What If You Only Need The Money Short Term

Although there are other qualifying exceptions to withdraw IRA or 401k assets penalty-free, those listed above are the major ones. But suppose youre not interested in paying any taxes at all. You can still use your 401k to borrow money via a loan. The interest goes to you, the loan isnt taxable, and it wouldnt show up on your credit report. Heres how it works.

It’s Better Than Falling Behind On Your Bills

Sometimes, you just don’t have a better option. If a 401 withdrawal is the only way that you can pay your bills without taking on costly credit card debt, do it. Leaving your retirement savings alone isn’t worth it if it threatens your current financial security and your ability to save more for retirement in the future.

Only withdraw as much as you need and keep seeking out alternative sources of funding. Look for a new job if you’ve lost yours, start a side hustle, or consider applying for a personal loan with a reasonable interest rate.

Withdrawing Funds From 401 After 55 But Before 59

If you are 55 or older and still working for the company managing your retirement savings, you cannot take a penalty-free distribution until you are 59 ½. However, you may still qualify to take a hardship withdrawal if you have a qualified expense. You will owe income taxes and a 10% penalty tax on the distribution you take. You may also qualify for a 401 loan if your retirement plan provides this benefit.

Read Also: Should I Transfer 401k To New Employer

Withdrawing Funds From 401 At 72

If you are age 72, you must start taking annual distributions from the 401, commonly known as required minimum distributions . You must take the first distribution by April 1 of the year you turn 72, and thereafter, you will be required to take the annual withdrawals by December 31 each year. If you delay in taking the first distribution, you must take two distributions in the same year, which will push you to a higher tax bracket. If you miss taking a mandatory distribution, the IRS imposes a 50% penalty on the amount you were required to take during the specific period.

An exemption to the RMDs is if you are still working. To qualify for this exception, you must not own 50% or more of the employerâs company. You can use this exception to delay taking the mandatory distributions until when you stop working.

You Don’t Really Need The Money

The government may have eased the restrictions on 401 withdrawals, but you should only take advantage of this if you absolutely need the money. Taking money from your retirement account sets you back. That forces you to save more money per month going forward in order to afford to retire according to your original schedule.

Say you have $25,000 saved for retirement and you’re hoping to get to $1 million. If you’re 35 and hope to retire at 65, you must save about $653 per month, assuming you earn a 7% average annual rate of return. Now let’s say you withdraw $5,000 this year, leaving you with only $20,000 in your retirement savings. If you still want to have $1 million by 65, you must save about $753 per month — $100 more — every year thereafter to have enough. It’s doable, but you can save yourself a lot of hassle by just leaving your retirement savings alone if you don’t actually need the money.

Read Also: Can You Use 401k To Buy Investment Property

How Taking A 401 Distribution Affects Your Retirement

Time in the market and compounding interest are critical factors when it comes to your retirement savings. While investment returns will vary, in general more money in the market means more at retirement, while anything you withdraw now is that much less you’ll have for your golden years. Plus, taking money out means missing any potential gains your investments would have seen along the way, even if you reinvest the money down the road.

That’s why it’s important to carefully assess your situation if you’re experiencing a true emergency and your retirement is your only financial source, consider limiting the amount you take out to only what you need. If you’re certain that you can pay yourself back, there’s also less of a risk in going this route. But if you can go without touching your nest egg, over time you may be able to reap the rewards of compound interest and avoid any potential losses.

