How Do I Close Out A 401k Account

Closing a 401 account can take a significant bite out of the balance.

If you leave an employer where you have a 401 plan, you might want to close out that 401 account. Sometimes you can let the money stay in that old 401, but people often want to completely cut their ties with the company and consolidate financial accounts for easier record keeping. You can reduce your liability for taxes and penalties by rolling these accounts into new tax-deferred accounts.

Whats The Difference Between 2020 And 2021 Rmd Requirements

Last year, the RMD age increased from 70½ to 72 as a result of the Setting Every Community Up for Security Enhancement Act, and RMDs were waived by the CARES Act. The temporary waiver applied to:

- 2020 RMDs from traditional IRAs, inherited IRAs, and employer-sponsored plans.

- 2019 RMDs due by April 1, 2020, for individuals who turned 70½ in 2019 and didnt take their RMDs before January 1, 2020.

There is no longer an RMD waiver for 2021. As a result, anyone age 72 or older as of December 31, 2021, must take their RMD by year-end to avoid the 50% penaltyunless this is their first RMD, in which case they have until April 1, 2022.

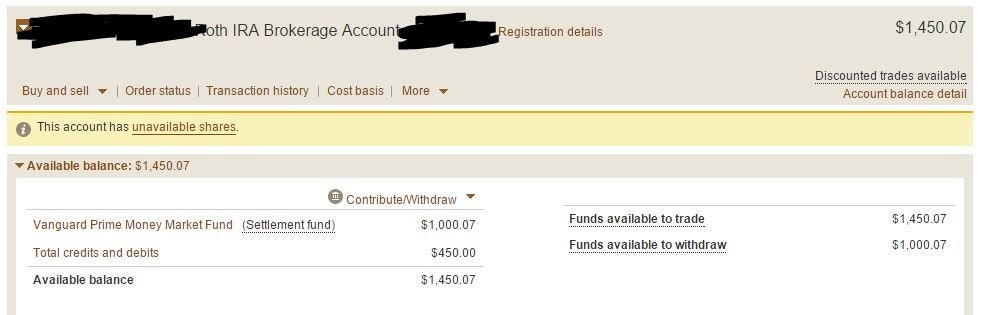

What Is A Roth Ira

A Roth IRA is an account that you can use to invest for retirement on your own, without an employer. You use after-tax dollars now, so you avoid paying taxes later on when it’s time for a distribution. The big difference between a Roth IRA and a Roth 401 is its flexibility.

“Roth IRAs also allow penalty-free distributions for first-time home purchases, education expenses and unreimbursed medical expenses,” Amaral says.

Roth IRAs are good for young investors who expect to be in a higher tax bracket later on. However, there are income eligibility requirements to contribute to a Roth IRA. The amount you can contribute is much less than a Roth 401. The maximum is $6,000, or $7,000 if you’re 50 or older. But it may be good in exchange for the flexibility a Roth IRA comes with.

“While you can save more for retirement in a Roth 401, a Roth IRA offers more flexibility for withdrawals. With a Roth IRA, you are able to withdraw your contributions after five years to avoid any taxes or penalties,” notes Amaral.

But first you need to see if you even qualify for a Roth IRA.

One of the benefits a Roth IRA has over a Roth 401 is that there are no required distributions while the account owner is alive. So you can take money out when you want, and never be forced into it. The money can also be used for first time home-buying or health insurance premiums while unemployed, which makes it an attractive and flexible retirement savings vehicle.

Also Check: How To Borrow From 401k To Buy A House

What If I Dont Need The Rmd Assets

RMDs are designed to spread out your retirement savings and related taxes over your lifetime. If you dont depend on the money to satisfy your spending needs, you may want to consider:

- Reinvesting your distributions in a taxable account to take advantage of continued growth. You can then add beneficiaries to that account without passing along future RMDs to them.

- Gifting up to $100,000 annually to a qualified charity. Generally, qualified charitable distributions, or QCDs, arent subject to ordinary federal income taxes. As a result, theyre excluded from your taxable income.

When To Consider A Retirement Early Withdrawal

You should consider making withdrawals from a retirement account only under dire circumstances. Given the financial and emotional impact that situations such as the COVID-19 pandemic as well as national disasters have had on Americans, there are situations when it could make sense to withdraw early.

