How To Claim Solo 401k Contributions On Your Tax Return

June 17, 2020 by Editorial Team

Its not too late to make contributions to your Solo 401k plan for 2019. And remember to claim the Solo 401k deductions on your tax return. Get it while you still can! Solo 401k contributions are tax deductible. Dont miss out on this chance to claim that contribution and pay less in taxes.

Follow this link for the information you need about contribution limits for the tax year 2019. The extended tax filing day is July 15, 2020 because of COVID-19. If you need additional information about extended tax filing deadlines, follow this IRS link. But lets get to the specifics involving your Solo 401k.

Prototype Plan Vs Custom Plan

Once you understand what options you want for your solo 401k plan, it’s time to discuss plan documents.

See, your solo 401k really has two parts:

When it comes to the solo 401k plan documents, you can either use a prototype plan, or create your own custom plan.

A prototype plan is typically offered by the brokerage firms that offer free solo 401k plans. They are called prototype plans because they are very generic plans that were created by a lawyer, and anyone can use them. However, because these are generic plans, they might not offer all of the options you’re looking for in a solo 401k.

For example, Fidelity’s solo 401k plan doesn’t offer a Roth solo 401k option. Vanguard’s solo 401k plan doesn’t offer loans from your 401k. As such, you need to carefully consider the options available in a prototype solo 401k. E*Trade offers the most robust prototype solo 401k plan.

On the other hand, you can create a custom solo 401k plan. This is where you pay a company to draft you plan documents that are custom to your needs. The reason you create this is because you want to invest in alternative assets like real estate.

Other options include:

Setting Up A Solo 401k

First get an EIN from the IRS online. Then fill out some paperwork from a solo 401k provider. I use Fidelity and I recommend it without reservation for this purpose. Fidelity has detailed getting started guide on its website. Fidelity doesnt charge any setup or maintenance fee.

Vanguards solo 401k doesnt accept incoming rollovers from IRAs. You cant use it to enable the backdoor Roth. In addition, it doesnt allow you to invest in lower-cost Admiral shares or ETFs. It ends up costing more than Fidelity.

Recommended Reading: How Does A 401k Retirement Plan Work

Solo 401 Early Withdrawal Rules

Early withdrawal rules for Solo 401s depend on which type of account you have. With a few exceptions, you must pay a 10% penalty tax on withdrawals from a traditional Solo 401 account made before you turn 59 ½, plus income taxes on the amount withdrawn.

With a Solo Roth 401, early withdrawals of contributions are free of the 10% tax penalty and income tax payments, but you pay the penalty and income tax on earnings. You cannot withdraw contributions exclusively from a Roth Solo 401, meaning you will have to pay taxes and a penalty on at least part of your early withdrawal.

Can An Llc Establish A Solo 401k Plan

BANCKGROUND: I own an LLC but also have a $130K IRA at Charles Schwab & Co., Inc. Since I am a sole owner/member of my LLC, I wanted to open a solo 401k that has a loan provision along with the opportunity to have checking account ability to invest in non-traditional assets in addition to with the ability to own stock/bonds/mutual funds like my current positions at Schwab.

Your paperwork to establish a solo 401k plan seems straight forward however, since I know that I will need a separate EIN number for that retirement plan, my question would be the name that I file with the IRS to set up the EIN. This retirement plan name would be the same I would use for the account at Schwab, a bank, or other ownership of investments that qualify for investment within a 401k plan, and with your organization to create the necessary documentation to create a Solo401k.

You May Like: Can I Sign Up For 401k Anytime

How To Obtain Or Re

Retirement plan trustees shouldnt use the plan sponsors EIN for their retirement plan trust. See the EIN application page for further information.

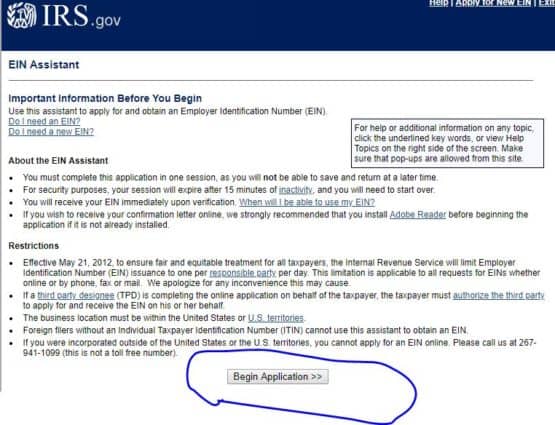

To obtain an EIN for a retirement plan trust, the plan trustee or practitioner can either apply online, or mail or fax Form SS-4, Application for Employer Identification Number to the IRS.

