Deadline To Set Up And Fund

- For taxable years 2020 and beyond, individual 401 plans may be set up by tax filing deadlines plus extensions. Note: It can take 30 or more days to establish a plan.

- Salary deferral portion of the contribution must be deducted from a paycheck prior to year end, with some exceptions for certain business structures.

- Business owner contribution may be made up through the business tax filing due date plus extensions.

Things To Consider When Opening A Solo 401k

If you’re considering opening a solo 401k, there are a few things to consider when it comes to plan features.

There are five key areas that you need to decide before you open your solo 401k:

Everyone who opens a solo 401k will have different requirements. However, I would recommend you open a solo 401k plan with the most options and flexibility. While you can always amend your plan documents, it can be a hassle and can cost you money . As such, it makes sense to create a solo 401k plan with the most options up front.

What Are The Pros And Cons Of A Solo 401

One of the biggest benefits of opening a solo 401 is that it comes with some of the highest contribution limits. Since you can make contributions as an employer and an employee, you can maximize your contributions.

And while you do have to be self-employed to open a Solo 401, it doesn’t have to be your only source of income. If you have a full-time job and consult on the side, you’re eligible to open a solo 401.

You can also choose from a much broader range of assets than you can with a traditional employer-sponsored 401. For instance, you can invest in index funds, mutual funds, exchange-traded funds , stocks, and bonds.

However, there are some downsides you should consider. Like most retirement plans, you’ll get hit with taxes and fees if you withdraw the funds before the age of 59½.

“One disadvantage is that you must have a triggering event, usually retirement or ending employment, to take a distribution,” says deMauriac.

And you’re responsible for managing the plan and handling the paperwork on your own.

|

Pros |

|

|

|

You May Like: What Happens If I Quit My Job With A 401k

Lets Talk About Your Financial Future

Schedule a one-on-one session with an expert alternative investment counselor. Were here to answer any questions, help guide you through the process, and provide more detailed information and education specific to your journey.

Equity Trust Company is a directed custodian and does not provide tax, legal or investment advice. Any information communicated by Equity Trust Company is for educational purposes only, and should not be construed as tax, legal or investment advice. Whenever making an investment decision, please consult with your tax attorney or financial professional. Equity Institutional services institutional clients of Equity Trust Company. Brokerage Services Available Through ETC Brokerage Services, Member SIPC, and FINRA. *Founded in 1974 | Self-Directed IRA Custodian since 1983. The predecessor business to Equity Trust Company was established in 1974 and the IRS approved as a custodian in 1983. **Assets under custody as of 8/31/2021.

Before Converting There Are A Few Things To Consider:

- You cannot recharacterize. Understand your tax situation and ability to pay for the conversion because a Roth conversion cannot be recharacterized.

- The availability of funds to pay income taxes. The benefits of a conversion are increased if the income taxes due can be paid out of non-retirement assets.

- To help manage your tax liability, you may choose to convert just a portion of your assets. There is no limit to the number of conversions you can do, so you may convert smaller amounts over several years.

You May Like: How Can I Find My 401k

Solo 401 Pros And Cons

At some point in everybodys life, you contemplate the dilemma of what retirement plan best suits your needs. Today, there are over 50 million individual retirement accounts. However, that doesnt necessarily mean the IRA is the right retirement strategy.

Determining whether you can enhance your retirement savings with a Solo 401 or self-directed 401 plan) completely depends on whether you are self-employed and have a business.

There are a number of significant advantage to establishing a Solo 401 over an IRA.

How We Chose The Best Solo 401 Companies

To choose the best solo 401 companies, we looked at 10 top providers of solo 401 accounts. In evaluating providers, we focused on pricing, investment options, account features, and trading platforms.

Pricing and fees were the single biggest factor considered, followed by investment choices. The ability to make Roth contributions or take out a 401 loan was the third major factor considered, as they may be less important to some investors. Account trading platforms, both online, desktop, and mobile, were also considered but carried less weight, as they are not as important to the typical retirement account investor.

Read Also: What’s The Max You Can Put In A 401k

Other Financial Benefits Of A Solo 401

The solo 401 can be an excellent choice for those with a side gig as well, especially if theyre already able to live comfortably on their main salary. With the solo 401 you can go above the usual limits of a 401.

While you may contribute to multiple 401 accounts, your total employee contribution to all types of 401s may not exceed the annual maximum contribution, that is, $19,500 in 2020 and 2021.