You May Like: How To Take Money Out Of 401k Without Penalty

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

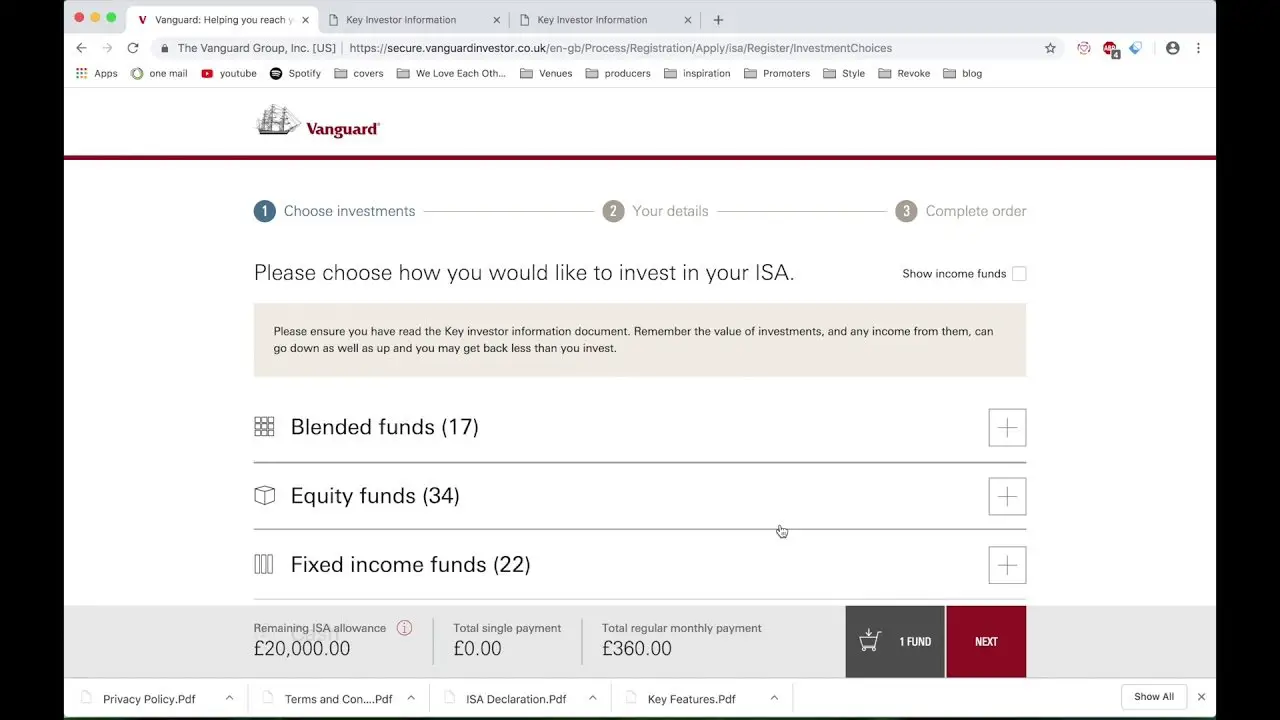

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

You May Like: When Can I Set Up A Solo 401k

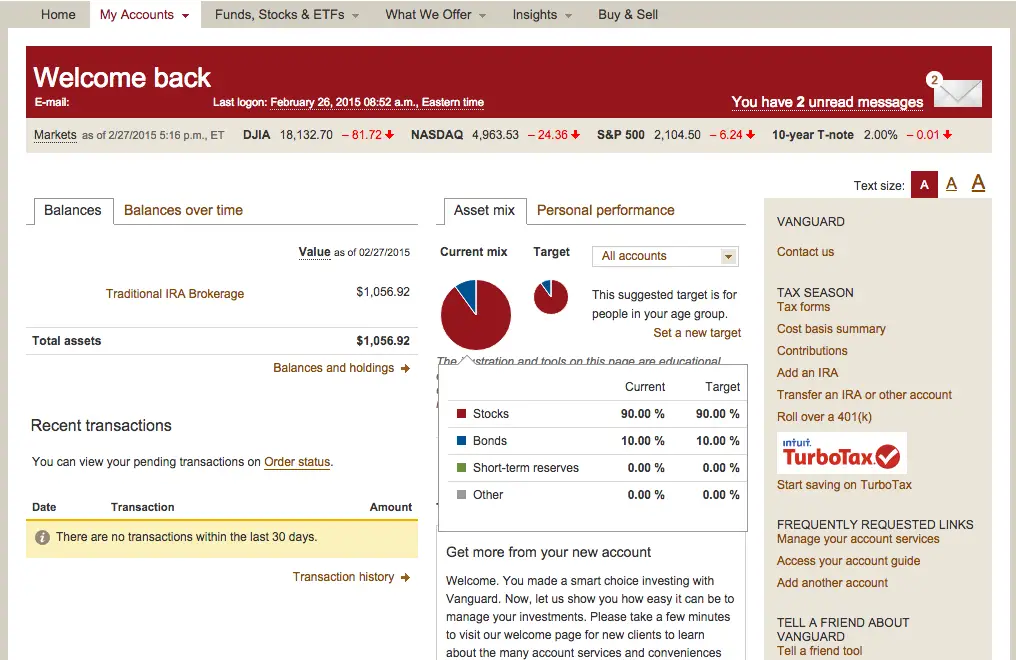

How To Withdraw Money From Vanguard Vanguard Withdrawal Options

Withdrawal via bank transfer is by far the most common option. It is available at basically all brokers, and Vanguard is no exception.

However, bank transfer is the only withdrawal option available at Vanguard, putting it at a slight disadvantage over brokers that also offer withdrawal to credit/debit cards or electronic wallets.

Speed also matters. Unlike some deposit options, withdrawal is rarely instant. It usually takes at least 1 business day, but often several business days for your money to arrive.

We tested withdrawal at Vanguard and it took us 2 business days, which is considered fairly average.

To withdraw money from Vanguard, you need to go through the following steps:

- Log in to your account

- Select ‘Withdrawal’ or ‘Withdraw funds’ from the appropriate menu

- Select the withdrawal method and/or the account to withdraw to

- Enter the amount to be withdrawn, and, if prompted, a short reason or description

- Submit your request

We And Our Partners Process Data To:

Actively scan device characteristics for identification. Use precise geolocation data. Store and/or access information on a device. Select personalised content. Create a personalised content profile. Measure ad performance. Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance. Develop and improve products.

Don’t Miss: Can I Buy A Business With My 401k

Should You Take A Distribution From Your 401 Or Ira

Like the CARES Act, the Consolidated Appropriations Act allows you to withdraw funds from both a 401 and an IRA, as long as the amount is up to $100,000 across all accounts. If you are deciding whether to take a distribution from either your IRA or a 401, think about factors such as each of the account’s typical rules around penalties and taxes. F

New & Outstanding Disaster Loans:

- Loan payment dates that are due between the disaster event date and ending 180 days after the disaster period may be delayed.

