You Can Better Optimize Your Investments

When you have several accounts held in different places, it is more difficult to have a well-diversified portfolio. As an investor, you are limited to the options provided within your firmâs plan.

When you consolidate your accounts, you open yourself up to more investment options. If you go through an account custodian like Charles Schwab or Vanguard, thousands of new investment options will become available.

Heres An Example Of How You Can End Up With Multiple 401 Retirement Accounts:

On your first job, you signed up for your employer-sponsored 401 and accumulated a balance of $1,500 after two years. At that point, you accepted a dream job all the way across the country and had to arrange a big move. With so many moving pieces you forgot about your 401 and left no instructions to your plans administrator.

On your second job, youre automatically enrolled in a new 401 and accumulated a balance of $9,000 over a four-year period. Fast forward to today, you decide to accept a new job offer and find that the third employers qualified plan doesnt accept rollovers from other 401 plans. Since youre happy with the 401 from your second employer, you decide to leave the $9,000 there. You remember your 401 from your first job, and you contact the plan administrator and find out that the balance of that account is now at a forced-transfer IRA.

In summary, now you have:

-

A forced-transfer IRA account from your first employer

-

A 401 from your second employer

-

A 401 from your current employer

Maintaining multiple 401 plans hurts your nest egg, and there are many reasons why keeping several 401 plans is a bad idea.

Consolidating Your Retirement Accounts Can Help

Heres some good news. In most cases, you dont have to leave those accounts with your former employers. Instead, you may be able to roll them over into a single retirement account.

This is known as consolidating accounts. And it offers a lot of advantages.

Consolidating retirement accounts can make it easier to:

