What Happens If I Have Unclaimed 401 Funds From A Previous Job

The majority of unclaimed money comes from brokerage, checking, and savings accounts, along with annuities, 401s, and Individual Retirement Accounts. Once an account is considered inactive or dormant for a period of time , companies are required by law to mail abandoned funds to the owners last known address. If theyre returned, or the owner cant be reached, the assets must be relinquished to the state.

How To Access My 401k Online

Although youll have set up your 401K through your employer, your funds will be managed through a custodian or brokerage firm, for example, the likes of Charles Schwab or Vanguard. You should be able to log into your 401K account online through the website of the broker your 401K is with.

If you cant remember your login details, youll need to contact your 401K provider to get your password reset, or failing that you may be able to check your balance over the phone.

If youre not sure which custodian your 401K is set up with, speak to your human resources department at work. They wont be able to tell you your 401K balance, but theyll be able to direct you to the relevant 401K broker.

How To Check Your 401 Balance

If you already have a 401 and want to check the balance, it’s pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America – Get Bank of America Corp Report, T. Rowe Price – Get T. Rowe Price Group Report, Vanguard, Charles Schwab – Get Charles Schwab Corporation Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Read more on TheStreet about how to find an old 401 account.

You May Like: How To Pull 401k Early

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

The Cons Of Leaving Your 401 Behind

Risk of Losing Track of Old 401s

Rolling over an old 401 or managing your savings during a job transition can be stressful and chaotic. Some people end up leaving behind an old account with the intention to revisit it later, only to forget about it or lose track of it as they are faced with other aspects of their job transition. This will make it difficult to put your savings to good use in a way that promotes your financial stability in the future.

As of now, if you have less than $5,000 in any old accounts, your previous employers will likely either cut you a check for the remaining balance or move the money into an IRA. Its up to you to find it, though.

Missing Out on Investment Opportunities

Do you know when you forget your old 401 accounts, you miss out on a chance for a solid investment plan? You were wise enough to set up a retirement plan to secure your financial freedom for the future. But, when you leave behind any amount of savings, it leads to loss of earning capacity.

Leaving behind money in an old retirement account also means that your savings dollars may not be invested in the most beneficial way possible for you. Staying on top of old accounts or rolling them over into your current plan can help you ensure you are investing every dollar with purpose, efficiency and your unique goals in mind.

You May Like: What Do I Do With 401k When I Retire

Look For Contact Information

If you don’t know how to contact your former employer perhaps the company no longer exists or it was acquired or merged with another company see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you don’t have an old 401 statement handy or yours doesn’t tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement account’s tax return, known as Form 5500. That will most likely have contact information for your 401’s plan administrator.

What Is A Partial 401 Match

With a partial 401 match, an employers contribution is a fraction of an employees contribution, and the employers total contribution is capped as a percentage of the employees salary. According to Jean Young, a senior research associate with Vanguard Investment Strategy Group, partial matching is the most commonly used matching formula in Vanguard 401 plans.

Matching structures vary by plan, said Young. In fact, we keep records on over 150 unique match formulas. But the most commonly offered match is $0.50 on the dollar, on the first 6% of pay. About one in five Vanguard plans provided this exact matching formula in 2018.

Lets say you earn $40,000 per year and contribute $2,400 to your 4016% of your salary. If your employer offers to match $0.50 of each dollar you contribute up to 6% of your pay, they would add $1,200 each year to your 401 account, boosting your total annual contributions to $3,600.

Recommended Reading: How Do I Sign Up For 401k

How To Find Out If You Had A 401

Keeping track of your 401 benefits is essential to retirement planning.

Saving enough money to retire often means taking advantage of multiple retirement savings accounts. Employers only match your 401 contributions while you are on the payroll. However, the money in your account still belongs to you after you leave your job. If you aren’t sure if you had a 401 with a previous employer, there are several ways to find out.

Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you don’t want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasn’t automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.

Read Also: Why Choose A Roth Ira Over A 401k

What Should I Do With My Lost Retirement Account

Once youve tracked down your lost retirement funds, you have some decisions you need to make. You can, of course, withdraw the funds and spend them, but there are a few reasons that might be a bad idea. If youre withdrawing funds from a forgotten 401 or other savings plan, take some time to research the taxes or penalties youll have to pay on any money you take out. Unless you put after-tax funds in, youll be taxed on the funds as you would with any type of income.

If youre 72 years old, though, youll need to pay attention to the Required Minimum Distributions to avoid a penalty. The amount youre required to take each year is based on a calculation that divides your account balance by your life expectancy factor. You can use the IRS Required Minimum Distribution Worksheet to help with that.

For the remainder of the amount, you may choose to leave it alone, withdraw it, or roll it into an IRA. You may find you can save on fees by rolling the amount over, but after retirement, the fees involved in doing that may eat into any cost savings. Weigh your options, including calculating the income taxes youll owe on any amount you withdraw, before making any decisions.

Your Kids Are Underage

If you want to name a minor child as a beneficiary, you should consider consulting with an estate planning attorney first. Most 401 plans will not transfer money directly to a minor. Instead, a court will have to appoint a trustee or guardian to receive the funds, which can take some time.

