When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Now The Clock Starts Ticking

As soon as you start the process of moving your money to another bank, the IRA clock starts ticking. You have 60 daysto move the IRA savings account from one bank to another. After 60 days, the transaction will be treated as a distribution from the IRA rather than a transfer. Youll then have to pay income taxes on the interest youve earned, plus a 10 percent penalty on the balance of the CD.

Its unusual for banks to take more than 60 days to transfer money, but its on you to request and fill out the paperwork quickly to avoid the tax penalty. The new bank should lead you through the process. Ask for help transferring the IRA CD from your old bank and they will send you the paperwork you need to fill out. Most times, you will not see the money it will simply transfer from the old bank to the new bank.

References

Tips On Conducting An Hsa Rollover

- A financial advisor can help guide you through the complexities of conducting an HSA rollover. Finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Not sure where to roll over your HSA funds? As long as you keep your HSA-eligible HDHP coverage, you can open one at almost any bank. But the choice can be difficult with so many options. To help you out, we published our report on the best banks in America.

Read Also: How Much Will I Have When I Retire 401k

Option : Roll It Into An Ira

If your new employer doesnt offer a 401 or you dont like their option, you can roll your 401 into an IRA.

Rolling over accounts is easier than it sounds. You may need to open an IRA at a brokerage company and sign a few papers that allow the brokerage to transfer the money into your new account. This option will help keep your balance growing tax deferred and you can continue to make tax-deferred contributions.

How To Establish An Hsa Rollover

The easiest and safest way to kick off an HSA Rollover is by contacting your current HSA provider. It could be a financial institution such as a bank or a mutual fund company. If youve opened one through your employer, the benefits department should tell you exactly whom to get in touch with.

From there, instruct your HSA provider to establish a trustee-to-trustee transfer of your funds into a new account with a different HSA provider. Most allow you to do this online. Or you can call and ask for a trustee-to-trustee form. Fill it out, send it back and your HSA provider will handle the rest.

You may have heard that the IRS allows HSA rollovers once every 12 months. In truth, you can make as many trustee-to-trustee transfers as you wish. The IRS doesnt treat each transfer as an official rollover.

However, an actual rollover does follow the 12-month rule. Heres how it works. You contact your current HSA provider and request it sends you a check or direct deposit of your funds, so you can set up an HSA rollover. Then you have 60 days to deposit those funds into your new HSA account. If you fail to do so, the IRS will levy income tax on the amount you rolled over, plus a 20% penalty.

However, these methods apply to ordinary HSAs. If your HSA money is technically invested in securities like mutual funds and stocks, the process works a little differently.

