Dont Bail Out Too Soon

Along with starting early, sticking with it is key to retirement saving success. One of the mistakes many people make is to cash out of their retirement accounts when they change jobs. Research by the Employee Benefit Research Institute shows that it typically takes 13 years or more of contributions to an account before you begin to reach a level of savings that is enough to fund a number of years of retirement as a supplement to Social Security. So be sure to roll over your account if you change jobs. And dont under-estimate the amount you need to retire. Take the earlier example. Most experts would not consider even the $191,000 saved through 44 years of regular $100 monthly contributions to be enough to retire on in comfort.

If you are approaching your planned retirement age and your savings fall short of what you need, keep working. After all, it is better to keep working than to run out of money in mid-retirement. Besides, every added year you work is one more year of saving and one less year of living off your savings a double bonus. For additional information, see the American Savings Education Council Web site at www.asec.org.

How Much Does It Cost To Set Up A 401 For A Small Business

Costs to set up a 401 plan will vary depending on the size of your business and the types of benefits you select. Initial setup fees can generally run anywhere from $500 to $3,000, depending on the chosen retirement service provider. Other costs to consider are fees associated with rolling assets over from another plan and initial consulting costs for investment advice.

Roth 401 Vs Traditional 401

Most people are familiar with how traditional 401 retirement plans work: An employee contributes pre-tax dollars and can choose from a variety of investment options. Then, contributions and potential earnings grow tax-deferred until they’re withdrawn, usually in retirement.

With a Roth 401, the main difference is when the IRS takes its cut. You make Roth 401 contributions with money that has already been taxedjust as you would with a Roth individual retirement account . Any earnings then grow tax-free, and you pay no taxes when you start taking withdrawals in retirement.1

Another difference is that if you withdraw money from a traditional 401 plan before you turn 59½, you pay taxes and may potentially owe a 10% penalty on the entire distribution.2 With a Roth 401, your non-qualified withdrawals are a pro-rata amount of your contributions and earnings, and you may potentially be subject to the 10% early withdrawal penalty on funds that are considered gross income.3

One similarity between Roth and traditional 401s is that you must start taking required minimum distributions once you reach age 72 to avoid facing a penalty. However, you can get around this requirement when you retire by rolling your Roth 401 into a Roth IRA, which has no RMDs.4 This way, your assets have the opportunity to grow tax-free, and if you pass down your IRA to your heirs, they won’t have to pay taxes on distributions either.

Read Also: Can I Sign Up For 401k Anytime

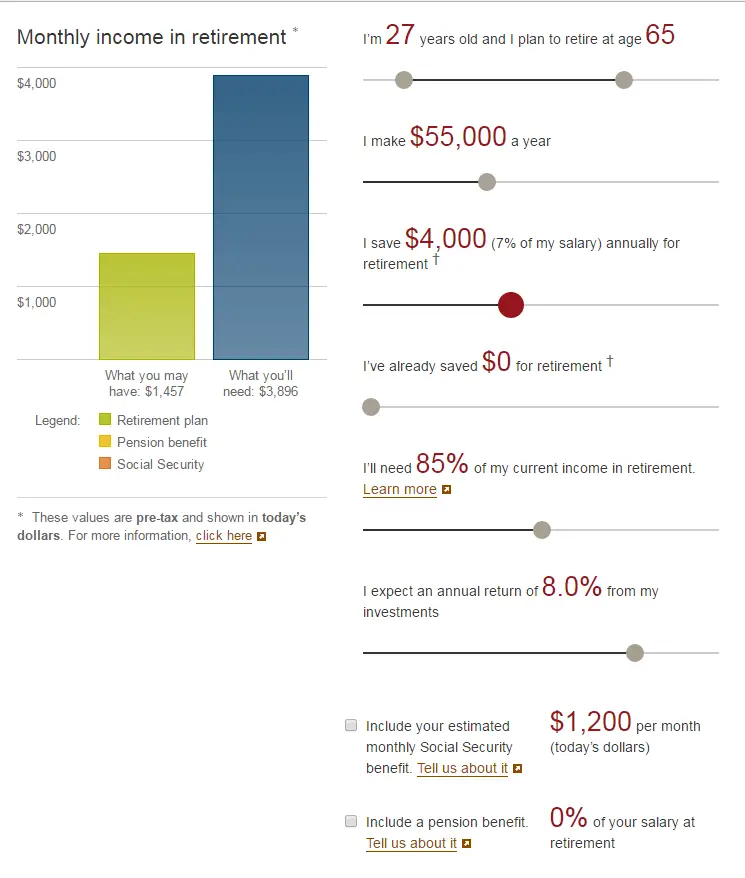

How Much Should I Invest

When deciding how much to invest, youll obviously have to think about your budget and your income. But there are a couple of other points to consider:

