Employer Match Does Not Count Toward The 401 Limit

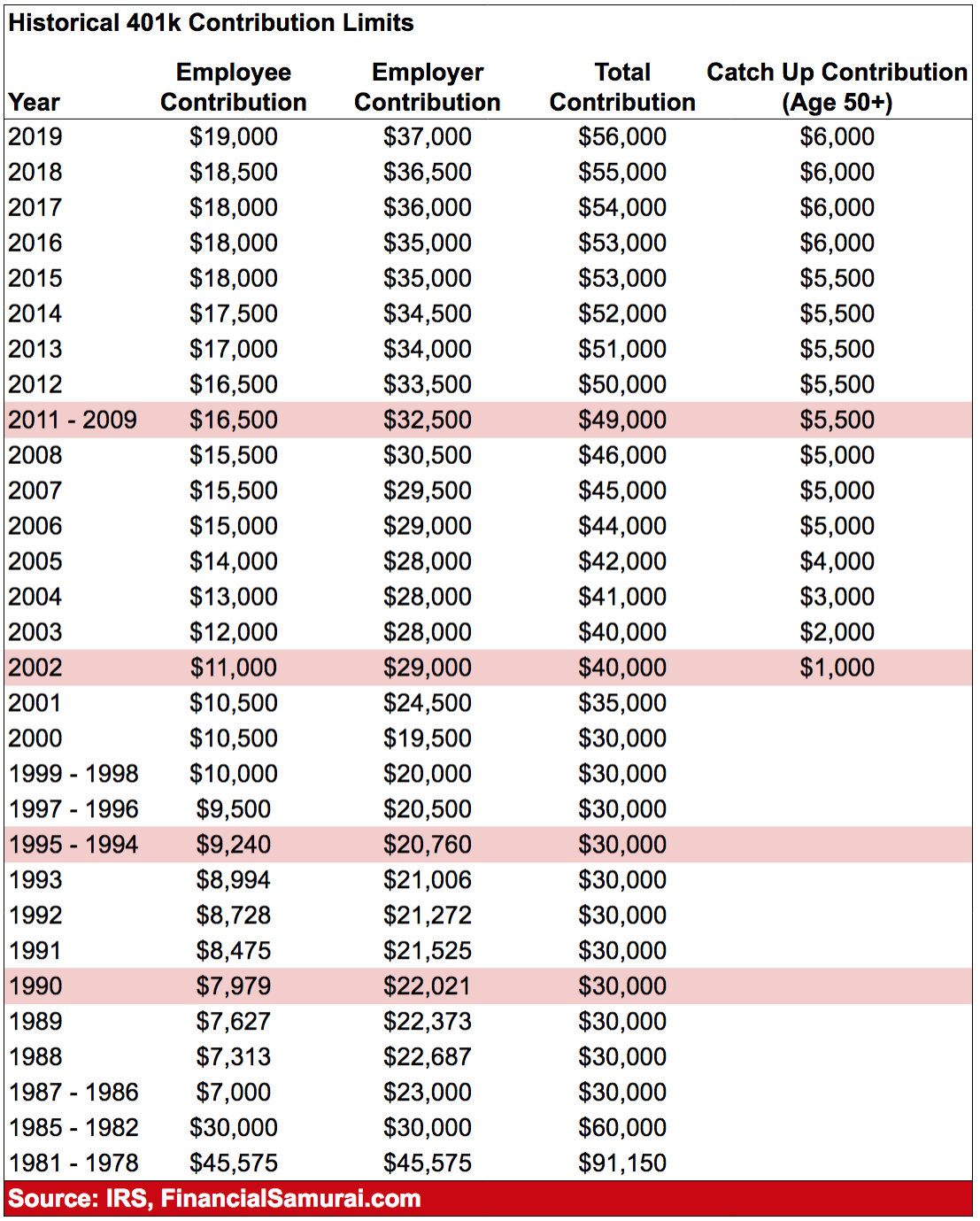

There are two sides to your contribution: what you provide as the employee and the match from your employer . You can only contribute a certain amount to your 401 each year. For 2019, that limits stands at $19,000. In 2020, the limit is expected to rise to $19,500. This contribution limit includes deferrals that you elect to be withheld from your paycheck and invested in your 401 on a pre-tax basis.

The good news is that this limit does not include employer match contributions. If you contribute, say, $18,000 toward your 401 and your employer adds an additional $5,000, youre still within the IRS limits.

However, there is another limit which applies to overall contributions your employer match contributions are taken into account for this overall contribution limit. For 2019, that limit stands at $56,000. This means that together, you and your employer can contribute up to $56,000 for your 401. If you contribute the max of $19,000, your employer can contribute up to $37,000 for 2019. For 2020, you and your employer can contribute up to $57,000. Note, though, that most employers are not this generous with their contributions, so youre likely in little danger of exceeding this limit.

Irs Lifts 401 Contribution Limits For 2020

The IRS has nudged up the basic employee contribution limit for 2020 to 401 accounts to $19,500. And it boosted the catch-up contribution for the first time in five years.

