Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 or 10% of that $10,000 withdrawal in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

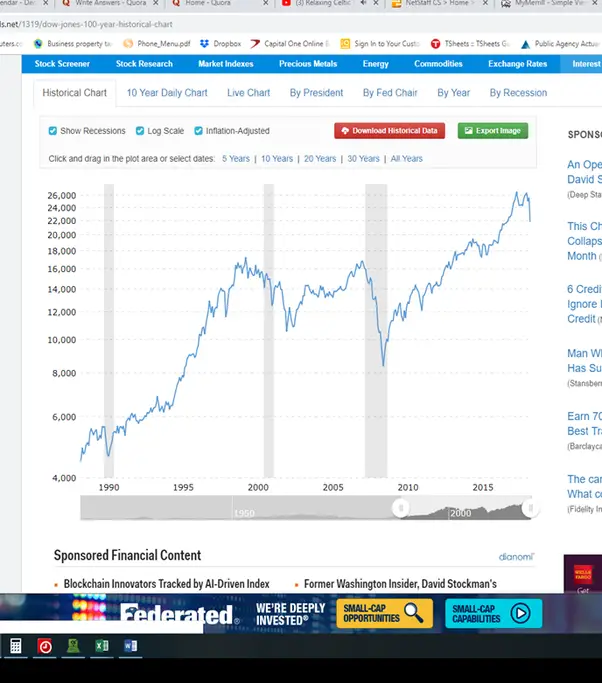

You may lock in your losses. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona. That may mean less money for your future.

How To Make A 401 Hardship Withdrawal

To make a 401 hardship withdrawal, you will need to contact your employer and plan administrator and request the withdrawal. The administrator will likely require you to provide evidence of the hardship, such as medical bills or a notice of eviction. The administrator will also review your request to ensure it meets the criteria for a hardship withdrawal. If the request is approved, the administrator will process the withdrawal and release the funds to you.

You may have to pay deferred taxes on the amount withdrawn, and you could also have to pay a penalty if the withdrawal is for certain unapproved purposes. Note that once the funds are withdrawn, they cannot be repaid into the account.

It is important to carefully review the terms of your 401 plan and consult with your plan administrator to understand the process for making a hardship withdrawal and any potential consequences. Additionally, it is generally advisable to exhaust other options, such as an emergency fund or outside investments, before considering a hardship withdrawal from your 401 plan.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Don’t Miss: How Do I Get My 401k From An Old Job

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Living With A Disability

If you become totally and permanently disabled, getting access to your retirement account early becomes easier. In this case, the government allows you to withdraw funds before age 59½ without penalty. Be prepared to prove that youre truly unable to work. Disability payments from either Social Security or an insurance carrier usually suffice, though a doctor’s confirmation of your disability is frequently required.

Keep in mind that if you are permanently disabled, you may need your 401 even more than most investors. Therefore, tapping your account should be a last resort, even if you lose the ability to work.

You May Like: Where Do I Check My 401k

Withdrawals After Age 72

Many people continue to work well past age 59 1/2. They delay their 401 withdrawals, allowing the assets to continue to grow tax-deferred, but the IRS requires that you begin to take withdrawals known as “required minimum distributions” by age 72.

Those who are owners of 5% or more of a business can defer taking their RMDs while they’re still working, but the plan must have made this election. This only applies to the 401 of your current employer. RMDs for all other retirement accounts still must be taken.

Avoiding The 10% Penalty:

If for any reason you need to take money out of your 401k sooner than age 59-1/2, there is generally a 10% penalty to be paid on it .

However, as with most of the laws on the books, there are exceptions to these rules. A few of them include:

The employees death

Complete disability for the employee

Separation from service in or after the year the employee reached age 55

Substantially equal periodic payments under section 72

A qualified domestic relations order

Certain deductible medical expenses

A loan

Each one of these exceptions carries their own set of rules and obligations that you must comply with -Resource-Guide—Plan-Sponsors—General-Distribution-Rules” rel=”nofollow”> IRS 401k resource guide). It is highly advised that you speak to a legal or financial representative before using any of them.

In addition, since the 401k vs IRA effort is intended to help you create a secure retirement, it is not recommended that you take money out of your 401k early unless it is truly your last resort. The reason for this is because when you do, that money is no longer in your account generating returns. This disrupts the effects of compound interest which can alter the potential overall balance of your account greatly. Tread with caution if you must exercise this option!

Recommended Reading: How Can You Take Out Your 401k

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

College Tuition And Education Fees For The Next 12 Months

If your 401 plan permits hardship withdrawals, you can generally make withdrawals to cover higher education expenses. FYI, the 10 percent penalty will apply.

However, IRA withdrawals for qualified expenses are not subject to a penalty.

Whether it is for yourself, your spouse, your children, grandchildren, or your immediate family, a qualified plan can cover higher education expenses. For post-secondary education, this usually includes room and board, books, tuition, supplies, and supplies.

You May Like: How To Check How Much Is In Your 401k

Consider Converting Your 401 To An Ira

Individual retirement accounts have slightly different withdrawal rules from 401s. So, you might be able to avoid that 10% 401 early withdrawal penalty by converting your 401 to an IRA first. s and IRAs, of course.) For example:

-

Theres no mandatory withholding on IRA withdrawals. That means you might be able to choose to have no income tax withheld and thus get a bigger check now. You still have to pay the tax when you file your return, though. So if youre in a desperate situation, rolling the money into an IRA and then taking the full amount out of the IRA might be a way to get 100% of the distribution. This strategy may be valuable for people in low tax brackets or who know theyre getting refunds.

