Should You Use Fidelitys Brokeragelink Option

If you are one of the 22 million investors with a retirement plan at Fidelity, you may have access to an option within your plan that could dramatically improve the success of your 401k. Fidelitys BrokerageLink® option is a self-directed brokerage account within the 401k or 403b plan. In this article, youll learn what the BrokerageLink® option is and when it may make sense to take advantage of it.

Most retirement plans provide a short list of investment choices across stock and bond categories along with one stop shopping in target date retirement funds. It is usually possible to craft a fairly well-diversified portfolio using the standard options offered by most plans. Interestingly, most investors dont undertake the effort. As of Q1 2019, 52% of individuals with a Fidelity 401k had all of their retirement savings in a target date fund.1

For investors who want more control over their asset allocation, BrokerageLink® may be the way to go. For purposes of our discussion today, well focus on Fidelitys offering, but many retirement plans administered by other institutions such as Charles Schwab, Alight, Ascensus, Vanguard, and Merrill Lynch offer similar brokerage window options.

What is BrokerageLink®?

Benefits of BrokerageLink®

Additional Considerations

The following are some additional considerations to make before opening a BrokerageLink® account:

The Number Of Workplace Retirement Accounts With $1 Million Or More Hit An All

Despite surging covid cases and climbing inflation, Americans retirement account balances continue to rise to record levels. Others, though, are fighting to pay rent unable even to think about investing for the future.

Lets look at the haves who are saving for retirement in workplace plans.

Fidelity Investments just released its quarterly analysis of more than 30 million 401 and 403 retirement accounts. Average retirement account balances maintainedan upward trend for the third straight quarter.

Workers who continue to contribute to their plans, even as the pandemic produced some heart-clutching moments in the stock market, were rewarded with significant increases in their account balances, according to Fidelity, the largest administrator of workplace retirement accounts.

In fact, as the pandemic caused people to lose their jobs, 38 percent of 401 savers increased their savings rate. And this wasnt just among older workers, who you might expect would contribute more as they get closer to retirement.

People are really seeing the benefit of long-term investing, said Jessica Macdonald, vice president for thought leadership at Fidelity.

Macdonald said 85 percent of the growth in account balances came from stock market performance.

How To Make Contribution And Investment Changes

Fidelity is the Master Administrator for the Plan this means that you have the streamlined ability to enroll in the Plan and make contribution changes, whether you contribute to Fidelity, TIAA, or both. In order to contribute to TIAA, you need to have an RIT TIAA account. By offering one consolidated plan, RIT is able to avoid unnecessary fees and keep costs to employees as low as possible.

- View and/or change your contribution percentage

- View and/or change the split between your pre-tax and Roth contribution percentage

- Join the annual increase program to automatically increase your contribution each September 1

