My Employer Doesn’t Offer A 401 Should I Care

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Millions of American workers don’t have access to 401 retirement plans. Many of these people are self-employed or younger workers others work for smaller companies without established benefit packages. Sometimes, other employee benefits are offered in lieu of a 401. Whatever the reason, such workers need to find alternative ways to save for retirement and, in some cases, could consider switching to another company.

If You’re An Employee

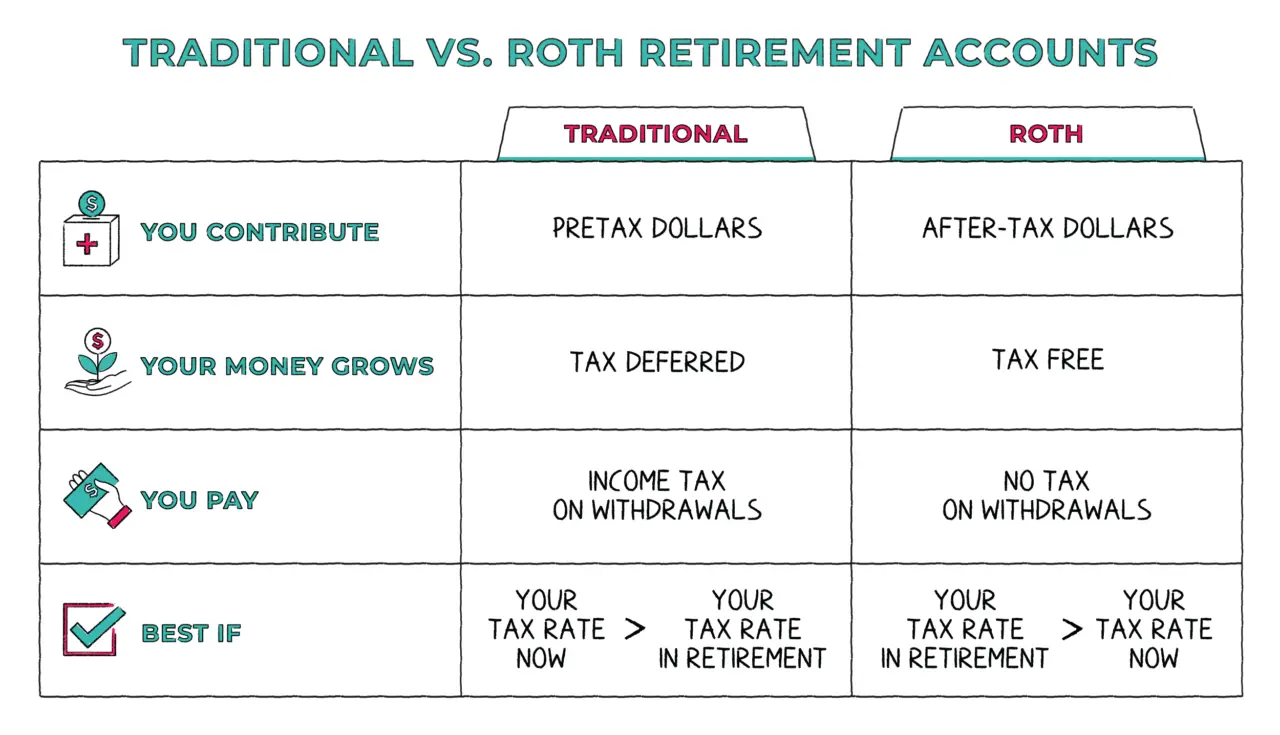

You can fund a Roth 401sometimes referred to as a designated Rothif your employer offers one as part of its retirement plan options. Not all employers do, but their numbers are growing, especially among large companies. If your employer matches your contributions, or some percentage of them, that money, unlike your own Roth 401 contributions, is considered a pretax contribution and is therefore taxable when you withdraw it.

Unlike Roth IRAs, which have income limits, you can open a Roth 401 regardless of how much money you earn. Another key difference between the two Roths is that unless you are still working for the company through which you have the Roth, you must generally take required minimum distributions from your Roth 401 starting at age 72 Roth IRAs, on the other hand, have no RMDs during your lifetime.

