Are 401k Contributions Based On Gross Income

Traditional 401 contributions effectively reduce both fixed gross costs and modified gross costs . A Roth 401 , similar to the Roth IRA, is paid through tax dollars and does not provide for immediate tax deduction.

What percentage of gross income should 401k?

Numerous financial planning studies show that the appropriate portion of retirement savings is between 15% and 20% of total income. These contributions can be made in the 401 scheme, 401 line received from employer, IRA, Roth IRA, and / or tax authorities.

Is 401k based on base salary?

The main rule of thumb is to give at least 10% of your total income to your 401 . In some cases, employers make a corresponding contribution. In that case, it is recommended to donate enough money to get the most relevant donation.

Heres The Maximum You Can Save In Your 401 Plan In 2021

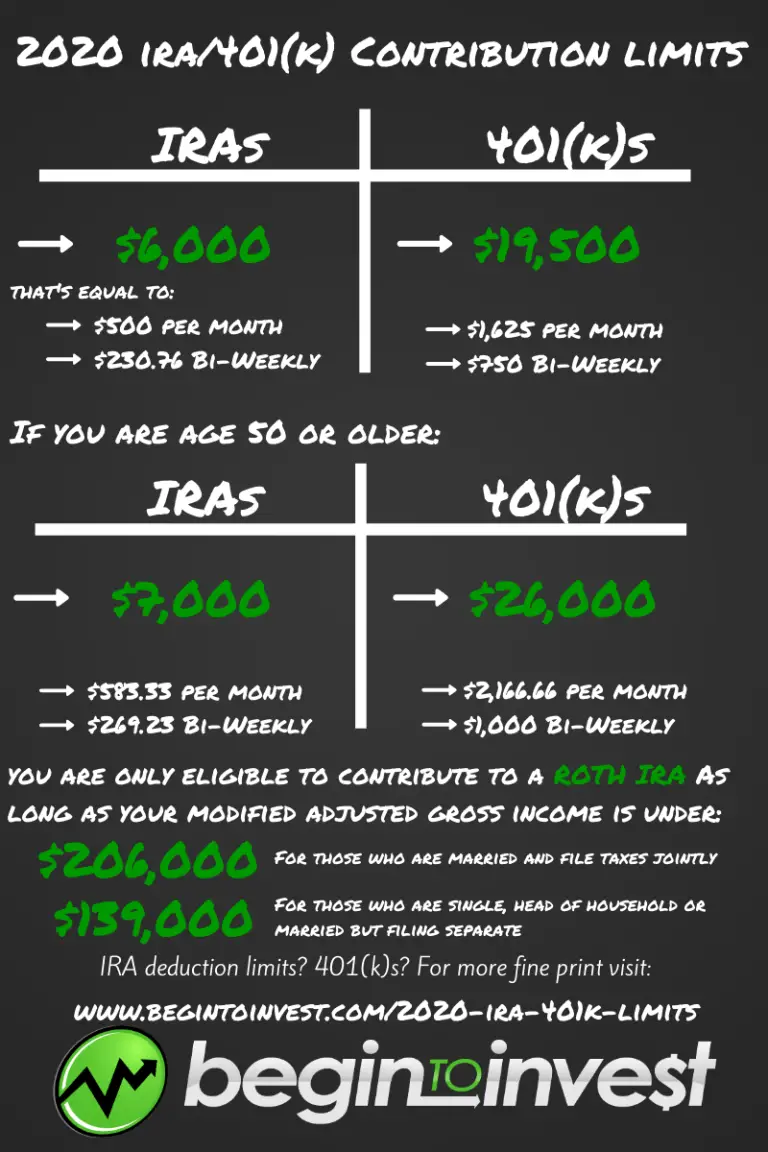

- Next year, workers can defer up to $19,500 into a 401 plan at work, plus $6,500 if theyre aged 50 and over. Those levels are unchanged from 2020.

- In 2021, you can contribute up to $6,000 to a traditional or Roth individual retirement account. Add in an extra $1,000 if youre 50 and over. These limits are also unchanged from 2020.

- Got a high deductible health plan? Contribute up to $3,600 in your health savings account next year if you have self-only coverage. That number goes up to $7,200 for family plans. Add $1,000 if youre over 55.

If you’re signing up for next year’s workplace benefits, now is the best time to develop a strategy for increasing your savings.