Don’t Miss: How Do I Get My 401k

How The Rollover Is Done Is Important Too

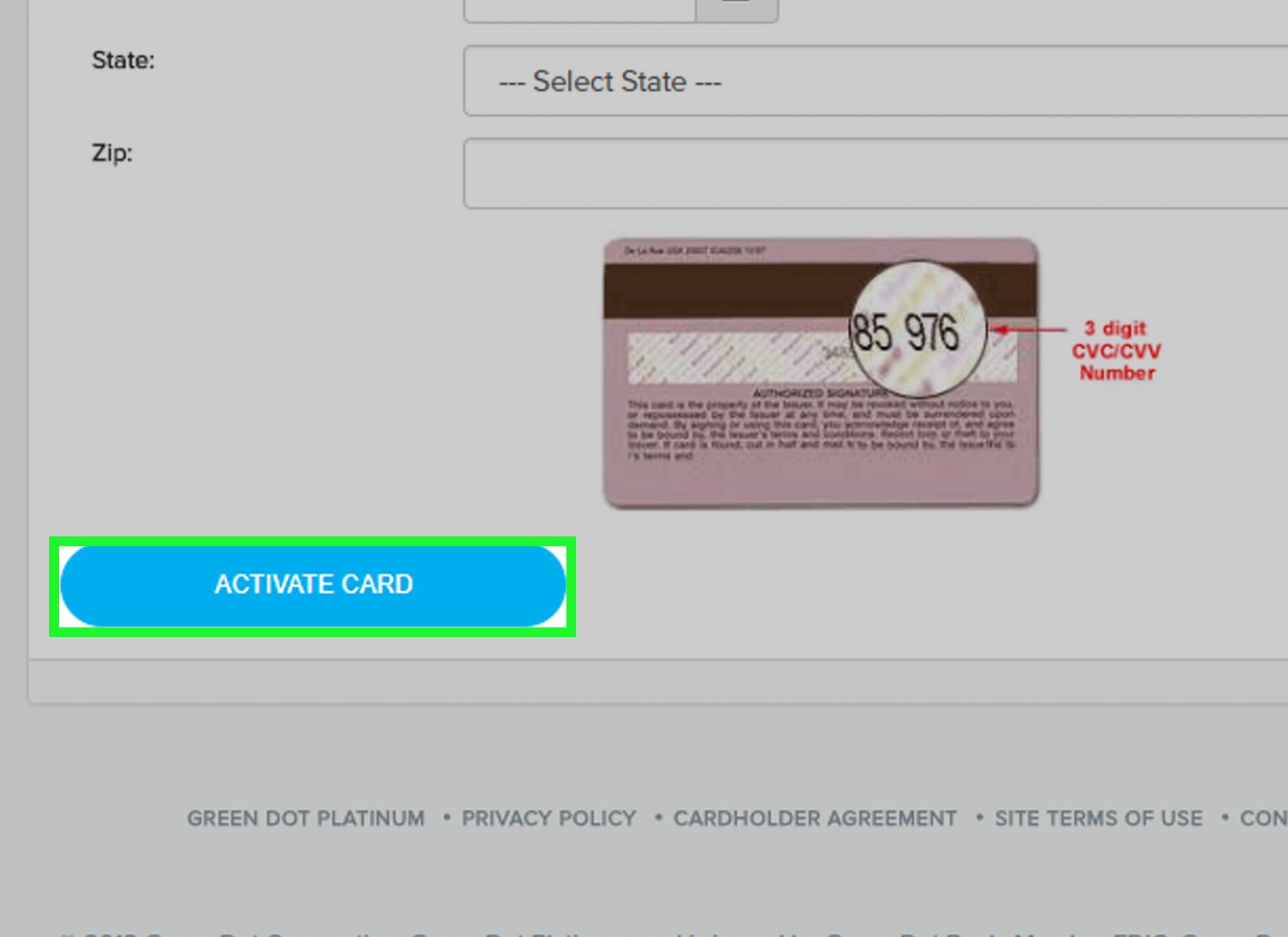

Whether you pick an IRA for your rollover or choose to go with your new employer’s plan, consider a direct rolloverthats when one financial institution sends a check directly to the other financial institution. The check would be made out to the bank or brokerage firm with instructions to roll the money into your IRA or 401.

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your employer is required by the IRS to withhold 20% for taxes. As if that wouldn’t be bad enoughyou only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401 or IRA. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, you’d have to come up with the 20% that was withheld and put it into your new account.

If you’re not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money but you may also owe a 10% penalty if you’re under age 59½ because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401.

What If You Have An Existing 401 At Your Previous Employer

If you have a 401 at a previous employer, youll want to consider whether a rollover makes sense for you. You may want to consult with a tax professional to make sure that you are making a decision that is best for your unique circumstances.

As youre thinking about what to do with your old 401, here are some options to consider:

Also Check: How To Increase 401k Contribution Fidelity

Can I Roll A Portion Of My Retirement Plan Balance To An Ira Or My New Employers Plan And Take The Remaining Portion In Cash

Yes, you can take a portion of your retirement plan balance in cash and either move the remaining balance to a new employers plan or roll to an IRA. However, the portion taken in cash will be subject to applicable taxes, and possible penalties. Check with your new employer to find out if the rollover will be accepted by the new plan.

What Happens If I Leave My Employer And I Have An Outstanding Loan From My Plan Account

Keep in mind that most plans require that loans be repaid when you leave. If you roll over your remaining account balance to a new employers plan, you may also be able to roll over the outstanding balance of your loan to your new employers plan. Check with your new employer to find out if the loan will be accepted by the new plan. You cannot roll over your loan to an IRA.

If you cant move the loan to your new plan, and if you dont repay the loan within the time allotted, the outstanding balance will be treated as a withdrawal, subject to federal and applicable state and local taxes. If youre under age 59½, you may also have to pay a 10% early withdrawal penalty unless you qualify for an exception.

