Are Social Security Benefits Taxable

Approximately 56% of Social Security recipients have to pay income tax on their Social Security benefits.

Taxation of your Social Security benefits depends on whether or not you have modified adjusted gross income above certain levels after you retire. If you do, figure out your combined annual income by adding your nontaxable interest and half of your Social Security benefits to your adjusted gross income . If youre single and your combined income is between $25,000 and $34,000 a year or if youre married and file jointly and your combined income is between $32,000 and $44,000 a year up to 50% of your Social Security benefits will be taxable.

However, if youre single and your combined income is more than $34,000 a year or if youre married and file jointly and your combined income is more than $44,000 a year up to 85% of your Social Security benefits will be taxable. No more than 85% of Social Security benefits is ever taxable, regardless of the amount of your modified adjusted gross income.

Some states also assess state income tax on Social Security benefits. Currently, they include Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Vermont, Utah and West Virginia .

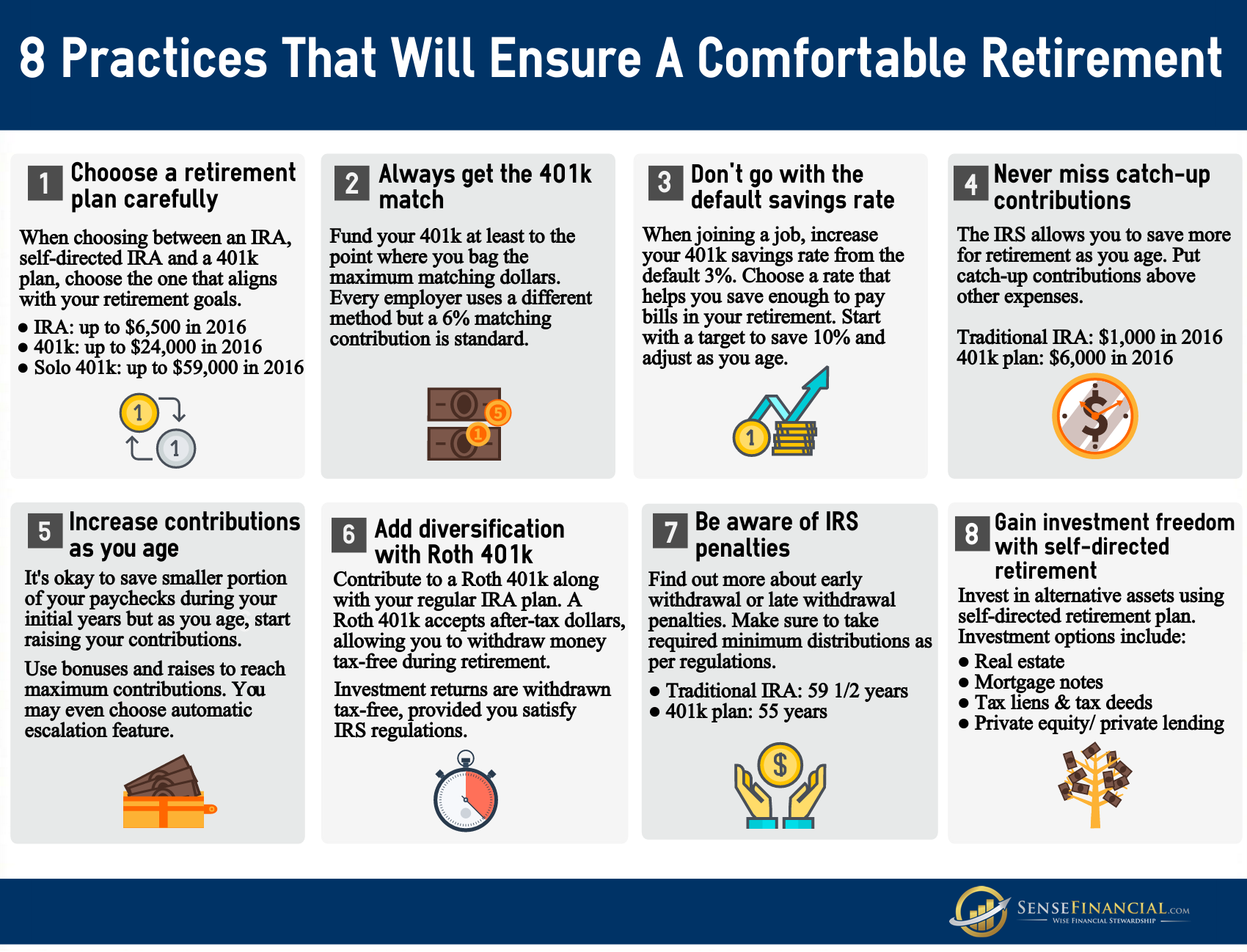

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to rollover an old 401 into an IRA, you will have several options, each of which has different tax implications.

C How Much Do You Need To Save Up

To calculate this amount on an annual basis, you will need to subtract expected government pensions from the annual expenses you calculated in Step A, and then multiply the remainder by 25 .

For example, a couple who estimate their annual retirement income needs to be $70,000 will need to save:

| Annual expenses in retirement from age 65 | $70,000 |

| How Much Do You Need To Save For Retirement? c | $985,975 |

a. Most individuals will not get the full government pension amount from OAS and CPP. The amount here reflects 70% of the maximum CPP amount for a couple in 2021 i.e. moderately conservative estimate. b. Line 1 minus line 2c. Derived by multiplying the annual income withdrawn by 25 or dividing by a 4% withdrawal rate . The result is the same for both formulas.

As shown in the table above, government pensions offset some of the savings required by the couple pre-retirement. The more government pension they qualify for, the less money required in their investment portfolio.

Additionally, if one or both partners have a defined benefit pension, it will further lower the amount of savings required to meet their desired retirement income.

Overall, to fund their preferred retirement lifestyle, the couple in the scenario above will need about $1 million in their retirement nest egg.

Related: CPP and OAS Benefits for Surviving Spouse and Children

Don’t Miss: How Do I Use My 401k To Start A Business

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but a few examples may offer food for thought.

