Whats A 401 Rollover And How Does It Work

So that jobs history. But that 401 from your old employer is still your money. Choose your own adventure time: What are you going to do with it?

You could leave it where it is, but you wont be able to contribute any more to it after youve left. If you change jobs a lot, thats a lot of old accounts to keep track of. And while many employers pay at least part of your 401 plans administration fees, theres no guarantee theyll keep doing that if you leave.

You could also cash it out, but wait do not pass go, do not collect any of those dollars. This option comes with massive tax penalties. Like potentially over-50%-of-the-balance-in-your-account massive.

If youve decided that neither of those options is right for you, that leaves a 401 rollover.

Should I Convert My 401 Into A Gold Ira

If you no longer have earned income as an early retiree and can no longer contribute to my company 401, converting your 401 to a Gold IRA may be a good idea. For those of you who are transitioning to a new job, rolling over your 401k to a Gold IRA is also a good idea.

Even though a 401 may provide about 40 or so mutual fund choices provided across various sectors, countries, and asset classes, it may not be enough for what you want to do with your overall retirement plan. With a Gold IRA, youve got plenty more investment options.

If you are ready to rollover your 401 or even a Fidelity 401 to a Gold IRA, view our List of Top 10 Gold IRA Companies and see why it you should choose to work with the most trusted IRA Custodian in the industry, Regal Assets.

Do you have any questions on what is the best way to rollover your Fidelity 401 to a Gold IRA? Ask below!

When Changing Jobs Is This Your Best Option

When an employee leaves a job due to retirement or termination, the question about whether to roll over a 401 or other employer-sponsored plan quickly follows. A 401 plan can be left with the original plan sponsor, rolled over into a traditional or Roth IRA, distributed as a lump-sum cash payment, or transferred to the new employers 401 plan.

Each option for an old 401 has advantages and disadvantages, and there is not a single selection that works best for all employees. However, if an employee is considering the option of transferring an old 401 plan into a new employer’s 401, certain steps are necessary.

Read Also: How Do You Roll A 401k Into An Ira

What Do I Request On The Call

After your identity is verified, youll be able to tell the customer service representative that you want to do a direct rollover. A direct rollover is where your funds are directly transferred to your new IRA provider. It often means the check is made out in the name of that IRA provider but for the benefit of you. This is generally the simplest approach. Your 401 provider will usually ask you for the name and mailing address of your new IRA provider and your new IRA account number. We also recommend that you take this opportunity to update your mailing address since they may have an old address for you. Thats because youll be sent additional documents, including a tax-related document known as a 1099-R that tells the IRS youre doing a tax-free rollover.

An indirect rollover is where funds are first transferred to you, or a check is made out in your name. You deposit the funds in one of your own accounts, but then you have 60 days to send that money on to your IRA account if you want the rollover to be tax-free. This can create a little extra work for you which is why most people opt for a direct rollover.

Have a rollover expert on the call with you! Capitalize can handle your 401-to-IRA rollover for you and set up a call with your provider walking you through each step along the way. Get started

Look Out For Your Check In The Mail And Deposit Into Your New Account

Fidelity will only distribute your 401 funds directly to you, using the mailing address they have on file for your account. Once you get the check, its then up to you to deposit that check with your new IRA provider.

There are a few ways you can deposit your check depending on the provider:

- Mobile deposit the easiest option is to check your providers mobile app to see if they have a mobile deposit option. Not all providers provide this option but its worth checking. Mobile deposits are the quickest option and typically take 3-5 business days to show up in your account.

- Deposit in person at a local branch if your provider has a physical branch near by, you can also deposit the check in person. Checks deposited in person typically take 3-5 business days to show up in your account.

- Send the check by mail you can also send the check by mail to the provider using the address you previously looked up. Funds that are mailed can take up to 15 business days to show up in your account.

Also Check: How To Know If I Have 401k

Where Fidelity Go Shines

Low cost: Fidelity Go charges no fees for accounts below $10,000, and a flat monthly fee of $3 for account balances between $10,000 and $49,999.

Fidelity integration: Customers who already have an IRA or taxable account with Fidelity can easily take advantage of the companyâs robo offering.

Human portfolio oversight: The day-to-day investment and trading decisions for portfolios are handled by a team of humans from Strategic Advisors, a registered investment advisor and Fidelity company.