Benefits season also happens to coincide with the annual IRS release of the 2021 maximum contribution limits for certain tax-advantaged accounts, including your 401 plan, individual retirement account and healthcare flexible spending accounts.

Uncle Sam updates these figures around this time each year to reflect inflation.

Be aware that while these maximum amounts may be something for savers to strive for, they’ll need to balance their long-term savings goals with daily cash needs.

You don’t want to shortchange your emergency fund so that you can squirrel away a few more dollars in your 401 plan.

“Being able to contribute the maximum is a fantastic place to be, but most people aren’t there,” said Dave Stolz, CPA and chair of the American Institute of CPAs’ personal financial specialist committee,

Ira Benefits And Drawbacks

The investment choices for IRA accounts are vast. Unlike a 401 plan, where you’re likely to be limited to a single provider, you can buy stocks, bonds, mutual funds, ETFs, and other investments for your IRA at any provider you choose. That can make finding a low-cost, solid-performing option easy.

However, the amount of money you can contribute to an IRA is much lower than with 401s. For 2021 and 2022, the maximum allowable contribution to a traditional or Roth IRA is $6,000 a year, or $7,000 if you are age 50 or older. If you have both types of IRAs, the limit applies to all of your IRAs combined.

An added attraction of traditional IRAs is the potential tax-deductibility of your contributions. But, the deduction is only allowed if you meet the modified adjusted gross income requirements. Also, it is subject to phase out if you have a workplace retirement plan and make above a certain amount. For single taxpayers covered by a workplace retirement plan, the phase-out range in 2022 is $68,000 to $78,000, up from $66,000 to $76,000 in 2021. For married couples filing jointly, if the spouse making the IRA contribution is covered by a workplace retirement plan, the phase-out range is $109,000 to $129,000 in 2022, up from $105,000 to $125,000 in 2021.

Having earned income is a requirement for contributing to an IRA, but a spousal IRA lets a working spouse contribute to an IRA for their nonworking spouse, making it possible for the couple to double their retirement savings.

