Transfer Funds From Current Employer 401k That We Rolled Over From Another Employer 401k Question:

Good question, and yes those funds from the former employer 401k that are currently held in the existing employer 401k can certainly be transferred to the solo 401k plan as long as the current employers plan allows for it. It is a tricky situation because even though the rules allow for it, the current employer can restrict the transfer of funds transferred into the plan from a former employer 401k plan. We strongly recommend getting a copy of the existing employers 401k plan Basic Plan Document or Summary Plan Description Agreement as specific language will be embedded in these documents regarding this topic. We will gladly review those documents for you once you obtain them from your current employer 401k provider.

Why Employers May Not Offer A 401

Facilitating a 401 plan can be expensive for a company. The IRS requires testing and reporting to ensure retirement plans keep up with regulations. As a result, many small businesses simply can’t afford to administer a 401 plan.

If a company is brand new and trying to get off of the ground, they may not have the time to organize a retirement plan for their employees. Since bringing in an outside firm costs even more money, usually, small businesses don’t have a 401 plan in place.

And because nearly a half of Americans work for small businesses, the amount of people left to their own means to save for retirement is significant.

If Youre Short Decide How Youll Make Up The Difference

If there’s a gap between what youre saving now and what you may need, you have options. Consider the following.

- Defer more money into your 401 retirement plan, especially if youre not setting aside enough to get the full company match. Figure out how much it costs per week to put another 1% in your retirement plan. Make it bite-sized and its more doable. Then continue to bump your deferral another 1% as you can. A good time to do that is when you get a promotion or raise.

- Make annual contributions to a traditional Individual Retirement Account .Like a 401, it allows you to invest for the long-term and pay taxes on earnings later.

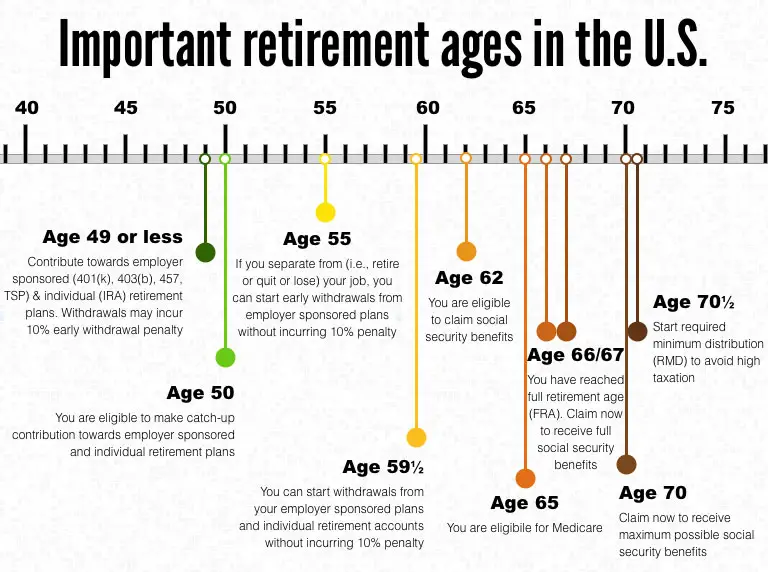

- Makecatch-up contributions to your 401 or IRA if youre age 50 or older.

- Manage debt so you have more money in your budget for long-term savings.

- Plan to work longer, if youre able. Delaying retirement by a year or two could help boost your savings.

- Work for a significant bump in income and then save it. How? Change jobs, try for a promotion, or turn a side hustle into extra cash flow.

- Win the lottery.

Recommended Reading: Can You Use Your 401k To Buy Real Estate

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Solo 401k Plan For A Sole Proprietor

QUESTION 2: Can a sole proprietor open a solo 401k plan?

ANSWER: Yes a sole proprietorship can also sponsor a solo 401k plan. A sole proprietor files a Schedule C to report the self-employment activity. We would list your name as the self-employed business on the solo 401k plan documents, and your contributions to the solo 401k plan would be based on line 31 of the Schedule C.

Recommended Reading: What To Do With Your 401k

Irc 401 Plans Establishing A 401 Plan

When you establish a 401 plan you must take certain basic actions. For instance, one of your decisions will be whether to set up the plan yourself or consult a professional or financial institution – such as a bank, mutual fund provider, or insurance company – to help you establish and maintain the plan.

Comparing The Most Popular Solo 401k Options

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

I’ve been doing my research over the last few months on the best solo 401k providers for small businesses and side hustlers like myself. I’ve shared in the past the best options for saving for retirement with a side income, and I’ve leveraged a SEP IRA in the past.