There are a few ways to avoid this, and your options may depend on the laws in your state. Some states allow parents to name a minor as a beneficiary and a custodian who will manage the assets in the childs best interest until they reach a certain age usually 18 to 25, depending on the state.

Another option is to create a trust. When you create a trust, you also name a trustee who will manage trust assets on behalf of your child either until they reach a certain age or for their lifetime. Then you would list your childs trust as your beneficiary. In either case, its a good idea to consult with an attorney first to make sure youre not unintentionally jeopardizing your childs inheritance.

Recommended Reading: How To Diversify 401k Portfolio

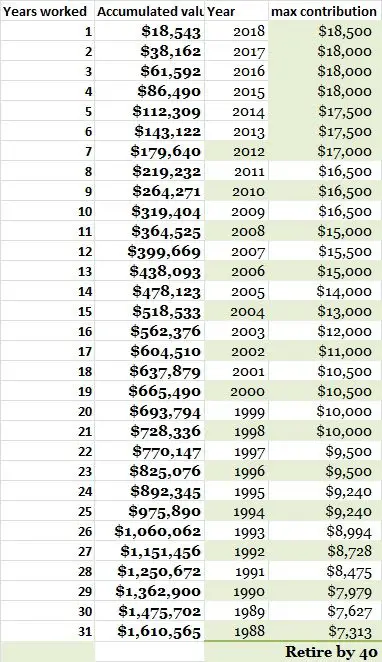

Contribution Limits 401k Ira Hsa

2022 Contribution Limits

Retirement Plan Contribution Limits for 2022

Subscribe to our channel:Click here to book a complimentary 15-minute 401k Strategy Session with us: Visit our site: Click to Enroll Today here: The IRS has announced contribution limits for qualified retirement plans for 2022.

However, there may be changes coming to the info below.

In the November 3 draft of the Build Back America Act currently sitting in Congress, there are proposed provisions to curb contributions and accelerated distributions for high-balance retirement accounts.

In addition, the bill also has provisions to cut backdoor Roth IRAs and after-tax 401 contributions.

In the meantime, keep reading below to find out exactly how much you can contribute for 2022, and start making plans now to do what you can to max out your retirement savings next year.

401 Retirement Plan Contribution Limits for 2022

401sEmployee contribution limits for 401, 403, most 457 plans, and the federal Thrift Savings Plan are $20,500 up from $19,500.

For those age 50 and older, the 401 catch-up contribution remains the same at $6,500 for 2022. If you turn 50 anytime during December of 2021, youre still eligible to contribute the additional $6,500.

The compensation limit has also risen to $305,000 in 2022, up from $290,000 in 2021.

IRA Retirement Plan Contribution Limits for 2022

- Tags

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

Also Check: How Do I Add Money To My 401k

What Are 401 Matching Contributions

If your employer offers 401 matching contributions, that means they deposit money in your 401 account to match the contributions you make, up to a certain threshold. Depending on the terms of the 401 plan, an employer may choose to match your contributions dollar-for-dollar, or they may offer a partial match. Some employers may also make non-matching 401 contributions.

Matching contributions arent required by law, so not all employers offer them as part of their 401 plans. But according to Katie Taylor, vice president of thought leadership at Fidelity Investments, a 401 match can be a core employee benefit that helps an organization retain talent and build strong teams.

About 85% of the employers we work with offer some sort of matching contribution, said Taylor. The average employer contribution dollar amount into 401s in 2019 was $4,100, which equates to a little bit more than $1,000 per quarter.

Some 401 plans vest employer contributions over the course of several years. This means you must remain at the company for a set period of time before you fully take ownership of your employers matching contributions. Employers use vesting to incentivize employees to remain at the company. When you complete the schedule, you are said to be fully vested.

Consider The Amount Of Money In Your Old 401 Account

Your past employer doesnt have to keep overseeing your 401 account if your balance is less than $5,000.

At less than $1,000, your old company can just write you a check.

If you hold more than $1,000 but less than $5,000 in a 401 account with a company for which you no longer work, you should receive a request for payout instructions from your former employer. If you fail to respond to those instructions, your former company can roll the money into an IRA of its choice.

You can search the FreeERISA website to find an old IRA. You wont have to pay to use the site, but it does require you to register to search its database.

Recommended Reading: How To Put 401k Into Ira

Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employer’s plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

Also Check: How Can I Get Money Out Of My 401k

Option : Move The Money To Your New 401

If you have a new job with a new 401, your current employer may permit you to roll over your old 401 funds into your new account. However, not all plans allow this, so check with your company’s HR department or plan administrator to see if it’s an option for you.

If it is and you decide it’s your best move, you must choose between a direct and an indirect rollover. Direct rollovers are the better choice because you don’t handle the money at all. You just fill out a form telling your old plan administrator where to send the funds and they take care of it for you.

With an indirect rollover, the plan administrator cuts you a check for the funds in your account and you place that money into your new account. But if you fail to do this within 60 days of cashing out your old account, the government considers it a distribution and taxes you on that money for the year.

Before you decide to move your money to your new 401, make sure you like your investment options and are comfortable with the fees your new 401 charges. Many employers don’t allow you to transfer money out of your 401 if you’re a current employee, so once you transfer your old 401 funds to your new account, they could be stuck there, at least until you leave your current job.