What You Can Do

- Roll over a traditional 401 into a traditional IRA, tax-free.

- Roll over a Roth 401 into a Roth IRA, tax-free.

- Roll over a traditional 401 into a Roth IRAthis would be considered a “Roth conversion,” so you’d owe taxes. Note: A Roth conversion that happens at the same time as your rollover may not be eligible for all plans. We can usually complete the Roth conversion once your pre-tax assets arrive into your Vanguard IRA account, though.

Option : Roll It Into An Ira

If your new employer doesnt offer a 401 or you dont like their option, you can roll your 401 into an IRA.

Rolling over accounts is easier than it sounds. You may need to open an IRA at a brokerage company and sign a few papers that allow the brokerage to transfer the money into your new account. This option will help keep your balance growing tax deferred and you can continue to make tax-deferred contributions.

How To Transfer From Your 401 To An Ira

When youre ready to make the transfer, you need to do three things:

Unfortunately, you typically have to go through your former employer or a vendor they use. With many 401 plans, you cannot request a transfer using paperwork from the receiving IRA custodian.

Who to Contact

If you work for a large company, you can most likely contact your 401 provider directly. For example, contact Fidelity, Vanguard, or whatever website you use to manage your account. Alternatively, call whoever prints your 401 statements. If you work for a small company, you may need to contact the human resources department, which might just be the person who hired you. Either way, you eventually need one of the following:

A financial advisor like me can guide you through the process if you have questions.

What to Say

Where to Deposit

Indirect vs. Direct Rollovers

You May Like: How To Collect Your 401k From Previous Employer

Should I Convert My Current 401 Into A Roth 401

If you already have a traditional 401 at your current job and the company just introduced a Roth 401 option, converting that 401 into a Roth might sound like a good idea. But is a conversion your best option? It depends on your situation.

The main drawback of converting a traditional 401 into a Roth 401 is the tax bill that comes with making the switch. Youre going to have to pay taxes on that money because it hasnt been taxed yet.

Lets say you have $100,000 in your traditional, pretax 401 and you want to convert the account into a Roth, after-tax 401. If youre in the 22% tax bracket, that means youd be paying $22,000 in taxes. Thats a lot of cash!

If you convert your 401 into a Roth 401, you need to have the cash on hand to cover the tax billno exceptions. Do not use money from the investment itself to pay the taxes. If you do, youll lose a lot more than $22,000. Youll also miss out on years of compound interest, which is typically about 10%. So after 30 years, a $100,000 account could grow to be $436,000 more than an account with a $78,000 starting point because of compound interest.

There are also alternatives to a 401 conversion to consider. For example, you can leave your traditional 401 alone and start putting money from your paycheck into a new Roth 401 instead. That way, you dont have to worry about taking a hit paying taxes now and still take advantage of the Roths tax-free growth later.

How Much Does It Cost To Roll Over A 401 To An Ira

If you do the process correctly, there should be few or no costs associated with rolling over a 401 to an IRA. Some 401 administrators may charge a transfer fee or an account closure fee, which is usually under $100.

Because moving your money from a 401 to an IRA allows you to avoid the 10% early withdrawal penalty that results if you withdraw money from a 401 before 59 1/2, it’s a far better option if you can’t keep your money invested in an old employer’s plan or move it to a 401 at your new company.

You should consider whether rolling over a 401 to an IRA is a better option than either leaving it invested when you leave your job or moving the money to your new employer’s retirement plan. If you can avoid 401 management fees and gain access to investments with lower expense ratios, an IRA may be a cheaper account option.

Read Also: How To Set Up 401k In Quickbooks

Pick An Ira Provider For Your 401 Rollover

When moving your money, you need to figure out which brokerage will provide you with the services, investment offerings and fees you need. If youre a hands-on investor who wants to buy assets beyond stocks, bonds, ETFs or mutual funds, you need to look for a custodian that will allow you to open a self-directed IRA. On the other hand, if youre more hands-off, it might make sense to choose a robo-advisor or a brokerage that offers target date funds.

Rolling Over To A New 401

If your new employer allows immediate rollovers into its 401 plan, this move has its merits. You may be used to the ease of having a plan administrator manage your money and to the discipline of automatic payroll contributions. You can also contribute a lot more annually to a 401 than you can to an IRA.