Employer match

Again, your employer is basically giving you money, so want to take advantage of that as much as you can. The Art of Manliness shows just how much you can earn with an employer match:

Lets say you make $50,000 a year and your employer says it will match you $1 for every dollar you contribute to your 401 on the first 5% of your salary you invest. You decide to save 10% of your salary in your 401. Thats $5,000 that YOU contribute out of your pocket to your 401.

Now here comes your employers contribution. It matches your contribution dollar for dollar up to 5% of your salary. That means your employer will contribute $2,500 to your account. Thats $2,500 of FREE money and a 50% return on your initial investment of $5,000.

The more you can take advantage of this, the better. But at least consider contributing the minimum amount thats required to make you eligible to receive a match.

Contribution limits

There are limits to how much you can save in your 401. In 2020, you can contribute no more than $19,500 out of pocket for the year . If youre over 50, the limit is $26,000.

But if you have an employer match, you can save more than your individual limit. The maximum combined contributionthe amount you save with your employers matchis $57,000. For those over 50, that amount of is $63,500.

What’s The Bottom Line About 401s

Ultimately, a 401 plan could be the right method of saving if you want to reach your retirement goals on time and not sweat finances too much. 401 plans are advantageous for many Americans, so consider contributing to one if you haven’t already.

That said, 401 plans are just one of the retirement options you can pursue. IRAs and other retirement plans might be better, depending on your circumstances.

Looking for more info to expand your financial and professional knowledge? Explore Entrepreneur’s Money & Finance articles here.

Don’t Miss: What Is The Tax Rate On 401k Withdrawals

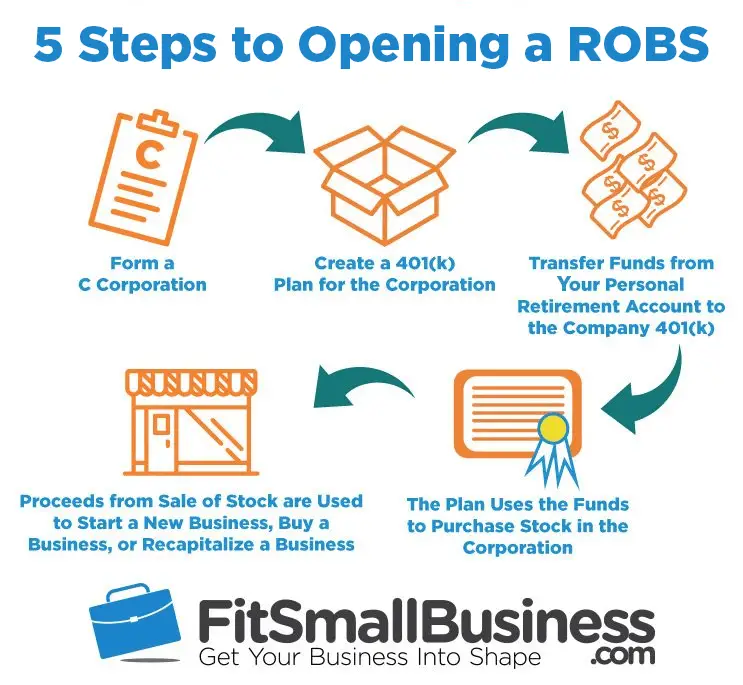

How To Set Up A 401 Plan

Now that you know the landscape, youre ready to set up a plan as an employer or self-employed individual. Whether youre establishing a plan for a large enterprise or or on your own the next steps are:

- If youre self employed, decide if you want a SoloK, SEP, or SIMPLE.

- Decide which plan provisions you want , Safe Harbor, matching, vesting schedules?).

- Choose a vendor .

- Complete the adoption agreement along with other agreements and submit to your vendor.

- Communicate and educate: Inform employees of the plans existence and features.

- Set up individual participant accounts.

- Fund the plan through payroll or any employer contributions.

- Review the plan regularly to ensure its meeting the needs of plan participants.

- Monitor and adjust the plan as regulations change and your needs evolve.

- Provide required information to participants on an ongoing basis.