Early Withdrawal // 11 Ways To Cash Out Without Penalty

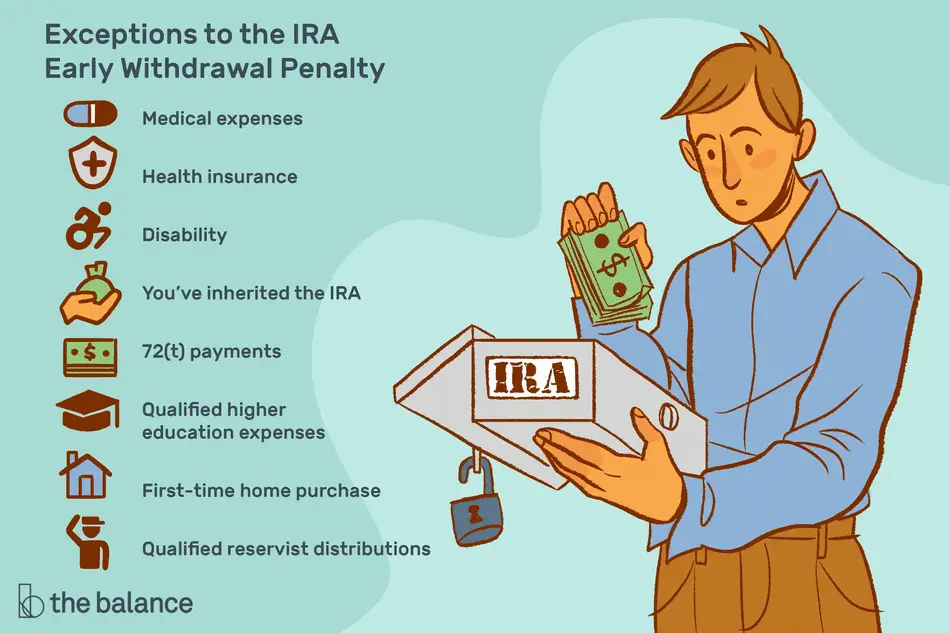

If you are in financial need, it might seem extremely tempting to simply withdraw some money from your 401, IRA, or other retirement account to cover the need. However, that withdrawal generally comes with a heavy penalty of 10% of the withdrawal amount. Retirement accounts are intended to be used for retirement, so the IRS imposes this penalty to discourage you from withdrawing money from your retirement savings. But what if you are in a true financial hardship? When can you withdraw from your 401 without this penalty? In some cases, you might be able to take some cash from your 401 without a penalty. Here is everything you need to know about early withdrawals from your 401 plus some ways that you can cash out without a penalty.

Don’t Miss: How To See How Much 401k You Have

Making A Hardship Withdrawal

Depending on the terms of your plan, however, you may be eligible to take early distributions from your 401 without incurring a penalty, as long as you meet certain criteria. This type of penalty-free withdrawal is called a hardship distribution, and it requires that you have an immediate and heavy financial burden that you otherwise couldn’t afford to pay.

The practical necessity of the expense is taken into account, as are your other assets, such as savings or investment account balances and cash-value insurance policies, as well as the possible availability of other financing sources.

What qualifies as “hardship”? Certainly not discretionary expenses like buying a new boat or getting a nose job. Instead, think along the lines of the following:

- Essential medical expenses for treatment and care

- Home-buying expenses for a principal residence

- Up to 12 months worth of educational tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

The home-buying expenses part is a bit of a gray area. But generally, it qualifies if the money is for a down payment or for closing costs.