- Loan repayments may be delayed for one year , with the loans term extended by the period of the delay.

- Loan balances will continue to accrue interest during this delayed timeframe.

- The max 5-year loan term is disregarded for outstanding loans deferring payment for 1 year.

Don’t Miss: How To Transfer 401k To Another 401 K

Can I Convert 401 To Ira Without Leaving Job

Your 401k contains cash for your golden years, but you may end up closing your account long before you quit work. You can close your account when you retire, change jobs and, in some instances, while still employed. When you terminate a 401k plan, though, you have to contend with taxes and penalties.

Need Money From Your Retirement Fund Vanguard Advises Taking Loans Instead Of Withdrawals

Need some emergency money? With more than 36 million Americans unemployed in the wake of the pandemic, you are not alone.

- May 18, 2020

Need to take emergency money out of your retirement fund?

With more than 36 million Americans unemployed in the wake of the pandemic, you are not alone. Thats the largest rise in claims since the U.S. Department of Labor started tracking the data in 1967.

As a result, the federal government changed the rules surrounding retirement accounts so we can take our money out more easily. The changes were part of the massive $2 trillion economic stimulus plan called the CARES Act.

However, Vanguard is advising investors that taking money out of our retirement accounts comes at a cost. Borrowing from your retirement plan may be a better strategy than withdrawing money. Heres why, according to Vanguard: When you borrow from your 401 or other IRA or retirement plan, you generally begin to repay the loan with every paycheck.

The automatic nature of repayment makes it more likely that the borrowed money will be returned to your long-term savings. Yes, you can repay a withdrawal from the plan for up to three years under the new law, but it can take more discipline and foresight to do so, the mutual fund giant said in a note to clients.

The biggest risk of any retirement plan loan is that you wont be able to pay the money back.

If your plan usually charges a loan origination fee, it will be waived.