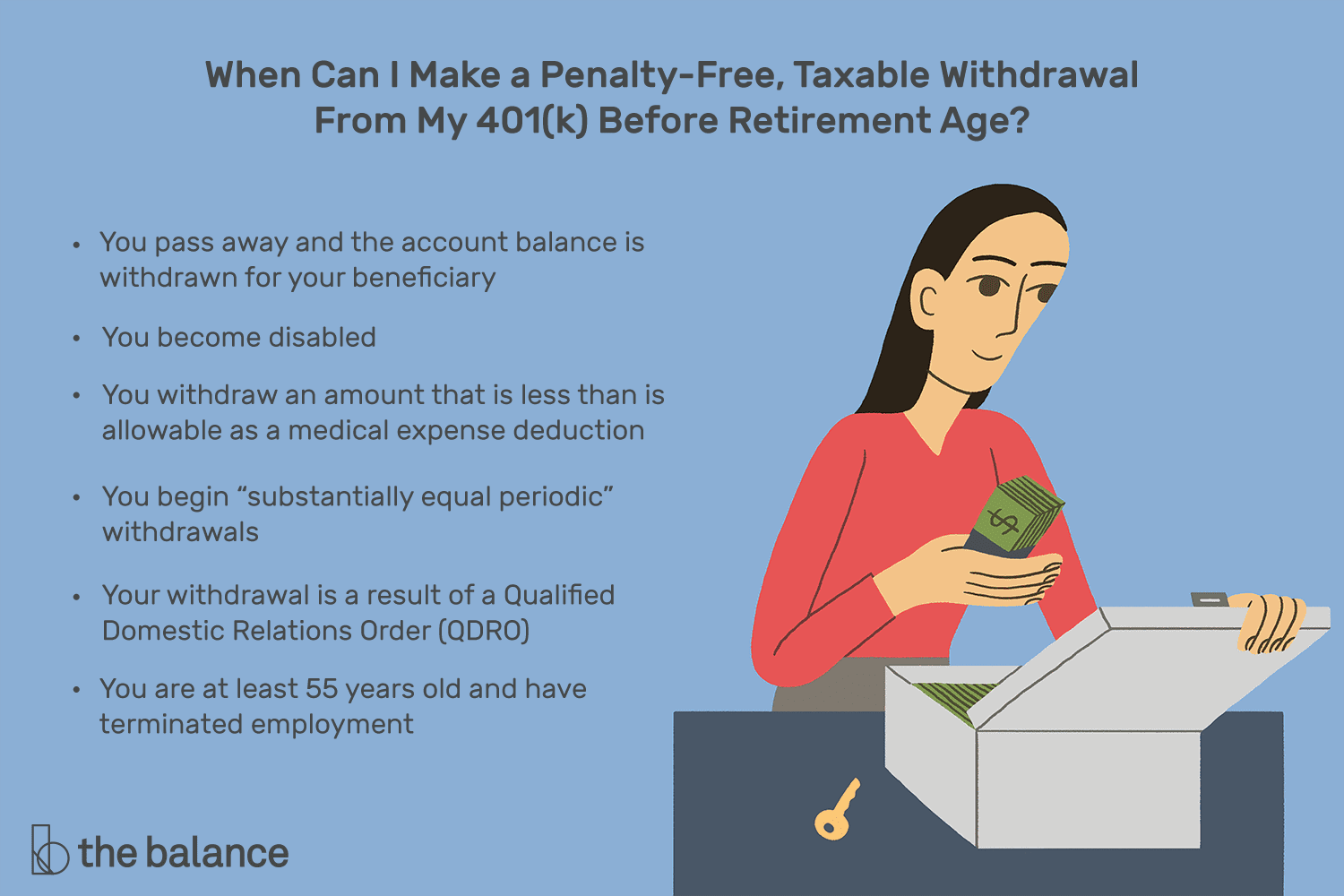

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Note: Some public safety workers can avoid early withdrawal penalties from a retirement plan as early as age 50. If you worked for a federal, state, or local government, be sure to explore your options.

Depending on state laws, money in IRAs might be treated differently, and a 401 might offer more protection . Federal law often applies to ERISA-covered 401 plans, while state laws cover IRAs. However, there is some federal protection for IRAs in bankruptcy. When you owe federal tax debts or assets are due to an ex-spouse, protection is usually limited.

Roth Conversions

RMD While Working

Stable Value Offerings

Fees and Expenses

See The World Or Your Corner Of It

Travel ranks near the top of a lot of what to do in retirement wish lists. Some retirees have a certain city theyve always wanted to visit. And for others, a more consistent schedule of travel is a lot more exciting.

You dont have to cross an ocean to have a great travel experience. You could travel through North America and never see it all. Even travel within your own state could yield experiences that you didnt know were there.

The life of a traveler is varied. Some people buy an RV, and some love to take a train. Of course flying will take you practically everywhere. As for lodging, retirees can get creative. Book hotels, if thats your thing. Or check out Airbnb, a service that connects travelers with private B & B experiences in the U.S. and around the world.

You might even consider becoming an Airbnb host and rent out your home while you travel the world letting your home pay for your adventures.

Here are 20 Ideas to Make Great Retirement Travel Your Reality

You May Like: Who Has The Best 401k Match

Investment Choices Can Be Limited

When you open an IRA, you’re generally given the choice to hand-pick stocks for your retirement portfolio. Doing so could help you grow a lot of wealth in your retirement plan, especially if you know how to research companies well.

With a 401, you generally can’t invest in individual stocks. That limits your choices and may create a situation where the options you’re presented with don’t align with your personal strategy or goals.

How You Want To Live In Retirement

In other words, do you expect your expenses to go down when you retire? We call that a below average lifestyle. Or will you spend as much as you do now? That’s average. If you expect your expenses will be more than they are now, that’s above average.

Let’s look at some hypothetical investors who are planning to retire at 67. Joe is planning to downsize and live frugally in retirement, so he expects his expenses to be lower. His savings factor might be closer to 8x than 10x. Elizabeth is planning to retire at age 67 and her goal is to maintain her lifestyle in retirement, so her savings factor is 10x. Sean sees retirement as an opportunity to travel extensively, so it may make sense for him to save more and plan for a higher level of retirement spending. His savings factor is 12x at age 67.

