarter of their U.S. retirement savings to taxes when they followed improper advice about making the transfer.

And even if clients dont want to move their money, they may be forced to. Plans have the ability to kick a participant out either due to account size or non-residency in the U.S., says Debbie Wong, a CPA and vice-president with Raymond James in Vancouver. That means Canadian residents could be out of luck.

Jacqueline Power of Mackenzie Investments in Toronto agrees. A lot of U.S. suppliers dont want to deal with Canadians anymore, she says. Weve had lots of advisors saying their clients are being essentially forced out of the U.S.

L.J. Eiben, president and CEO of Raymond James Ltd. in Vancouver, says a U.S. firm usually gives the individual 30 to 60 days to transfer out. If not done by that date, the firm will liquidate the retirement account and send the participant a cheque for the remaining proceeds minus withholding tax, penalties, et cetera.

How The Rollover Is Done Is Important Too

Whether you pick an IRA for your rollover or choose to go with your new employer’s plan, consider a direct rolloverthats when one financial institution sends a check directly to the other financial institution. The check would be made out to the bank or brokerage firm with instructions to roll the money into your IRA or 401.

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your employer is required by the IRS to withhold 20% for taxes. As if that wouldn’t be bad enoughyou only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401 or IRA. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, you’d have to come up with the 20% that was withheld and put it into your new account.

If you’re not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money but you may also owe a 10% penalty if you’re under age 59½ because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401.

You May Like: How To Find 401k From Previous Employer

Tax Implications Of A 401 Money Transfer To Bank

A 401 is a tax-deferred retirement account, and the money contributed to the account grows tax-free. Any gains on investments are not taxed until when they are withdrawn.

When you make a withdrawal, you will owe taxes at the federal income tax rate. A higher withdrawal amount pushes you into a higher tax bracket, and you will have to pay higher tax amounts on your withdrawal. For example, if you withdraw $20,000, and you are in the 35% tax bracket, you will have to pay $7,000 in income taxes.

Tags

Cant I Just Write A Check

For most workers, the answer is no. Your regular contributions to your 401 account typically only happen through salary deferral. In other words, the Payroll department needs to send money, and you cant just write a personal check if youre hoping to invest a large chunk or reach the maximum contribution limit by the end of the year.

Why not? For starters, the law does not allow you to defer funds that you already received. If the money is in your checking account, you received it. Also, your 401 plan might have specific rules saying you cant make your own payments into the plan.

Catch-up contributions: Those over age 50 can make additional catch-up contributions to retirement accounts. But 401 catch-up contributions, like other employee contributions, generally must go in through payroll deduction.

Don’t Miss: How Do You Rollover Your 401k To A New Employer

How To Rollover An Hsa From One Employer To Another

If youve opened your HSA account through your employer and youre changing jobs, your HSA comes with you. But maybe your new employer works with a better HSA provider. Or you found a financial institution you want to work with.

Either way, just follow the steps detailed above. Contact the HSA provider directly and request a trustee-to-trustee transfer. Or request a check, and rollover the funds yourself. Just remember you have 60 days from when you get your money to deposit it into a new HSA or youll suffer a tax penalty.

You May Need To Take Money Out Of A 401 Here’s What You Need To Know

401s are incentivized plans to help Americans save for retirement. The government provides tax breaks to encourage you to contribute, but it also enforces certain rules to discourage you from taking distributions before retirement. In some cases, breaking those rules and taking distributions early can cost you a 10% penalty in addition to the ordinary income taxes you’ll owe on withdrawn funds.

Let’s look at all the approved ways you can take money out of a 401 and look into the penalties you’ll incur if your early distributions don’t fall within one of those exceptions.

Read Also: Can You Have A Solo 401k And An Employer 401k

Can You Roll A 401k Into A 403b

Companies cannot offer both a 401k and 403b plan to its employees, because 401k plans are only offered by for-profit employers, while 403b plans can only be offered by non-profits. However, if you change employers from a for-profit company to a non-profit, you might want to take your retirement savings account with you. The Internal Revenue Service permits moving money from a 401k plan into a 403b plan.

How To Complete An Ira To 401 Rollover

The first step is checking whether your employers 401 plan accepts IRA rollovers. Not all plans will allow you to roll over IRA assets. If they do, youll want to request a direct transfer to avoid any income tax or the 10% early withdrawal penalty.

If a direct transfer isnt an option, your IRA provider will send you a check for 80% of your accounts value and withhold the remaining 20% for taxes. You must deposit 100% of the value of your IRA into your 401 within 60 days or the transaction will be treated as an early distribution, triggering the 10% penalty and income taxes. The 20% that your IRA provider withheld will serve as a tax credit when you file your tax return.

You May Like: How Do I Add Money To My 401k

Moving Money From A Retirement Plan Is Only One Of The 8 Common Ways To Free Up Money To Fund A Bank On Yourself Plan

These range from restructuring debt, to reducing funding of your traditional retirement account, converting existing life insurance policies, and tapping your savings.

Moving some of your safe money into the Bank On Yourself wealth-building strategy can result in your dollars working much harder for you, without losing sleep. The return is many times greater than you can get in a CD, money market or savings account but without the risk of stocks, real estate or other volatile investments.

The Bank On Yourself Professionals are masters at helping people restructure their finances to free up more seed money to fund a plan that can help you reach your goals and dreams in the shortest time possible without taking any unnecessary risk.

What If You Have An Existing 401 At Your Previous Employer

If you have a 401 at a previous employer, youll want to consider whether a rollover makes sense for you. You may want to consult with a tax professional to make sure that you are making a decision that is best for your unique circumstances.

As youre thinking about what to do with your old 401, here are some options to consider:

Recommended Reading: How To Switch 401k To Ira