Review The Irs Limits For 2021

The IRS has announced the 2021 contribution limits for retirement savings accounts, including contribution limits for 401, 403, and most 457 plans, as well as income limits for IRA contribution deductibility. Contribution limits for Health Savings Accounts have also been announced. Please review an overview of the limits below.

Contribution Limits In 2020 And 2021

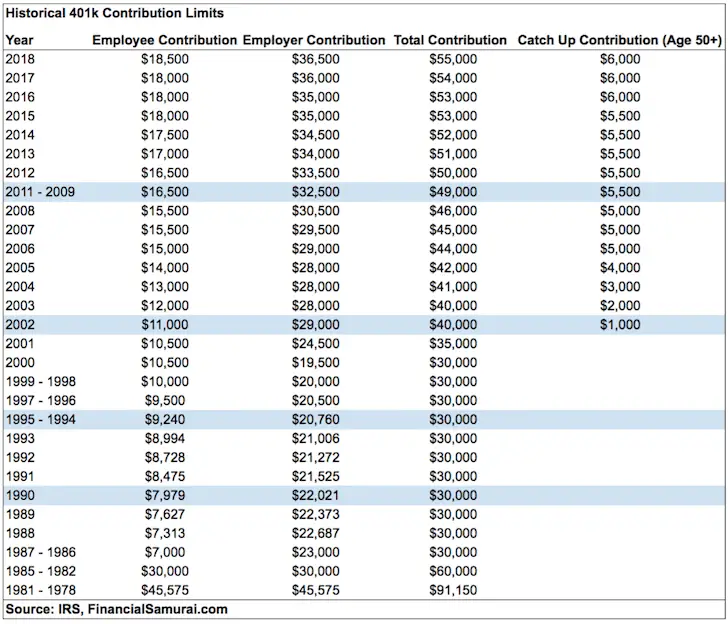

For 2021, the 401 limit for employee salary deferrals is $19,500, which is the same amount as the 401 2020 limit. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $58,000 in 2021, up from $57,000 in 2020.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits | ||

|---|---|---|

| Maximum salary deferral for workers | $19,500 | |

| Catch-up contributions for workers 50 and older | $6,500 | |

| Total contribution limit, plus catch-up contribution | $64,500 | |

| Compensation limit for figuring contributions | $290,000 | |

| Compensation threshold for key employee nondiscrimination testing | $180,000 | |

| Threshold for highly compensated employee nondiscrimination testing | $130,000 | none |

The Maximum You Can Put Into A 401 In 2021

-

If youre under age 50, your maximum 401 contribution is $19,500.

-

If youre 50 or older, your maximum 401 contribution is $26,000 because you’re allowed $6,500 in catch-up contributions.

For 2021, your total 401 contributions from yourself and your employer cannot exceed $58,000 or 100% of your compensation, whichever is less.

Employers who match employees’ 401 contributions often do so between 3% and 6% of the employee’s salary. So if you make $50,000 and contribute 5% of your salary and your employer matches that full 5%, you’ll add $5,000 to your balance each year.

You May Like: Can I Use My 401k To Start A Business

How To Claim Your Retirement Savings

Normally, getting at your money can be difficult, and the rules are often imposed by the plan design rather than regulations.

For instance, regulations allow you to access the money without a bonus penalty by:

- Taking out a loan.

- Getting a hardship withdrawal before age 59 ½.

- Waiting until age 59 ½.

- Leaving your employer in the year you turn 55 or after

While most plans do have loan provisions, many dont allow hardship withdrawals, and some plans require that a person be terminated before accessing their money, even if they are 59 ½ or older.

Last year, due to COVID-19, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, made it easier to get at your money up to $100,000 in loans or distributions, if the plan allows. These withdrawals had to be before the end of 2020. If you took a hardship loan in 2020, you can avoid paying the 10 percent penalty on the money, as well as take the option to repay the loan tax-free over the next three years. Consider consulting with a tax professional as you prepare your taxes if youre in this position, since it involves filing amended returns.