- Change your record keeper election between Fidelity and TIAA

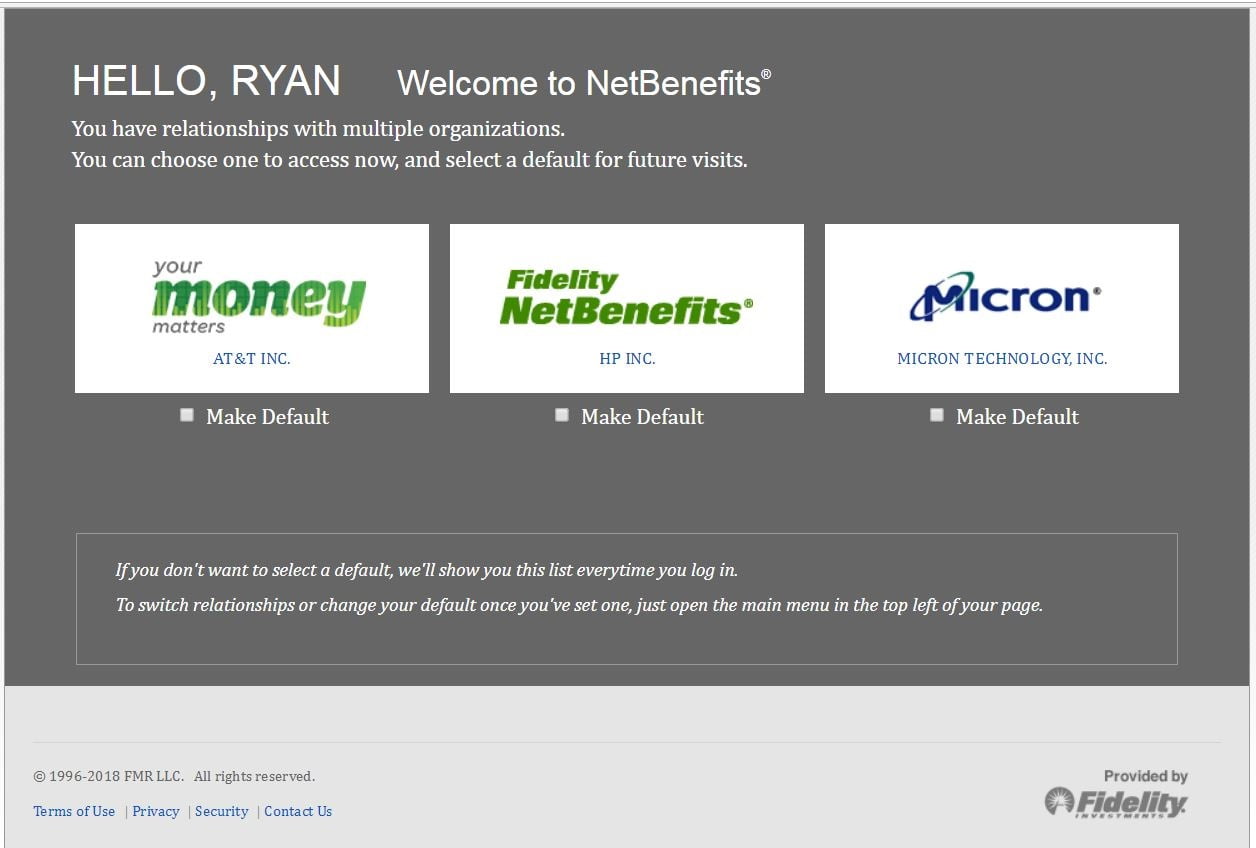

Log in at . You can set up a login if you do not have one by clicking on “Register Now” at the top of the page and follow the prompts.

Step 1:Once logged in, click on the drop down arrow to the right of Quick Links and choose “Contribution Amount“. If you are already logged in, click on the “Contributions” tab.

Step 2:There are three choices:

- Contribution Amount – to view and change your contribution percentage and/or the split between pre-tax and after-tax Roth contributions

- Annual Increase Program – to enroll or change participation in the program to automatically increase your contribution effective each September 1

- Retirement Providers – to view and change the allocation for your future contributions between the two record keepers, Fidelity and TIAA

Read Also: What Employees Can Be Excluded From A 401k Plan

T Rowe Blue Chip Growth Fund

With the nation facing a recession and what will likely be a long recovery, blue chip stocks are solid bets for investors. These are the stocks of companies that are stalwarts of their industries. They’re stable, profitable, and well-established, with the size and strength to not only survive an economic downturn, but even grow.

T. Rowe Price Blue Chip Growth Fund is a top performer in this asset class. This fund, with roughly $75.6 billion in assets, invests in large- and mid-sized blue chip companies. The portfolio is much more focused than the others, with only about 130 holdings. Amazon is the largest at 10.7%. The top 10 holdings account for 49% of the portfolio.

The portfolio management team is led by Larry Puglia, who has managed the fund since 1993. Puglia and his team look for growth companies that lead their industries and consistently meet or beat earnings targets. The performance has been stellar, up 10.74% over the last five years, which beats the S& P 500 benchmark by more than 4%. Over the past 10 years, the T. Rowe Price Blue Chip Growth Fund is up 13.86%, much better than the 10.53% return of the benchmark. For an actively managed fund, it has a surprisingly below-average 0.69% expense ratio.

Best Fidelity Funds For Your 401k: International Growth

Manager: Jed WeissExpenses: 1.04%

Jed WeissFidelity International Growth Fund invests in companies from around the globe that he believes shows above-average potential for growth. Jed looks for multiyear structural growth stories and high-barriers-to-entry businesses at attractive valuations on his earnings forecast.

Currently, more than half of FIGFXs holdings are in Europe, though the top country representation is the United States at 20%. The U.K. follows at a 14.8% weighting, Switzerland at 13.2% and Sweden at 5.6%.

Healthcare , consumer staples and consumer discretionary are the highest-weighted sectors in the fund, reflected in top holdings such as RocheHoldings , Anheuser Busch Inbev SA and .

A couple other notes: FIGFX began trading in November 2007 and has a market value of over $700 million.

Read Also: How To Invest My 401k Money

Observers Say That Advisers Delivering Financial Wellness Programs To 401 Plans Should Take Note

Fidelity Investments, the largest record keeper of defined-contribution plans, has upgraded its managed account service to encompass more holistic financial planning and advice for 401 investors. Observers say the move signals a trend thats likely to accelerate among other providers and that may concern retirement plan advisers who fear that Fidelity is competing with them on participant services.

Fidelitys new managed account offering Personalized Planning & Advice, which launched Tuesday helps plan participants set financial goals and priorities, like paying down student debt and establishing an emergency fund.