Also Check: How To Take Money Out Of 401k Without Penalty

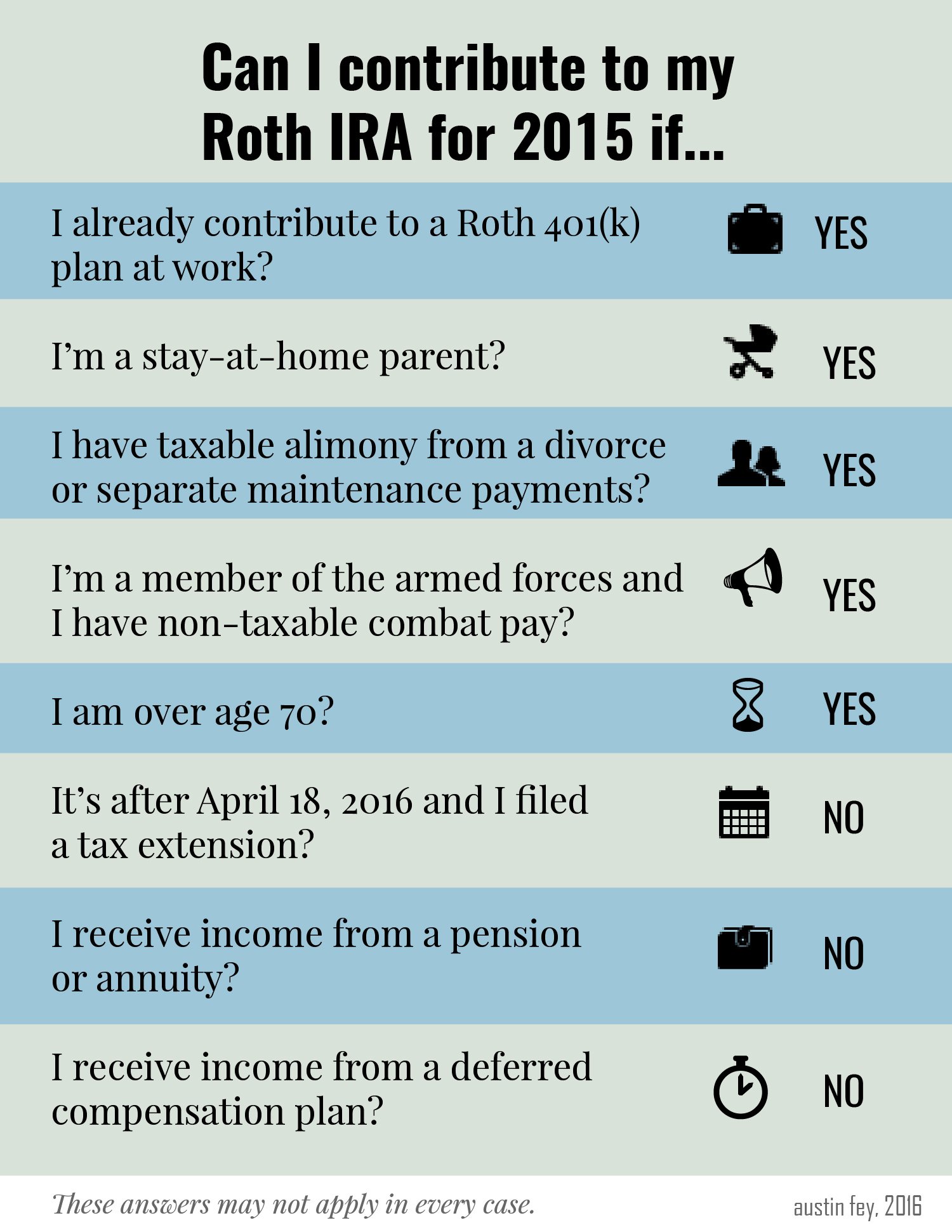

Income Limits On Roths

Before contributing to a Roth, it’s a good idea to contribute enough to your employer’s retirement plan to take full advantage of any matching contribution your employer offers.

Also, if your modified adjusted gross income reaches a certain threshold, the amount you can contribute to a Roth is reduced or eliminated.

The table below shows the contribution and income limits as well as the income phase-out range based on tax filing status.

| 2021 and 2022 Roth IRA Income Limits |

|---|

| Filing Status |

| Not eligible |

What Are The Advantages Of A Roth Ira

Roth IRAs allow taxpayers to make after-tax contributions from time to time and then withdraw their contributions and income tax-free upon retirement. This is very beneficial, especially for young savers who are likely to have a higher tax bracket in retirement.

Roth ira vs brokerage accountWhat is the difference between an IRA and a brokerage account? The securities account is managed like a savings account with a bank. However, your brokerage money can grow faster because it is invested in financial assets. Consequently, the brokerage account is more focused on growth. An IRA can also be called a minor escrow or escrow account.What do banks offer Roth IRA?Roth Bank IRAs generally

Also Check: What Is A 403 B Plan Vs 401k

How Traditional Iras Work

Like employer-sponsored 401s, traditional IRAs can dramatically reduce the amount of income you have to fork over to the federal government. Investors generally contribute pretax dollars, and the balance grows on a tax-deferred basis until retirement. Withdrawals after the age of 59½ are then subject to ordinary income taxes at the rates of your current tax bracket.

Be aware, though, that there are limits on how much you can contribute. Its also worth bearing in mind that the two most common varieties of this savings vehicletraditional IRAs and Roth IRAshave different rules.

Can I Contribute $5000 To Both A Roth And Traditional Ira

His expertise is in private investment and investment, and real estate. You can maintain both the traditional IRA and Roth IRA, as long as your total contribution does not exceed the Internal Revenue Service limits for any given year, and meets certain eligibility requirements.

Is it wrong to have a Roth and a traditional IRA? It would be appropriate to donate to all of the antiquities and Roth IRAâ if you can. Doing so will give you tax and tax-free deduction options in retirement. Financial planners call this tax differentiation, and it is usually a wise move if you are not sure what your tax profile will look like in retirement.

Recommended Reading: Can You Get 401k If You Quit

What Are The Disadvantages Of A Roth 401k

3 Barriers to Retirement Retirement in Roth 401

- Tax bracket risk. When you deposit money into a Roth account or IRA), you are gambling that is, your tax bucket will go down the line even now.

- RMDs continue to play.

- Limited planting options.

Is it better to contribute to Roth or 401k?