Can You Withdraw Money From A 401 Early

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

If the answer is yes, you will need to determine the type of withdrawal that you want to make, fill out the necessary paperwork, and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but when all the paperwork has been submitted, you will receive a check for the requested funds, hopefully without having to pay the 10% penalty.

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Recommended Reading: How Long Will My 401k Last Me In Retirement

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, the penalty will likely be waived if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year.

What Do I Do With My 401 If I Leave My Job

If you’re older than 55 and are no longer employed, you can start withdrawals from your 401 without penalties. If you’re under age 55, you may be able to keep the 401 with your previous employer or move it to a new employer’s plan when you start working again. Talk to the plan administrator about your options. No matter what, don’t abandon your 401 when you change employers.

Also Check: Can I Use My 401k To Buy Gold

What Are The 401k Withdrawal Rules For Getting My Money Back

February 14, 2016 by Justin

Before you go putting too much money into your employers retirement plan to try to hide it from Uncle Sam, it may help you to understand the 401k withdrawal rules and what is involved with getting your money back. For example:

- What if you have an emergency and you need the money right now?

- What if you are planning on buying a house?

- What if you are plan to retire early ?

The Basics Of 401 Withdrawals

The IRS mandates that you leave your money in your 401 until you reach the minimum retirement age of 59 1/2, become permanently disabled, have a specific financial hardship, the plan dissolves or you leave your job. If you meet any of these conditions, you may be able to take funds from your 401, but the amount may be limited and in some cases, you can still be refused. Its also important to be aware that you may or may not be eligible for any additional funds that the company has contributed to your account, depending on the details of your plan and how long you have participated in it.

Also Check: What Is A 401k Loan

Your 401 Account May Be Frozen

The IRS sets the basic guidelines on 401s, but employers can set further limitations with their plans.

One of the powers 401 administrators have is placing âfreezesâ on the 401 plans they manage.

An employer can freeze your 401 for many reasons. Pending litigations against the plan, company mergers, or changes in who manages the 401 plans can all cause your 401 to be frozen. Legally, your plan’s administrator must provide a 30-day notice beforehand to give participants enough time to make arrangements.

You will be unable to contribute new funds and will be unable to withdraw any funds. However, if you are already receiving required minimum distributions, you are required to receive them. If you are not, document your requests for them to avoid any IRS penalties.

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

Also Check: When Changing Jobs What To Do With 401k

Whats Better: 401 Loans Or 401 Distributions

In some cases, it can be difficult to distinguish between 401 loans and withdrawals. But, there are minor differences to be aware of.

401 withdrawals.

You may be eligible for a traditional withdrawal, such as a hardship withdrawal, depending on your situation. In addition to medical expenses and foreclosure, IRS considers tuition, funeral, and purchase and repair of primary residence costs as immediate and heavy financial needs. Also, some plans allow for non-hardship withdrawals, but all are unique, so ask your employer for more information.

Withdrawals have the advantage that no repayment is required.

A hardship withdrawal from a 401 account will not give you the full amount since ordinary income is taxed on withdrawals from these accounts. Unless you qualify for one of the IRS exceptions, early withdrawals before age 59 ½ are subject to a 10% penalty.

401 loans.

You borrow money from your retirement savings account when you take out a 401 loan. Within a 12-month period, you may be able to withdraw as much as 50% of your retirement savings, up to a maximum of $50,000, depending on what your employers plan allows.

In most cases, you will need to pay back your loan. As well as interest within 5 years from the date you took it out. You are also limited in the number of loans outstanding from your plan by its rules. To take out a loan, you may also need your spouses or domestic partners consent.

What Happens If I Stop Contributing To My 401k

If you are considering stopping contributions to a 401k, you would be better served to merely suspend those contributions. A short-term suspension will slow the performance of your retirement fund, but it wont keep it from growing. It also will lessen the temptation to simply withdraw all the funds and wipe out retirement savings in the process.

Recommended Reading: How To Find Forgotten 401k Accounts

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Roll Your Money To An Ira

Transfer your money into an Individual Retirement Account .

- Your savings stay invested, with similar tax advantages

- You have access to a wide range of investment options

- You can roll in retirement savings from other jobs

- You can keep contributing money to the account

- Loans aren’t allowed, but you may be able to withdraw money before you retire under certain circumstances

Recommended Reading: Can I Start A 401k For My Child

Withdrawal Rules Frequently Asked Questions

If you participate in a 401 plan, you should understand the rules around separation of service, and the rules for withdrawing money from your account otherwise known as taking a withdrawal. 401 plans have restrictive withdrawal rules that are tied to your age and employment status. If you dont understand your plans rules, or misinterpret them, you can pay unnecessary taxes or miss withdrawal opportunities.

We get a lot of questions about 401 withdrawal rules from participants. Below is a FAQ with answers to the most common questions we receive. If you are a 401 participant, you can use our FAQ to understand when you can take a withdrawal from your account and how to avoid penalties.

What Is A 401 Early Withdrawal

First, lets recap: A 401 early withdrawal is any money you take out from your retirement account before youve reached federal retirement age, which is currently 59 ½. Youre generally charged a 10% penalty by the Internal Revenue Service on any withdrawals classified as earlyon top of any applicable income taxes.

If youre making an early withdrawal from a Roth 401, the penalty is usually just 10% of any investment growth withdrawncontributions are not part of the early withdrawal fee calculation for this type of account.

But the entire account balance counts for calculating the fee if youre making an early withdrawal from a traditional 401. These rules hold true for early distributions from a traditional IRA as well.

Recommended Reading: Is A 401k A Defined Benefit Plan