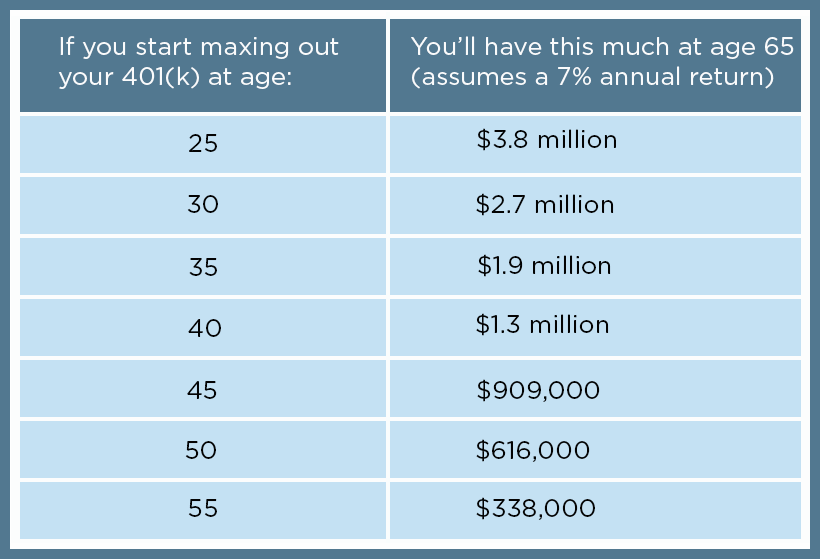

Unless youre really in a bind, Brewer advises against taking a distribution or a loan. Theres no replacing time in the market, she points out, and consistent saving over time is one of the best ways to build wealth for the future.

Real Estate Investing Suggestions

In addition to aggressively investing in your 401k, I highly recommend investing in real estate. Real estate is my favorite asset class to build wealth. Real estate provides shelter, produces income, and is a tangible asset. You cant live in your stocks, but you can in your properties.

If youre interested in a hands off approach to real estate investing, consider investing in a publicly traded REIT or in real estate crowdfunding.

My favorite two real estate crowdfunding platforms are:

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends.

Both platforms are free to sign up and explore.

Also Check: What Percentage Should I Be Putting In My 401k

Can I Contribute To Ira If I Max Out 401k

Yes, you can contribute to both a 401 and an IRA at the same time. If youre under 50, you can contribute $19,500 to a 401 for 2021. Those age 50+ can contribute an additional $6,500 for a total of $26,000. On top of that, those under 50 can contribute an additional $6,000 to an IRA.

Employers Have A Higher Contribution Ceiling

The employers 401 maximum contribution limit is much more liberal. Altogether, the most that can be contributed to your 401 plan between both you and your employer is $58,000 in 2021, up from $57,000 in 2020. That means an employer can potentially contribute much more than you do to your plan, though this is not the norm.

The salary cap for determining employer and employee contributions for all tax-qualified plans is $290,000. Even at that level, the employer would have to contribute a hefty amount to reach the $58,000 limit.

You May Like: How Many Loans Can I Take From My 401k

When To Begin Taking Rmds

You are generally allowed to take penalty-free distributions starting at age 59½. However, by April 1 of the year after you reach age 72, you are required to begin taking RMDs from your IRAs.

Depending upon the terms of your 401 or other employer plan, you may be able to delay taking RMDs until April 1 of the year following the later of the year you attain age 72 or the year you retire, provided you are not a 5% or greater owner of the business. Check with your plan administrator for details.

For subsequent years, you must withdraw your RMD amount from your plans by Dec. 31 of each year. This includes the year after you turn age 72, even if you take your first withdrawal that year. NOTE: If you were born on June 30, 1949 or earlier, you were required to begin taking RMDs by April 1 following the year you reached age 70½.

For example, if you turn 72 in October 2021, your first RMD must be taken by April 1, 2022 and your second RMD must be taken by Dec. 31, 2022. Most IRA owners will take their first RMD in the year they turn 72 rather than delaying until April 1 of the next year to avoid having two taxable distributions in one year.

