Keep Your Hands Out Of The Cookie Jar

Taking out loans on a 401 or cashing it out altogether is generally a terrible idea, for a number of reasons. Loans from a 401 not only require you to repay yourself with interest, but in many cases, you’ll also have to halt any contributions until the loan is repaid. That reduces your retirement savings in two ways. Even worse is cashing out a 401, which will incur taxes, plus a 10% early withdrawal penalty.

These mistakes not only bring hefty fees, but raid the very retirement savings that are your precious safety net in your golden years. Don’t think of your 401 as a piggy bank that’s what savings and brokerage accounts are for. If you switch jobs, don’t cash out your 401 instead, roll it over into your new plan or into an individual retirement account.

Where Fidelity Go Falls Short

Tax strategy: The company does not offer tax-loss harvesting, one of the features that makes robo-advisors stand out for taxable accounts.

No human advisor guidance: Although Fidelity Go has investment advisors managing and rebalancing portfolios, these advisors do not give financial planning guidance or answer other investment questions.

Sysco 401 Plan Enhancement

When you need to take a loan or withdrawal from your 401 plan, it can take days or even weeks to access your funds due to waiting periods. In an effort to support our associates impacted by coronavirus, weâve partnered with Fidelity to make Electronic Funds Transfer and eCertified Hardships available, so you can access your funds quickly.

Electronic Funds Transfer â Starting today, we have eliminated the 10-day waiting period for EFTs. Now, when a participant enters their banking information in NetBenefits, they no longer have a 10-day waiting period to receive funds. EFTs are immediately available for any loans or withdrawals that are $50,000 or less. In addition to eliminating wait times, this will also reduce cost to the participant.

eCertified Hardships â If you need to make a hardship withdrawal, you may be able to initiate a withdrawal in as little at 48 hours through eCertification. You can speak with a representative or initiate a qualifying hardship withdrawal anytime on NetBenefits.

To learn more about accessing your retirement funds for coronavirus-related relief, call Fidelity at 1-800-635-4015 or visit the Fidelity website. Review the rest of the content on this page to learn more about the Sysco 401 Plan.

Recommended Reading: Can I Transfer Money From 401k To Ira

What Do I Need To Know

Taking the time to choose your beneficiaries now can help your family avoid probate later. Please tell your family or friends if you’ve selected them as a beneficiary, because your beneficiaries must contact Fidelity themselves to receive their assets. We’ll distribute your assets to your beneficiaries without requiring a will or other legal documents.

You’ll need to assign at least one beneficiary for each account most of the time you can add, change, or delete your beneficiaries online. To get started, please provide:

- Beneficiary type

- Full name

- Date of birth

- Social Security number

You can also name contingent beneficiaries. Contingent beneficiaries receive your assets if there is no living primary beneficiary.

Note: Some retirement accounts or plans may require spousal consent , Keogh) before you can add or change the beneficiary.

If you do not see the account you want to update on the Beneficiary Summary page, and its not an annuity or a NetBenefits® account, you may have a workplace plan that’s not serviced by Fidelity. To request changes, contact your plan’s administrator or trustee.