You May Like: How Do I Take Money Out Of My Fidelity 401k

Can I Keep The Same Funds I Have In My Retirement Plan

This depends on your plan. First, you’ll want to reach out to your provider to determine if moving the assets over “in-kind” or “as is” could be an option for you.

If it is an option, then you’ll want to contact us at 877-662-7447 . One of our rollover specialists can help determine if we can hold your current investments here at Vanguard.

If it isn’t an option, don’t worrywe can still help you choose new investments once your assets have arrived here at Vanguard.

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fidicuary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Don’t Miss: How To Transfer 401k Without Penalty

Rollover To A Traditional Ira

Transferring funds between a traditional 401 and a traditional IRA or between a Roth 401 and a Roth IRA is relatively straightforward. In many cases, you can do a direct rollover, also called a trustee-to-trustee transfer. This involves your 401 provider wiring funds directly to your new IRA provider. Alternatively, your 401 provider may send you a check that you then deposit into your new IRA.

Look out for any taxes your provider may have preemptively deducted. You shouldnt owe any taxes or penalties as long as you deposit money in a tax-advantaged retirement account within 60 days.

How 401 Rollovers Work

If you decide to roll over an old account, contact the 401 administrator at your new company for a new account address, such as ABC 401 Plan FBO Your Name, provide this to your old employer, and the money will be transferred directly from your old plan to the new or sent by check to you , which you will give to your new companys 401 administrator. This is called a direct rollover. Its simple and transfers the entire balance without taxes or penalty. Another, even simpler option is to perform a direct trustee-to-trustee transfer. The majority of the process is completed electronically between plan administrators, taking much of the burden off of your shoulders.

A somewhat riskier method, Ford says, is the indirect or 60-day rollover in which you request from your old employer that a check be sent to you made out to your name. This manual method has the drawback of a mandatory tax withholdingthe company assumes you are cashing out the account and is required to withhold 20% of the funds for federal taxes. This means that a $100,000 401 nest egg becomes a check for just $80,000 even if your clear intent is to move the money into another plan.

You May Like: Is There A Limit For 401k Contributions

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

How Do Transfers Work

Transfers are a direct custodian-to-custodian movement of money from one of your HSAs to another . In a transfer, you never take possession of the funds transferred.

You can do an unlimited number of HSA transfers within any given tax year, and transfers require no tax reporting by you or by your custodian.

You can make a one-time transfer from your IRA into your HSA, but you cant transfer any other retirement account into your HSA. However, you can roll 401 funds into an IRA, then transfer that IRA over to your HSA.

Transfers only count against your annual contribution limit if you transfer funds from an IRA. If you transfer funds from an IRA, you must be HSA-eligible when you make the transfer and continue to be eligible for 12 months after the transfer. If not, you will face a tax penalty.

Recommended Reading: How To Make More Money With My 401k

How To Roll Over Your 401

The U.S. Bureau of Labor Statistics found that 2.9% of Americansthats 4.3 million peoplequit their jobs in August 2021, a record-breaking month that has been preceded by similar statistic-shattering months that year. Whats been coined the Great Resignation, this phenomena has been triggered by several factors, including the pandemic and the rise of remote work. These pandemic epiphanies have caused workers to reconsider their priorities in life, often resulting in a reshuffling of careers.

If you’re one of millions of workers who’s changedor is considering changingjobs, it’s important to make the most of any retirement savings you may have. Knowing how to roll over your 401 is an essential step to maximize your nest egg. From understanding how vesting works to knowing the required steps to do an indirect rollover, we’ll review how to roll over a 401 after leaving an employer.

Roll Over Your 401 To A Roth Ira

If you’re transitioning to a new job or heading into retirement, rolling over your 401 to a Roth IRA can help you continue to save for retirement while letting any earnings grow tax-free.2

- Cons

-

- You can’t borrow against a Roth IRA as you can with a 401.

- Any Traditional 401 assets that are rolled into a Roth IRA are subject to taxes at the time of conversion.

- You may pay annual fees or other fees for maintaining your Roth IRA at some companies, or you may face higher investing fees, pricing, and expenses than you did with your 401.

- Some investments offered in a 401 plan may not be offered in a Roth IRA.

- Your IRA assets are generally protected from creditors only in the case of bankruptcy.

- Rolling over company stock may have negative tax implications.

Also Check: How To Transfer 401k From Charles Schwab To Fidelity

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917