What you do with RMDs is generally up to you you may be able to take distributions in cash or in kind which you can then move to a non-qualified brokerage account. The amount of each year’s RMD depends on your age and the account balance at the end of the previous year.

How Much You Should Have Saved In Your 401k By Age 50

The assumptions for the below chart are as follows:

* The Low End column accounts for lower maximum contribution amounts available to savers above 45.

* The Mid End column accounts for lower maximum contribution amounts available to savers below 45.

* The High End column accounts for savers who are under the age of 25. After the first year, one maximizes their contribution every year to their 401k plan without failure.

* Average starting working age is 22. But you can follow the number of years working as a different guideline if you graduate later or earlier.

* $18,000 is used as the conservative base case maximum contribution amount for ones entire working life. Hopefully the government will increase the max contribution amount over time.

* No after tax income contribution, although more power to you if you have the disposable income to do so.

* The rate of return assumptions are between 0% 10%.

* Company match assumption is between 0% 3%.

* The Low, Mid, and High columns should successfully encapsulate about 80% of all 401K contributors who max out their contributions each year. There will be those with less, and those which much, MUCH greater balances thanks to higher returns.

* You are logical and not a knucklehead. Just by searching this topic, you are taking ownership of your retirement and are thinking ahead with an action plan.

Read Also: Can You Merge 401k Accounts

Could You Increase Your 401 Contribution

A 1% increase only makes a small difference in your paycheckbut may make a big difference down the road.

Cutting or reducing non-essentials could allow you to bump up the money youre putting into your 401 or 403. Like the gym membership you havent used in 6 months, for example. Or buying a certified used car instead of a new one. How about those merit increases or a bonus?

A little could go a long way in the future. Consider this example1 for a $35,000 annual income:

| Additional contribution | Reduction in bi-weekly take-home pay | Estimated additional monthly retirement income | Total employee contributions over 30 years |

|---|---|---|---|

| 5% | |||

| $18,068 |

Imagine if you could increase it to 10% of your pay?

If youre wondering how to save more toward retirement, read 5 smart money tips from super savers.

Tip: Dont forget inflations impact on retirement savings. You may feel like youre saving enough to maintain your current lifestyle. Even though your income may increase over the years, so will your cost of living . If you spend $50,000 a year to live in todays dollars, for example, how much more will it take 30 years from now?

Where To Invest If You Don’t Have A 401

Don’t worry if your employer doesn’t offer a 401 there are still ways you can save for retirement on your own.

Many big banks and brokerages offer Individual Retirement Accounts, or IRAs, that allow you to put your retirement money into a range of investments, such as individual stocks, bonds, index funds, mutual funds and CDs. Just like with a 401, you can set up automatic contributions into your IRA from a checking or savings account.

When shopping around for an IRA, choose an account that has no minimum deposits, offers commission-free trading and provides a variety of investment options. Taking these factors into account, Select narrowed down our favorites for every type of retirement saver.

Read Also: How To Open A 401k Plan

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

Are There Income Limits For 401s

While there’s not a universal income limit on 401 contributions, in some cases the IRS does impose contribution limits on “highly compensated employees” when a company encounters disproportionate contribution levels among its workers. The IRS has a test that helps employers who sponsor 401 plans assess whether employees are participating in their plan at levels proportionate to their compensation.

If the test determines that people across compensation levels aren’t participating in a manner the IRS deems proportionate, employee contribution levels for highly compensated employees can be lowered. In these cases, your employer may need to return some of your excess contributions.

The IRS defines a highly compensated employee in one of two ways:

An individual who either owned more than 5% of the interest in a business at any time during the year or the preceding year, no matter how much they were paid.

An individual who received over $130,000 from the business in the preceding year and, if the employer ranks employees by compensation, was in the top 20%.

