Where Can I Open A Solo 401k Account

If you are self-employed, find out where you can open a Solo 401 and the process involved when opening a self-directed retirement account.

One of the perks of being self-employed is the ability to self-direct your retirement savings. Self-employed individuals can open a Solo 401 account to access the same level of service as a company-sponsored 401 plan. A Solo 401 allows the owner-employee of the business to contribute up to $19,500 in 2021, and still make profit-sharing contributions up to $58,000 in 2021, or $64,500 if you are above 50.

You can open a Solo 401 account with different types of providers such as brokerages, banks, and self-directed custodians. You should compare the different Solo 401 providers to determine the company with the best Solo 401 account that meets your retirement needs. You should also compare the fees charged by each provider and the investment options available in each plan.

How To Set Up A 401k For A Small Business

Setting up a 401 for your small business includes some crucial steps, some of which can be outsourced. It’s important to remember that the employer maintains a fiduciary duty to ensure that the plan is providing a benefit to participants. The U.S. Department of Labor provides in-depth details of the process:

1. Create a 401 plan document

Create a plan document that complies with IRS Code and outlines the details of your retirement plan. Set up procedures to ensure the document is followed.

2. Set up a trust to hold the plan assets

A plan’s assets must be held in trust to assure its assets are used solely to benefit the participants and their beneficiaries. At least one trustee must handle the plan’s activities regarding contributions, plan investments, and distributions. Given that these decisions affect the plan’s financial integrity, selecting a trustee is a critically important decision. Another fiduciary, such as the employer who sponsors the qualified retirement plan, will generally assign the trustee.

3. Maintain records of 401 employee contributions and values

Maintain accurate records that track employee contributions and current plan values. Many small businesses choose to work with a 401 recordkeeper to help them manage plan setup and ongoing record management.

4. Provide information to plan participants

What Are The Rules For A Roth Ira

Roth IRAs are only available to people making less than $129,000 a year as an individual, or $191,000 for married couples. They have contribution limits of $5,500 a year, or $6,500 for those over 50. Unlike 401ks and traditional IRAs though, there’s no penalty for withdrawing part of your contribution early.

You May Like: When Leaving A Company What To Do With 401k

What About A Traditional Ira

If your income is too high to contribute to a Roth IRA, you can go with a traditional IRA. Like a Roth IRA, you can contribute up to $6,000 a year$7,000 if youre 50 or olderand you and your spouse can both have an account.4

Thats where the similarities end. Unlike a Roth IRA, there are no annual income limits. But youre required to begin withdrawing once you turn 72, and even though contributions to a traditional IRA are tax-deductible, youll have to pay taxes on the money you take from it in retirement.5

Still with us? Now, lets look at some other options you can explore if youre self-employed.

Sponsorship: An Employers Role

Each 401 plan has a sponsor, usually your employer. The sponsor decides which factors determine your eligibility, what percentage of your salary you can contribute to your plan, whether to match your contributions and which investments will be available within your plan. The plan administrator keeps track of the companys 401, handling management details and making sure that the plan runs smoothly. Your sponsor also chooses your plan provider, typically a financial services company that offers investment products, plan administration and record-keeping services.

Some provisions of your 401 plan are dictated by ERISA, the federal law that governs qualified retirement plans. For example, plans must cover all eligible employees and treat them equitably. Other details are specific to each individual plan. Thats why, if you move from one job to another, each with a 401, some things will seem familiar and others different.

401 plans are largely self-directed. You decide how much you would like to contribute to your plan, how you would like to investor reinvestthose contributions within the limits of your plans investment menu, and eventually how you would like to handle withdrawals from your account.

With many employers, you have to sign up before you can contribute part of your earnings to your plan account. You have to choose how much to put away. And you decide where to invest your contributions, selecting among the investment choices offered in the plan.

Recommended Reading: What Happens To 401k When You Leave Your Job

Types Of Retirement Accounts: Iras And 401s

We can help. By learning about your options, you can choose the type of savings account thats right for your life, now and in the future.

