Your 401 Account May Be Frozen

The IRS sets the basic guidelines on 401s, but employers can set further limitations with their plans.

One of the powers 401 administrators have is placing âfreezesâ on the 401 plans they manage.

An employer can freeze your 401 for many reasons. Pending litigations against the plan, company mergers, or changes in who manages the 401 plans can all cause your 401 to be frozen. Legally, your plan’s administrator must provide a 30-day notice beforehand to give participants enough time to make arrangements.

You will be unable to contribute new funds and will be unable to withdraw any funds. However, if you are already receiving required minimum distributions, you are required to receive them. If you are not, document your requests for them to avoid any IRS penalties.

How Much Of Your 401 Do You Get When You Leave An Employer

This one is definitely a 401 FAQ that many people wonder about. You are entitled to 100 percent of any contributions youve made into the plan, and how much of any employer match you are entitled to is based on how the plan is set up. A vesting schedule is based on the length of time required to have ownership in the employers contributions. If you are 100 percent vested in employer contributions you will receive all of the money the company has contributed on your behalf.

If you have not been with the company for the required amount of time you may receive a percentage of employer contributions, again based on the plans vesting schedule. The rest of the money set aside for you is forfeited back to the company for uses prescribed in the plan documents. Most 401 providers delineate how much of your balance is fully vested. If youre not sure, you can always call to inquire.

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be an expensive proposition because of the hefty penalties they carry under many circumstances.