But the solo 401 can be valuable even if you already have a 401 plan and even if youve maxed out that other plan for a given year. Thats because you can still make an employer contribution, allowing you to exceed the smaller employee-only contribution amount. So the solo 401 allows you to save more with the employer contribution, reducing your business taxes.

Another benefit of the solo 401 is that it doesnt prevent you from taking advantage of other retirement plans such as the IRA. You can still contribute up to the annual maximum there. If youre an individual looking to set up a traditional IRA or Roth IRA, then youll want to look at the benefits of those plans.

Like the typical 401 plan, the solo 401 also allows you to take out a loan against your account. loan.)

While I generally encourage clients to avoid that strategy, it can come in handy at times, Conroy says.

What Paperwork You Need To Fill Out To Open Your Account

I was surprised at how much paperwork is required to open a solo 401k account. You’d think it would be simple, with very common forms to fill out. However, it’s completely the opposite. It becomes even more challenging if you add a Roth solo 401k, and you have to do double the paperwork if you’re adding a spouse to your plan.

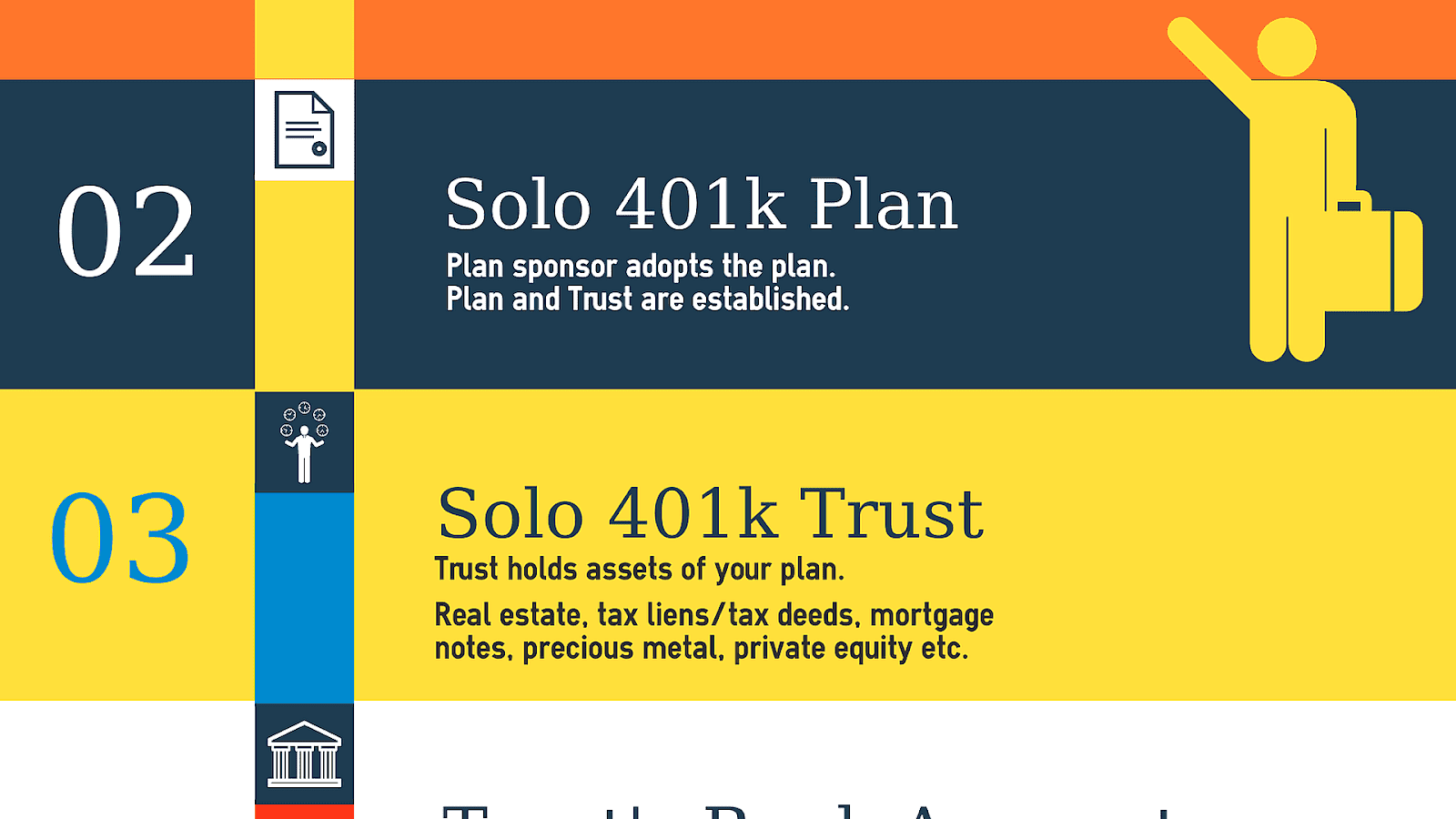

When opening your solo 401k plan, you will need to create the following documents. You will need to create separate plan documents for both your Traditional and Roth Solo 401ks. They are both considered separate plans for tax purposes.