The program offers participants an asset allocation thats based on their financial plan and delivers follow-up correspondence, on at least a quarterly basis, to make sure participants are on track to meet their goals.

This approach differs from the previous iteration of Fidelitys managed account branded as Portfolio Advisory Service at Work, or PAS-W which factored more basic information, such as risk tolerance and investment preference, into an investors asset allocation without considering broader financial goals or providing regular check-ins.

Were really doubling down on the financial plan, said Sangeeta Moorjani, head of product, marketing and advice for Fidelitys Workplace Investing group.

A team of Fidelity representatives, registered with Finra Series 7 and/or 66 licenses, can help with the financial plan and quarterly reviews.

Best Fidelity Funds For Your 401k: Blue Chip Growth

Manager: Sonu KalraExpenses: 0.8%, or $80 annually for every $10,000 invested

Fidelity Blue Chip Growth Fund manager Sonu Kalra invests in blue-chip companies that he believes have above-average potential for earnings growth. Battleship balance sheets are the best way to play 2015s charted and uncharted waters you never know when the seas will turn turbulent, but you can rest reasonably assured that when they do, bigger will either be better or become so.

There are plenty of technology and healthcare names in this fund: Apple Inc. , Google Inc and Gilead Sciences, Inc. , among others.

The top three sectors are information technology , consumer discretionary and health care . Foreign holdings make up 10.2% of the investments.

Read Also: What Happens To 401k When You Die

Best Fidelity Funds For Your 401k: Low

Manager: Joel TillinghastExpenses: 0.82%

Still inimitable, still head and shoulders above even the best crop of giants you can find in the space, lead manager Joel Tillinghast is about as far a cry from leveraged stocks as you can get.

Fidelity Low-Priced Stock invests in low-priced stocks, which for his purpose are stocks $35 or less. While that sounds like a gimmick, its the secret to this funds genius, and was Joels brainchild, making him of one of the best managers of any generation. It can lead to a small-/mid-cap tilt, but it also can lean toward even mega-caps in ultra-bear markets .

FLPSX began trading in December 1989 and has a market value of over $30 billion. The fund is heavily weighted toward consumer discretionary , with ample weight given to information technology and financials . Top holdings for now are UnitedHealth Group Inc. , Seagate Technology PLC and Next plc. Its noteworthy that of the funds weve discussed so far, FLPSX is the only one with more than 5% of the fund currently in cash .

Joel is a stock pickers stock picker if hes around the water cooler, other managers are keen to hear what he has to say. While unsung by the media, he is a manager that compares with Peter Lynch, his mentor while Joel was learning the trade. His stealth advantage: Hes always been a global investor.

Best Fidelity Funds For Your 401k: Select Health Care

Manager: Eddie YoonExpenses: 0.77%

Fidelity Select Health Care Portfolio invests in companies involved in numerous parts of the healthcare industry so thats pharmaceuticals, medical instruments, biotechs and hospitals, among others.

This nearly $10 billion funds top holdings include Actavis plc , Medtronic PLC , McKesson Corporation , Amgen, Inc. and Alexion Pharmaceuticals, Inc. . This also is a very international-heavy fund at 31.6% of FSPHXs investments.

I like Select Healthcare for reasons that follow this refrain: Healthcare provides necessary goods and services for huge, worldwide demographics that are aging and whose collective demand isnt slowing.

Eddie Yoon invests with an eye on the necessary demographic trends and stories of aging boomers needing a youth-inducing crutch, as well as on the emerging-market theme of new consumers demanding better healthcare.

Also Check: How To Find 401k From An Old Employer

Fidelity Equity Income Fund

Fidelity Equity Income is consistently among the best Fidelity funds for dividends. It consists of large-cap value stocks with the highest concentration in financials and health care sectors. Top holdings include JP Morgan Chase , Berkshire Hathaway , and Johnson & Johnson . The 30-day yield for FEQIX is 1.93% and the expense ratio is at 0.61%. There is no minimum investment to get started with this fund.

Best Fidelity Funds For Dividends

When picking the best Fidelity funds for dividends, savvy investors know to look at the fund’s 30-day SEC Yield. This is also called the “30-day yield” or “SEC yield.” This figure will tell you how much a fund earned during the last calendar month, minus expenses. It doesn’t translate directly to how much you’ll see as a payout, since each fund works differently, but it offers a small look at total returns. The SEC yield is measured against other stocks or mutual funds, so a fund with a high yield is above average when compared to other funds of its kind during the last term, and it is likely to pay out more.

To assess funds is more of an art than a science. Professional investors look at a range of metrics to predict how a stock might perform, including the SEC yield, distribution yield, annual returns, and shareholder reports. The key thing is to make sure your fund aligns with your tolerance for risk and your money goals.