What If I Dont Have Access To A 401

If you work for an employer that does not offer a 401, you do have other options for saving for retirement. Maxing out your Traditional IRA or Roth IRA each year is a great start. The maximum for 2023 is $6,500 per year, which is much lower than most people need to set aside to have a secure retirement. That doesnt mean you have to stop saving. You can add money to a taxable brokerage account with the intention of saving those funds for retirement. This account wont have the same tax-deferred or tax-free options that a retirement account has, but it can still be a solid way to save and invest for your future.

If your employer is open to a discussion about offering a 401 to their employees, bring it up. They may not know how easy it can be. Many employers dont know that the business can receive tax benefits for offering a 401 to employees. It can also be a great retention tool to keep great employees when the company offers employee benefits. There are many reasons a company might want to consider starting a plan, and the employer may just need some information and a nudge to get the ball rolling.

You May Like: How Do I See How Much Is In My 401k

How To Open A Roth Ira

In 2023, you can contribute $6,500 a year to your Roth IRAor $7,500 if youre 50 or older.2 You can choose from thousands of mutual funds, making it easy to spread out your investments evenly among the four categories we recommend: growth, growth and income, aggressive growth, and international.

You could open a Roth IRA through an investment company, bank or brokerage. But the best way to open an account is with an experienced investing pro who will act as a teacher and a guide. Remember, you should never invest in anything you dont fully understand. Check out SmartVestor to find a pro in your area who can walk you through each step.

How A 401 Benefits Employers:

Attract and retain top talent:

40% of employees working for small businesses say that they would leave their current company for one that offers a 401K.

Not only can 401s lure great employees away from other companies, but they can also lure them directly to you! Providing employment benefits to employees is much more than a gimmick, it is a benchmark that employees gravitate to and take action on. Taking advantage of this fact by implementing your own 401 program can have a positive impact on the ongoing development of your team.

Tax Benefits:

By now you have probably heard about the tax benefits of this form of retirement savings account but you may not know that businesses can reap tax rewards by sponsoring 401 plans. According to the IRS the there are two advantages to utilizing these plans in your business.

The first advantage is that employers are allowed to deduct their contributions to 401s on their tax returns. This is allowed as long as contributions do not exceed set limits which can be found in section 404 of the Internal Revenue Code or on page 15 of the IRSs Publication 560 .

Less risky alternative to pensions:

If youre considering whether you should offer employees a pension or a 401, you may want to consider the benefits of sponsoring a 401. With a pension a majority of the risk falls on the provider because they are offering a set amount of retirement income without involving the employee in the management of the account.

Recommended Reading: How To Transfer 401k To New 401k

Qualified Distributions Are Allowed At Age 59

A 401 plan is an employer-sponsored retirement account that allows employees to contribute a portion of their salary before IRS tax withholding. Companies commonly match a percentage of the employee’s contribution and add it to the 401 account.

Before age 59½, an employee faces an IRS penalty if they withdraw money from a 401 account. The IRS allows penalty-free withdrawals, called qualified distributions, from retirement accounts after age 59½.

At that time, individuals are also permitted to convert their company-sponsored 401 into a more flexible individual retirement account . Withdrawals from a 401 are mandated after age 72 and are called required minimum distributions, or RMDs.

Can I Set Up A 401 Without An Employer

Unfortunately, no. You cannot set up a 401 plan for yourself. You can only access a 401 through an employer-sponsored plan. If you are a sole proprietor, working as a freelancer or consultant for example, you may be able to set up a for yourself. If you own your own business and only have you or you and your spouse as the employee, thats when the solo 401 can be a great tool.

Also Check: Where To Invest 401k Money Now

How To Set Up A 401k For A Small Business

Setting up a 401 for your small business includes some crucial steps, some of which can be outsourced. It’s important to remember that the employer maintains a fiduciary duty to ensure that the plan is providing a benefit to participants. The U.S. Department of Labor provides in-depth details of the process:

1. Create a 401 plan document

Create a plan document that complies with IRS Code and outlines the details of your retirement plan. Set up procedures to ensure the document is followed.

2. Set up a trust to hold the plan assets

A plan’s assets must be held in trust to assure its assets are used solely to benefit the participants and their beneficiaries. At least one trustee must handle the plan’s activities regarding contributions, plan investments, and distributions. Given that these decisions affect the plan’s financial integrity, selecting a trustee is a critically important decision. Another fiduciary, such as the employer who sponsors the qualified retirement plan, will generally assign the trustee.

3. Maintain records of 401 employee contributions and values

Maintain accurate records that track employee contributions and current plan values. Many small businesses choose to work with a 401 recordkeeper to help them manage plan setup and ongoing record management.