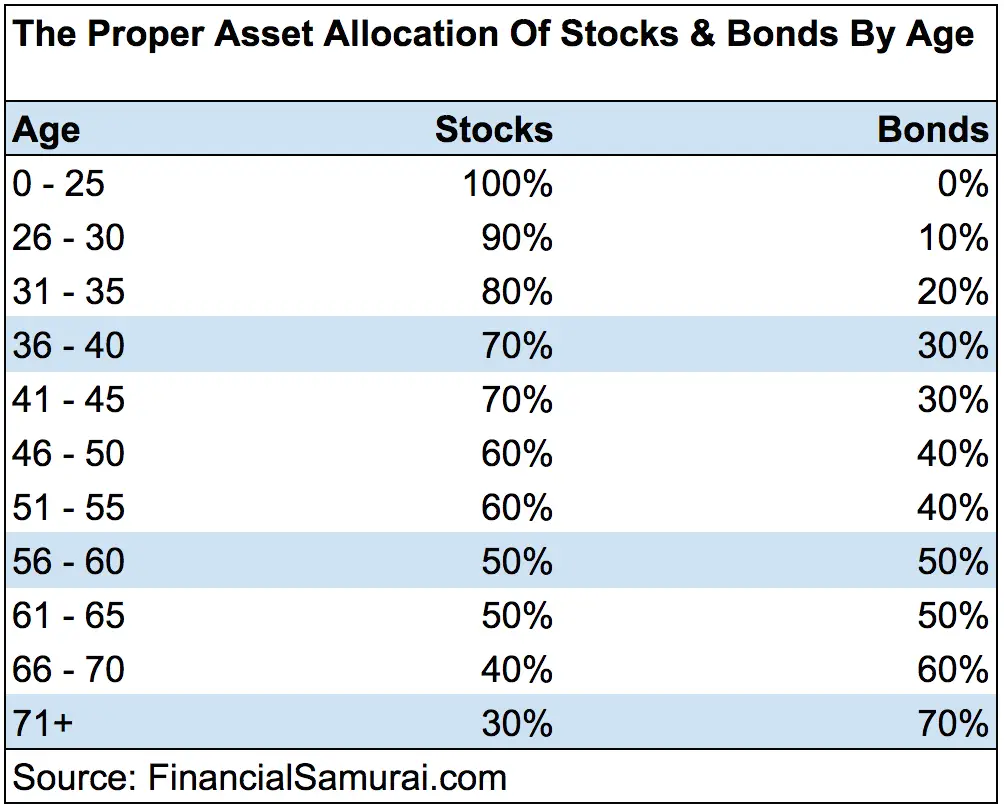

So What Should You Do Right Now To Protect Your 401 From A Stock Market Crash

Protecting your 401 from a stock market crash will depend based on where you are in your career. If youâre younger, you can keep investing more in stocks because you have time to recover from any downturn. If youâre older, moving your money into government and municipal bonds will help shield most of your money from the volatility of the stock market.

Remember, time and consistency will help your 401 grow. If the stock market drops, keeping your money in your 401 is the best strategy. Youâll not only prevent you from cashing out your investments at a loss but will also see your 401 grow when the stock market recovers.

Consider talking to your planâs custodian or a financial planner as you near retirement. Youâll be able to get expert insight on how to best protect your 401 from a stock market crash.

Tags

Don’t Miss: What Is The Difference Between Roth 401k And Roth Ira

Other Features You Should Know

Itâs common among broker-launched online advisors to pair computer algorithms with dedicated financial advisors. Fidelity Go takes a different approach, with humans handling investment and trading decisions for portfolios.

That oversight makes Fidelity Go a good choice for those who are reluctant to hand off all of the control to a robot â though those advisors arenât there to answer your phone calls.

Like other advisors, Fidelity Go uses a questionnaire â designed to gauge your risk tolerance and financial goals â and computer algorithms to match investors to a portfolio. We especially like that without signing up or sharing any personal information, users can take that questionnaire and view a portfolio recommendation and sample investments.

Fidelity Goâs Target Tracking lets customers set goals while Fidelity monitors their progress. Customers also have access to the robo-advisorâs other financial planning tools and apps, as well as the companyâs educational resources, which are strong.

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to rollover an old 401 into an IRA, you will have several options, each of which has different tax implications.

You May Like: What Is The Difference Between A Pension And A 401k

How To Make Contribution And Investment Changes

Fidelity is the Master Administrator for the Plan this means that you have the streamlined ability to enroll in the Plan and make contribution changes, whether you contribute to Fidelity, TIAA, or both. In order to contribute to TIAA, you need to have an RIT TIAA account. By offering one consolidated plan, RIT is able to avoid unnecessary fees and keep costs to employees as low as possible.

- View and/or change your contribution percentage

- View and/or change the split between your pre-tax and Roth contribution percentage

- Join the annual increase program to automatically increase your contribution each September 1

- Change your record keeper election between Fidelity and TIAA

Log in at . You can set up a login if you do not have one by clicking on “Register Now” at the top of the page and follow the prompts.

Step 1:Once logged in, click on the drop down arrow to the right of Quick Links and choose “Contribution Amount“. If you are already logged in, click on the “Contributions” tab.