A fund’s success can also be measured by its annual return, or how much its value has grown over a full year. The annual return is a good way to gauge how stable a company is over time, which can help you decide how to invest, but it doesn’t quite capture details of short-term profits or losses, or dividend payouts. Steady cash payouts are not always part of what makes up a company’s full annual return.

Here are the best Fidelity funds that pay above-average dividends:

Recommended Reading: Can You Buy A House With 401k

Make The Best Decision For You

When it comes to deciding what to do with an old 401 or 403, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary, so it’s important to find out the rules your former employer has, as well as the rules at your new employer.

Also, do compare the fees and expenses associated with the accounts you’re considering. If you find the comparison confusing or overwhelming, speak with a financial professional to help with the decision.

Fidelity Solo 401k Brokerage Account From My Solo 401k Financial

A Fidelity Investments Solo 401k brokerage account with checkbook control from My Solo 401k Financial is ideal for those looking to still have the option to invest in equities while also gaining checkbook control over their retirement funds for investing in alternative investments such as real estate, notes, tax liens, and private shares in addition to processing a solo 401k participant loan.

Read Also: Should I Convert My 401k To A Roth Ira

How To Find & Calculate Fidelity 401 Fees

To understand how much youre paying for your Fidelity plan, I recommend you sum their administration and investment expenses into a single all-in fee. Expressing this as both a percentage of plan assets, as well as hard dollars per-participant, will ultimately make it easier for you to compare the cost of your Fidelity plan to competing 401 providers and/or industry averages.

To make this easy on you, weve created a spreadsheet you can use with all the columns and formulas youll need. All you need to do is find the information for your plan, then copy it into the spreadsheet.

Doing this for Fidelity can be a bit of a pain, but not to worry well show you everything you need to do in 4 simple steps.

Step 1 Gather All the Necessary Documents

To calculate your Fidelity 401 fees, the only document youll need is their 408 fee disclosure – what Fidelity has named a Statement of Services and Compensation.

Fidelity is obligated by Department of Labor regulations to provide employers with a 408. This document contains plan-level information about their administration fees. This information is intended to help employers evaluate the reasonableness of these fees. This document can be found on the Fidelity employer website.

If you hired an outside financial advisor for your plan, youll need to factor their pricing into your Fidelity fee calculation. This information can usually be found in a services agreement or invoice.

Step 2 Locate Fidelitys Direct 401 Fees

More From Portfolio Perspective

To give your retirement savings an extra boost, Jessica Macdonald, a vice president at Fidelity, recommends opting into an auto-escalation feature, if your employer offers it, which will automatically boost your savings rate by 1% or 2% each year.

And always contribute enough to get the full employer match, she said, “that way you won’t leave money on the table.”

Overall, aim to save 15% of your income in a retirement account, including the employer contribution, Macdonald also advised.

If you are over age 50, you set aside even more withcatch-up contributions. plans and $6,000 for IRAs in 2021 those who qualify can put an extra $6,500 in their 401 or $1,000 in their IRA.)

Finally, avoiding borrowing from these accounts at all costs. “Try to stash a little bit of money away in a rainy-day fund so you can dip into that instead,” Macdonald said.

Don’t Miss: Should I Roll My 401k Into An Annuity

Annuities Provide Growth Potential And Flexibility

American Fidelity offers a variety of annuities that can be used as investments within a 403, 457, IRA or Roth IRA plan to help individuals plan for retirement. American Fidelity also offers annuities as non-qualified, after-tax annuities for personal retirement savings. Annuities provide a valuable savings vehicle with growth potential and flexibility. A key advantage that annuities offer over typical methods of saving is the opportunity for guaranteed lifetime income. Annuities can provide benefits and features that may be beneficial to a diversified portfolio and can be a valuable retirement planning tool.

- Fixed Annuity: An insurance contract that allows the owner to accumulate interest with minimal risk. American Fidelity guarantees both the principal and interest on our fixed contracts and there is a guaranteed minimum rate of interest which the contract will never pay less than, as long as the contract is in force.

- Variable Annuity*: This contract allows the potential for greater returns on investments over the long term by allowing the owner the ability to invest in various market-based portfolios. In a variable contract, principal, interest, and market gains are not guaranteed and are therefore not suitable for everyone.

Fidelity Investments 401 Review 2021

Fidelity Investments is a multinational company based in Boston. The company ranks among the largest financial asset managers, operating a brokerage firm, a large offering of mutual funds, retirement services, wealth management and life insurance. Fidelity can serve as a full-service firm to small businesses that wish to do more than just administer a 401 plan through Fidelity.

Read Also: How To Take Money From 401k Without Penalty