Substantially Equal Period Payments

Substantially Equal Period Payments might be a good option if you need to withdraw money for a long term need. These payments must last a minimum of 5 years or until you reach the normal 401k withdrawal age of 59 1/2, whichever is shorter. For this reason, this is not a good option if you have a short term need like a sudden unexpected expense. You cannot withdraw funds under this method if you still work for the employer through which you have the 401. To calculate the amount of these payments, the IRS recognizes three acceptable methods.

Dont Miss: How Do I Transfer 401k To New Employer

Youve Got Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into a new account with your new employer, or roll it into an individual retirement account , but you must first see when you are eligible to participate in the new plan. You can also take some or all of the money out, but there are serious tax consequences to that.

Make sure to understand the particulars of the options available to you before deciding which route to take.

Your 401 K And Income Tax

You may be wondering if your 401 k is subject to income tax. Once you’ve withdrawn the money from the 401 k, you need to pay tax on it. It is considered part of your taxable estate. This is why you must check the terms of your 401 k before you get any money from it. Terms like these should be clearly outlined in the plan. Withdrawing funds without understanding the implications of doing so is one common mistake that people make when changing employers in the USA. It’s important to consider the other options you have.

If you’re changing employers, you still have plenty of time to build up passive capital via investment and your 401 k. You’re unlikely to get much out of rushing into a decision that you aren’t completely ready for. Roll all of the funds out of your 401 k at once, and you might end up drowning in taxes.

Don’t Miss: Should I Use My 401k To Pay Off Debt

Expecting Relatively Large Long

Spreading traditional IRA withdrawals out over the course of retirement lifetime may make sense for many people. However, if an investor anticipates having a relatively large amount of long-term capital gains from their investmentsenough to reach the 15% long-term capital gain bracket thresholdthere may be a more beneficial strategy: First, use up taxable accounts, then take the remaining withdrawals proportionally.

The purpose of this strategy is to take advantage of zero or low long-term capital gains rates, if available based on ordinary income tax brackets. Tax rates on long-term capital gains are 0%, 15% or 20% depending on taxable income and filing status. Assuming no income besides capital gains, and filing single, the total capital gains would need to exceed $40,400 after deductions, before taxes would be owed.

Tax rates: Singles

| 20% |

One strategy for retirees to help reduce taxes is to take capital gains when they are in the lower tax brackets. For example, single filers with taxable income less than $40,400 are in the 2 lower tax brackets. That equates to a 0% tax on capital gains. If taxable income is between $40,401 and $445,850, long-term capital gains rate is 15%. Remember, the amount of ordinary income impacts long-term capital gain tax rates.

The big difference: Jamie pays zero on her long-term capital gains because her income is below that key threshold of $40,400, but David pays 15% on his $5,000 because of his higher earnings.