If you are 50 or older, you can kick in as much as an additional $6,500.

The combined limit would be $26,000.

The limits apply to regular 401 accounts and to Roth-style accounts, if your plan permits them.

How To Maximize Your 401 Retirement Savings

A workplace 401 account can be a powerful tool to help build your retirement savings. To maximize your 401 benefits, follow these tips:

1. Set your contribution level to take full advantage of your employers 401 match. If your company matches a certain percentage of your contributions, set your contribution level to take maximum advantage of the match. Otherwise, youre leaving money on the table.

2. Start contributing to your 401 immediately.

3. Take advantage of target-date funds. If youre overwhelmed by the investment options offered by your 401 plan, choose a target-date fund aligned with your anticipated year of retirement. Target date funds are optimized for your retirement timeline, making them great options for beginners or more hands-off investors.

4. Increase your 401 contribution percentage regularly. Each year, increase your 401 contribution rate by at least one additional percentage point. Gradual small increases have a minor impact on your take-home pay and a major impact on your retirement nest egg over time. In addition, if you receive any raises or bonuses, dedicate at least a portion of them to your savings.

Recommended Reading: How To Withdraw My 401k From Fidelity

Take Note Older Savers

If you start saving later in life, especially when you’re in your 50s, you may need to increase your contribution amount to make up for lost time.

Luckily, late savers are generally in their peak earning years. And, from age 50, they have a greater opportunity to save. As noted above, the 2021 limit on catch-up contributions is $6,500 for individuals who are age 50 or older on any day of that calendar year.

If you turn 50 on or before Dec. 31, 2021, for example, you can contribute an additional $6,500 above the $19,500 401 contribution limit for the year for a total of $6,000.

“As far as an ‘ideal’ contribution is concerned, that depends on many variables,” says Dave Rowan, a financial advisor with Rowan Financial in Bethlehem, Pa. Perhaps the biggest is your age. If you begin saving in your 20s, then 10% is generally sufficient to fund a decent retirement. However, if you’re in your 50s and just getting started, you’ll likely need to save more than that.”

The amount your employer matches does not count toward your annual maximum contribution.

Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employer’s plan. Amounts that are retained in a former employer’s 401 plan or transferred to another employer’s plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

Read Also: How To Take Money From 401k Without Penalty

How Much Should I Save For Retirement

We get that question a lot. So we asked Stanley Poorman, advice and planning manager for Principal®, who said theres no one-size-fits-all answer.

A good rule of thumb is to save 1015% of your income toward retirement, but that also depends on when you get started. That may be fine if youre 25, but if youre starting at 50, you may need to save more to retire comfortably, Poorman says.

One way to get a quick snapshot of how much you may need to save is to use the Retirement Wellness Planner. By entering a few numbers, youll get a sense of whether youre on track or not.

Another factor is whether you have a matching contribution from your employer, and if so, what percentage the company contributes. Poorman suggests deferring enough of your pay to get that match.

The Takeaway: You Can Contribute The Maximum To Your 401 Account

This article spells out the benefits of saving the maximum in your 401. Actually, if you save $18,000 but subtract the tax-saving benefit of $4,500, youre only saving $13,500 per year. Its clear that if you contribute the maximum to your 401, youll have more money in retirement and pay less in taxes during your working years. Yet, even if you cant hit the savings mark, there are marginal benefits from saving and investing as much as you can in your retirement account. Give it a try for a few months and see how it works out. You may be surprised to discover that once the money is out of your account, you can adjust your lifestyle to live on less. Sources and calculators used in this article that you may find useful, as well as a related article:

Also Check: What Happens To Your 401k When You Switch Jobs

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is The Maximum An Employer Can Contribute To Your 401 In 2021

One of the best things about a 401 is that most employers offer some kind of match on your contributions, usually up to a certain percentage of your salary. In fact, about 86% of companies with a 401 plan provide a match on employee contributions.2 And the average employer 401 match is around 4.5% of your salary.3 Thats great news for you. After all, an employer match is basically free money!

But there is a limit on how much you and your employer can put in together. Between you and your employer, the maximum that can be put into your 401 in 2021 is $58,000 .4

You May Like: How To Cash Out 401k After Leaving Job

Choosing Investments Within A Plan

Generally, 401 plans offer several options in which to invest contributions. Such options generally include mutual funds that may invest in stocks for growth, bonds for income, or money market investments for protection of principal. This flexibility may help lower investment risk by diversifying a portfolio amongst different types of classes, manager styles, investment styles, and economic sectors.

Company Matching Aka Free Money

Because many companies offer their employees a dollar-to-dollar match on 401 contributions up to a certain amount, many employees choose to max out their 401 contributions for the year first, then contribute to another retirement account, such as an IRA. At a minimum, you should aim to contribute enough to take full advantage of your employer match, if they offer one, says Jason DallAcqua, a CFP and president of Crest Wealth Advisors LLC. .

Recommended Reading: Should I Rollover My 401k When I Retire

When Is An Ira A Better Option

An IRA and a 401 are both retirement saving vehicles and the two share commonalities. But there are a few important differences that make IRAs the better choice in some situations.