Plan Documents For Traditional Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Plan Documents For Roth Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Required Documents For Individual

- Brokerage Account Application for 401k Account

- Brokerage Account Application for Roth 401k Account

- Designation of Beneficiary Form for Account

- Power of Attorney

Required Documents For Spouse

- Brokerage Account Application for 401k Account

- Brokerage Account Application for Roth 401k Account

- Designation of Beneficiary Form for Account

- Power of Attorney

When you’re done with all these documents, you’ll have two solo 401k plans, and 4 accounts .

Read Also: How To Take Out 401k Money For House

The Modern Small Business Owner Is Lean And Efficient

While employment offered stability for factory workers and factory owners in the Industrial Era, employment has many disadvantages in the modern Information Era.

Disadvantages of employment to the worker now include:

- Employment is becoming harder and harder to find

- Over 70% of college graduates today will not work in their field of study

- Employees get less tax deductions

- Employees usually have their retirement money locked up in the stock market, leaving their financial future at high risk

- Employees in the Information Era are less likely to have career stability because their employers are less lean and efficient than modern small businesses

Disadvantages of employment to the business owner now include:

- Its harder to attract great staff because with employment more money goes to taxes and less goes to the staffs take-home paycheck

- Its nearly impossible to provide powerful retirement and investment tools to employees

- Its more difficult to compete with lean and efficient companies and respond to changes in the marketplace with employees

Solo 401k Rules For Multi

A multi owner LLC or partnership is a very common business structure. If you have one, you may be wondering, can I still have a Solo 401k even though my business has multiple owners who are not me or my spouse? The answer is yes! As usual, you just need to stay within the rules. With a multi-member LLC we can simply exclude the other partners from your Solo 401k plan by role title. We just need the other partners role titles, such as president or secretary. These should be listed in your LLC operating agreement

When we exclude the other role titles from your plan, this keeps your Solo 401k truly solo and separate from your other partners. Just the same, each partner can have their very own Solo 401k plan with the other partners excluded. Each plan can include the partners spouse whos plan it is.

Don’t Miss: Is It Too Late To Start A 401k

Not Owning A Small Business Today Is A Big Mistake

Many people today dont own a business because of certain misconceptions that used to be true in the Industrial Era.

For instance, owning a business used to involve substantial capital investment, risk, and time commitment. This is no longer the case. Today, downloading and using an app on your smartphone can make you a business owner.

Becoming a business owner can, in many cases, immediately lower your taxes by making some of your expenses tax-deductible. The biggest lifetime expenses of an American is taxes, and most people overpay their taxes.

To Roll Over Other Plan Assets

If you already have a retirement savings plan for your business, you may be able to roll over or transfer existing plan assets to a Self-Employed 401. Consult with your tax advisor or benefits consultant prior to making a change to your retirement plan.

Assets from the following plans may be eligible to be rolled over into a Self-Employed 401:

- Profit Sharing, Money Purchase, and 401 plans

Don’t Miss: When I Leave My Job What Happens To 401k

Solo 401 Features And Insights

-

The ability to support multi-owners and spouses with your plan

-

Government tax reporting including 1099R and signature-ready Form 5500 if needed

-

Roth 401 feature, Loan option, and allows for account consolidation / rollovers

-

The capability for one-time, web-based contribution and/or regular automated ACH deposits

-

Toll-free access to your ShareBuilder 401k advisor and customer care team

-

Automatic pricing discounts as your assets grow

-

Set roster of retirement appropriate, index-based investments and a money market

There is an ongoing price per month to support your plan for those with < $250,000. This amount lowers as your assets hit specific milestones and can be more than offset by the tax benefits for those regularly contributing to their account.

How To Open A Solo 401

You can open a solo 401 at most online brokers, though youll need an Employer Identification Number. The broker will provide a plan adoption agreement for you to complete, as well as an account application. Once youve done that, you can set up contributions. Youll have access to many of the investments offered by your broker, including mutual funds, index funds, exchange-traded funds, individual stocks and bonds.