| $995 | $5,414 |

Why Does Slavic401k Reimburse All Revenue Paid By The Funds

Also Check: How To Open A Solo 401k

Recommended Reading: Do I Need Ein For Solo 401k

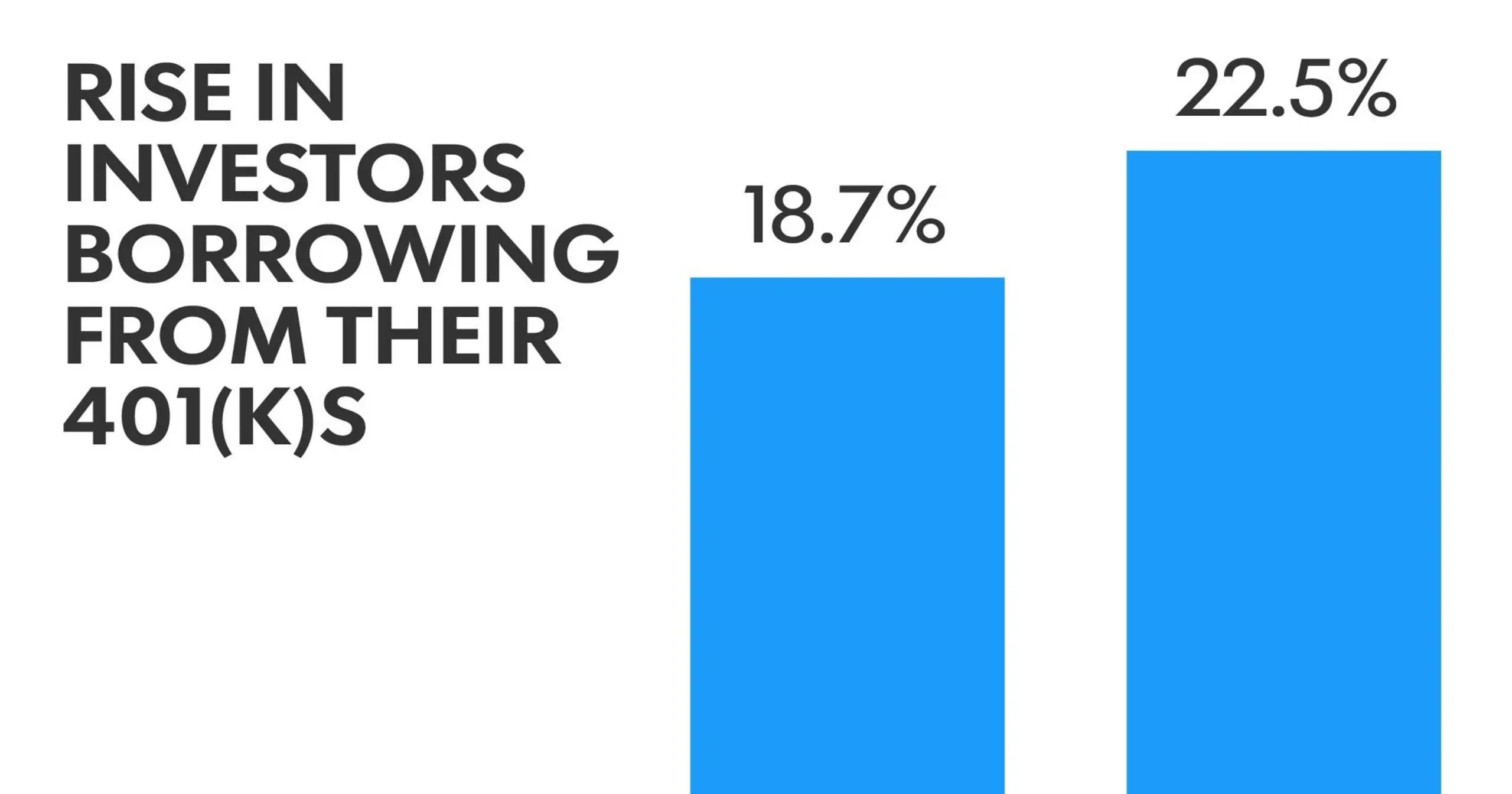

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

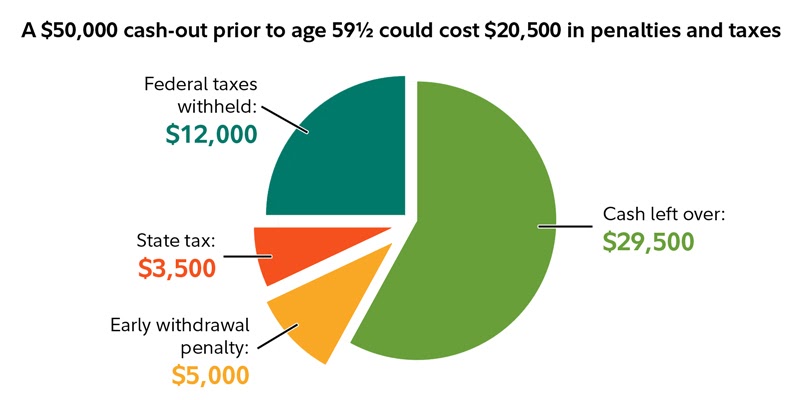

Withdrawing Money Early From Your 401

The method and process of withdrawing money from your 401 will depend on your employer, and which type of withdrawal you choose. As noted above, the decision to remove funds early from a retirement plan should not be made lightly, as it can come with financial penalties attached. However, should you wish to proceed, the process is as follows.

Step 1: Check with your human resources department to see if the option to withdraw funds early is available. Not every employer allows you to cash in a 401 before retirement. If they do, be sure to check the fine print contained in plan documents to determine what type of withdrawals are available, and which you are eligible for.

Step 2: Contact your 401 plan provider and request that they send you the information and paperwork needed to cash out your plan, which should be promptly completed. Select providers may be able to facilitate these requests online or via phone as well.