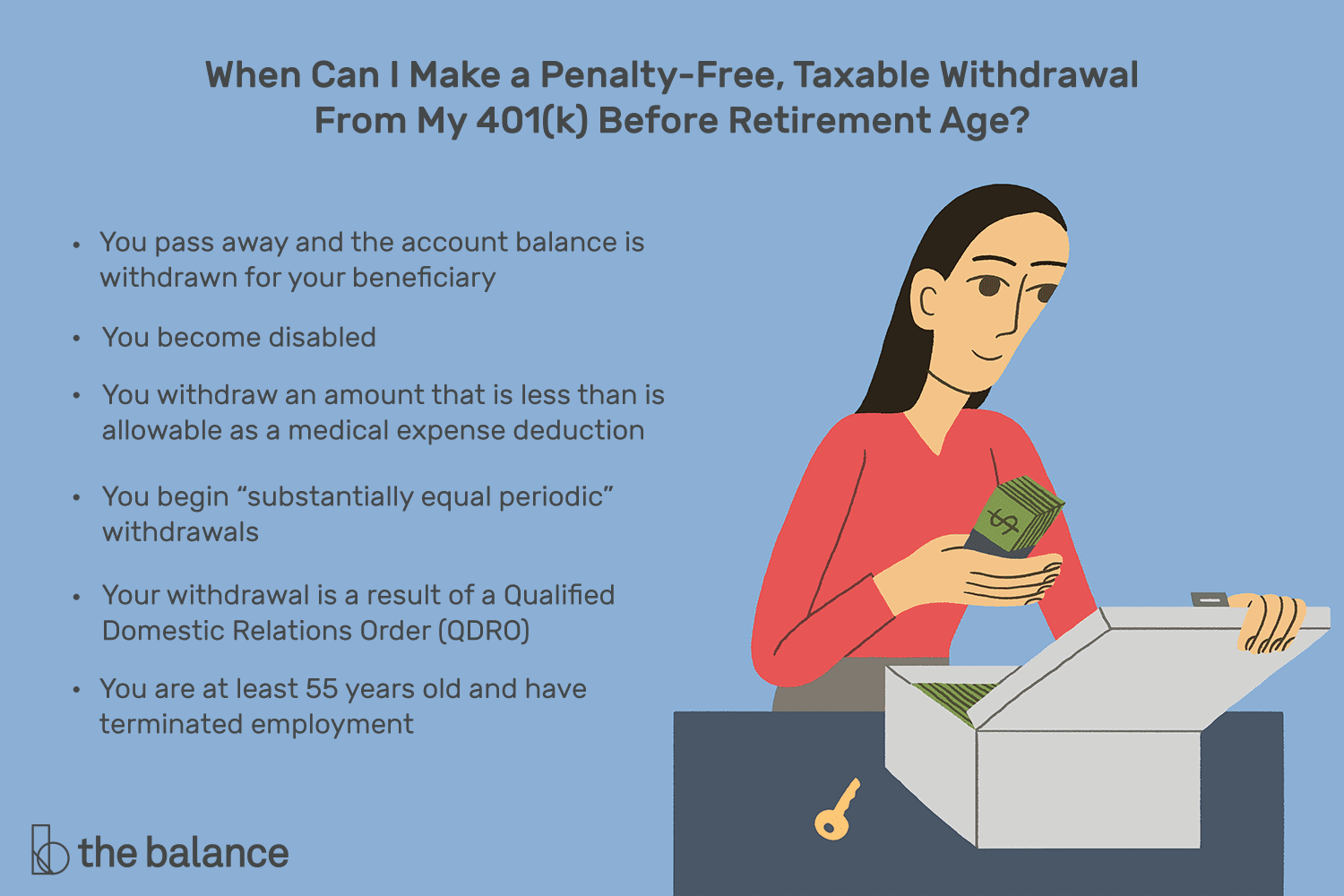

Can I Withdraw From My 401 At 55 Without A Penalty

If you leave your job at age 55 or older and want to access your 401 funds, the Rule of 55 allows you to do so without penalty. Whether you’ve been laid off, fired or simply quit doesn’t matteronly the timing does. Per the IRS rule, you must leave your employer in the calendar year you turn 55 or later to get a penalty-free distribution. So, for example, if you lost your job before the eligible age, you would not be able to withdraw from that employer’s 401 early you’d need to wait until you turned 59½.

It’s also important to remember that while you can avoid the 10% penalty, the rule doesn’t free you from your IRS obligations. Distributions from your 401 are considered income and are subject to federal taxes.

Recommended Reading: How To Get Your 401k Without Penalty

Those Who Can Pay Themselves Back

Its not free money. You have to pay it back or risk getting hit with a hefty tax bill, says Jeff Levine, of Nerds Eye View, an online news source that caters to financial planners.

Someone who may not be able to pay it back should think a little harder about whether they should tap into their retirement assets or not, Pfau says.

Another thing to keep in mind is how close you are to retirement. For many people, this could force them into an early retirement. Borrowing from their 401 may just be a way of actually starting to take distributions for retirement earlier, Pfau says. You just have to recognize the trade-offs, like not having as much money for retirement down the road.

Spousal Rrsp Withdrawal Rules

Spousal RRSPs have some specific rules about withdrawals. Fred and Ginger have a spousal RRSP. Fred makes the contributions and receives the tax deduction Ginger owns the account and will receive the income from it at retirement. Ginger will be taxed on the income.

Attribution rule:The spousal attribution rule is designed to prevent the use of a spousal contribution for tax avoidance. If funds are withdrawn within 3 years of the contribution being made, the contributor, rather than the annuitant will be taxed.

If Fred contributes to Gingers RRSP, and then Ginger withdraws the money within a year later, Fred will have to pay tax on the withdrawal amount.

Spousal RRIF:A spousal RRSP converts to a spousal RRIF at age 71. If Ginger withdraws only the minimum required RRIF amount, Ginger will pay the tax. However, if Ginger withdraws more than the minimum amount, Fred will be taxed on the excess amount.

You May Like: Can You Have Your Own 401k

To Meet Additional Essential Needs

Money for items such as medical expenses, prescriptions, food, or elder care add up fast. If you do decide pulling money from 401 or other retirement funds makes sense in a disaster scenario, consider taking out only what you need and set up a plan to pay back the amount no later than the three-year time frame.