Also Check: How Much To Invest In 401k To Be A Millionaire

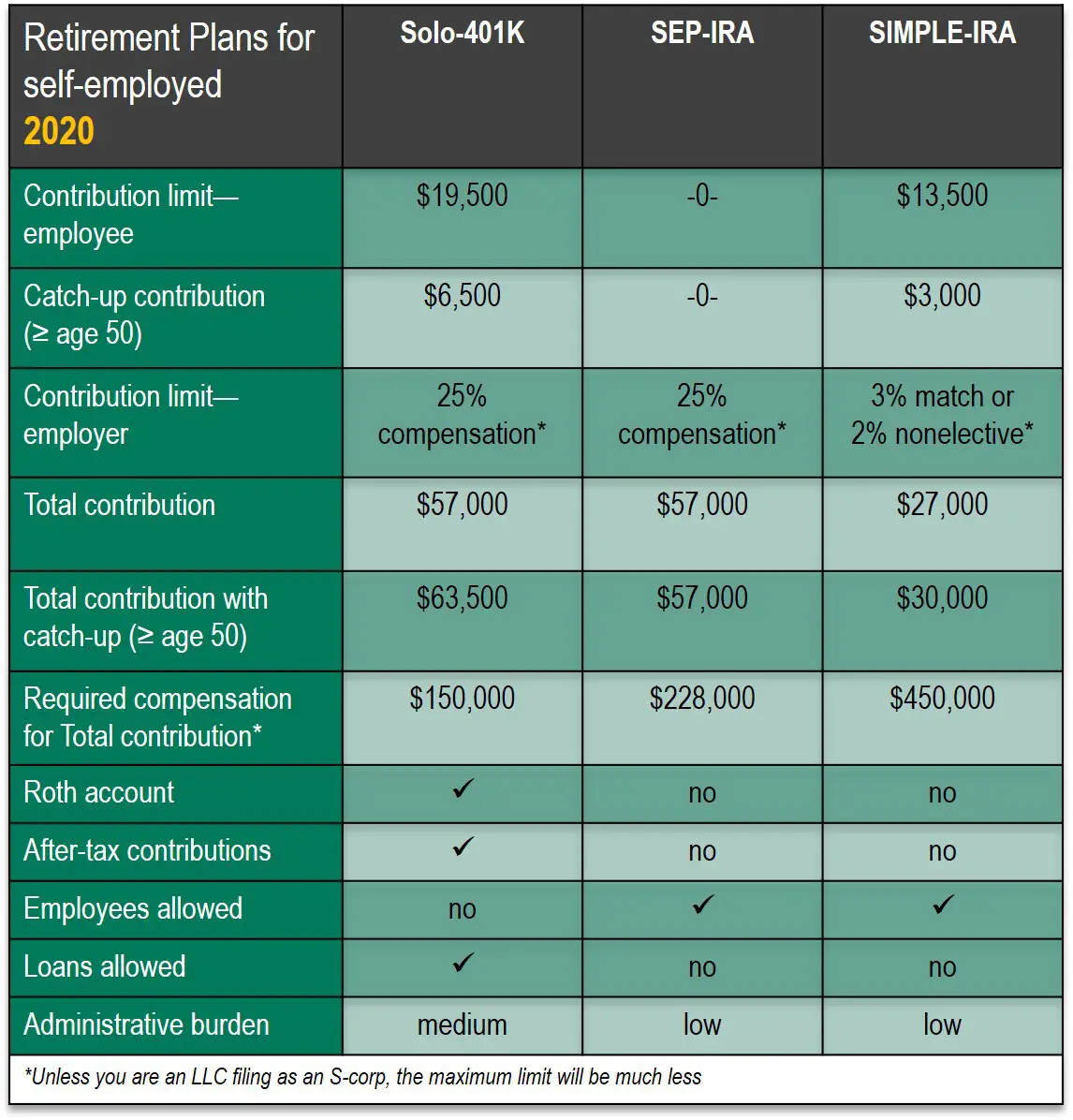

Rule # 3 Employer Contributions Are 20% Of Net Earnings From Self

When calculating the employer contribution for a SEP-IRA or an Individual 401, you use your net earnings from self-employment. This includes any amount used for an employee contribution, but excludes the amount used for S Corp distributions and the amount used for the employer half of the payroll taxes .

The employer contribution in an individual 401 and a SEP-IRA is exactly the same , but since you can also make an employee contribution into an individual 401 money isn’t included in the backdoor Roth pro-rata calculation), a 401 is generally the better option for the self-employed, even if it is slightly more complicated to open .

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: What Should I Do With My Old Company 401k

Should You Have A Joint Retirement Account

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Update: The deadline for making IRA contributions for tax year 2020 has been extended to May 17, 2021.

No matter what stage of life youre intackling student loan debt or buying a houseits likely that planning for retirement may be looming in the back of your mind. And thats a good thing: According to the Center for Retirement Research, 50% of households are at risk for not having enough to maintain their living standards in retirement.

50% of households are at risk for not having enough to maintain their living standards in retirement.

One way to start your retirement savings plan is to work shoulder-to-shoulder with your partner. You have probably heard of joint checking accounts, but what about joint retirement accounts? While some retirement plans do not allow for multiple owners, there are ways couples can plan their retirement savings together.

Roll It Over To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it,says Michael Landsberg, CPA/PFS, member of the American Institute of CPAs Personal Financial Planning Executive Committee.

You May Like: Why Choose A Roth Ira Over A 401k

My Accountant Doesn’t Believe You

Obviously, having access to multiple 401s is an unusual situation among Americans in general, even if it is quite common among doctors. As such, an unbelievable number of accountants have a misunderstanding of the rules noted above, particularly the one about having a separate $57K limit for each unrelated employer. However, taking a look at this article on IRS.Gov written in layman’s language, you can see this is true:

Net Unrealized Appreciation And Company Stock In A 401

If you have company stock in a 401, it could save you significant money on taxes to transfer those shares into a taxable brokerage account to take advantage of net unrealized appreciation, or NUA. NUA is the difference between what you paid for company stock in a 401 and its value now.

For example, if you paid $20,000 for company stock and its now worth $100,000, the NUA is $80,000.

The benefit of the NUA approach is that it helps you avoid paying ordinary income tax on these distributions of your own companys stock from your retirement account. That can be up to 37 percent, which is now the highest tax bracket, says Landsberg.

Instead, youll enjoy capital gains tax treatment, which even at the highest tax bracket is only 20 percent, on any appreciation. High earners, however, will be subject to a bonus 3.8 percent net investment income tax. And an NUA may be subject to a 10 percent early withdrawal tax if you move funds prior to age 59 1/2.

Landsberg says NUA makes the most sense when the difference in tax rates is higher.

Net unrealized appreciation is a very powerful tool, if used correctly, Landsberg says. So you can get creative and potentially have a pretty nice windfall if you use the NUA rules correctly.

You May Like: How To Find 401k From An Old Employer

Option : Doing Nothing

Lastly, you may opt to leave your 401 accounts exactly as they are. Here are some pros and cons of this strategy:

Pros:

1. You are happy with the financial institution and/or investments

If you like your current investment allocation and investment options and want to continue using them, you may choose to leave your 401 as it is.

Cons:

1. Difficult to manage

It could be hard to manage a cohesive investing strategy across multiple accounts. This may be especially true for someone that has multiple accounts at different institutions.

2. Cannot add money to an old employer-sponsored 401

It is not possible to contribute new money to an old 401 account that was previously tied to an employer. New money must go into a current 401 or some other self-directed retirement account, such as a Solo 401, Roth IRA, or Traditional IRA.

If you do not currently have access to an employer-sponsored 401, you may want to seek out another retirement account for which you can make contributions.

3. Possible maintenance fees

Old 401 accounts may charge monthly or annual fees such as account maintenance fees. By consolidating, it may be possible to eliminate all or most of these fees.