For 2020 and 2021, employees can contribute up to $19,500 to their 401 plan. Anyone age 50 or over is eligible for an additional catch-up contribution of $6,500.

Another reason to take this step: If you plan to continue to work after age 72, you should be able to delay taking RMDs on funds that are in your current employer’s 401 plan, including that roll over money from your previous account. .

The benefits should be similar to keeping your 401 with your previous employer. The difference is that you will be able to make further investments in the new plan and receive company matches as long as you remain in your new job.

Mainly, though, you should make sure your new plan is excellent. If the investment options are limited or have high fees, or there’s no company match, the new 401 may not be the best move.

If your new employer is more of a young, entrepreneurial outfit, the company may offer a SEP IRA or SIMPLE IRAqualified workplace plans that are geared toward small businesses plans). The IRS does allow rollovers of 401s to these, but there may be waiting periods and other conditions.

Recommended Reading: What Happens With My 401k When I Quit

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

How To Do A Rollover

The mechanics of rolling over 401 plan are easy. You pick a financial institution, such as a bank, brokerage, or online investing platform, to open an IRA with them. Let your 401 plan administrator know where you have opened the account.

There are two types of rollovers: direct and indirect. A direct rollover is when your money is transferred electronically from one account to another, or the plan administrator may cut you a check made out to your account, which you deposit. The direct rollover is the best approach.

In an indirect rollover, the funds come to you to re-deposit. If you take the money in cash instead of transferring it directly to the new account, you have only 60 days to deposit the funds into a new plan. If you miss the deadline, you will be subject to withholding taxes and penalties.

Some people do an indirect rollover if they want to take a 60-day loan from their retirement account.

Because of this deadline, direct rollovers are strongly recommended. Nowadays, in many cases, you can shift assets directly from one custodian to another, without selling anythinga trustee-to-trustee or in-kind transfer. If, for some reason, the plan administrator can’t transfer the funds directly into your IRA or new 401, have the check they send you made out in the name of the new account care of its custodian. This still counts as a direct rollover. However, to be safe, be sure to deposit the funds within 60 days.

Don’t Miss: Where To Put My 401k

The Benefits Of Rolling Over Your 401 When You Leave A Job

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Whenever you change jobs, you have several options with your 401 plan account. You can cash it out, leave it where it is, transfer it into your new employer’s 401 plan , or roll it over into an individual retirement account .

Forget about cashing it outtaxes and other penalties are likely to be staggering. For most people, rolling over a 401or the 403 cousin, for those in the public or nonprofit sectorinto an IRA is the best choice. Below are seven reasons why. Keep in mind these reasons assume that you are not on the verge of retirement or at an age when you must start taking required minimum distributions from a plan.

Roll It Into A New 401 Plan

The pros: Assuming you like the new plans costs, features, and investment choices, this can be a good option. Your savings have the potential for growth that is tax-deferred, and RMDs may be delayed beyond age 72 if you continue to work at the company sponsoring the plan.

The cons: Youll need to liquidate your current 401 investments and reinvest them in your new 401 plans investment offerings. The money will be subject to your new plans withdrawal rules, so you may not be able to withdraw it until you leave your new employer.

Don’t Miss: Where Can I Get 401k Plan

How Do I Roll Over My 401 To An Ira

When you leave your job for any reason, you have the option to roll over a 401 to an IRA. This involves opening an account with a broker or other financial institution and completing the paperwork with your 401 administrator to move your funds over.

Usually, any investments in your 401 will be sold. The money will then be deposited into your new account or you will receive a check that you must deposit into your IRA within 60 days to avoid early withdrawal penalties.

If Youre Thinking Of Quitting Your Job

Timing is important here. If your company offers matching contributions, dont walk away and leave that money on the table. Check your plans vesting schedule to see whether working longer will let you vest more in your employer contributions. Also, find out when matching contributions are deposited into your account. Some companies make the deposit every pay period some only once a year. If you leave before that years contribution is made, youll lose it. *

Also Check: Should I Transfer My 401k To A Roth Ira

Should You Roll Over Your Tsp Into An Ira

Should you roll your TSP into an IRA after you leave federal service? The author offers some pros and cons to consider.