Vanguard issued some tips on its website:

You May Like: Which 401k Investment Option Is Best

Rmds Are Back For : What You Need To Know

Whether youre preparing for retirement or already enjoying it, one thing remains true: You want to make the most of your income and protect it from unnecessary penalties. Sounds easier said than done, especially when required minimum distribution rules change from time to time and both RMDs and withdrawal strategies have tax consequences. Were here to help simplify important details:

- Understanding how RMDs work.

- Learning how 2021 rules differ from 2020 Coronavirus Aid, Relief, and Economic Security Act exemptions.

- Inheriting an IRAand the applicable tax implications.

- Avoiding tax penalties.

- Planning ahead for RMDs in your pre-RMD years.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How To Get Money Out Of 401k Without Penalty

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

To Meet Additional Essential Needs

Money for items such as medical expenses, prescriptions, food, or elder care add up fast. If you do decide pulling money from 401 or other retirement funds makes sense in a disaster scenario, consider taking out only what you need and set up a plan to pay back the amount no later than the three-year time frame.

Don’t Miss: How Do You Get Money From 401k

Special Rules If You’re At Least 55

If you terminated employment for any reason with a company and you’re 55 or older, you can withdraw money from your 401 without the usual 10 percent penalty. By requesting a withdrawal of the entire balance, you can close your account. But keep in mind that you’ll still pay taxes on the entire withdrawal, at the regular income tax rate.

References

Why Does Gethuman Write How

GetHuman has been working for over 10 years on sourcing information about big organizations like Vanguard in order to help customers resolve customer service issues faster. We started with contact information and fastest ways to reach a human at big companies. Particularly ones with slow or complicated IVR or phone menu systems. Or companies that have self-serve help forums instead of a customer service department. From there, we realized that consumers still needed more detailed help solving the most common problems, so we expanded to this set of guides, which grows every day. And if you spot any issues with our How Do I Close My Vanguard Account? guide, please let us know by sending us feedback. We want to be as helpful as possible. If you appreciated this guide, please share it with your favorite people. Our free information and tools is powered by you, the customer. The more people that use it, the better it gets.

Vanguard

Recommended Reading: How To Find 401k From Previous Employer

Taking 401 Distributions In Retirement

The 401 withdrawal rules require you to begin depleting your 401 savings when you reach age 72.

At this point, you must take a required minimum distribution each year until your account is depleted. If you are still working for the employer beyond age 72, you may be able to delay required minimum distribution until you stop working if your plan allows this delay. The delay option is not available to you if you own 5% or more of the business.

You have until April 1 of the year after you turn 72 to take your first required minimum distribution. After that, you must take a minimum amount by December 31 each year. Your 401 plan administrator will tell you how much you are required to take each year.

The amount is based on your life expectancy and your account balance. If you dont take your required minimum distribution each year, you will have to pay a tax of 50% of the amount that should have been taken but was not. If you participate in more than one employer plan, you must take a required minimum distribution from each plan.

How To Withdraw Money From Vanguard Bottom Line

Vanguard withdrawal is free of charge in most cases. However, you can only do it via bank transfer other convenient options such as withdrawal to credit/debit cards or electronic wallets are missing.

To see how Vanguard’s withdrawal fees and options stack up against the rest of the brokerage market, check out our broker comparison tool.

You May Like: How To Diversify 401k Portfolio

Roth 401 Pros And Cons

|

Pros |

|

|

|

Loan Or 401 Withdrawal

While similar, a 401 loan and 401 withdrawal aren’t interchangeable and have a few key differences. While you can use either to access up to $100,000 of your retirement funds penalty- and tax-free as part of the Consolidated Appropriations Act, they each have their own rules.

As part of a 401 withdrawal:

- Repayment isn’t required.

- There’s no withdrawal penalty.

- Distribution will be taxed as income, but you can pay it back within three years and claim a refund.

As part of a 401 loan:

- You must repay the loan within a specified time frame .

- The loan amount isn’t taxed initially, and there’s no penalty. If you can’t pay it back within the specified time frame, the outstanding balance is taxed and you’ll also be assessed a 10 percent early withdrawal penalty, if you are under age 59 1/2.

- If you leave your job, you have until mid-October of the following year to offset the outstanding loan amount. Otherwise, you could owe 401 early withdrawal taxes and penalties.

Work with your plan sponsor to learn more about the pros and cons of a 401 withdrawal vs. 401 loan.

You May Like: How Much Money Can You Put In 401k Per Year