Solo 401 Withdrawals And Details

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

You May Like: How To Borrow From 401k For Home Purchase

How To Open A Traditional And Roth Solo 401k

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

Who Must File Form 5500

File a 5500-EZ if your Solo 401k had more than $250,000 in total assets during the previous calendar year or if last year was the final year of your plan. If you have less than $250,000 in plan assets, you dont need to file the 5500-EZ. However, some account holders file the form no matter what to start the clock on statute of limitations for an audit.

If last year was the FINAL year of your Solo 401k , you MUST file a 5500-EZ. File 5500-EZ even if you had less than $250,000 in total plan assets.

Also Check: How Does Taking Money Out Of 401k Work

Is A Solo 401k Required To Have A Separate Ein

| March 5, 2021

Yes. The solo 401k is classified as a retirement trust, which is an entity that is separate from your operating business. You probably already have an EIN for your business, but you will need an EIN for the 401k trust itself. When you open a bank or brokerage account for the 401k the institutions will need this EIN.

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

»Want more info? Heres our in-depth comparison of Roth and traditional 401s

Recommended Reading: What Are Terms Of Withdrawal 401k

What Is Form 5500

IRS 401k form 5500-EZ is an information-only filing completed and filed by 401k plan administrators. Completing and filing this form is part of your responsibility in running your Solo 401k plan.

From the IRS: Form 5500-EZ is used by one-participant plans and foreign plans that are not subject to the requirements of section 104 of the Employee Retirement Income Security Act of 1974 and that do not choose to file Form 5500-SF electronically to satisfy certain annual reporting and filing obligations imposed by the Code.

In other words, the 5500-EZ form reports your Solo 401k annual holdings.

Who Is Eligible For Solo 401 Payroll And Incorporation Services As Part Of Paychex Solo

If youre self-employed, you may establish payroll and a solo 401 through Paychex Solo if you do not have any employees, are incorporated, and you meet general401 plan qualification requirements. Our incorporation services can help you with the filings necessary to start the process.

You May Like: How Do Companies Match 401k

How Much Can I Contribute To A Solo 401

As a business owner or freelancer, you can act as two different entities the employee AND the employer. Meaning you can contribute to your Solo 401 in two ways.

The IRS caps your total contributions at $58,000 for 2020 and 2021. Your elective deferral limit is $19,500. If you are over 50, an additional $6,500 catch-up contribution is permissible.

The most your employer’s nonelective contribution can be is 25% of your compensation from the business, or until you reach $58,000 total, whichever is less.

The IRS has a useful example to illustrate how this works:

âBen, age 51, earned $50,000 in W-2 wages from his S Corporation in 2020. He deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. His business contributed 25% of his compensation to the plan, $12,500. Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Ben for 2019.â

In other words, you can contribute $58,000 into your Solo 401 without paying taxes first. This will be able to grow tax-free until itâs time to withdraw during retirement.

Keep in mind that if your business is a side-business, these limits are tied to the person, not the account. If you participate in a 401 with another company, these limits apply to contributions you make to that account as well.

Covering Your Spouse Under Your Solo 401

The IRS allows one exception to the no-employees rule on the solo 401: your spouse, if he or she earns income from your business.

That could effectively double the amount you can contribute as a family, depending on your income. Your spouse would make elective deferrals as your employee, up to the $19,500 employee contribution limit . As the employer, you can then make the plans profit-sharing contribution for your spouse, of up to 25% of compensation.

Recommended Reading: Can You Pull From 401k To Buy A House

Completing The Irs Form 5500

It is important to work with a tax professional when completing the IRS Form 5500-EZ. When working with IRA Financial Group, our tax professionals will help you complete and file the IRS Form 5500-EZ if your plan has assets valued at $250,000 or above as of December 31 of the previous year as part of our compliance service.

Do I Need A Third Party Administrator For The Solo 401k

July 5, 2018 by Editorial Team

A Solo 401k plan is surprisingly easy to administer. With the Solo 401k plan by Nabers Group, you do not need a third party administrator. In fact, you are allowed to act as your own administrator. Read on to learn about the roles and duties of a 401k plan administrator and how you can make it work for your retirement plan.