If you choose to pay taxes now and get it out of the way, if you think your tax rate will be higher in retirement than now, choose Roth 401 . In exchange, each Roth 401 donation will reduce your income by more than the old 401 donation, as it is done after taxes than ever before.

Can you lose money in a Roth 401 K?

There are no tax consequences when you take money from Roth 401 you are 59½ and face a five-year sentence. If you want $ 20,000, subtract $ 20,000, and no tax is due. If you take the same distribution from the standard 401 scheme, the amount you deduct is subject to the normal tax.

How Much Should I Put In My Roth Ira Monthly

The IRS, in 2021, closes the maximum amount that you can contribute to a traditional IRA or Roth IRA $ 6,000. Seen the other way, its $ 500 a month you can donate throughout the year. If you are age 50 or older, the IRS allows you to contribute up to $ 7,000 annually .

How much should you put into a Roth IRA? The most you can contribute to all your traditional and Roth IRAs is the smaller of: For 2020, $ 6,000, or $ 7,000 if you are age 50 or older at the end of the year or. compensation to you for the year. For 2021, $ 6,000, or $ 7,000 if you are age 50 or older by the end of the year or.

You May Like: How Can I Find My 401k

Roth 401 To Roth Ira Conversions

If your 401 plan was a Roth account, then it can only be rolled over to a Roth IRA. The rollover process is straightforward. The transferred funds have the same tax basis, composed of after-tax dollars. This is not, to use IRS parlance, a taxable event.

You should check how to handle any employer matching contributions, because those will be in a companion regular 401 account and taxes may be due on them. You can establish a new Roth IRA for your 401 funds or roll them over into an existing Roth.

Is Roth 401k Contribution Based On Gross Income

You pay to Roth 401 after the tax deduction has been deducted from your income, making the so-called tax contributions. When you withdraw money from your Roth 401 account, you do not pay tax on your withdrawals. Compare these treatments with the traditional 401 , where donations are made pre-tax.

Roth 401k donations limited by available income? Because there are no revenue limits for Roth 401 donations, these accounts provide a way for high-income earners to invest in Roth without changing the IRA culture. In 2021, you can donate up to $ 19,000 to Roth 401 , classic 401 or a combination of both.

Don’t Miss: Can I Borrow From My Solo 401k

Complete The Rollover Before Earnings Accrue

You want to roll over your money as soon as possible because you want to minimize the likelihood your funds see any investment returns as these will be taxed in the conversion.

If your after-tax contributions do end up generating investment growth, the IRS allows you to split up the funds, rolling the after-tax contributions into a Roth IRA and the investment earnings into a traditional IRA.

First You Need To Understand Contribution Limits

Before we get into how to contribute to multiple 401s and IRAs, we need to understand the limitations.

The IRS sets limits to how much you can contribute to your retirement accounts. 401s have different contribution limits than IRAs.

The contribution limit for any 401 account is $19,500. This limit is for total contributions, whether to just one account or split between a 401 and Roth 401. If you are 50 and older, you can contribute an additional $6,500 as a catch-up bonus.

Additionally, if you receive an employer match, the total contribution for a 401 canât exceed $58,000, or $64,500 if you’re 50 and older.

For IRAs, the IRS limits annual contributions to $6,000 for each account. Individuals 50 and older can contribute an additional $1,000.

You May Like: How To Find Out If You Have Unclaimed 401k Money

Limitations On Having Both An Ira And 401

As mentioned, while you are always eligible to contribute to both retirement accounts, if your income is too high, you may not be eligible for the tax benefits of both. To work through this yourself you need to answer two questions:

If you answered no to the first question, then youre set. However, if you or your partner participate in a work-sponsored retirement plan such as a 401, you will be ineligible to deduct your IRA contributions because your income exceeds whats known as the phase-out limit.

If you are filing as single or head of household, the phase-out limit is between $64,000 and $74,000. If your income is less than $64,000, you are eligible for full tax deduction of your contribution to an IRA. If its over $74,000, you are not eligible, and if you are in between you are eligible for a partial deduction.

If you are filing jointly, the limit is $103,000 to $123,000. The same rules apply .

The Benefits Of Having Both A 401 And Roth Ira

A traditional 401 has pretax contributions and Roth IRAs have post-tax,’ Ryan Marshall, a New Jersey-based certified financial planner, tells CNBC Make It. If you make a $75,000 salary and contribute $5,000 to a traditional 401, your taxable income for that year is reduced to $70,000. On the other hand, if you contribute $5,000 to a Roth IRA and nothing to a traditional 401, then you have a taxable income of $75,000.