Unlike Roth IRAs, Roth 401s are subject to required minimum distributions.

If you’d like to hedge your bets, you can have both a Roth 401 and a traditional one and split your contributions between them. The maximum total you can contribute to the two accounts is the same as if you had just one account: $19,500 plus another $6,500 in catch-up contribution if you’re 50 or older.

Which Account Is Better

Neither account is necessarily better than the other, but they offer different features and potential benefits, depending on your situation. Generally speaking, 401 investors should contribute at least enough to earn the full match offered by their employers. Beyond that, the quality of investment choices may be a deciding factor. If your 401 investment options are poor or too limited, you may want to consider directing further retirement savings toward an IRA.

Your income may also dictate which types of accounts you can contribute to in any given year, as explained earlier. A tax advisor can help you sort out what you’re eligible for and which types of accounts might be preferable.

You May Like: Should I Roll My 401k Into An Annuity

Solo 401 Contribution Limits

The total solo 401 contribution limit is up to $57,000 in 2020 and $58,000 in 2021. There is a catch-up contribution of an extra $6,500 for those 50 or older.

To understand solo 401 contribution rules, you want to think of yourself as two people: an employer and an employee . Within that overall $57,000 contribution limit in 2020, your contributions are subject to additional limits in each role:

-

As the employee, you can contribute up to $19,500 in 2020 and 2021, or 100% of compensation, whichever is less. Those 50 or older get to contribute an additional $6,500 here.

-

As the employer, you can make an additional profit-sharing contribution of up to 25% of your compensation or net self-employment income, which is your net profit less half your self-employment tax and the plan contributions you made for yourself. The limit on compensation that can be used to factor your contribution is $285,000 in 2020 and $290,000 in 2021.

Keep in mind that if youre side-gigging, employee 401 limits apply by person, rather than by plan. That means if youre also participating in a 401 at your day job, the limit applies to contributions across all plans, not each individual plan.

Can I Contribute To Both A 401 And A Roth 401

Most employers that offer both a Roth 401 and a traditional 401 will let you switch back and forth between them or even split your contributions. Employers may even match Roth 401 contributions. In fact, if your employer offers matching dollars and you contribute to a Roth 401, you’ll also have a traditional 401 because the matching amount must go into a pretax account.

Using both accounts especially if youre not eligible for a Roth IRA because of income limits can enable tax diversification in retirement. Youll be able to choose whether to pull money from a tax-free or a tax-deferred pot, or a combination of the two, each year. That will let you better manage your taxable income.

|

one year of financial planning |

Also Check: How Long Does A 401k Rollover Take

How Much You Can Invest

If you’re under age 50, your annual contribution limit is $19,500 for 2020 and $19,500 for 2021.

If you’re age 50 or older, your annual contribution limit is $26,000 for 2020 and $26,000 for 2021.

If you’re under age 50, your annual contribution limit is $6,000 for 2020 and 2021.

If you’re age 50 or older, your annual contribution limit is $7,000 for 2020 and 2021.

There Are Fees You Pay For Your 401

Unfortunately, 401 plans come with fees but many savers dont realize this. According to TDAmeritrades January 2018 Investor Pulse Survey, 37% of Americans dont know that they pay any 401 fees, 22% dont know if their plan has fees, and 14% dont know how to determine the fees. Typically larger plans will have lower fees but the number of enrollees and the plans provider can also affect the cost. Typically, fees will range from 0.5% to 2% of the plan assets.

Pay attention to each fund’s expense ratio, which is a measure of a fund’s operating expenses expressed as an annual percentage. The lower the expense ratio, the less youll pay to invest. A total expense ratio of 1% or less is reasonable. Look at your 401 plan’s website to find a fund’s expense ratio.

The good news is that your plan may give you access to lower-cost institutional shares, which are cheaper than different share classes of the same investment bought through an IRA. The average equity mutual fund expense ratio for stock funds in 401s was 0.50% in 2020, according to the Investment Company Institute. One way to cut costs: Look to see whether your plan offers index funds, which tend to be cheaper than actively managed funds.