Step 2:There are three choices:

- Contribution Amount – to view and change your contribution percentage and/or the split between pre-tax and after-tax Roth contributions

- Annual Increase Program – to enroll or change participation in the program to automatically increase your contribution effective each September 1

- Retirement Providers – to view and change the allocation for your future contributions between the two record keepers, Fidelity and TIAA

How Does Brokeragelink Work

Put simply, its an account within your UC 403, 457, or DC Plan that gives you access to thousands of mutual funds available through Fidelity FundsNetwork®, as well as exchange-traded funds .

A BrokerageLink account is not for everyone.

- If you are comfortable managing a portfolio of expanded investment choices and, you are prepared to assume the responsibility of more closely monitoring this portion of your portfolio, then BrokerageLink may be appropriate for you.

- However, if you do not feel comfortable actively managing a portfolio of options beyond those available through the UC Retirement Savings Program fund menu, BrokerageLink may not be a good choice.

Remember that it is always your responsibility to ensure that the options you select are consistent with your particular situation, including your goals, time horizon, and risk tolerance.

Don’t Miss: Should I Roll My Old 401k Into My New 401k

Look At The Whole Investment Pie

A frequent mistake investors make is not looking at their whole investing pie. When considering your asset allocation, imagine that the assets in every one of your investment accounts are actually in one account. The one big account includes your 401, Roth, or traditional individual retirement account and your taxable investment brokerage account holdings.

Picture your investments and accounts like a strawberry, banana, and rhubarb pie. You dont have one section for the strawberries, another for the banana, and a third for the rhubarb. All the ingredients in your accounts go into the asset allocation pie.

How Do I Change My 401k Contribution Fidelity

Step 2: To change where your future contributions are invested, click on Future Investments. Step 3: To change your current investment mix, click on the appropriate box. Step 4: Follow the prompts. If you prefer, you can make these changes by phone call Fidelity at 1-800-343-0860/V and 1-800-259-9734/TTY.

You May Like: How Do You Find Out About Your 401k

Fees Associated With A Brokeragelink Account

Before you open a BrokerageLink account, you should understand all of the applicable fees associated with investing through this account.

Some funds have transaction fees, while others dont. For funds with transaction fees, these fees are imposed based on how you make your trades. The most economical way to place trades is online.

For a complete list of the fund options and corresponding fees, please refer to the Commission Schedule under the BrokerageLink tab on NetBenefits. To find it, log in to your account on NetBenefits, click the Quick Links drop-down next to your preferred plan, then select BrokerageLink.

More Details About Fidelity Go’s Ratings

Account minimum: 5 out of 5 stars

Fidelity requires no minimum deposit to open an account, although you must have at least $10 in your account to begin investing.

Account management fee: 4 out of 5 stars

Fidelity Go, the robo-advisor from online broker Fidelity Investments, brings a different pricing model to the market. As noted above, Fidelity Go charges no fees for accounts below $10,000, and a flat monthly fee of $3 for account balances between $10,000 and $49,999. Fidelity charges a 0.35% management fee, with no additional investment expenses, for accounts $50,000 and higher.

Investment expense ratios: 5 out of 5 stars

Expense ratios are charged annually on mutual funds, index funds and ETFs to cover the cost of managing your investments. This fee is represented as a percentage of your entire investment. Fidelity Go customers have access to Fidelity Flex Funds, Fidelity mutual funds that have zero investment expense ratios.

Account fees: 5 out of 5 stars

Fidelity Go doesn’t charge annual or inactivity fees, and does not charge for transferring money, trades, account maintenance or setup.

Portfolio mix: 3 out of 5 stars

Customers can choose from 14 portfolios. There are seven taxable, and seven retirement portfolios available. Portfolios are built from Fidelity Flex mutual funds.

Although Fidelity Go has a somewhat well-diversified portfolio, it lacks exposure to international bonds and non-market-correlated assets such as real estate investment trusts and commodities.

Read Also: How To Withdraw My 401k From Fidelity

Ignoring Or Forgetting Old Plans

If you’ve switched jobs frequently in your career, you may be ignoring or have entirely forgotten an old 401 plan.

Rolling over old 401 balances usually can’t be done in a fully digital fashion it can be a tedious process of phone calls and some paperwork. Still, it’s a small inconvenience that’s well worth the benefits you’ll reap. Your 401 plans should be monitored frequently accounts need re-balancing, your progress and performance should be tracked, and you should stay abreast of fees.