You May Like: When Can You Take Out 401k

What Can Change Your Retirement Income Needs

Calculating your income needs in retirement is not an exact science. Life happens and it may leave your retirement plan in tatters. Some possibilities include:

- Health issues that cause you to retire earlier than planned or which result in higher-than-expected medical bills early in retirement

- Financially dependent kids in retirement

- Divorce

- Significant mortgage payments

- Run-away inflation or a market crash, and much more.

If for one reason or the other, you are unable to save enough money for retirement at age 60, or 65, or earlier depending on what your plans were initially, the following strategies may be useful in managing your savings/income gap:

1. Work for longer and delay government pension till later: Working for a few more years and/or delaying when you start receiving OAS/CPP can significantly increase your eligible payouts down the road.

2. Semi-retire and work part-time: Every year you delay dipping into your retirement nest egg means more money to spend in the future.

3. Start saving aggressively: The earlier you start saving, the better for you. Time is the game-changer when it comes to the returns you are able to earn on your investment portfolio. If you are running out of time, you will need to put aside more funds more often.

6. Other Government safety nets: If your income in retirement puts you in the low-income bracket , you may qualify for additional government benefits, including the Guaranteed Income Supplement or the Allowance.

Other Sources Of Retirement Income

Home Equity and Real Estate

For some people in certain scenarios, preexisting mortgages and ownership of real estate can be liquidated for disposable income during retirement through a reverse mortgage. A reverse mortgage is just as it is aptly named â a reversing of a mortgage where at the end , ownership of the house is transferred to whoever bought the reverse mortgage. In other words, retirees are paid to live in their homes until a fixed point in the future, where ownership of the home is finally transferred.

Annuities

A common way to receive income in retirement is through the use of an annuity, which is a fixed sum of periodic cash flows typically distributed for the rest of an annuitant’s life. There are two types of annuities: immediate and deferred. Immediate annuities are upfront premiums paid which release payments from the principal starting as early as the next month. Deferred annuities are annuities with two phases. The first phase is the accumulation or deferral phase, during which a person contributes money to the account . The second phase is the distribution, or annuitization phase, during which a person will receive periodic payments until death. For more information, it may be worth checking out our Annuity Calculator or Annuity Payout Calculator to determine whether annuities could be a viable option for your retirement.

Passive Income

Inheritance

Also Check: Why Choose A Roth Ira Over A 401k

How To Transfer From Your 401 To An Ira

When youre ready to make the transfer, you need to do three things:

Unfortunately, you typically have to go through your former employer or a vendor they use. With many 401 plans, you cannot request a transfer using paperwork from the receiving IRA custodian.

Who to Contact

If you work for a large company, you can most likely contact your 401 provider directly. For example, contact Fidelity, Vanguard, or whatever website you use to manage your account. Alternatively, call whoever prints your 401 statements. If you work for a small company, you may need to contact the human resources department, which might just be the person who hired you. Either way, you eventually need one of the following:

A financial advisor like me can guide you through the process if you have questions.

What to Say

Where to Deposit

Indirect vs. Direct Rollovers

Impact Of Inflation On Pensions And Savings

The amount you get from public pensions, like the Old Age Security pension and Canada Pension Plan, is protected against inflation. This means as the cost of living goes up, the value of your benefit goes up as well.

Not all employer pensions are protected against inflation. Ask your pension administrator or employer whether your pension is protected against inflation.

Personal savings and investments, such as mutual funds or guaranteed investment certificates , are usually not directly protected against inflation. Your savings need to grow by at least the rate of inflation. If not, the amount of things your savings can buy in the future will be less than what they can buy now.

For example, something bought for $100 in 2002 would cost $129.92 in 2016. If your income isn’t protected against inflation, you may have a hard time maintaining your lifestyle in retirement as the cost of goods and services increases.

You May Like: How To Diversify 401k Portfolio

Withdrawing Money From A 401 After Retirement

Once you have retired, you will no longer contribute to the 401 plan, and the plan administrator is required to maintain the account if it has more than a $5000 balance. If the account has less than $5000, it will trigger a lump-sum distribution, and the plan administrator will mail you a check with your full 401 balance minus 20% withholding tax.