Lets start with the two most common ways to saveIndividual Retirement Accounts and 401 accounts. Well break down the similarities and differences between traditional 401s and traditional IRAs, then share details around Roth IRAs and Roth 401s, giving you a basic understanding of each.

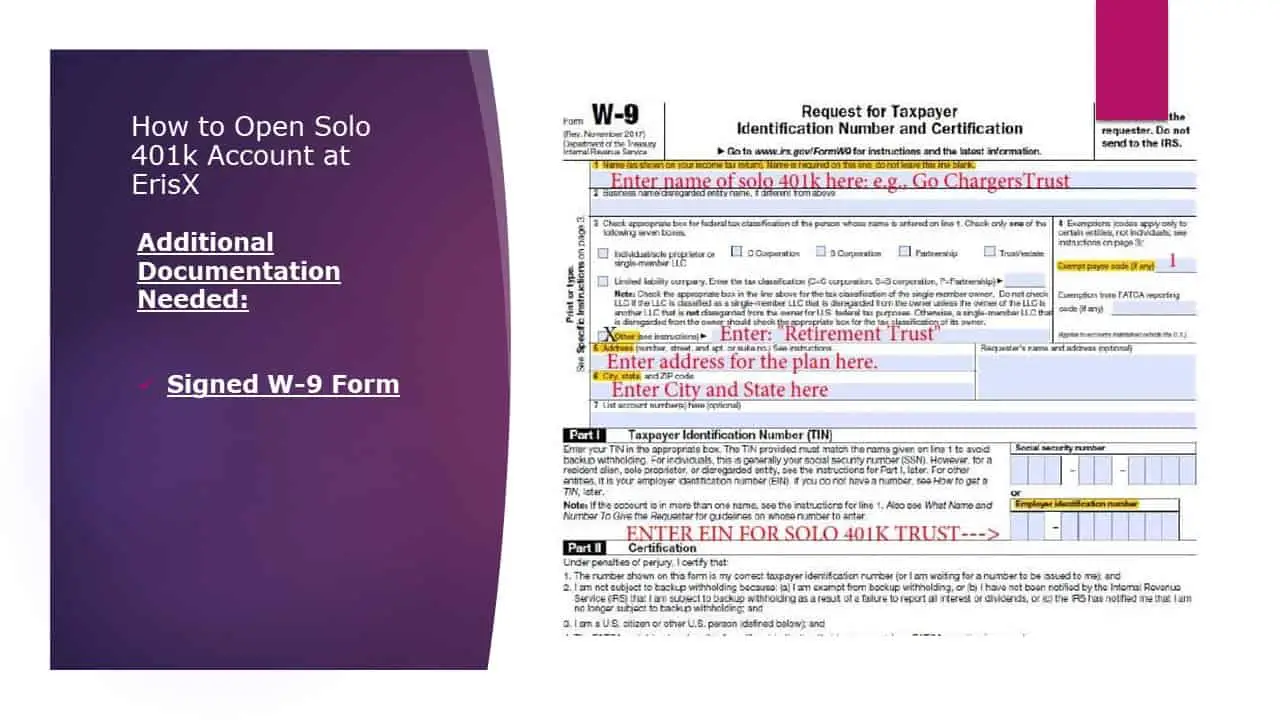

How To Open A Td Ameritrade Account For The Solo 401k

Each brokerage house is different in how they classify their investment-only accounts and applications can update at any time. We have made our best efforts to provide you the most up to date applications here, but please check with TD Ameritrade to ensure you have the right application to open an investment-only brokerage account under your Solo 401k plan and trust.

It’s important to remember you’re not opening a TD Ameritrade 401k. Rather, your 401k plan and trust are opening an investment-only account with TD Ameritrade.

TD Ameritrade calls these types of accounts “Trust accounts” and they are designed to work with your Solo 401k.

Read Also: How To Borrow Against 401k Fidelity

Solo 401 Early Withdrawal Rules

Early withdrawal rules for Solo 401s depend on which type of account you have. With a few exceptions, you must pay a 10% penalty tax on withdrawals from a traditional Solo 401 account made before you turn 59 ½, plus income taxes on the amount withdrawn.