Experts recommend you have no more than two to three retirement accounts at any time. To the extent possible, consolidate them into a rollover IRA, and only keep old 401 plans active if they offer excellent investment options and low fees that you can’t enjoy in an IRA.

Your 401 is one of the most precious sources of financial security you’re likely to enjoy, so treat it kindly. If you contribute diligently, choose low-cost funds and respect the integrity of your savings, it’ll be there to cushion you for many comfortable years in retirement.

It’s All About The Asset Allocation

How your 401 account performs depends entirely on your asset allocation: that is, the type of funds you invest in, the combination of funds, and how much money you’ve allocated to each.

Investors experience different results, depending on the investment options and allocations available within their specific plansand how they take advantage of them. Two employees at the same company could be participating in the same 401 plan, but experience different rates of return, based on the type of investments they select.

Different assets perform differently and meet different needs. Debt instruments, like bonds and CDs, provide generally safe income but not much growthhence, not as much of a return. Real estate or real estate mutual fund or ETF) offers income and often capital appreciation as well. Corporate stock, aka equities, have the highest potential return.

However, the equities universe is a huge one, and within it, returns vary tremendously. Some stocks offer good income through their rich dividends, but little appreciation. Blue-chip and large-cap stocksthose of well-established, major corporationsoffer returns that are steady, though on the lower side. Smaller, fast-moving firms are often pegged as “growth stocks,” and as the name implies, they have the potential to offer a high rate of return.

It sounds like an advertising cliché, but it bears repeating anyway: Past returns of funds within a 401 plan are no guarantee of future performance.

You May Like: Can I Borrow From My Solo 401k

Educational Resources Trading Platforms And Market Research

Fidelity also has an extensive offering of trading platforms, research materials, and educational content. Its learning center gives you access to blogs and live webinars on relevant financial topics. And with Fidelity’s “news and research tab,” you can read up on stock market trends and real-time investment prices.

In addition to its online platform and mobile apps, Fidelity offers a trading platform specifically for its active traders: Active Trader Pro. Active Trader Pro is a downloadable platform that offers real-time trading alerts, investing insights, portfolio monitoring, customizable dashboard layouts, and option trading assistance. Though it doesn’t have a mobile version, this platform could be great for you if you want to stay on top of market movements and determine when to buy or sell securities. It also lets you place up to 50 orders at a time.

According to Fidelity’s website, the brokerage utilizes investment analysis and stock research from more than 20 independent providers, including Thomson Reuters StarMine. Fidelity also provides market insights and commentary through Fidelity Viewpoints, and it offers several retirement and investing tools.

I Cant Imagine A Better Financial Service

I have been a very happy Fidelity customer for 35 years. I tried the big brokerage companies that offer personal service. What did I find out? They grew rich and I barely broke even, even in booming markets. Fidelity gives me the tools and the information I need to make the best financial decisions. My money has grown exponentially so that I can withdraw funds to pay big bills and still see huge gains to my portfolio. It isnt rocket science. Research the highest yielding funds over the long and short term at the risk level you are comfortable with. Fidelitys research is sooo darn easy that I can find and print off the research in minutes. I rebalance my funds, drop the dogs, invest in some new winners. It really is that easy. Need money transferred to your bank account? Click, click, you are done. Fees are extremely low too. Need help? Call the 800 number and their very knowledgeable Representatives will assist you quickly and cheerfully. Now I am the one making the money, not my broker. I have taught all of my children to invest with Fidelity and they are light years ahead of their peers financially.

You May Like: How To Find Lost 401k

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Is Fidelity Trustworthy

The Better Business Bureau has given Fidelity Investments a A+ rating. The BBB assigns its ratings by using a grade scale of A+ to F.

However, the bureau also considers a number of other factors when determining its ratings. These include the company’s time in business, business operations, licensing and government actions, advertising issues, and more.

In 2020, Fidelity paid $28.5 million to settle a 2018 class-action lawsuit. The lawsuit accused Fidelity of failing to uphold its fiduciary duty by prioritizing its own proprietary investment products in its 401 plan.

Fidelity has closed nearly 350 customer complaints in the last 12 months, according to BBB data.

You May Like: How To Grow 401k Fast