4. Provide information to plan participants

How Long Does It Take To Set Up A 401

Theres no set timeframe for establishing a 401. It really depends on how long it takes you to complete the steps we just discussed. For many businesses, it typically takes less than 60 days.

One way you can speed and streamline the process is to partner with a 401 third party administrator to handle a lot of the tasks for you and take some of the responsibility off your plate. As you evaluate potential partners, youll want to ask how easy it is to get your plan up and running and whats required of you during the process.

For example, all providers will ask you to fill out some documents but find out if you will get a dedicated point of contact to help you navigate the tasks involved and ensure you correctly complete the forms.

Youll also want to ask if they offer automatic enrollment for a hassle-free onboarding process that also increases participation. To make it even easier on your employees, find out whether the interface theyll be using is simple and intuitive for tasks like monitoring their account or making changes to their salary deferrals.

Don’t Miss: How To Fund A Solo 401k

Consider The Roth Option

Most 401 plans now allow investors to choose whether they want to contribute to a traditional 401 or a Roth 401.

Contributions to a Traditional 401 go in tax-free and grow tax-free, but youll pay taxes on withdrawals in retirement. For a Roth 401 contributions go in after-tax, but youll owe no taxes on growth or future withdrawals.

In general, the Roth option makes sense for those who think theyll be in a higher tax bracket in retirement, either because they have more income or because tax rates have gone up. If youre not sure, splitting your contributions across the Roth and traditional 401 can provide you with more flexibility later.

What If You Leave Your Job

Fortunately, your 401 plan does not disappear when you leave your employer. Many â if not most â companies allow you to transfer your 401 plan if you switch jobs.

However, switching employers does mean that you may have a slightly different 401 plan and rules to follow. For instance, one employer may match your contributions up to 3%, while another may only match your contributions up to 2%.

You should carefully read the fine print when deciding to switch employers because it can impact your retirement plan.

You can also continue contributing to your 401 account even if you switch to a new employer or stop working for employers that offer 401 matching entirely.

Read Also: Where Can I Find My 401k Balance

Employee And Employer Combined

Regardless of whether contributions to your 401 come from you and/or from employer matching, all deferrals are subject to an annual contribution limit dictated by the Internal Revenue Service . For 2022, the total contribution amount allowed for all 401 accounts held by the same employee is $61,000, or 100% of compensation, whichever is less. For 2023, this limit rises to $66,000.

Irc 401 Plans Establishing A 401 Plan

When you establish a 401 plan you must take certain basic actions. For instance, one of your decisions will be whether to set up the plan yourself or consult a professional or financial institution – such as a bank, mutual fund provider, or insurance company – to help you establish and maintain the plan.

You May Like: How To Pull Money Out Of My 401k

Roth And Traditional Iras

Often the first thing advisors recommend to those who don’t have an employer-sponsored 401 is opening a Roth individual retirement account, where you’d set up your own contributions with after-tax dollars.

“I love the Roth IRA for young investors,” said Tess Zigo, a certified financial planner at Emerge Wealth Strategies in Lisle, Illinois, adding that this is because young people are usually in a lower tax bracket early in their careers than they will be later.

Saving money in a Roth IRA means the funds will grow tax-free, meaning you don’t have to pay anything to withdraw the money in retirement. People using a Roth IRA can also put away a nice chunk of money each year. In 2021, the total you can save in a Roth IRA is $6,000, or $7,000 if you’re 50 or older.

More from Invest in You:10 work-from-home jobs that pay six figures

Of course, there are some limits. In 2021, your modified adjusted gross income must be less than $140,000 for single filers and $208,000 for those married filing jointly in order to qualify.

If you have taxable compensation, you could also save for retirement in a traditional IRA, which allows you to defer taxes, similar to a 401. This makes sense if you are in a higher tax bracket now than you will be later. In 2021, the contribution limit for a traditional IRA is $6,000 or $7,000 if you’re 50 or older.

How Many Employees Do You Need To Have A 401 Plan Can Small Businesses Even Offer A 401

Lets get this out of the way. Yes, any size business can offer a 401 plan. Traditionally, 401 providers charged small and mid-sized businesses exorbitant fees or ignored them altogetherleading millions of smaller businesses out in the cold without an easy way to offer meaningful retirement benefits. Guideline is changing that by offering small businesses an easy, affordable 401.

Recommended Reading: How To Take Money From 401k Without Penalty