What Is An Ira

Anyone who is earning an employment income can open an IRA account.

An IRA is also a retirement account that grows tax free until you withdraw the money.

It is an individual account and not tied to your employer.

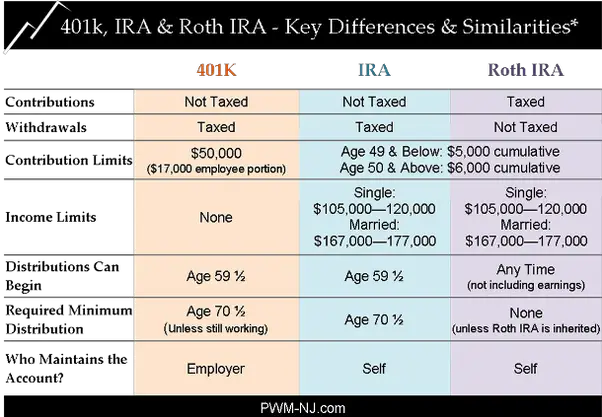

Unlike a 401k, your yearly contribution to an IRA is much less. You may contribute $6,000 into your IRA for the year of 2020. If you are 50 years old and older, you may contribute up to $7,000.

Both wife and husband can contribute up to $6,000 each year, making it a total of $12,000 even if only one spouse is working. Your can deduct all of your traditional IRA contributions every year.

However, your IRA may not be deductible if you or your spouse participates in a retirement plan at work, like a 401k.

If you cannot deduct your IRA contribution, consider opening a nondeductible account called a Roth IRA.

If youre single with an adjusted gross income of less than $124,000 or married filing jointly with an AGI of $196,000, you can contribute up to $6,000 per year to a Roth IRA.

Those who are 50 years old and older can contribute $6,000.

| 2020 IRA Maximum Contribution |

Evaluate Your 401 Planand Aim For Your Contribution Limit

The general consensus is to contribute to your 401 up to the company match and then start contributing to a Roth IRA.

However, Clark says that its totally fine perhaps even preferable to max out your 401 contributions before turning toward an IRA. Thats especially true if you work for a large company with a low-cost plan and the option to contribute to a Roth 401.

Clark says that if your all-in expenses for your 401 the expense ratios of your investments plus administrative costs are lower than 0.5%, contribute up to the IRS maximum first. Then move to a Roth IRA.

If youre with a smaller employer, an employer with less than 500 employees, usually its going to be cheaper to pick up the employer match and then do your own Roth IRA, Clark says.

If for whatever reason your company doesnt offer a 401 match, you can consider opening a Roth IRA first. Just make sure youre going to contribute every time you get paid.

Clark is a huge fan of 401 contributions because they come out of your paycheck before it hits your bank, taking away any temptation to spend the money.

Traditional Vs Roth: Whats The Difference

Whether youre contributing to a 401 or an IRA, you may get to choose between Roth or traditional.

If you still arent confident about the difference, dont fret.

When you contribute to a traditional 401 or IRA, youre putting in pre-tax dollars. That means you havent paid any taxes to the IRS on those dollars. And you wont pay any taxes until you withdraw the money in the future.

When you contribute to a Roth 401 or IRA, youre putting in post-tax dollars. That means youve already paid taxes to the IRS on those dollars. And if you follow the rules, you wont ever have to pay taxes on that money again.

Clark expects taxes to rise in the future. So unless youre sure that your tax rate is higher now than it will be in the future, he thinks Roth is better than traditional .

Read Also: Where To Check 401k Balance

Taxes With 401k Or Traditional Iras

No matter the type of retirement account you choose to open, there will likely be associated tax questions. At H& R Block, were here to help. With many ways to file your taxes with H& R Block, you can opt for in-office or virtual tax preparation, keeping all tax laws related to retirement savings accounts in mind, we can make sure youre producing an accurate tax return that maximizes allowable tax deductions.

Not in need of tax preparation at the moment? Read more about taxes on retirement income, pensions and annuities.

Related Topics

Learn more about the qualification rules for tax-exempt military pay with the experts at H& R Block. Find out if you qualify for tax benefits.

Why Invest In An Ira

Many financial experts estimate that you may need up to 85% of your pre-retirement income in retirement. An employer-sponsored savings plan, such as a 401, might not be enough to accumulate the savings you need. Fortunately, you can contribute to both a 401 and an IRA. A Fidelity IRA can help you:

- Supplement your current savings in your employer-sponsored retirement plan.