The investment growth for both 401s and Roth IRAs is tax-deferred until retirement. This is a good thing for most participants since people tend to enter into a lower tax bracket once they retire, which can lead to substantial tax savings.

Youre going to want flexibility in retirement, especially since no one can predict what tax rates will be in the future, how your health will fare or how the stock market will behave, Marshall says. By having multiple buckets of money in diversified retirement funds, such as a Roth IRA and 401, youll have more flexibility when facing unknowns, he adds.

Incorporating more flexibility into your savings strategy can lead to more tax-efficient withdrawals in retirement, Marshall says. For example, a 401 balance of $1 million will only be worth about $760,000 to $880,000, depending on your federal tax bracket, Marshall explains. Thats because lump sum 401 withdrawals are typically taxed at 22% or 24%, and once you add in state tax, you could be looking at 30% going to taxes, Marshall says.

Read Also: Can I Use 401k Money To Start A Business

What Happens If I Contribute To A Roth Ira But Make Too Much Money

If you contribute more than is allowed to the IRA, you have contributed ineligible or in excess. See the article : Daniel Calugar outlines 7 benefits of starting to invest at a young age DU Clarion. You will pay an additional 10% early withdrawal penalty on earnings if you cannot take a qualified distribution from your IRA to correct the error.

What to do if you made too much for a Roth IRA?

I Do Too Much To Contribute To A Roth IRA â What I Do.

- Withdraw excess contributions plus any workable income.

- Proposed return corrected.

- Apply the excess to next years contribution.

- Transfer excess contributions to a Traditional IRA through a recharacterization, including your earnings.

Can you have a Roth IRA if you make too much money?

Roth IRA Income limits You can contribute to a traditional IRA regardless of how much money you earn. But you dont have the right to open or contribute to a Roth IRA if you make too much money.

What happens if you contribute to a Roth IRA and your income is too high?

The IRS will charge you a 6% penalty tax on the excess amount for each year where you do not take action to correct the error. For example, if you donate $ 1,000 more than is allowed, you should owe $ 60 each year until you correct the mistake.

More Details On Ira Contributions

With Roth and traditional IRA contributions, limits are imposed per taxpayer, not per account. That means an individual may not contribute $6,000 to a Roth IRA and an additional $6,000 to a traditional IRA in 2021. Instead, one may contribute a total of $6,000 split across the different IRAs, say $4,000 to a Roth IRA, and the remaining $2,000 to a traditional IRA.

Spousal IRAs are regular IRAs that married couples who file jointly may participate in.

Married couples can also contribute the same amounts to a spousal IRA for a non-working spouse, as long as one spouse earns enough income to cover both contributions.

Read Also: Should You Move Your 401k To An Ira

Figuring The Tax Bill

If the IRA is worth $49,500, $5,352 of your $6,000 would be taxable:

- Nondeductible contribution to traditional IRA = $6,000

- IRA rollover balance = $49,500

- Total of contribution plus IRA balance = $55,500

- $6,000/$55,500 = 0.108 = 10.8%. This is the percentage of your conversion that will be non-taxable.

- $6,000 x 10.8% = $648 nontaxable conversion balance

- $6,000 $648 = $5,352 taxable conversion balance

- Only the $648 will be subtracted from the total contribution as nontaxable

If the IRA is worth $3,000, only $1,980 would be taxable:

- Nondeductible contribution to traditional IRA = $6,000

- IRA rollover balance = $3,000

- Total of contribution plus IRA balance = $9,000

- $6,000/$9,000 = 0.666 = 67%

- $6,000 x 67% = $4,020 nontaxable conversion balance

- $6,000 $4,020 = $1,980 taxable conversion balance

- $4,020 will be subtracted from the total contribution as nontaxable

If you have one or more IRAs that you funded with deductible contributions, even the backdoor strategy cannot keep you from owing taxes on a Roth conversion. You can’t open a second IRA and roll over only that second account and owe no taxes.

Your Roth IRA, by the way, will just have the $6,000 in it. Your other IRAs wont be folded into it theyll just be included in the governments tax calculations. The tax bill will be assessed regardless of whether a new or existing account is used.