What To Do Once Ive Reached My Cap

If you have capped out your 401k account and still want to invest in your retirement, your next best option is a Roth IRA account. You can contribute your taxed income and let it grow tax-free. Unfortunately, IRAs are also capped. In 2019, this amount is $6,000 annually or $7,000 if over the age of 50.

Getting Started With A 401

When saving for your retirement, employers may need some guidance, such as deciding between a Simple IRA vs 401 plan. For employees, the enrollment process may vary within different organizations, and different companies may also have different waiting periods for new hires before they are eligible to participate.

Eligible employees are required to receive a summary plan document which provides information about their plan and its available options. If they’re not sure how much to save each paycheck, provide them resources such as a 401 calculator to help them estimate both expected contributions and account earnings over time.

Investing Through Your 401

The administrator of your 401 plan decides on a handful of investment options that you will choose from. These are usually some combination of mutual funds, including target-date funds. Its very rare to have a 401 that allows you to invest in individual stocks or bonds.

When youre deciding how to invest, youll want to factor in your risk tolerance, age and how much you need for retirement. To simplify things, many people choose to invest in the aforementioned target-date funds. These automatically rebalance your portfolio to become more risk-averse as you approach the year of your retirement.

Once you decide between the investment choices, youll need to pick what percentage of your paycheck you want to allocate to your 401 account. Theres no magic percentage, as everyones financial situation is different. Ideally, youll contribute as much as you can while still keeping enough to manage your day-to-day and monthly expenses. At the very least, though, you should aim to contribute at least as much as your employer will match.

Read Also: Can I Take Money Out Of My Fidelity 401k

A Tax Savings Example

Assume you make $50,000 per year. You decide to put 5% of your pay, or $2,500 a year, into your 401 plan. You’ll have $104.17 taken out of each paycheck before taxes have been applied if you get paid twice a month. This money goes into your plan.

The earned income you report on your tax return at the end of the year will be $47,500 instead of $50,000, because you get to reduce your earned income by the amount you put in. The $2,500 you put into the plan means $625 less in federal taxes paid if you’re in the 25% tax bracket. Saving $2,500 for retirement therefore only costs you $1,875.

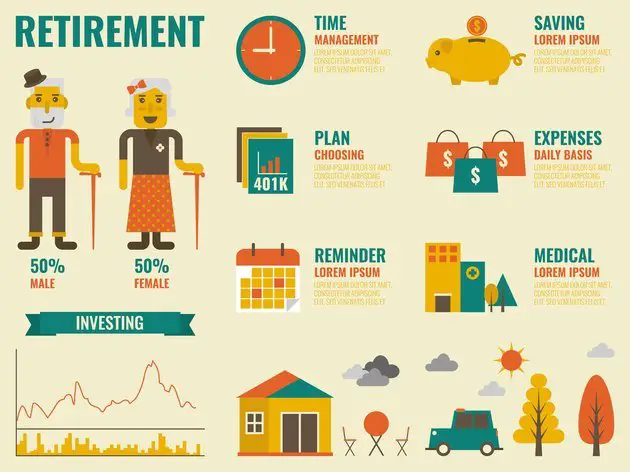

Private Sector Employees Can Invest For Retirement With A 401 Plan

A retirement plan may be one of the most valuable benefits of employment. Used effectively, it can deliver a long-term impact on your financial well-being. See how a retirement plan works and learn about the power you have to control your financial future.

In general, a 401 is a retirement account that your employer sets up for you. When you enroll, you decide to put a percentage of each paycheck into the account. These contributions are placed into investments that youve selected based on your retirement goals and risk tolerance. When you retire, the money you have in the account is available to support your living expenses.

Recommended Reading: How To Calculate Employer 401k Match

How Do Retirement Account Contribution Limits Work

Contribution limits are placed on retirement accounts so that high-income earners cant unfairly take advantage of tax-free savings. However, contribution limits arent set in stone, because inflation is constantly changing. Therefore, the IRS decided to make retirement account contribution limits indexed to inflation, meaning they are reassessed each year and increased by the prevailing rate of inflation, more or less.

Some years contribution limits arent changed because inflation isnt quite bad enough to merit it. However, in years like 2021, a thirty-year-high inflation rate has a big impact on both spending power and contribution limits. Its important to note that these contribution limits apply to retirement accounts differently, based on the account type.

What Happens If You Default On The Loan

When you default on a 401 loan, the remaining loan balance is counted as a deemed distribution from your 401. That has two big consequences:

- The loan amount is considered a distribution and will be taxed. Also, you will have to pay a 10% early withdrawal penalty if you are younger than age 591/2.

- You cannot roll over the defaulted amount into an IRA or any other employer retirement plan. This means there is no way you can avoid taxes and penalties.

However, the good news is that your default is not reported to the credit bureaus and hence will not affect your credit score.