Recommended Reading: How To Know If You Have A 401k

Contribution Limit As An Employer

Wearing the employer hat, you can contribute up to 25% of your compensation. The total contribution limit for a solo 401 is $57,000 for 2020, not counting the employee’s $6,500 catch-up amount for those over the age of 50. For 2021, the employer maximum is $58,000. In other words, in 2021 you can contribute $58,000 along with a $6,500 catch-up contribution if applicable for a total of $64,500 for the year.

Open Your Own Retirement Accounts

If you are investing on your own, there are several ways you can stash away money for your long-term goals.

First, you can contribute to an individual retirement account. In 2018, you can contribute up to $5,500 in a traditional pre-tax IRA, and up to $6,500 if you are 50 years old or over. Alternatively, you may choose to fund a post-tax Roth IRA.

A Roth IRA is preferable in many cases because your money will grow 100 percent tax-free, Sun said. In addition, it can also serve as an emergency fund for younger investors because you can withdraw the principal you contributed to a Roth penalty-free.

Ideally, you want to fully fund your IRA in the first month of the year, Sun said, in order to get an extra 12 months of returns.

If you are married, you may want to contribute to a spousal IRA in your spouse’s behalf, said Cathy Curtis, founder and chief executive officer of Curtis Financial Planning.

Spousal IRAs let you put aside an additional $5,500 to $6,500 for your husband or wife, provided they are not working. Other rules apply, depending on whether you are investing in a traditional IRA or Roth IRA.

Higher earners who are not eligible to contribute to Roth IRAs may want to consider a back-door Roth IRA, whereby assets in a traditional IRA are converted to a Roth IRA, Curtis said.

Recommended Reading: How To Cash Out 401k After Leaving Job

Do I Need A Third Party Administrator For The Solo 401k

July 5, 2018 by Editorial Team

A Solo 401k plan is surprisingly easy to administer. With the Solo 401k plan by Nabers Group, you do not need a third party administrator. In fact, you are allowed to act as your own administrator. Read on to learn about the roles and duties of a 401k plan administrator and how you can make it work for your retirement plan.

Comparing The 5 Most Popular Solo 401k Providers

Now that we’ve covered the five major “free” solo 401k providers, let’s compare them in a chart side-by-side to see how their offerings compare to each other.

Sorry, the chart doesn’t display on mobile.

|

Comparing The Most Popular Solo 401k Providers |

|

|---|---|

|

Fidelity |

|

|

$0/trade |

$0/trade |

Some notes: Vanguard’s annual fees can be waived over $50,000 in assets. Also, all of these companies offer commission-free ETFs, so you could potentially invest for free within your Solo 401k. Vanguard also have a very odd pricing schedule. While they do offer their own products commission free, if you want to buy other stocks or ETFs, you’ll pay anywhere from $2-$7 depending on how much in assets you have.

Now you can see why the choice of solo 401k providers is so difficult. Each firm has strengths and weaknesses, and the selection depends really on what matters to you.

And if none of these really excite you, you can always create your own solo 401k with a third party provider.

You May Like: What Are Terms Of Withdrawal 401k

Think About Switching Jobs

You may be willing to do without benefits when you start working if your goal is to gain experience, or because you really believe in a company. Some startups may not have retirement plans in the first few years, but they plan to offer them later. But you may want to think about switching jobs to a more established company to make the most out of your savings if you’ve been there for years with no change in benefits.

How To Set Up A Defined Benefit Plan

Under a defined benefit plan, a participants account earns a pay credit, normally 5% to 8% of salary each year, plus an interest credit applied to your account balance. When the plan reaches its time to distribute the funds, one can move their funds to another tax-advantaged account in order to defer tax until when they require the distribution.

A participant under a defined benefit plan receives a benefit defined by their account balance. Lets take an example of a participant with $100,000 in the defined benefit plan account who has attained the age of retiring, that is 65 and he retires, he is entitled an annuity based on this balance, approximately $8,500 annually for his entire life.

Recommended Reading: Should I Roll 401k To Ira

Managing Your Retirement Funds

Make no mistake, you need to start saving for retirement as soon as you start earning income, even if you cant afford much at the beginning. The sooner you start, the more youll accumulate, thanks to the miracle of compounding.

Let’s say you save $40 per month and invest that money at a 3.69% rate of return, which is what the Vanguard Total Bond Market Index Fund earned across a 10-year period ending in December 2020. Using an online savings calculator, an initial amount of $40 plus $40 per month for 30 years adds up to just under $26,500. Raise the rate to 13.66%, the average yield of the Vanguard Total Stock Market Index Fund over the same period, and the number rises to more than $207,000.

As your savings build, you may want to get the help of a financial advisor to determine the best way to apportion your funds. Some companies even offer free or low-cost retirement planning advice to clients. Robo-advisors such as Betterment and Wealthfront provide automated planning and portfolio building as a low-cost alternative to human financial advisors.