With a Solo Roth 401, early withdrawals of contributions are free of the 10% tax penalty and income tax payments, but you pay the penalty and income tax on earnings. You cannot withdraw contributions exclusively from a Roth Solo 401, meaning you will have to pay taxes and a penalty on at least part of your early withdrawal.

Open Fidelity Investment Account: Rolling Over From A Fidelity 401k

Open a non-prototype retirement account . Include your full Adoption Agreement and your full trust document. These documents can be found in your 401k documents, located on your 401k dashboard.

Complete the form to transfer between existing Fidelity accounts

Personalize, complete and sign the rollover acceptance sample template : If you use this template, be sure to update the information in red to reflect your information. This simple document lets Fidelity know you are accepting the rollover as the 401k plan administrator.

Mail your application along with your full Adoption Agreement and full Trust Agreement to Fidelity at:Fidelity Investments, P.O. Box 770001, Cincinnati, OH 45277-0036.

If you have any questions on completing your non-prototype retirement account application, please contact Fidelity at 544-6666.

Don’t Miss: What To Invest My 401k In

Open Solo 401 Account

Once youâve obtained the required documents, you can set up the Solo 401 account. You should open the retirement before the tax filing date, and it should be created based on the rules provided in the plan documents. For example, if you want to contribute during the year, you can open the account any time before December 31.

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which you’ll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

You May Like: What Happens To 401k When Switching Jobs

Traditional Or Roth Ira

If none of the above plans seems a good fit, you can start your own individual IRA. Both Roth and traditional individual retirement accounts are available to anyone with employment income, and that includes freelancers. Roth IRAs let you contribute after-tax dollars, while traditional IRAs let you contribute pretax dollars. In 2021, the maximum annual contribution is $6,000, $7,000 if you are age 50 or older, or your total earned income, whichever is less.

Most freelancers work for someone else before striking out on their own. If you had a retirement plan such as a 401, 403, or 457 with a former employer, the best way to manage the accumulated savings is often to transfer them to a rollover IRA or, alternatively, a one-participant 401.

Rolling over allows you to choose how to invest the money, rather than being limited by the choices in an employer-sponsored plan. Also, the transferred sum can jump-start you into saving in your new entrepreneurial career.

What Are The Roth Ira Requirements

To be eligible to fully contribute to a Roth IRA, you must:

-

Have an earned income.

-

Have whats called a modified adjusted gross income . But it has to be less than $198,000 for married couples filing jointly or $125,000 for single people.3

Now listen up, married people, because this is important. Even if you or your spouse doesnt have an earned income, you can still have two Roth IRAs between both of you with something called a spousal IRA, if your spouse has an earned income. For most folks, fully funding two Roth IRAs will be enough to reach the goal of investing 15% of their income for retirement.

Read Also: How To Transfer 401k From Fidelity To Vanguard

Other Benefits Of Solo 401s

The advantages of Solo 401s arent limited to taxes. If your spouse works with you at your companyeven part-timethey may be able to invest in a Solo 401 as well.

As long as your husband or wife works for you at least part-time, they can contribute up to $19,500 a year to a Solo 401, or up to $26,000 if theyre 50 or older. You, as their employer, can then contribute up to 25% of their compensation, up to a total of $58,000 in 2021 or $57,000 in 2020. This allows couples to invest more than $100,000 in tax-advantaged retirement accounts.

Review The Investment Choices

The 401 is simply a basket to hold your retirement savings. What you put into that basket is up to you, within the limits of your plan. Most plans offer 10 to 20 mutual fund choices, each of which holds a diverse range of hundreds of investments that are chosen based on how closely they hew to a particular strategy or market index .

Here again, your company may choose a default investment option to get your money working for you right away. Most likely it will be a target-date mutual fund that contains a mix of investments that automatically rebalances, reducing risk the closer you get to retirement age. Thats a fine hands-off choice as long as youre not overpaying for the convenience, which leads us to perhaps the most important task on your 401 to-do list …

Don’t Miss: Can I Invest My 401k In Gold

Open Td Ameritrade Investment Account: No Rollovers

If you’re simply opening the new investment-only account with TD Ameritrade to get into traditional equities, then your work is done! Fund your TD Ameritrade account with new contributions, calculated from your business income and you’re ready to go!