Donât Miss: What Happens When You Roll Over 401k To Ira

Making A Fidelity 401k Withdrawal

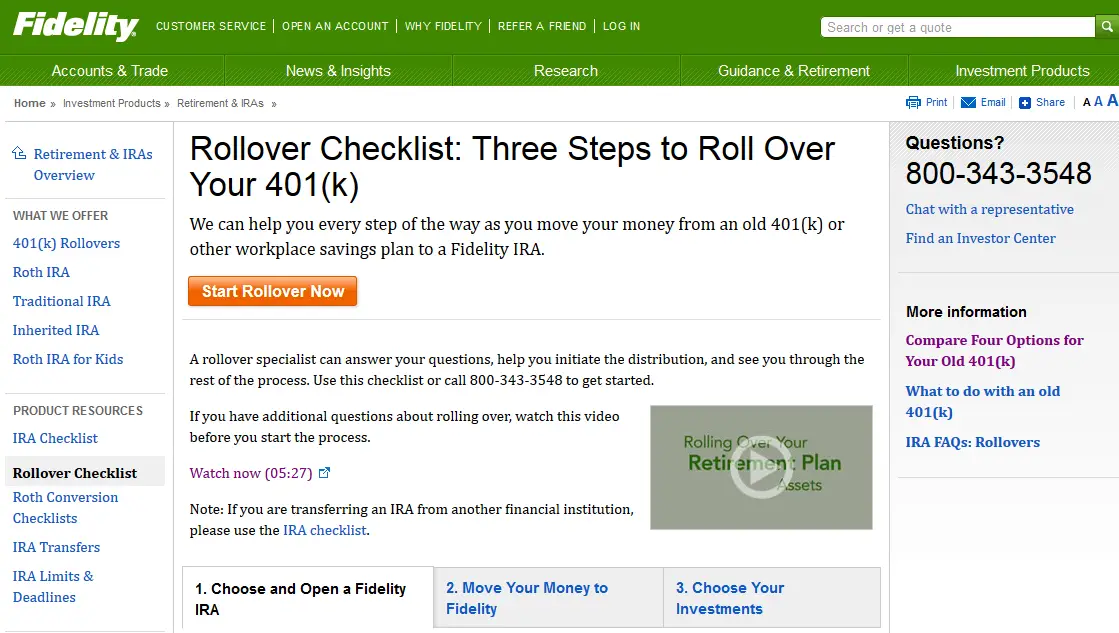

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

Borrowing From Your 401k: What You Need to Know

Also Check: What Percent Should You Put In 401k

If I Roll My Account Into An American Funds Ira What Sales Charges Or Account Fees Will I Have To Pay

It depends. Generally, an amount already invested in American Funds can be rolled over into an American Funds IRA without paying any up-front sales charges. Any amount held in investments other than American Funds is subject to applicable sales charges.

A one-time $10 setup fee will be deducted from your account when you open an American Funds IRA. There is also an annual custodian fee .

Choose Which Type Of Ira Account To Open

A 401 rollover to an IRA may give you more investment options and lower fees than your old 401 had.

-

If you do a rollover to a Roth IRA, youll owe taxes on the rolled amount.

-

If you do a rollover to a traditional IRA, the taxes are deferred.

-

If you do a rollover from a Roth 401, you won’t incur taxes if you roll to a Roth IRA.

Don’t Miss: Can You Transfer Money From 401k To Bank Account

Youve Got Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into a new account with your new employer, or roll it into an individual retirement account , but you must first see when you are eligible to participate in the new plan. You can also take some or all of the money out, but there are serious tax consequences to that.

Make sure to understand the particulars of the options available to you before deciding which route to take.

If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Recommended Reading: How To Withdraw My 401k From Fidelity

Don’t Miss: Is It Good To Convert 401k To Roth Ira

Confirm A Few Key Details About Your Adp 401

First, get together any information you have on your ADP 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

Can I Move My Assets From One Type Of Plan To Another For Example From A 403 To A 401

You can generally move the vested portion of your account from one type of plan to another as long as the new plan accepts rollovers.

Your after-tax contributions are only transferable between similar plans plan to 403 plan), and you must move your money directly between plans.

Check your new plan to see if it accepts rollovers of Roth assets and/or after-tax contributions.

Read Also: How To Withdraw Money From My Fidelity 401k

Confirm A Few Key Details About Your Fidelity 401

First, get together any information you have on your Fidelity 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

You May Like: How Do I Take Money Out Of My Voya 401k

Is There Any Portion Of A Distribution Thats Tax

Yes, if the distribution includes after-tax contributions or Roth contributions. Non-Roth after-tax contributions can be distributed tax-free, but earnings are taxable. Qualified distributions from Roth 401 or Roth 403 accounts are tax-free. However, the earnings portion of nonqualified Roth distributions is taxable.

What Happens If A Check From My Former Employer Plan Is Made To Me

The distribution will be subject to mandatory tax withholding of 20%, even if you intend to roll it over later. This withholding can be credited to your income tax liability when you file your federal tax return if you roll over the full amount of any eligible distribution you receive within 60 days.

If you are not able to make up for the 20% withheld, the IRS will consider the 20% a taxable distribution it will be subject to regular income tax and, if you are under age 59½, an additional 10% early-withdrawal penalty.

You May Like: How Do You Max Out Your 401k

Roll Over Your 403 Into An M1 Ira

1. Open an M1 IRA account.

2. Contact your current 403 administrator and tell them that you would like to initiate a rollover.

If you dont know who your administrator is, you can check your last statement or reach out to your former employer.

Helpful tips:

- Have your current administrator make the check payable to Apex Clearing.

- The check should include your name and M1 IRA account number in the memo line.

- Your M1 IRA account number is foundin the account information drop down menu.

- If the account number is not on the check, please include a slip of paper with your M1 IRA account number written on it.

3. Have the rollover check sent to:

Apex Clearing c/o BPO

350 North St. Paul Street #1300

Dallas, TX 75201

If the 403 administrator sends your distribution check to you directly, then you will need to send the check to Apex Clearing Corporation at the address above.

If the check is made out to you, please make sure to endorse the check. After the check is sent, please allow 20 days before contacting M1.

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

You May Like: When Can You Take Out 401k Without Penalty