For example, a person could roll old 401 accounts that charge a maintenance fee into an account that has no such fee, whether that be their current 401 or a Traditional IRA.

4. Limited investing options

In general, a Traditional IRA can provide more flexibility and investing options than a 401.

SOIN19068

This Tax Information Is Not Intended

This tax information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends that you consult with a qualified tax advisor, CPA, financial planner, or investment manager. Depending on the type of account you have, there are different rules for withdrawals, penalties, and distributions. Please understand these before opening your account.

A rollover of retirement plan assets to an IRA is not your only option. Carefully consider all of your available options which may include but not be limited to keeping your assets in your former employer’s plan rolling over assets to a new employer’s plan or taking a cash distribution . Prior to a decision, be sure to understand the benefits and limitations of your available options and consider factors such as differences in investment related expenses, plan or account fees, available investment options, distribution options, legal and creditor protections, the availability of loan provisions, tax treatment, and other concerns specific to your individual circumstances.

Don’t Miss: What Is An Ira Account Vs 401k

Roll Over 401 Into An Ira

For those who would prefer not to rely on their new companys 401 plan’s investment offerings, rolling over a 401 to an IRA is another option. Again, rollovers can be direct, direct trustee-to-trustee transfers, or indirect, with the distribution paid to the account owner. But either way, once you start the process, it has to happen within 60 days.

Ford generally favors rolling the money over into the new companys 401 plan, though: For most investors, the 401 plan is simpler because the plan is already set up for you safer because the federal government monitors 401 plans carefully less expensive, because costs are spread over many plan participants and provides better returns, because plan investments are typically reviewed for their performance by an investment advisor and a company 401 investment committee.

Can I Combine Multiple 401 Plans Into One Account

Find out how to consolidate multiple retirement accounts and simplify your finances.

Q: “My husband and I both have two 401 accounts from previous employers. Can I combine all four of them into one account in order to simplify our finances?”

A: You can’t combine retirement accounts owned by different people, even if you’re married. The only exceptions to this rule are death and divorce.

But you can combine accounts in your own name by doing a rollover. A rollover is a tax-free transfer of assets from one retirement account to another. For instance, if you have a new 401 plan that allows rollovers, you could move funds from one or more old 401s into the new plan.

Another great option or not) is to rollover old 401s into an IRA of your choice. Having your retirement money in a rollover IRA gives you the flexibility to choose from a wide variety of investment options.

If you simply leave money in an ex-employer’s retirement plan, you will continue to enjoy the benefit of having taxes deferred on annual growth in the account until retirement. However, you won’t be able to make any new contributions to the account.

Also Check: Can I Open A 401k Without An Employer

Advantages Of A 401 Rollover

The Wall Street Journal suggests that 401 owners consider the costs that plans charge, including account-maintenance fees that some employers charge ex-workers. Some 401 plans let owners take loans from the account, sometimes including the funds that were added through a rollover — an option that isn’t available if you roll over into an IRA instead. Also, 401 plans may offer more ways to make emergency withdrawals from your account before retirement age. Another advantage to 401 rollovers is the control gained by consolidating funds into one account, along with a reduction in paperwork.

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Don’t Miss: Can I Rollover My 401k To An Existing Ira

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

It Will Be Easier To Calculate Your Rmd

At some point in your retirement, you will be required to take money from each retirement account that you have. These are called Required Minimum Distributions . When this starts at age 70.5, you will have multiple custodians contacting you every year to process these distributions.

If you have a lot of accounts, that means a lot of calculations need to be done. With a consolidated statement, you only need to perform one calculation.

If you fail to take out your RMDs annually, you face a 50% penalty on the amount you should have withdrawn. It becomes a lot easier to avoid those withdrawal penalties with a consolidated account.

You May Like: When Leaving A Job What To Do With 401k

Merging Traditional Ira Accounts

Just as is the case with employer-sponsored retirement plans, its pretty easy to reach the point you have more than one IRA account. It often happens as a result of job changes you leave one job and roll an old 401 plan into an IRA. Then you take another job with a 401, and maybe while youre there you set up another IRA account, just because you can. Once you leave the second job, that 401 gets rolled over into its own IRA, and now you have three IRAs.

Sometimes multiple IRAs develop based on the various incentives that are offered by individual IRA account managers, similar to the reasons why people often maintain savings and checking accounts with multiple banks.

Whatever the reason, its easy to reach a point where you have three or four IRAs, all sitting with different trustees. Eventually, you come to a place where you want to merge them all into a single IRA.

When that time comes, just be sure the other accounts you’re rolling the IRA into is the best plan of the batch. It should offer the widest investment selection, at the lowest price.

There are two ways to merge one traditional IRA into another:

In many cases, the trustee of the old account will withhold 20% of the distribution from the plan to cover income taxes. While this could be an excellent cover in the event that you dont complete the rollover within the required 60 days, it comes with a set of complications all its own.