Before you can start taking distributions, you should contact the plan administrator about the specific rules of the 401 plan. The plan sponsor must get your consent before initiating the distribution of your retirement savings. In some 401 plans, the plan administrator may require the consent of your spouse before sending a distribution. You can choose to receive non-periodic or periodic distributions from the 401 plan.

For required minimum distributions, the plan administrator calculates the amount of distribution for the qualified plans in each calendar year. The 401 may provide that you either receive the entire benefits in the 401 by the required beginning date or receive periodic distributions from the required date in amounts calculated to distribute the entire benefits over your life expectancy.

Cautions On Early Retirement

Finances aside, there may be reasons to rethink retiring at 50. If you’ve always been a career-oriented person, a “type A” personality, or an over-achiever, and you have the funds to sustain an early retirement, you may want to think twice before retiring. You may find retirement enjoyable for a few months, but without a new project to work on, too much leisure time may become boring for you. Business owners and working professionals are those who are most likely to get bored in retirement.

Another thing to think about is your long-term health. In middle age, you may be vibrant and healthy, but in a few decades things might change. To have a successful early retirement, you should assume that your health needs and medical expenses will increase. To retire at 50, you need to account for the fact that your funds may need to cover 40 years of living expenses that won’t look the same as your current situation.

If your retirement fund has sufficient assets, and you wish to take money out without paying an early-withdrawal penalty, you may be able to set up 72 payments. This option allows you to access your retirement savings at any age without paying the early-withdrawal penalty.

You May Like: How To Check My Walmart 401k

Your 401 Savings And Your Desired Retirement Lifestyle

How you want to live out your golden years is another huge factor in what your 401 savings will need to look like. Thats because retirement has evolved over time to become a more active time of life. Its now viewed as a new beginning to our lives rather than a beginning of our end. That shift in mindset has driven the need for additional sources of retirement income.

The Employee Benefit Research Institute study on the Expenditure Patterns of Older Americans shows that as we age our expenses decline. Using age 65 as a benchmark, the study found that household expenses drop by 19% by age of 75 and 34% by age 85. The study also found that people over the age of 50 spend 40-45% of their budget on their home and home-related items. The bottom line is that by the time we retire our expenses are down between 20% and 40%. This is why expert opinions differ on how much of our pre-retirement income we need. Guidelines generally vary from 60% to 80%.

If you have a household income of $100,000 when you retire and you use the 80% income benchmark as your goal, you will need $80,000 a year to maintain your lifestyle. Assuming your 401 savings grow at 8%, you should expect to have up to $80,000 a year in interest income so you can avoid having to touch your principal as much as possible.

How To Invest Without A 401

Fortunately, you do have some alternatives if your company does not offer a 401 plan or a good one. For example, anyone with earned income can access an IRA and those with their own business even a side gig have alternatives, too.

If your employers retirement plan doesnt measure up, here are eight investing alternatives to consider:

Read Also: Should I Roll 401k To Ira

Indirect Rollovers Can Be Complicated To Manage

With an indirect rollover, you receive a check for the balance of your account that is made payable to you. That might sound good, but as a result, you are now responsible for getting it to the right place. You have 60 days to complete the rollover process of moving these assets to your new employer’s plan or an IRA.

If you dont complete the rollover within this 60-day window, you will owe income taxes on the amount you failed to roll over. If you’re under 59 1/2, you will also face a 10% penalty tax. Indirect rollovers can be made once a year.

Your old employer is required to withhold 20% from your distribution for federal income tax purposes. To avoid being taxed and penalized on this 20%, you must be able to get enough money from other sources to cover this amount and include it with your rollover contribution.

Then, youll have to wait until the following year, when you can file your income tax return to actually get the withheld amount back.

Suppose the 401 or 403 from your prior employer has a balance of $100,000. If you decide to take a full distribution from that account, your prior employer must withhold 20%. That means they keep $20,000 and send you a check for the remaining $80,000.

Even if you have an extra $20,000 on hand, you still must wait until you file your income tax return to get the withheld $20,000 returnedor a portion of it, depending on what other taxes you owe and any other amounts withheld.