Don’t Miss: How To Set Up A 401k Account

Saving For Retirement If Youre Self

Okay, if youre self-employed and don’t have any employees, a one-participant 401also known as a solo 401may be right up your alley. Contributions are tax-deductible, and you can contribute up to $19,500 every year . Then, on top of that, you can put in up to 25% of your incomeas long as what you contribute is less than $58,000 per year.6

Another option is the are primarily used by small-business owners who want to help their employees with retirement, but freelancers and the self-employed can also use this option. You can contribute to your own retirement this way, but again, you cant exceed either 25% of your income or $58,000 .7

Ira Benefits And Drawbacks

The investment choices for IRA accounts are vast. Unlike a 401 plan, where you’re likely to be limited to a single provider, you can buy stocks, bonds, mutual funds, ETFs, and other investments for your IRA at any provider you choose. That can make finding a low-cost, solid-performing option easy.

However, the amount of money you can contribute to an IRA is much lower than with 401s. For 2020 and 2021, the maximum allowable contribution to a traditional or Roth IRA is $6,000 a year, or $7,000 if you are age 50 or older. If you have both types of IRAs, the limit applies to all of your IRAs combined.

An added attraction of traditional IRAs is the potential tax-deductibility of your contributions. But, as discussed above, the deduction is only allowed if you meet the modified adjusted gross income requirements.

Your MAGI may also limit your contributions to a Roth IRA. In 2020, single filers have to make below $139,000, while married couples filing jointly must make less than $206,000 to be eligible for a Roth. These amounts rise for 2021 when single filers must make below $140,000, and married couples filing jointly must make less than $208,000 to be eligible for a Roth IRA .

Having earned income is a requirement for contributing to an IRA, but a spousal IRA lets a working spouse contribute to an IRA for their nonworking spouse, making it possible for the couple to double their retirement savings.

Read Also: How To Grow 401k Fast

You Get A Tax Break For Contributing To A 401

With its name derived from the tax code, the 401 is an employer-based retirement savings account, known as a defined-contribution plan. You contribute pretax money from your salary, which lowers your taxable income and helps you cut your tax bill now. For instance, if you make $4,000 a month and save $500 a month in your 401, only $3,500 of your monthly earnings will be subject to tax. Plus, while inside the account, the money grows free from taxes, which can boost your savings.

What Is The Maximum 401k Contribution Amount

Starting in 2020 , you can contribute up to $19,500 each year to your 401k if you are under 50. If you are over the age of 50, you may be able to make catch-up contributions. This provision lets you invest up to an additional $6,500 in your 401k .

PRO TIP: You need to be behind in your 401k contributions to make catchup contributions.

When compared to a Roth IRA, where you can only contribute up to $6,000/year, this is an amazing opportunity especially since your pre-tax money is being compounded over time.

Also Check: How To Diversify 401k Portfolio

If Your Employer Doesn’t Offer A Retirement Account

Maybe your employer doesn’t offer retirement accounts like 401s. Or maybe there is a workplace plan, but you haven’t worked there long enough to be eligible.

If that’s the case and you don’t have any freelance income you’re left with two options: a Traditional or Roth IRA. They both allow your money to grow tax-free.

If you choose a Traditional IRA, you might be able to deduct your contributions and lower your tax bill. But you can’t touch your money until age 59 ½ without getting hit with a penalty.

Contributions to Roth IRAs are not tax deductible, but you can withdraw the money in retirement tax free. Plus you can access the money you put in at any time, without penalty.

Compared to other retirement accounts, Traditional and Roth IRAs have low contribution limits. Both currently allow you to save up to $5,500 annually . Even if you contribute the max each year, you probably won’t have enough to fund a comfortable retirement without saving elsewhere.

“To save extra money, the best thing is to use a plain old brokerage account,” said Adam.

You won’t get a tax deduction, but you’ll be able to access your money at any time to use for any reason.

Invest In A Business Startup

The thrill of funding the next big thing makes investing in a startup exciting, however, it also includes a high degree of risk. Crowdfunding or focused investment platforms are a few ways that startups reach out to both potential investors and future customers.

Key benefits: Low investment threshold, rapid growth could lead to a corporate buyout and a large financial gain.

Drawbacks: High failure rates, may take a long time for the investment to pay off and/or to liquidate the investment.