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55, and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer. You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal. but only from a current 401 account held by your employer. You can’t loans out on older 401 accounts. You can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company. But these plans must accept these types of rollovers.

Think twice about cashing out. You’ll lose valuable creditor protection that stays in place when you keep the funds in your 401 plan at work. You could also be subject to a tax penalty, depending on why you’re taking the money.

Also Check: What Is The Minimum 401k Distribution

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

When Faced With A Sudden Cash Crunch It Can Be Tempting To Tap Your 401 More Than A Few Individuals Have Raided Their Retirement Account For Everything From Medical Emergencies To A Week

But if you’re under 59-1/2, keep in mind that an early withdrawal from your 401 will cost you dearly. You’re robbing your future piggy bank to solve problems in the present.

You’ll miss the compounded earnings you’d otherwise receive, you’ll likely get stuck with early withdrawal penalties, and you’ll certainly have to pay income tax on the amount withdrawn to Uncle Sam.

If you absolutely must draw from your 401 before 59-1/2, and emergencies do crop up, there are a few ways it can be done.

Hardship withdrawals

You are allowed to make withdrawals, for example, for certain qualified hardships — though you’ll probably still face a 10% early withdrawal penalty if you’re under 59-1/2, plus owe ordinary income taxes. Comb the fine print in your 401 plan prospectus. It will spell out what qualifies as a hardship.

Although every plan varies, that may include withdrawals after the onset of sudden disability, money for the purchase of a first home, money for burial or funeral costs, money for repair of damages to your principal residence, money for payment of higher education expenses, money for payments necessary to prevent eviction or foreclosure, and money for certain medical expenses that aren’t reimbursed by your insurer.

Loans

Most major companies also offer a loan provision on their 401 plans that allow you to borrow against your account and repay yourself with interest.

You then repay the loan with interest, through deductions taken directly from your paychecks.

Recommended Reading: How Do I Find Out Where My Old 401k Is

Early Withdrawal Age Rules Only Apply To The Assets In The 401 Plan Maintained By Your Former Employer

Assets in an IRA have their own rules regarding a penalty-free early withdrawal. In a similar vein, assets that youve rolled over from your 401 to an IRA will generally no longer be eligible for penalty-free early withdrawals unless you qualify for a different exemption . If theres a possibility you may need to tap into the savings in your 401, you may want to hold off on rolling those assets over to an IRA until you turn 59 ½.

Borrow Instead Of Withdrawing From A 401

Some 401 plans allow employees to take a loan from their 401 balance before attaining retirement age. The specific terms of the loan depend on the employer and the plan administrator, and an employee may be required to meet certain criteria to qualify for a 401 loan.

The amount borrowed is not subject to ordinary income tax or early-withdrawal penalty as long as it follows the IRS guidelines. The IRS provides that 401 account holders can borrow up to 50% of their vested account balance or a maximum limit of $50,000. This limit applies to the total outstanding loan balances of all loans taken from the 401 account. The loan must be paid within five years, and the borrower must make regular and equal loan payments for the term of the loan.

Also Check: What’s The Max You Can Put In A 401k

Should You Take A Distribution From Your 401 Or Ira

Like the CARES Act, the Consolidated Appropriations Act allows you to withdraw funds from both a 401 and an IRA, as long as the amount is up to $100,000 across all accounts. If you are deciding whether to take a distribution from either your IRA or a 401, think about factors such as each of the account’s typical rules around penalties and taxes. F

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Also Check: How To Invest My 401k Money

Can The Government Take Your 401k

Lets get one thing out of the way first: unless you have an IRS levy or other legal judgment against you, the US Government has no legal standing to seize the contents of your private retirement account, such as your 401k, IRA, Thrift Savings Plan, your self-employed retirement plan, or any other retirement plan.

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

Recommended Reading: What Should I Invest In 401k

If You’re Still Working For The Company

Most 401 plans don’t allow “regular withdrawals” at age 55 while you’re still working for the company. A regular withdrawal is defined as one that’s not subject to penalties and doesn’t require you to qualify based on special circumstances.

You might be able to take a 401 loan or qualify for a hardship withdrawal rather than take a regular withdrawal if your 401 plan allows these options. Not all 401 plans are required to offer loans or hardship withdrawals, however.

You can check with your plan administrator to see if they have a special provision that allows for something called an “in-service distribution.”