Your TSP is an incredible investment tool, especially during your career. The question, is it worth keeping in retirement?

Many people suggest that it always makes sense to roll your TSP into an IRA, but this isnt always the best for everyone. Lets dig into the pros and cons.

Should You Roll Over Your 401

To start, its worth knowing that you dont have to make a 401-to-IRA rollover, even if you do leave your job. You have the option of leaving the money youve invested in the plan at your old company. You cant keep contributing to it, but it will stay invested and if your investments go up, youll continue to see your account grow. This is called an orphan account.

Do you like the way your money is invested currently? If so, you may want to consider keeping your money in the existing plan. If you currently arent working but anticipate taking a new job soon, you could leave your money at your old plan temporarily and put it into your new companys plan once you have access to it.

For those who dont think theyll end up in another 401 plan but still want to save more for retirement, it might make sense to do a 401-to-IRA rollover. Remember, even though you still have your account at your old companys 401, you wont have the ability to make more contributions.

Don’t Miss: How To Direct Transfer 401k To 403b

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

Set Up Your New Account

If you don’t already have a rollover IRA, you’ll need to open onethis way, you can move money from your former employer’s plan into this account. If there are both pre-tax and post-tax contributions in your 401, you might need to open a Roth IRA too.* Which IRA should you consider for your rollover?

Don’t Miss: How To Invest 401k With Fidelity

When Leaving Your Job You Can Typically Cash Out Your 401 Or Roll It Over Into A Different Retirement Account Certain Options Can Make You Much Richer

Both a 401 and IRA are tax-advantaged retirement accounts, but they work differently. 401s are sponsored by employers and often offer limited investment options. IRAs aren’t linked to employment. They can be opened with any brokerage firm or other financial institutions and have a wider variety of investment selections, but require more hands-on management.

Because 401s are offered through employers, you’ll need to determine what to do with yours when you leave your job. Your options include:

- Leave it invested

- Rollover to a new 401

- Rollover to an IRA

There are plenty of pros and cons to these options, but let’s take a close look at when rolling your workplace 401 into an IRA may make sense for you.

Us Tax Treatment Of A Qualified 401 Vs International Funds

The big difference between Stateside 401s and international funds is the U.S. tax treatment. The U.S. offers special tax treatment on what they classify as qualified retirement plans. The qualified means it meets certain requirements in the Internal Revenue Code Section 401. A few examples you may be familiar with are:

Most foreign retirement plans and foreign pensions are not considered qualified plans, and may even be classified as PFICs, or passive foreign investment companies .

If you do choose to transfer funds from a U.S. Qualified Plan to a foreign retirement plan, it will be neither be tax free nor will it count as a qualified rollover. This means moving your 401 to an international fund will result in U.S. tax liability and possibly the 10% penalty for an early withdrawal.

In addition, whatever contributions you make to your international retirement plan likely wont be tax-deductible, and you may have to pay U.S. taxes on the plans yearly gains.

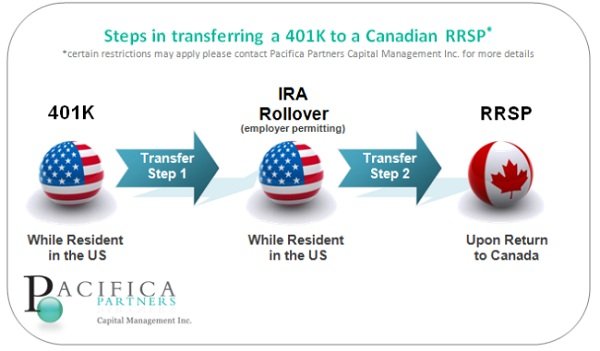

There is some good newsthe U.S. maintains tax treaties with other countries outlining special tax treatment of some pensions and retirement plans. So, if you have a foreign pension in the U.K., Canada, Germany, the Netherlands, or Belgium, youve got a tax treaty that basically allows your foreign pension to be taxed the same as a U.S. retirement plan.

Don’t Miss: How To Find My Fidelity 401k Account Number