Step 3: Obtain any necessary signatures from plan administrators or HR representatives at your former employer affirming that you have filed the necessary paperwork, executed the option to cash in your 401 early, and are authorized to proceed with doing so. Note that depending on the size of the company, this may take some time, and you may need to follow up directly with corporate representatives or plan administrators at regular intervals.

Recommended Reading: Can I Rollover My 401k To An Existing Ira

How To Close Fidelity 401k Account

Fidelity investments po box 770001Fidelity is weird in that they dont do electronic transfers for your solo 401k, so you literally just have to handwrite a check to them to put the money into your account.Fidelity told me i had to prove the hardship and provide documents.Fidelity workplace | 401 solution for small businesses.

Find your account number using fidelitys mobile app.For gifts sent to a brokerage account outside of fidelity, please provide:For these types of gifts, your letter of instruction should be mailed to:Generally, you cant close out a 401k thats sponsored by your current employer.

Hello, i currently have about $360k in my fidelity 401k spread through various funds but im thinking of creating a brokeragelink account to buy other securities and set up a simpler portfolio.How do i close an account?I am trying to close my 401k due to medical hardship.I have been on disability since the end of november collection $1500.00 a mont.

I set up direct deposit with fidelity and used my wiring number instead of my account number.I use my banks check writing feature and have them mail the check for me.If all you want to do is close your 401k account, thats easy.If youre contributing to your 401 at the recommended amounts, you should have roughly twice your annual salary saved by the age of 35, fidelity says.

Take A Cash Withdrawal

Partial, total, and systematic cash withdrawals allow you to receive income only as you need it and provide a high degree of flexibility. Your remaining accumulations continue to be tax-deferred until you take a distribution, and will continue to experience the investment performance of your chosen funds. See Cash Withdrawals and Loans for details. Keep in mind the following:

-

Income tax is due on cash withdrawals.

-

Your contributions and earnings are available for cash withdrawal at any age once you have terminated employment with the University.

-

University contributions and earnings are available for cash withdrawal at age 55 or older once you have terminated employment, or at any age as an official University of Michigan retiree .

Also Check: How To Collect My 401k Money

Recommended Reading: When Can You Take Out 401k

How To Withdraw Money From 401s And Iras During Retirement

If youve built a nest egg big enough for retirement, congratulations!

You may have thought saving enough to retire would be the hardest part.

Now:

For some people, figuring out how to withdraw from a 401, IRA or other retirement savings is more difficult.

Once you understand some basic concepts, things become more clear.

Read Also: Can Business Owners Have A 401k

Remember Required Minimum Distributions

While you dont need to start taking distributions from your 401 the minute you stop working, you must begin taking required minimum distributions by April 1 following the year you turn 72. Some employer-sponsored plans may allow you to defer distributions until April 1 of the year after you retire, if you retire after age 72, but it is not common. Keep in mind that this exception does not apply to plans you may have with previous employers that you no longer work for.

If you wait until you are required to take your RMDs, you must begin withdrawing regular, periodic distributions calculated based on your life expectancy and account balance. While you may withdraw more in any given year, you cannot withdraw less than your RMD.

The age for RMDs used to be 70½, but following the passage of the Setting Every Community Up For Retirement Enhancement Act in Dec. 2019, it was raised to 72.

Recommended Reading: Can You Use 401k To Buy Investment Property

Rules About 401 Required Minimum Distributions

Again, the minimum age for RMDs was changed in recent years. Before, you had to start taking them either when you retired or when you turned 70.5. However, this age requirement still holds for anyone who turned 70.5 in 2019 or earlier. Anyone who has yet to turn 70.5 can wait until April 1 of the year after theyre 72 to start taking RMDs.

The year in which April 1 is your RMD deadline is your starting year. After the starting year, the deadline shifts to December 31. So your second year and thereafter, you must take your RMD by December 31.

If you wait until April 1 of your starting year to take your RMD, you will have to take two years worth of RMDs the same year. You should avoid this, as it will increase your income for that year, likely putting you in a higher tax bracket. If you fail to take any RMD or you dont take a large enough RMD as required by the IRS, you may have to pay a 50% penalty on the money you should have withdrawn.

Read Also: What Is The Interest Rate On A 401k

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Recommended Reading: How Do I Stop My 401k

Read Also: Should I Convert My 401k To A Roth Ira

Early Withdrawals From Roth Retirement Accounts

You may be able to withdraw funds from Roth retirement accounts early without penalties, too.