- Gain access to a potentially wider range of investment choices than your employer-sponsored plan.

- Take advantage of potential tax-deferred or tax-free growth.

You should try to contribute the maximum amount to your IRA each year to get the most out of these savings. Be sure to monitor your investments and make adjustments as needed, especially as retirement nears and your goals change.

Also Check: Can You Roll Over 401k From One Company To Another

Simple 401 Vs Simple Ira: Which Is Better For Small Business

Both SIMPLE plans allow small employers to provide employees with a retirement savings option. They both permit employees to contribute to a retirement savings account via salary reductions, and allow for catch-up contributions to participants over 50 years old. Some key differences include the following:

- SIMPLE 401 plans may permit loans, while a SIMPLE IRA doesn’t allow this feature.

- Companies with a SIMPLE IRA may not sponsor another plan with one exception: employees covered by collective bargaining agreements.

- There is no minimum age requirement for SIMPLE IRA eligibility, while SIMPLE 401 plan participants must be at least 21 years old.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: How To Manage 401k In Retirement

Stick With The 401k If

In addition to lower costs, many 401 plans offer stable-value funds. This is a low-risk option you cant get outside of an employer-sponsored plan. With recent yields averaging about 1.8%, stable-value funds provide an attractive alternative to money market funds. And unlike bond funds, they wont get hammered if interest rates rise. There are other good reasons to leave your money behind:

Ira Vs 401 Withdrawal Criteria

Traditional IRA and 401 account owners both typically need to wait until age 59 1/2 to withdraw funds to avoid penalties. If you take out money before age 59 1/2, you could be charged a 10% penalty on the amount withdrawn and also have to pay taxes on the withdrawal.

However, 401s and IRAs both have some exceptions to the early withdrawal penalty. For example, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, allows retirement account holders impacted by the coronavirus pandemic in 2020 to take out up to $100,000 with no penalties. If the amount is paid back to the account within three years, no taxes are due. Those with 401 accounts who leave their jobs at age 55 or older can take penalty-free 401, but not IRA, withdrawals. IRA holders can take penalty-free withdrawals for a variety of specific circumstances, including health insurance after a layoff and college costs.

Traditional 401s and IRAs both generally require distributions after age 72. However, a 401 plan may allow you to delay required distributions if you are still working. There are also separate guidelines for account holders during the coronavirus outbreak. Required distribution has been waived just for the year 2020 as part of the CARES Act.