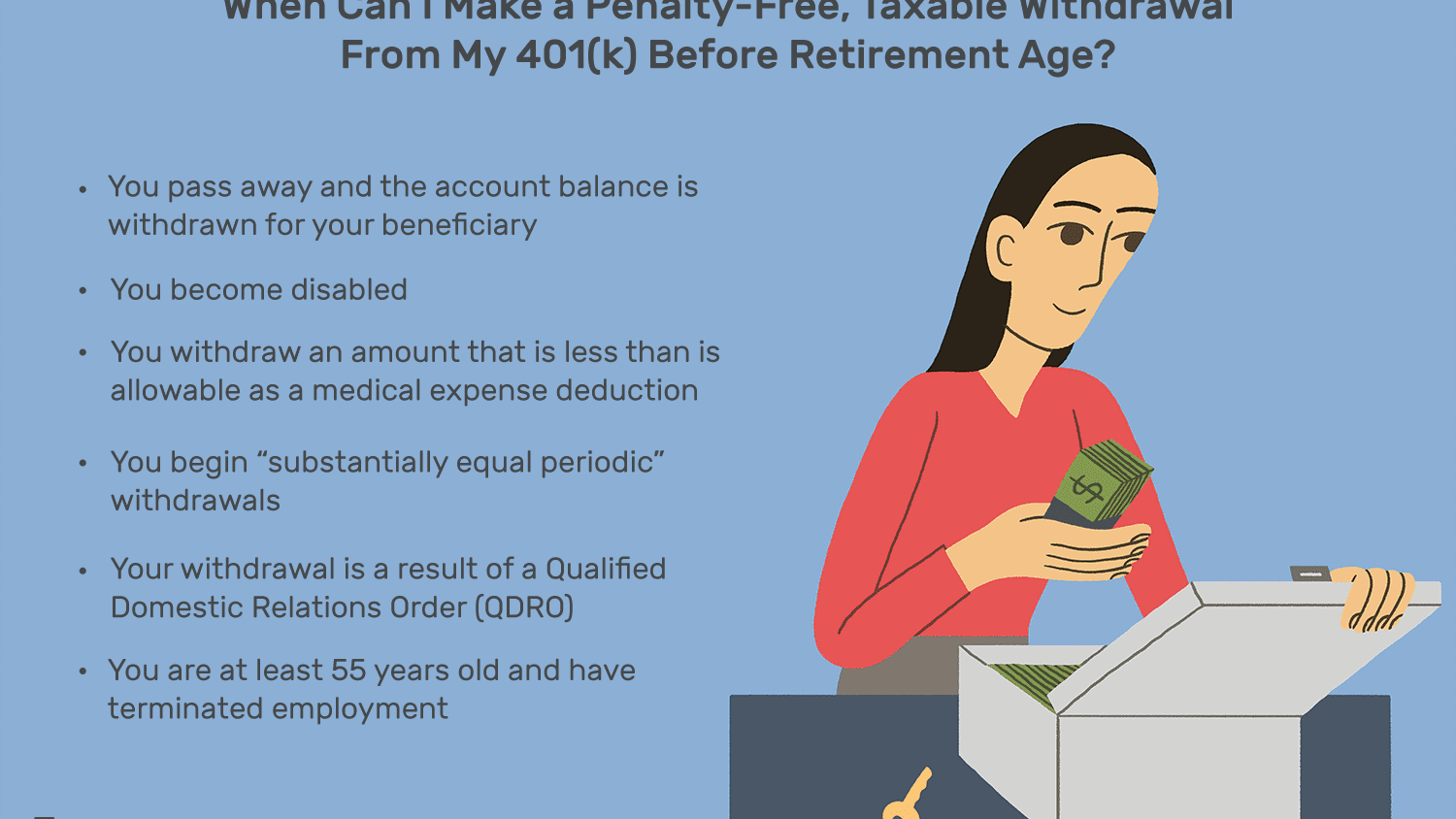

The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72 . There are some exceptions to these rules for 401ks and other qualified plans.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement. The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, you can use this calculator to determine how much other people your age have saved.

Also Check: How Do I Transfer 401k To New Employer

Roll It Over To Your New Employer

If youve switched jobs, see if your new employer offers a 401 and when you are eligible to participate. Many employers require new employees to put in a certain number of days of service before they can enroll in a retirement savings plan.

Once you are enrolled in a plan with your new employer, its simple to roll over your old 401. You can elect to have the administrator of the old plan deposit the contents of your account directly into the new plan by simply filling out some paperwork. This is called a direct transfer, made from custodian to custodian, and it saves you any risk of owing taxes or missing a deadline.

Alternatively, you can elect to have the balance of your old account distributed to you in the form of a check. However, you must deposit the funds into your new 401 within 60 days to avoid paying income tax on the entire balance. Make sure your new 401 account is active and ready to receive contributions before you liquidate your old account.

Consolidating old 401 accounts into a current employers 401 program makes sense if your current employers 401 is well structured and cost-effective, and it gives you one less thing to keep track of, says Stephen J. Taddie, managing partner, Stellar Capital Management LLC, Phoenix, Arizona. Keeping things simple for you now also makes things simple for your heirs should they need to step in to take care of your affairs later.

Our Take: When Can You Withdraw From Your 401k Or Ira Penalty

There are a number of ways you can withdraw from your 401k or IRA penalty-free. Still, we recommend not touching your retirement savings until you are actually retired. Compounding is a huge help when it comes to maximizing your retirement savings and extending the life of your portfolio. You lose out on that when you take early distributions. To see how much compounding can affect your 401k account balance, check out our article on the average 401k balance by age.

We understand that its always possible for unforeseen circumstances to arise before you reach retirement. Being aware of the exceptions allows you to make informed decisions and possibly avoid paying extra fees and taxes.

To take control of your finances, a good place to start is by stepping back, getting organized, and looking at your money holistically. Personal Capitals free financial dashboard will allow you to:

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Don’t Miss: How To See How Much Is In My 401k

Option : Roll Over Your 401 To Your New Employer

The most common route people take is rolling over their 401 to their new employer. Typically, this is done through a direct transfer or having your employer automatically transfer your 401.

Alternatively, you may opt for your employer to mail you a check for you to manually deposit into your new 401. The 60-day rule applies again here: If the funds arent deposited into a new 401 after this time, youll pay income tax on the entire balance.

Before transferring your funds to a new 401 plan, make sure you understand your new plans rules, fees, and investment options. Look into your new companys 401 matching program, if there is one. Make sure youre making the most of your new 401 plan by knowing all your options and seeing if your new plan is better or worse than what was available at your previous employer.

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so it’s important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts you’re considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

You May Like: How To Look Up An Old 401k Account

Rollover Your 401 Into An Ira

If you leave a job, you have the right to move the money from your 401k account to an IRA without paying any income taxes on it. This is called a rollover IRA.

If you decide to roll over your money to an IRA, you can use any financial institution you choose you are not required to keep the money with the company that was holding your 401.

Ask the mutual fund company, bank or brokerage that will manage your IRA for an IRA application. Make sure your former employer does a direct rollover, meaning that they write a check directly to the company handling your IRA. If they write the check to you, they will have to withhold 20% in taxes.

Scenario : Monthly Pension

If you receive distributions as a monthly pension, you should check about the status of a tax treaty between the US and your home country. In most cases, you will only have to pay taxes in the country where you are a resident. If you have moved back to India, for instance, you only have to pay taxes in India when you receive your monthly 401 pension. However, you may still be required to file US tax returns. If there is no treaty between the US and your home country, the brokerage has to withhold 30% from the monthly distributions.