In general, you can withdraw only the money you contributed without paying taxes or penalties. This is because you already paid income taxes on this money.

Things get more complicated if you withdraw earnings early. In some cases, you can withdraw earnings penalty and income tax free, too.

To withdraw earnings from a Roth IRA without paying penalties or income tax, you must take the withdrawal:

- at least five years or more after you open the account, and

- be withdrawing money because you suffered a disability, or

- youre using up to $10,000 for a first home purchase within 120 days of withdrawal.

Read Also: How Much In 401k To Retire

More From The New Road To Retirement:

Heres a look at more retirement news.

Also be aware that if your balance is low enough, the plan might not let you remain in it even if you want to.

If the balance is between $1,000 and $5,000, the plan can transfer the money to an in the name of the individual, Hansen said. If its under $1,000, they can cash you out.

Its up to the plan.

Your other option is to roll over the balance to another qualified retirement plan. That could include a 401 at your new employer assuming rollovers from other plans are accepted or an IRA.

If under $1,000, they can cash you out. Its up to the plan.Will HansenExecutive director of the Plan Sponsor Council of America

Be aware that if you have a Roth 401, it can only be rolled over to another Roth account. This type of 401 and IRA involves after-tax contributions, meaning you dont get a tax break upfront as you do with traditional 401 plans and IRAs. But the Roth money grows tax-free and is untaxed when you make qualified withdrawals down the road.

If you decide to move your retirement savings, you should do a trustee-to-trustee rollover, where the transfer is sent directly to the new 401 plan or IRA custodian.

Also, while any money you put in your 401 is always yours, the same cant be said about employer contributions.

You May Like: How To Start Withdrawing From 401k

How To Cash Out A 401 From Your Old Job

By David Carlson

Every day thousands of employees switch jobs from one company to another. One thing that needs to be taken care of in this process is the employee’s 401k. There are a few options available to the employee including cashing out their 401k and transferring the funds to a rollover IRA.

Are you trying to find out how to cash out your 401k from old jobs? You’re in luck. We’ve got some advice for you in this post on how to go about cashing out your 401k, as well as an alternative option to cashing out that may save you more money.

What If You Cant Pay Back The 401 Loan

The main downside of a loan occurs if you either cant repay the loan or, in some cases, if you leave the employer prior to having paid off the loan.

If you default on the loan this becomes a distribution that is subject to taxes and to a 10% penalty if you are younger than 59 ½.

In some cases, leaving the company with an unpaid loan balance may trigger a distribution, but your plan may have repayment provisions that extend after you leave the company that allow for repayment without triggering taxes or a penalty.

Its always best to check with your companys plan administrator so you can fully understand the provisions of the loan.

Don’t Miss: Is There A Max Contribution To 401k

Set Up Your New Account

According to the IRS, most pre-retirement payments that you receive from a retirement plan can be rolled over to another retirement plan within 60 days. If you dont roll over your payment, it will be taxable, so its best to have the new account set up and in place well before you close out your old one.

Be sure to take advantage of the resources offered by your new account manager. They should be happy to have your business and should offer up plenty of assistance and maybe even some perks to entice you to use their services.

Of course, if youve been happy with Fidelity, you can consider using them for your new account as well by opening a Fidelity rollover IRA.

Leave It With Your Former Employer

If you have more than $5,000 invested in your 401, most plans allow you to leave it where it is after you separate from your employer. If it is under $1,000, the company can force out the money by issuing you a check, says Bonnie Yam, CFA, CFP, CLU, ChFC, RICP, EA, CVA, CEPA, Pension Maxima Investment Advisory Inc., White Plains, New York. If it is between $1,000 and $5,000, the company must help you set up an IRA to host the money if they are forcing you out.

If you have a substantial amount saved and like your plan portfolio, leaving your 401 with a previous employer may be a good idea. If you are likely to forget about the account or are not particularly impressed with the plans investment options or fees, consider some of your other options.

When you leave your job and you have a 401 plan which is administered by your employer, you have the default option of doing nothing and continuing to manage the money as you had been doing previously, says Steven Jon Kaplan, CEO, True Contrarian Investments LLC, Kearny, New Jersey. However, this is usually not a good idea, because these plans have very limited choices as compared with the IRA offerings available with most brokers.

Specifying a direct rollover is important. That means the money goes straight from financial institution to financial institution and doesn’t count as a taxable event.

Also Check: How To Cash Out Nationwide 401k