Rules Change Regarding Offering Solo 401k Plan To Par

QUESTION 5: Have the rules changed for 2020 regarding whether I can still fund my solo 401k if I have two part-time employees that work less than 1000 hrs/year, but more than 500 hrs/year? Would I have to open up retirement accounts for them?

ANSWER: In short yes resulting from the SECURE Act, but it would be for those part-time employees who satisfy the new rule by 2024. Effective for tax year 2021 , solo 401k plans will need to be offered to part-time employees who have three consecutive 12-month periods of 500 hours of service and who satisfy the plans minimum age requirement. Hours of service during 12-month periods beginning before January 1, 2021, are not taken into account for this rule. We are waiting for the IRS to release more guidance on this new rule in 2020. See Section 112 of the ACT for more information.

Last Weeks Most Popular Solo 401k FAQs

Don’t Miss: How Do I Find Previous 401k Accounts

When You Can’t Open A 401 Without An Employer

To be eligible for most retirement accounts, you need to have earned income during that year. If you don’t have an employer and received only unemployment income for the year, you won’t be eligible to contribute to many of these retirement account options.

The one exception to this is the Roth IRA. If you have a significant amount of savings, you can contribute up to the limits set by the IRS.

However, if you are employed, and your employer doesn’t offer a retirement plan, you can still participate in the Traditional and Roth IRAs.

Third Party Solo 401k Providers

If you need something a little more robust that the free prototype plans these five brokerage firms offer, then you need to find a third party service that will create the plan documentation for you.

Some of the common reasons why you’d consider using a third-party service to create your solo 401k documentation:

- You want a choice in brokerage

- You want to invest in alternative assets such as real estate, startups, cryptocurrency, promissory notes, tax liens, precious metals, and more.

- You want checkbook control over your 401k

- None of the prototype providers matches exactly what you’re looking for with options

We’re not going to go in-depth on these providers because this section effectively becomes al-la-carte with what you can get and pay for. I just wanted to list some of the most popular third party plan providers that you can reference in your search for the best plan.

Remember, just because you go with a third party provider also doesn’t mean you can’t invest at your favorite firm. For example, you can create a third party solo 401k and then have that 401k held at Fidelity. This gives you access to all of Fidelity’s investment choices, but your options are created by the plan, and NOT Fidelity.

Also, you can use these plans to execute a Mega Backdoor Roth IRA. In fact, several of these companies specifically advertise that they offer it.

This isn’t an exhaustive list. There are also local firms in most areas that can create 401k plan documentation as well.

Recommended Reading: What Is An Ira Account Vs 401k

How A Roth 401 Works

Like Roth IRAs, Roth 401s are funded with after-tax dollars. You don’t get any tax benefit for the money you put into the Roth 401, but when you begin to take distributions from the account, that money will be tax-free, as long as you meet certain conditions, such as holding the account for at least five years and being 59½ or older.

Traditional 401s, on the other hand, are funded with pretax dollars, providing you with an upfront tax break. But any distributions from the account will be taxed as ordinary income.

This basic difference can make the Roth 401 a good choice if you expect to be in a higher tax bracket when you retire than when you opened the account. That could be the case, for example, if you’re relatively early in your career or if tax rates shoot up substantially in the future.

How To Invest Without A 401

Fortunately, you do have some alternatives if your company does not offer a 401 plan or a good one. For example, anyone with earned income can access an IRA and those with their own business even a side gig have alternatives, too.

If your employers retirement plan doesnt measure up, here are eight investing alternatives to consider:

Recommended Reading: What Should I Do With My Old Company 401k

While You Can’t Invest In A 401 That Isn’t Sponsored By Your Employer There Are A Couple Of Exceptions To The Rule

Photo: 401kcalculator.org via Flickr.

A 401 is the most common type of retirement plan private-sector employers offer. However, many employers don’t offer a 401, or any type of retirement plan at all. If you are in this group, can you still take advantage of the many benefits of a 401?

The short answer: not really By definition, a 401 is an employer-sponsored retirement plan designed to encourage employees to save money for retirement and employers to help them do it. So to take advantage of this type of an account, you need to have an employer, and the employer needs to be the sponsor of the plan.

Some specific rules:

- You can’t invest in a 401 if you’re unemployed.

- You can’t invest in a 401 if your employer doesn’t offer one, or you don’t meet the qualifications for your employer’s plan .

- You can’t invest in an employer’s 401 if you aren’t that employer’s employee.

But just as with many other topics in finance, there are exceptions. Here are two major exceptions to the 401 rules.

Exception 1: You are the employerIf your income comes from self-employment, you can start a retirement savings account known as a Solo 401 or Individual 401.

Essentially, this gives you all the benefits of an employer-sponsored 401, as well as the ability to invest in any stocks, bonds, or mutual funds you want — not just in a small, specific basket of funds such as those that most employer-sponsored 401 plans offer.