Read Also: What Employees Can Be Excluded From A 401k Plan

What Is A 401 Retirement Plan And How Does It Work

Quick Answer: A 401K is a retirement savings plan that you can get through your employer or job. The advantage of investing your money into a 401K is that you do not have to pay taxes on the money you put it. You will only pay taxes on your money when you withdraw the money. You can contribute $19,500 per year. There is also an additional catch up contribution for folks who are 50 and over. Some employers will match your contributions up to a certain percentage. This is usually outlined in your employee handbook or can be verified through your HR department.

The 401k is an amazing way to save for retirement. There is a reason most Americans contribute their nest egg into a 401K. Not only does your employer most likely match a percentage of your contributions it also has tremendous tax benefits. If you are new to the 401k, consider its benefits to see if it is the right investment vehicle for you.

What Is The Annual 401k Contribution Limit For 2021

Compared to traditional pensions, in which the employer sets the dollar limit, the Internal Revenue Service determines the contribution limit for the 401K account. The contribution limits change periodically to account for inflation.

For instance, the necessary limitations on employee contribution have been $19,500 annually for employees below 50 in 2020 and 2021.

If you are beyond 50, you are allowed to contribute as much as $26,000 per year. In companies where the employer contributes, the overall employer & employee contributions must not exceed $58,000 for workers below 50. In contrast, you cant contribute more than $64,000 beyond 50.

Recommended Reading: How To Find My 401k Money

You Can Take It With You

If you leave your job someday for another, you can take your 401 with you. This won’t go into a box with your other belongings rather, you’ll need to roll over that account into a new one and for many people, converting that 401 to an IRA is a great idea. You’ll want to consult our guide for 401 rollovers when that time comes.

About the author:Dayana Yochim is a former NerdWallet authority on retirement and investing. Her work has been featured by Forbes, Real Simple, USA Today, Woman’s Day and The Associated Press.Read more

You Will Be Taxed On 401 Distributions

Traditional 401 contributions are often made on a pretax basis, which means they lower your taxable income during your working years.

Because the money wasnât taxed when you contributed it, when you begin taking distributions from your 401, youâll have to pay tax because the IRS treats this money as ordinary income. That means you wonât get to keep everything youâve saved. And if you withdraw too much in a given year, you could push yourself into a higher tax bracket â meaning the government will take a larger portion of your savings.

While you will owe income tax on money that you withdraw from a traditional 401, you will not owe tax on money that you have saved in a Roth 401. If your savings is in a traditional account, itâs possible to do a Roth conversion, where you will owe income tax on the amount you convert in the year that you convert it. With a Roth IRA, you can enjoy tax-free distributions in retirement.

So how does a 401 work in retirement? While it can be rolled to an IRA, ultimately itâs up to you and how you want to use your lifetime of savings to generate the income you need to fund the things youâve been dreaming about for your retirement. An experienced financial advisor who understands the ins and outs of retirement income and tax planning can help.

Recommended Reading

Read Also: Can I Move Money From 401k To Roth Ira

Why 401ks Are The Most Popular Employee Retirement Plan

In the last few years, the 401K plan is experiencing an increase in the number of participants while traditional pensions decreased. This circumstance is because the employers are handing over the responsibility and risks of retirement saving to their staff. With the 401K, it is the employees responsibility to choose a specific investment for themselves among those provided by the employer. As suggested earlier, these offers include but are not exclusive bonds, mutual funds, and stocks. Sometimes, a 401K plan may come with guaranteed investment from the insurance companies or the employers stock.

What To Do With Your 401 When You Retire

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

You know all about saving in your 401 while youre working, but how exactly should you handle those savings when you retire?

If youre not sure, join the crowd.

A quarter of 401 participants 45 and older say they dont know what theyll do with their retirement account when they retire, according to a survey of 1,000 people with a 401 account conducted for Cerulli Associates, a research and consulting firm.

Another 25% said theyll ask their financial advisor what to do, which is another way of saying theyre not sure what to do.

The best approach depends on your situation. Following these four steps can help you get started.

Recommended Reading: What’s My 401k Balance

How Much Should You Contribute To Your 401k

If you can, stuff as much money as you can into your 401k. Aim to hit the maximum contribution every year. The more money you can defer from taxes the better.

If you are just starting out, the first thing to do is make sure you at least get your employers match. For example, If your employer matches the first 5% of the money you contribute, it would be stupid not to contribute 5% of your salary.

Why? Because it is free money. You are leaving money on the table by not taking this contribution.

Aim to contribute at least 10% of your income in your 401K and 10% of your income in a Roth IRA.

You May Have A Roth 401 Option

Another choice to consider: a Roth 401. Not all plans offer the Roth option, but if yours does, you are allowed to put in after-tax money in exchange for tax-free growth and tax-free withdrawals in the future.

You can choose to divide your annual contribution between the traditional 401 and the Roth 401. Any employer match will go into a traditional 401.