Read Also: Can I Sign Up For 401k Anytime

Contribution Limits For 401 403 And Most 457 Plans

| 2020 | ||

| Employee pre-tax and Roth contributions1 | $19,500 | |

| Employee after-tax contributions and any company contributions2 | $37,500 | |

| Maximum annual contributions allowed3 | $57,000 | |

| Additional employee pre-tax and Roth contributions1 | $6,500 | |

| Maximum annual contributions allowed3 | $63,500 | $64,500 |

1. If you have contributed to more than one qualified retirement plan during the calendar year, it is your responsibility to ensure that you have not exceeded these limits.

2. Company contributions include any employer matching, profit-sharing, and non-elective contributions.

3. Amount typically not to exceed the lesser 100% of your compensation or this number. Your employer’s retirement plan might limit the compensation to something less than 100% please refer to your plan’s Summary Plan Description or plan document for other applicable limits.

The annual compensation limit is $290,000. You can make contributions up to the IRS contribution limits noted above up to $290,000.

Key Limit Remains Unchanged

The limit on annual contributions to an IRA remains unchanged at $6,000. The additional catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000.

Details on these and other retirement-related cost-of-living adjustments for 2020 are in Notice 2019-59 PDF, available on IRS.gov.

Read Also: How Much Money Should I Put In My 401k

Contribute To A Roth Ira

The Roth IRA is the peanut butter to the 401s jellythey just go better together! The beautiful thing about the Roth IRA, which stands for individual retirement account, is that it lets you enjoy tax-free growth and tax-free withdrawals in retirement. Tax-free . . . dont you just love the sound of that?

In 2021, you can put up to $6,000 into a Roth IRA .6 Sticking with our example above, maxing out your Roth IRA and investing $6,000 into your account brings your total retirement savings for the year to $9,750 . . . just a little bit short of your retirement savings goal.

So what are we going to do with the remaining $1,500? Its time to send you back . . . back to the 401!

Limitation On Elective Deferrals

The maximum amount you can defer into your 401 plan adjusts each year for inflation. As of 2012, the standard limit is $17,000. However, for people age 50 and older, the contribution limit increases by $5,500 because of what is known as a “catch-up” contribution. This extra $5,500 increases the total limit for someone older than 50 to $22,500. The catch-up contribution does not count toward the general 401 plan contribution limits.

Don’t Miss: When Can I Set Up A Solo 401k

How Much Should You Contribute To Your 401 Rule Of Thumb

As a rule of thumb, experts advise that you to save between 10% and 20% of your gross salary toward retirement. That could be in a 401 or in another kind of retirement account. No matter where you save it, you want to save as much for retirement as you can while still living comfortably.

Its important to say that this is just a general rule. The actual amount you should save depends on your individual situation. For example, if you are 50 years old and dont have any retirement savings, you should save more than 20% of your gross annual salary. If youre 30 years old and already have $100,000 in retirement savings, you could probably decrease your contributions for a bit in order to pay off a mortgage or loan. Its difficult to create a one-size-fits-all plan, because everyone is in a different place with his or her finances.

Saving 10% to 20% of your salary every year might sound like a lot. Luckily, you dont have to do it all at once. You can spread your contributions out throughout the year and you can contribute more or less some years. You also dont have to save all that money through your 401. Lets take a step back and talk about other factors you should consider when you think about how much to contribute to your 401.

Also Check: Should I Rollover My 401k When I Retire

Depend On Nobody But Yourself

Contribute the maximum pre-tax income you can to your 401k for as long as you work. This is the absolute MINIMUM you can do to by on the right 401k savings by age path. Below is a chart that shows the maximum 401k contributions in 2021 by employee and employer.

After you contribut a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

Treat your 401k just like Social Security and write it off completely from your mind. Do not expect either accounts to be there for you when you retire. Its just like how you should never expect the government to ever help you when youre in need.

Just imagine 30 years from now, the government deciding to raise penalty free 401k withdrawal to age 75 from 59.5? Unfortunately, you need the money at age 60. Because you withdraw, the government imposes a 30% penalty on top of the taxes you have to pay. Dont think it cant happen. Expect it to happen!

Read Also: How Do I Use My 401k To Start A Business