Don’t Miss: Can You Merge 401k Accounts

Did You Change Your Business Last Year

Did you restate your plan or change your Solo 401k adopting employer since your last 5500-EZ filing? If your business or plan name is different from your last 5500-EZ filing, complete questions 4a-4d as applicable.

If you restated your plan to the Solo 401k by Nabers Group and you already had a tax ID number assigned to your trust, only input the information here if your plan name and plan number have changed with the restatement.

Did you restate your plan to the Solo 401k by Nabers Group and you didnt have a tax ID number assigned to your trust? If so, input your new plan name and plan number here.

Part Ii Basic Plan Information

1a) Enter the name of the plan as it appears on the EIN letter from the IRS:

ABC Consulting 401 Trust

1b) Enter the numbers 001 for this year and every years future fillings use the same number. Note if this plan will be amending an existing solo 401 Plan, you will need to include the appropriate 3 digit code , which can be found in the plan Adoption Agreement.

1c) The date the plan became effective is found in Section One of your Adoption Agreement.

2a) Enter the name of the Adopting Employer:

ABC Consulting LLCdba or c/o if applicable1234 Ginger Street Family, FL

2b) Enter the Adopting Employer EIN XX-XXXXXXX no SS#. If plan is under a Sole Proprietor, YOU MUST OBTAIN AN EIN FROM THE IRS by completing the online application: Apply for an EIN

Alternatively, you can acquire an EIN by preparing and faxing the Form SS-4 to the IRS at I-800-829-3676 then call 1-800-829-4933 to receive your EIN by phone. The EIN is issued immediately once the application information is validated.

2c) Enter the Adopting Employer telephone number: 888-888-8888.

2d) Enter the 6 digit applicable code XXXXXX that best describes the nature of the plan sponsors business from the list of principal business activity codes included at the end of the instructions provided here.

3a) Enter the Plan Administrator information OPTIONAL. If preparer is the same as above, enter the same information.

3b) Enter and repeat the same EIN XX-XXXXXXX number as listed in 2b.

You May Like: How To Transfer 401k To Bank Account

Are You A Small Business Owner Or Independent Consultant

If so, there is a flexible retirement account that could be advantageous to you. It is a solo 401k, or an individual 401k, and resembles one offered at a large company. According to many large investment companies, this not-so-well-known account offers super high savings potential with tax advantages.

What exactly is a solo 401k?

In simple terms, it offers those who are self-employed with no employees a way to save for retirement. It provides tax advantages by allowing for pre-tax contributions. To avoid confusion, it can also be referred to as the following:

- One-participant 401k

Important note: this type of account does not help to avoid paying self-employment tax.

Are you the employer or employee?

With this type of account, the answer is both. The high savings potential is all the appeal of this account. You can actually set aside more money than in a traditional 401k or small business account since you own the role of the employer and the employee. You must be responsible for the earned income in the business. There is one helpful exception a business owners spouse can participate as well.

How can a solo 401k be set up?

Since these plans only involve well, yourself, they dont require complex administration. You might want to check fees and investment options when searching for the right company or broker to hold your account. There are no age or income restrictions.

For 2021, as an employee, you can make salary deferral contributions of:

When can you withdraw money?

Who Can Open A Solo 401

As mentioned, Solo 401s provide self-employed individuals a place to save for their retirement. The term individual is vital because Solo 401s are limited to small business owners with zero employees.

Freelancers and the self-employed tend not to have any employees however, small businesses with even one other employee on the books are not eligible.

There is one caveat to this rule. If your spouse is the only other person employed by your small business, both of you can contribute and receive matching contributions from the business-but more on that in a bit.

You May Like: How To Cash Out 401k After Leaving Job

When Ein Is Required For Sole Proprietors

If you’re a sole proprietor, you must have an EIN to:

- hire employees

- have a Keogh or Solo 401 retirement plan,

- buy or inherit an existing business that you operate as a sole proprietorship

- file for bankruptcy.

Also, some banks require you to have an EIN before they’ll set up a bank account for your business.

Contribution Limits For Self

You must make a special computation to figure the maximum amount of elective deferrals and nonelective contributions you can make for yourself. When figuring the contribution, compensation is your earned income, which is defined as net earnings from self-employment after deducting both:

- one-half of your self-employment tax, and

- contributions for yourself.

Use the rate table or worksheets in Chapter 5 of IRS Publication 560, Retirement Plans for Small Business, for figuring your allowable contribution rate and tax deduction for your 401 plan contributions. See also Calculating Your Own Retirement Plan Contribution.

Don’t Miss: Can You Transfer Your 401k