A 401 is only available through your employer. If you work at a company that doesnt offer a 401, you cant get one. People in work situations where the employer does not offer 401 accounts can still get retirement savings accounts with tax benefits thats where the IRAs come in.

IRAs are another type of retirement savings account. Unlike a 401, an IRA is not tied to your employer. You can sign up for an IRA at online brokerage like E*Trade, Vanguard, or Fidelity and open an account.

Another reason why someone might choose an IRA is for the investment options. IRAs are generally known to have a wider selection of investment opportunities than what youll find with a 401. But keep in mind that the contribution limits with an IRA account is much lower than the limits with a 401.

Contribution Limits For 2020 And 2021

When most people think of 401 contribution limits, they are thinking of the elective deferral limit, which is $19,500 in 2020 and 2021. This is the maximum amount you are allowed to voluntarily defer to your 401 for the year. Adults 50 and older are also allowed $6,500 in catch-up contributions, which are additional elective deferrals, in 2020 and 2021. This brings the maximum amount they can contribute to their 401s each year to $26,000.

The IRS also imposes a limit on all 401 contributions made during the year. In 2020, that limit is $57,000, or $63,500 if you’re 50 or older and therefore eligible for catch-up contributions. In 2021, it rises to $58,000 and $64,500, respectively. This includes all your personal contributions and any money your employer contributes to your 401 on your behalf. contributions, see the following section.)

Highly paid employees have some additional limitations to keep in mind. Companies can elect to stop a participant’s salary deferrals once that person has earned $285,000 in 2020 or $290,000 in 2021, and companies use only that first amount to calculate employer matching contributions.

For example, say your company matches up to 6% of your salary and you earn $300,000 in 2021. Six percent of $300,000 is $18,000 however, your company can only match you up to 6% of $290,000, the maximum employee compensation limit for 2021. So rather than up to $18,000, you’d get up to $17,400 as an employer match.

|

Type of Contribution |

|---|

Data source: IRS.

Don’t Miss: How Does Taking Money Out Of 401k Work

Contribution Limits In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

401 plans are an excellent way to save for retirement, but because 401s are tax-advantaged, the IRS sets a contribution limit on how much you and your employer can put into your 401 per year.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Read Also: How To Collect My 401k Money

Achieve Financial Freedom Through Real Estate

In addition to maxing out your 401, consider also investing in real estate. Real estate is my favorite way to achieving financial freedom because it is a tangible asset that is less volatile, provides utility, and generates income.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Contributions In Excess Of 2020 Limits

Evaluating your estimated contributions for the year ahead and analyzing your contributions at the end of a calendar year can be very important. If you find that you have contributions in excess of the 2020 limits, the IRS requires notification by March 1, 2021, and excess deferrals should be returned to you by April 15, 2021.

Recommended Reading: How To Get Your 401k Without Penalty

Try To Max Out Your 401 Asap

If you want to achieve financial freedom by the time youre in your 60s, you should max out your 401 every year for as long as possible. Given contributions are in pre-tax dollars, the retirement contributions shouldnt hurt as much.

Here is my guide for how much you should have in your 401 by age to ensure a healthy retirement. The gray area shows what the median and average 401 balance by age is for the typical American. The right three columns show my recommended amounts.

You will be able to achieve my recommended 401 balances by age if you consistently max out your 401 and allocate your cash properly. Add on company matching and everyone should be a 401 millionaire by the time they hit 60.

Although less than 15% of Americans who have 401s max out their 401s, dont be like most Americans who are struggling to come up with $1,000 for an emergency and need to rely on Social Security to survive in retirement.

Not only should you max out your 401, you should save an additional 20% or more after tax and building your after-tax investment accounts. It is your after-tax investment accounts that will generate passive income for you to live a comfortable retirement life.

Now that you know what percentage of Americans max out their 401k, its up to you to join the movement. You only have one life to live, make the most of it!

How Do The Immediate Tax Savings Work With My 401 Account

Jenae earns $75,000 per year and doesnt contribute to a retirement plan. Jenae is single with no dependents. She is eligible for one personal exemption of $4,050 and the standard deduction of $6,300 for a total deduction of $10,350. Jenae will owe $11,933.75 in Federal income tax. Heres how her tax return will look:

-

Adjusted gross income: $75,000

-

Taxable income: $64,650

-

Tax due : $11,933.75

Now, imagine that Jenae to her 401 account. Her adjusted gross income is reduced from $75,000 to $57,000 and her Federal tax liability decreases to $7,433.75 from $11,933.75 for a 37.71% savings. Heres Jenaes tax picture after contributing $18,000 to her 401:

-

Adjusted gross income: $57,000

-

Taxable income: $46,650

-

Tax due : $7,433.75

So, the immediate tax benefit of contributing the maximum amount allowed by law to a 401 is a juicy 37.71% tax savings, or $4,500 for Jenae.

Recommended Reading: What’s The Maximum Contribution To A 401k