If you want to make a contribution for this year, you must establish the plan by Dec. 31 and make your employee contribution by the end of the calendar year. You can typically make employer profit-sharing contributions until your tax-filing deadline for the tax year.

Note that once the plan gets rocking, it may require some additional paperwork the IRS requires an annual report on Form 5500-SF if your 401 plan has $250,000 or more in assets at the end of a given year.

If you need help managing the funds in your solo 401, robo-advisor Blooom will manage your 401 at your existing provider. If you want even more comprehensive financial help, you might opt for an online planning service. Companies such as Facet Wealth and Personal Capital offer low-cost access to human advisors and provide holistic guidance on your finances, including how to invest your 401.

You May Like: How Do I Take Money Out Of My Fidelity 401k

Is A Solo 401k The Same As A Roth 401k

Yes, a Solo 401k is the same as a Roth 401k except for the differences in the tax treatment mentioned in the section above. However, the difference between tax-deferred and tax-free funds does influence how you will want to manage the two.

The similarities are so close that you have the option to convert Solo 401k funds into Roth Solo 401k funds. This became possible when the IRS released an amendment in 2010 allowing in-plan Roth conversions. Nabers Group was the first document provider to begin offering these rollovers. Because the Roth Solo 401k is a subaccount, it allows you to convert a portion or even all your Solo 401k funds to Roth. Along with our expert team sharing best practices, articles, and guides with you, we also provide a Roth Conversion Calculator to compare the two alternatives with equal out-of-pocket costs to estimate the change in total net-worth at retirement. Nabers Group will never charge you any fees on in-plan conversions.

The main reason a Roth Solo 401k is a subaccount is due to the different tax treatment that requires the tax-deferred and tax-free funds to be managed differently. This makes bookkeeping much simpler and cleaner. During retirement, it also makes it easier to calculate required minimum distributions so that you further minimize taxes owed on the tax-deferred funds by knowing which funds you can remove tax-free.

Best For Mutual Funds: Vanguard

Vanguard

Vanguard is well known for its own mutual funds and ETFs. If you prefer investing in Vanguard funds, a Vanguard Individual 401 plan gives you easy access with no trade costs, making the company our review’s best choice for mutual funds.

-

No fee to establish an account

-

Trade the Vanguard family of funds with no commissions or load fees

-

Roth contributions allowed

-

$20 annual fee for each Vanguard fund held in this type of account

-

401 loans are not supported

If youre looking to stick with a well-respected list of mutual funds from Vanguard, choose the Vanguard Individual 401. The account doesnt have an annual fee on its own for accounts with at least $10,000 in Vanguard funds. It charges a $20 annual fee below that balance plus a $20 annual fee for each Vanguard fund held in the account. Depending on how you invest, this fee can add up fast and could be a reason to consider buying those Vanguard funds elsewhere. You can also trade stocks and ETFs with no commission, in addition to options and fixed-income investments.

Vanguards founder, the late John Bogle, is credited as a pioneer in index investing, bringing the first index fund to market in 1976. Vanguard remains a leader in investment funds as the second-largest asset manager in the world with $6.2 trillion under management.

Read our full Vanguard review.

You May Like: How Do You Roll A 401k Into An Ira

Make Contributions To Your Solo 401

Once all the paperwork is completed and the disclosures are reviewed, its time to fund your account. Most providers will accept a check, wire transfer, or automated clearing house payment to fund the Solo 401. Its up to you to decide whether you want to make monthly installments or fully fund the account in one lump-sum payment.

There are two pieces to the contribution strategy with a Solo 401. First, you are allowed to contribute up to $19,500 from your salary. If you are over 50 years old, you can contribute an additional $6,500. The second piece comes from the employer as a profit-sharing contribution of up to 25% of your net self-employment income. This earned income is your net profit minus your plan contribution to the Solo 401 and one-half of your self-employment tax.

The limit on compensation that can be used to determine your contribution is $290,000 in 2021. Consult your tax advisor to develop an optimal strategy thats IRS-compliant. Penalties for excessive contributions are applied in the year the contribution is made and when the money is distributed, so its important to get your contribution correct.

Once your account reaches $250,000 in assets, youll have new requirements, including filing Form 5500 with the IRS. If you ever hire employees who become eligible for your plan, youll need to make adjustments to accommodate these new participants.