Since taxation rules and requirements differ from one country to another, it would be best to consult a tax advisor like MYRA prior to your move to help you create a strategy.

Related Article: When Is It Ok To Withdraw Money Early From Your 401?

Recommended Reading: How To Find Out If I Have An Old 401k

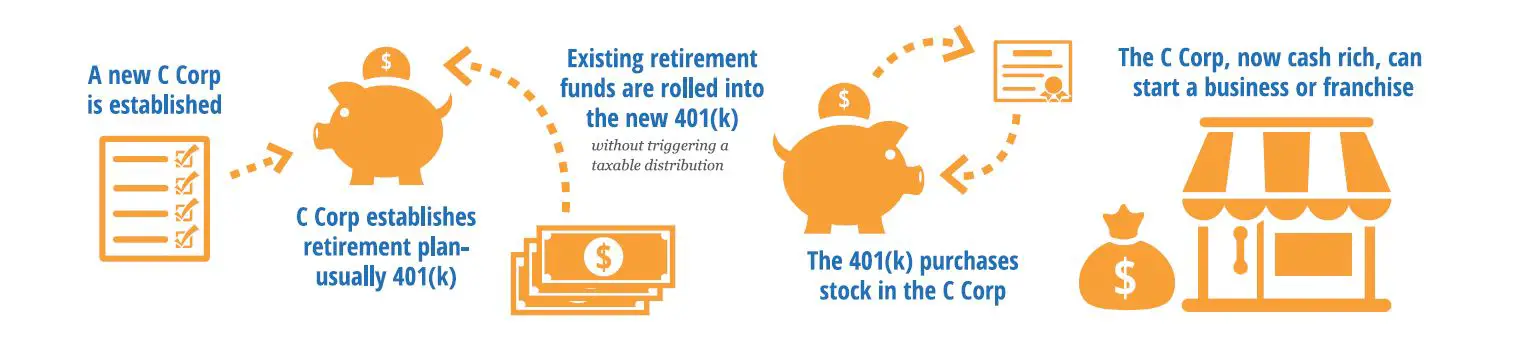

How To Use Your 401 Fund Your New Business

If your business requires less than $50,000 to start and you have a solid repayment plan, borrowing your businesss startup funds from your 401 may prove a viable option.

Borrowing money from your 401 to start a business may be a useful and effective option, as long as you understand the risks and implement a repayment plan.

Considering using your 401 to start a business? According to Fidelity Investments, the average retirement account balance is at an all-time high, and the number of 401 millionaires continues to grow. Thats a lot of cash invested in the markets. For some entrepreneurs, financing a business launch is an equally savvy way to grow those retirement dollars.

Depending on the amount of money youve put aside and the amount you need, there are two ways to leverage your retirement savings and bootstrap your business.

Borrowing from your 401 may be the answer if:

Withdrawals After Age 72

Many people continue to work well past age 59 1/2. They delay their 401 withdrawals, allowing the assets to continue to grow tax-deferred. But the IRS requires that you begin to take withdrawals known as “required minimum distributions” by age 72.

Those who are owners of 5% or more of a business can defer taking their RMDs while they’re still working, but the plan must have made this election. This only applies to the 401 of your current employer. RMDs for all other retirement accounts still must be taken.

Don’t Miss: How To Find Out If Someone Has A 401k

More From The New Road To Retirement:

Here’s a look at more retirement news.

Also be aware that if your balance is low enough, the plan might not let you remain in it even if you want to.

“If the balance is between $1,000 and $5,000, the plan can transfer the money to an in the name of the individual,” Hansen said. “If it’s under $1,000, they can cash you out.

“It’s up to the plan.”

Your other option is to roll over the balance to another qualified retirement plan. That could include a 401 at your new employer assuming rollovers from other plans are accepted or an IRA.

If under $1,000, they can cash you out. It’s up to the plan.Will HansenExecutive director of the Plan Sponsor Council of America

Be aware that if you have a Roth 401, it can only be rolled over to another Roth account. This type of 401 and IRA involves after-tax contributions, meaning you don’t get a tax break upfront as you do with traditional 401 plans and IRAs. But the Roth money grows tax-free and is untaxed when you make qualified withdrawals down the road.