Complete the trust plan application:

In Section 1, denote you’ll be opening an account for the Solo 401k and that it’s a non-TD Ameritrade plan:

In Section 3: Trust Information – include the Trust name, and Trust Tax ID number. The grantor is generally understood to be the Adopting Employer and you are the employee participant:

In Section 13, tick the checkbox that the plan is not covered under ERISA:

You must complete that section as you are establishing an account for a tax-exempt trust/QRP .

Include the first 4 pages of your Adoption Agreement and your trust document. These documents can be found in your 401k documents, located on your 401k dashboard.

Note: It is not required you fund the account when submitting the trust account application.

Fax your application to TD Ameritrade at 866-468-6268.

If you’re opening the new investment-only account with TD Ameritrade so you can transfer funds from a pre-existing TD Ameritrade IRA or TD Ameritrade 401k account, the please follow the transfer/rollover tips below.

How To Invest Your 401

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Nothing is more central to your retirement plan than your 401. It represents the largest chunk of most retirement nest eggs.

Finding the money to save in the account is just step one. Step two is investing it, and thats one place where people get tripped up: According to a 2014 Charles Schwab survey, more than half of 401 plan owners wish it were easier to choose the right investments.

Heres what you need to know about investing your 401.

Also Check: How Can You Take Out Your 401k

Contribute Enough To Get Any Employer Match

Even the priciest 401 plan can have some redeeming qualities. Free money via an employer match is one of them. Contributing enough money to get the match is the bare minimum level of participation to shoot for. Beyond that, it depends on the quality of the plan.

A standard employer match is 50% or 100% of your contributions, up to a limit, often 3% to 6% of your salary. Note that matching contributions may be subject to a vesting period, which means that leaving the company before matching contributions are vested means leaving that money behind. Any money you contribute to the plan will always be yours to keep.

If your company retirement plan offers a suitable array of low-cost investment choices and has low administrative fees, maxing out contributions in a 401 makes sense. It also ensures you get the most value out of the perks of tax-free investment growth and, depending on the type of account or the Roth version), either upfront or back-end tax savings.

How Do You Withdraw Money From A 401 After Retirement

To withdraw money from your 401 after retirement, you’ll need to contact your plan administrator. Depending on your company’s rules, you may be able to take your distributions as an annuity, periodic or non-periodic withdrawals, or in a lump sum. Your plan administrator will let you know which options are available to you. You can typically have funds deposited into an account or have your plan send you a check.

You May Like: How To Find 401k From Former Employer

How To Start A Retirement Fund

Saving for retirement is an important part of financial planning for nearly all Americans. There is currently a gap of $28 trillion between what Americans have saved for retirement and what they actually need, and thats expected to grow to $137 trillion by 2050, according to the World Economic Forum. One of the best ways to save for retirement is to create a retirement fund. This is a general way of saying saving for retirement using multiple types of specially designed financial accounts from a bank or other financial services company. There are a few types of retirement accounts you can choose from, and each has their own steps for starting one. For more help with planning for retirement, consider working with a financial advisor.

What Other Options Do I Have

If you work for a nonprofit or other tax-exempt organization, a 403 plan is another great pretax investment option that works a lot like a 401.

Federal employees can save for retirement through the Thrift Savings Plan . TSPs usually come with matching contributions and allow you to make after-tax contributions with the added plus of tax-free withdrawals when you retire. You can also choose how to split your TSP contribution among several investment options.

Don’t Miss: How To Cash Out Your 401k Fidelity

Benefits To Your Business

Your employer contributions are a deductible business expense, which reduces your business taxes.

Your business can get tax credits and other incentives for starting a plan. The tax credit is for employers with 100 or fewer employees, and is applied to 50% of your eligible startup costs for a 401, up to a maximum of $500 a year. The credit is given for setting up and administering the plan and educating your employees about it.

Beyond that, offering a retirement plan is attractive to current and potential employees, giving you a competitive advantage when hiring and retaining talent.