Also Check: Can You Roll A 401k Into A Self Directed Ira

You Can Withdraw Money Early From A 401

Money you stash in a 401 isn’t meant to be touched until retirement, and any money withdrawn before you turn 59 1/2 could be subject to a 10% early-withdrawal penalty. But if you leave a job as early as age 55, you can tap the 401 penalty-free.

Company 401s also generally allow participants to borrow from their accounts. You may have to pay a fee to take a loan. Plus, you’ll be charged interest on the amount you take out. But you’ll basically be paying interest to yourself because the money goes into the account. Watch out if you have outstanding loans when you leave a company — the loans will have to be repaid within 60 to 90 days. If not, the amount of the loan will be considered a taxable distribution.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: How To Open A Solo 401k

More Options If Youre A Freelancer Or Entrepreneur

If youre the boss of you, then you might have a few more choices available to you when it comes to saving for retirement.

One is a , which is like a regular IRA above, except the employer makes all the contributions. You just have to be 21 years old, earn at least $600 a year, and have worked for your company in three out of the last five years. The great part about SEP IRAs is that they have high contribution limits up to 25% of earnings or $58,000, whichever is lower.

Theres also a solo 401, aka a one-participant 401. With this kind of account, think about it like youve split yourself into two people: the employer and the employee. The employer side of you can contribute up to 25% of earnings, while the employee side of you can contribute up to $19,500 . The total limit is still $58,000, but depending on your income, this weird split might actually let you contribute more with a solo 401 than a SEP IRA.

So, no need to let a lack of a 401 get you down. You can still take care of Future You and build that dream retirement starting today.

The information provided should not be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice.

The information provided does not take into account the specific objectives, financial situation or particular needs of any specific person.

How To Get Started Investing In Either Iras Or 401s

If you want a 401 plan, check to see what your employer offers. You can only get a 401 plan through your job. The HR department is a good place to start looking for information about 401 plans at your work.

If you want an IRA, all you need to do is open an account with a broker. Figure out which IRA is best for you . Deposit your money and make sure its invested.

IRAs and 401s are not mutually exclusive you can get both.

You May Like: Should I Roll 401k To Ira

You Can Roll Over A 401 Account

Workers generally have four options for their 401 when they leave a company: You can take a lump-sum distribution you can leave the money in the 401 you can roll the money into an IRA or, if you are going to a new employer, you may be able to roll the money to the new employer’s 401.

It’s usually best to keep the money in a tax shelter, so it can continue to grow tax-deferred. Whether you roll the money into an IRA or a new 401, be sure to ask for a direct transfer from one account to the other. If the company cuts you a check, it will have to withhold 20% for taxes. And whatever money isn’t back in a retirement account within 60 days will become taxable. So if you don’t want that 20% to be considered a taxable distribution, you’ll have to use other assets to make up the difference.

While You Can’t Invest In A 401 That Isn’t Sponsored By Your Employer There Are A Couple Of Exceptions To The Rule

Photo: 401kcalculator.org via Flickr.

A 401 is the most common type of retirement plan private-sector employers offer. However, many employers don’t offer a 401, or any type of retirement plan at all. If you are in this group, can you still take advantage of the many benefits of a 401?

The short answer: not really By definition, a 401 is an employer-sponsored retirement plan designed to encourage employees to save money for retirement and employers to help them do it. So to take advantage of this type of an account, you need to have an employer, and the employer needs to be the sponsor of the plan.

Some specific rules:

- You can’t invest in a 401 if you’re unemployed.

- You can’t invest in a 401 if your employer doesn’t offer one, or you don’t meet the qualifications for your employer’s plan .

- You can’t invest in an employer’s 401 if you aren’t that employer’s employee.

But just as with many other topics in finance, there are exceptions. Here are two major exceptions to the 401 rules.

Exception 1: You are the employerIf your income comes from self-employment, you can start a retirement savings account known as a Solo 401 or Individual 401.

Essentially, this gives you all the benefits of an employer-sponsored 401, as well as the ability to invest in any stocks, bonds, or mutual funds you want — not just in a small, specific basket of funds such as those that most employer-sponsored 401 plans offer.

Also Check: Should I Keep My 401k Or Rollover To Ira