If you decide to move your retirement savings, you should do a trustee-to-trustee rollover, where the transfer is sent directly to the new 401 plan or IRA custodian.

Also, while any money you put in your 401 is always yours, the same can’t be said about employer contributions.

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived.

Read Also: Can I Buy A Business With My 401k

What Happens To Your 401 After You Leave A Job

It’s becoming increasingly common for professionals to switch jobs several times throughout their working careers, meaning that most people have to decide what to do with 401 after leaving the job. When you switch jobs or get laid off, you have to evaluate your options on what do you with your 401 account.

After leaving your current job, you have up to 60 days to decide what happens to your retirement savings. Otherwise, your savings will be automatically transferred to another retirement account. In most cases, employers have clear guidelines indicating what you can do with your 401.

What Happens To Your 401 When You Leave

Since your 401 is tied to your employer, when you quit your job, you wont be able to contribute to it anymore. But the money already in the account is still yours, and it can usually just stay put in that account for as long as you want with a couple of exceptions.

First, if you contributed less than $5,000 to your 401 while you were with that employer, theyre legally allowed to tell you, Your money doesnt have to go home, but you cant keep it here. . If you contributed less than $1,000, they might just mail you a check for that amount in which case you should deposit it into another retirement account ASAP so that you dont get hit with a penalty from the IRS . If you contributed between $1,000 and $5,000, your employer might move your money into an IRA, which is called an involuntary cashout.

Also, if you had a 401 match, then you only get to keep all of that money if the contributions had fully vested before you left. If not, your employer would get to take back any unvested contributions.

Also Check: Can I Move My 401k To An Ira

Rollover Your Old 401k Money Into A New Ira

Known as a rollover IRA, this type of IRA is designed to accept the transfer of assets from a former employers 401k. If your new employer doesnt offer a 401k or youre not pleased with the plans costs or investment options, this is probably your best option because it will give you the most flexibility and control to stay on track with your retirement savings goals. In fact, this is what we generally recommend to our clients who have old 401ks. IRAs generally have more investment options, no plan fees, and greater withdrawal flexibility.

In order to execute a rollover IRA, your first step is to open a new IRA with an investment advisor or financial institution. The rollover process is similar to the one described above except that you will instruct the administrator of your former employers 401k to transfer plan assets directly into your new rollover IRA.

Conversely, you can have a check sent directly to you, but make sure that the check is made payable to your IRA custodian for benefit of your name. The former plan administrator will withhold 20% of the amount for the payment of taxes and you will have 60 days to deposit the full balance, including the 20% withheld, into your rollover IRA. Failure to deposit the entire amount into your new IRA could result in current tax liabilities plus a 10 percent penalty if youre under age 59½.

Limited Access To Your 401 After You Leave

Although your former employer cannot refuse to give you your 401 funds without just cause after you leave, you can find yourself unable to access them.

As mentioned before, if you have an outstanding 401 loan when you leave your job, you may be required to pay back the full balance of the loan within 60 days.

Employers can refuse access to your 401 until you repay your 401 loan.

Additionally, if there are any other lingering financial discrepancies between you and your former employer, they may put on your 401 hold.

Read Also: How To Find 401k From An Old Employer

Circumstances When You Can Withdraw From A 401k If You Have An Outstanding Loan

Each 401 plan has different rules on 401 loans and 401 withdrawals. If your employerâs 401 plan allows employees to tap into their retirement money, you may be required to provide some proof to document that you are in an urgent financial need to get approved. The approval process is rigorous since allowing frivolous withdrawals puts the 401 plan at risk of losing its tax-favored status.

Some of the circumstances when you could withdraw money from your 401 plan if you have an unpaid loan include:

Roll Over 401 If You Have an Outstanding Loan

If you terminate employment with an outstanding 401 loan, you can rollover the money to an IRA or new employerâs 401. As long as the loan repayment was in good standing, the employer will rollover your retirement money net of the outstanding 401 loan. You will have until the tax due date to pay off the 401 loan balance.

For example, assume that you have a $50,000 vested 401 balance, including an outstanding 401 loan of $15,000. If you quit your job and request the plan sponsor to rollover the retirement savings to your new IRA, the plan sponsor will reduce the vested 401 balance by the $15,000 outstanding loan, and disburse the remaining $35,000 to your IRA. You will then have until the tax due date to come up with the $15,000 outstanding loan, after which you can rollover the $15,000 401 balance to your IRA.

Cash out 401 with an Outstanding Loan

Take a Second loan with an Outstanding Balance

Tags