You May Like: When Can I Set Up A Solo 401k

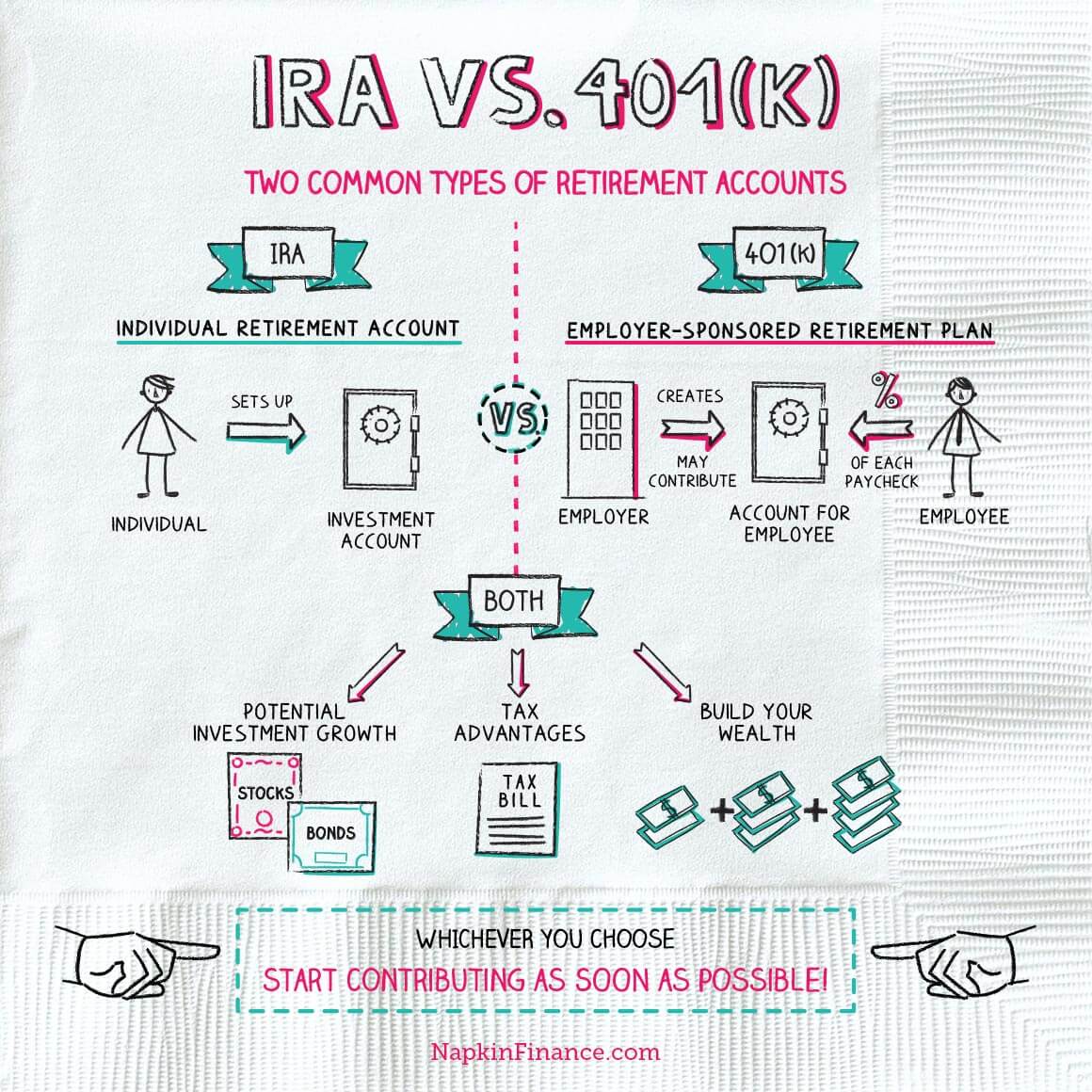

What Is The Difference Between A 401 And An Ira

The terms 401 and individual retirement account are bandied about quite a bit when discussing retirement planning, but what are the actual differences between the two? The main distinction is that a 401 — named for the section of the tax code that discusses it — is an employer-based plan, while an IRA is an individual plan, but there are other differences as well.

Both 401s and IRAs are retirement savings plans that allow you put away money for retirement. You may begin taking distributions from these plans at age 59 ½. There are two main types of IRAs: Roth and traditional. With a traditional IRA, you don’t pay taxes when you make contributions because the taxes are paid only when you withdraw the money, whereas with a Roth IRA, you pay the taxes up front and any gains accumulate tax-free. In addition, with a traditional IRA and 401, you are required to start taking minimum distributions at age 72 , but with a Roth IRA there is no requirement to take minimum distributions.

Local Elder Law Attorneys in Your City

Participation

In order to have a 401, you must work for an employer that offers this type of plan as part of its benefit package. Because it is a benefit, your employer may limit which employees may join the plan. Contributions are usually made through deductions from your paycheck.

Contributions

Investments

Loans

Beneficiaries

With an IRA, you can designate whomever you want to be your beneficiary without needing spousal consent.

The Importance Of Risk In A Portfolio

It would be great of there was a way to make money without taking on any risk. Many investors struggle to take on riskier investments, like stocks, because they fear loss.

There is no way to overstate how important risk is to growing your money. When safe investments like government bonds are compared to stocks , the importance that risk plays becomes very apparent.

Staying in safe investments like government bonds and money market accounts will help to ensure that you dont lose much, but there is also little chance that your portfolio will ever grow at more than 4% per year.

If you are already established, a 4% yield might be ok, but if you are 22 years old and have a portfolio that is worth $1,000, you need to introduce some risk into your investments. Tax-deferred retirement accounts are great, but it wont mean much if your portfolio only grows by 2% per year.

Read Also: How Much Will My 401k Grow If I Stop Contributing

Roth Ira Vs : Which Is Better For You

10 Minute Read | September 27, 2021

The Roth IRA and 401 are like cousins: They come from the same family of retirement investment accounts, so they have a lot in common. But look close enough, and youll see how different they are!

Once you understand how they work, you can choose the plan that will help you maximize your savings. And thats not just fancy investing talk. Your choice today could result in thousandsif not millionsof dollars down the road! You need to understand your options so you can be 100% prepared for retirement.

So, what are the major differences between a Roth IRA vs. a 401? And even more importantly: How do you know which one is better for you?

First, lets discuss the main features of each account.

Conversions Into Other Types Of Accounts:

401k: If you leave your job, you have several options for your 401k.

- You can leave it alone with the current provider.

- You can roll it over into the new account.