According to a survey conducted by global advisory firm Willis Towers Watson, seven in 10 employers offered a Roth option within their 401 in 2018. You’ll have to pay tax based on the investments’ value at the time of the in-plan conversion. But beware: Unlike IRA Roth conversions, you can’t undo a 401 Roth conversion — the decision is irrevocable.

Also Check: Can You Merge 401k Accounts

Roll Money Into An Ira

If you are not satisfied with the 401 investment options, you can rollover the money into an IRA since the latter has more investment options and offers greater control. You can reallocate your portfolio of investments to help you grow your investments further in years to come.

If you have a string of old 401s when you retire, you should consolidate them into an IRA for better management of your retirement savings. Also, you can reduce the administration fees of your retirement money, and even qualify for discounts on sales charges.

Caveats To The 4% Rule

Several variables can make this rule of thumb either too conservative or too risky, and you might not be able to live on 4%-ish a year unless your account has a significantly large balance.

The first caveat you should consider when thinking about applying the 4% rule to your personal situation is that it calls for putting 50% each in stocks and bonds. You may not be comfortable putting that much of your retirement assets in equities, and you may want to keep at least a portion of your nest egg in cash or a money market fund.

You also might not expect to live for 30 years after retirement, either because you retired later than most people do or for some health-related reason. And you may not feel you need the almost 100% confidence level Bengen was seeking in his rule a confidence level of 75% to 90% that you won’t run out of money might be acceptable to you and may afford a more flexible withdrawal rate.

Read Also: Can You Take Out Your 401k To Buy A House

What Does This Mean For Digital Iras

With growing interest in new technology, 2022 looks to be a strong year for digital currencies. And with an increase in contribution limits for many standard retirement accounts, individual investors are set to benefit from investing more tax-advantaged money into this new and growing asset class.

While future growth is unpredictable and entirely speculation, many experts expect cryptocurrencies will have massive growth in the coming years, all the more reason to reduce future taxes through an SDIRA.

While contribution limits are changing, its essential to know that this wont change your ability to invest in digital assets via these tax-advantaged retirement accounts. In fact, with higher contribution limits, you can now consider investing even more into a Digital Asset IRA.

BitIRA is here to help you navigate your Digital Asset IRA needs, whether it be opening a new SDIRA account, rolling over an existing account, or maxing out your contributions for the coming year. Get in touch with BitIRA today to learn more about how you can maximize your retirement savings through digital assets.

Important Disclaimer: Pricing data displayed on the Site are provided by or based on information provided by one or more exchanges, may be delayed or otherwise not up to date, may be incorrect, and there is no guarantee that any amount of Digital Currency can be purchased or liquidated for the price indicated. No price is guaranteed until the transaction is settled.

Your Company May Match Your 401 Contribution

Many employers will help you save in your 401 by matching an employee’s contribution up to a certain percentage, perhaps 50 cents for every dollar you contribute up to 6% of your pay. Be clear on what the company’s formula is.

Some companies will provide contributions to employees’ accounts, regardless of whether employees contribute their own money. And some employers may provide the match in company stock. Whichever way the company helps you save, ask whether there is a vesting schedule for that employer-provided money. You may have to work for the company for a certain amount of time before that money becomes 100% yours.

You May Like: Should I Pay Someone To Manage My 401k

What Is 401k Matching

For most employees, a defined contribution plan is one of the primary benefits offered by their employer, with a 401k being the standard employer-sponsored retirement plan used by for-profit businesses. Employer matching of your 401k contributions means that your employer contributes a certain amount to your retirement savings plan based on the amount of your annual contribution.

Learn More:The Average 401k Balance By Age

Similarly, some employers use 403b or 457b plans. While there are some minor differences between these plans, they are generally treated in a similar manner, and they usually have the same maximum contribution limits. The type of plan is based on the type of entity:

- 403b plans are used by tax-exempt groups, such as schools or hospitals

- 457b plans are for government workers, although there are some non-governmental organizations that also qualify to use these plans

Whether youre on your first job or are thinking about retirement, here are a few considerations to keep in mind when offered an employer matching your 401k contributions.

You Can Also Choose A Roth 401

Many 401 plans give participants the option to choose a Roth 401. With a Roth 401, you make contributions to your plan with after-tax income, meaning the contributions do not reduce your taxable income. Like a Roth individual retirement account , you pay no income taxes on qualified distributions, such as those made after the age of 59 ½ .

Choosing a Roth 401 can make sense if you believe you will be in a higher tax bracket when you retire than you are today. For many young earners who are just beginning their careers, lower income levels and tax brackets could make a Roth 401 a great choice.

There is nothing forcing you to choose between either a traditional 401 or a Roth 401you can make contributions to both kinds of 401 plan, if your employer offers them. Consider speaking with a tax professional or a financial advisor when deciding between a traditional or a Roth 401, or dividing your contributions between both types.

Also Check: What’s The Maximum Contribution To A 401k