- You can roll it over into an IRA with a new financial provider.

There can be a number of variables such as taxes or fees that will dictate whether this is the best move or not. Make sure you ask both the new and old financial service providers what the implications will be.

IRA: You can not convert a Roth IRA into a Traditional IRA. But you can convert a Traditional IRA to a Roth IRA.

You May Like: How Much Should I Have In My 401k At 55

Vs Roth Ira: An Overview

Both 401s and Roth IRAs are popular tax-advantaged retirement savings accounts that differ in tax treatment, investment options, and employer contributions. Both accounts allow your savings to grow tax-free.

Contributions to a 401 are pre-tax, meaning they are deposited before your income taxes are deducted from your paycheck. However, when in retirement, withdrawals are taxed at your then-current income tax rate. Conversely, there is no tax savings or deduction for contributions to a Roth IRA. However, the contributions can be withdrawn tax-free when in retirement.

In a perfect scenario, youd have both in which to put aside funds for retirement. However, before you decide, there are several rules, income limits, and contribution limits that investors should be aware of before deciding which retirement account works best for them.

A 401k And An Ira Can Work Together

Contents

The most important difference between a 401k and an IRA is that a 401k has to be set up by an employer, and an IRA is a personal retirement account that anyone can create for themselves. The amount that can be saved on a tax-deferred basis is also much higher with a 401k.

If you want to have a 401k, you will need to work for a company that creates them for its employees. Assuming you have a 401k from your work, you can also set up an IRA, and save even more money that can grow without being taxed.

Don’t Miss: Is A 401k Considered An Annuity

How Should I Save For My Future

The first set in getting ahead financially is setting up some sort of retirement account that allows you to avoid being taxed as your money grows. While there is no one-size-fits-all solution for savings, there are some important things to keep in mind.

As mentioned above, a Roth IRA probably makes the most sense for younger people.

If you are just getting into the workforce, you are likely in a low tax bracket. Once you stash your post-tax earnings in a Roth IRA, you will be able to access your savings tax-free when you are older, and in a higher tax bracket.

The kind of IRA you choose to open for yourself is important to consider, but the kinds of investments you make are going to determine how fast your money can grow.

Plans May Offer An Employer Match

While they might be harder to obtain, 401 plans make up for it with the potential for free money. That is, many employers will match your contributions up to some level.

401s sometimes will have a match depending on the employers generosity and financial position, says Michael Lackwood, founding principal of New York City-based Spring Delta Asset Management. If your employer does offer a match, it makes most sense to contribute to the 401 at least up to the maximum percentage match.

For example, if you contribute 4 percent of your salary, your employer may offer 2, 3 or 4 percent, as an inducement to help you save. Thats free money and an immediate return on your investment.

In contrast, youre on your own with an IRA, and your funds will consist only of what you contribute and any earnings on those contributions.

Also Check: Can I Sign Up For 401k Anytime

Learn To Trade Stocks Futures And Etfs Risk

Both are fantastic options for saving for your retirement and financial futures. Both offer a sustainable and growth focused plan. Lastly, the IRA and 401k allow you deduct your contributions.

Whats nice about these options is that there is no tax or interest on capital gains until you start withdrawing the money as a distribution. And they are both subject to the same penalty for early with drawls up to a 20% tax and 10% penalty if you take it out before you are 59 ½. Thank you, IRS.

Stop Looking For A Quick Fix Learn To Trade The Right Way

This gives you the flexibility of having a fully managed and sturdy retirement plan option while also giving you the ability to invest and direct some of your retirement as you hunt for the next Apple or Amazon.

Word of warning though! $55,000 is the maximum you can contribute each year. So if you are planning on contributing to both a 401k and an IRA, make sure you dont over contribute. If you do both the 401k and IRA with same company, you wont have to worry about that: theyll prevent you from over contributing.

However, if you are doing the 401k from your employer and then you open your own IRA, you need to make sure that your contributions are limited to the $55,000 amount. If you dont, Uncle Sam and the IRS are going to just love you.

Read Also: How To Transfer 401k After Leaving Job

Understanding The Advantages Of The Ira Vs 401k:

So is an IRA or a 401k really better than one or the other? The answer: It depends!

Your unique situation and financial goals will dictate which one has better tax advantages, contribution limits, and even whether or not you qualify to participate.

But why go with one or the other? Why not get to know the strengths and weaknesses of both so that you can leverage them to create the biggest nest egg you can make!

Read on to learn more about each one and how you can use it to your benefit.