Pick The Right Funds For Your 401

Without a thorough understanding of your mutual fund options, its easy to make bad investing choices. For instance, lets say a sample companys 401 materials have 19 investment choices that arent target date funds: six growth funds, four growth and income funds, two equity income funds, two balanced funds, four bond funds, and one cash-equivalent money market fund.

If youre trying to invest according to our advice by splitting your 401 portfolio evenly between growth, growth and income, aggressive growth, and international funds, youre already in trouble. According to the brochure, you dont have any aggressive growth or international options! You meet with an investment professional and they let you konw that of the six options the brochure has listed as growth funds, two are actually international funds and one is an aggressive growth fund. Thats exactly the kind of insight you need to help you make smart investment selections.

A lot of people dont know you can work with an outside professional to select your 401 investments, but you can!

Other investors worry that working with their own investing pro will be expensive. Your investing professional may charge a one-time fee for a 401 consultation, and thats a reasonable cost for the time they spend to help you make smart 401 selections. Just make sure you know what to expect before your appointment so there are no surprises.

Dont Panic When Your 401 Loses Value

Itâs natural to freak out when your 401 loses value. Checking your 401 balance and seeing youâve lost hundreds or thousands of dollars in a few months is never fun.

However, what you donât want to do is panic and make any changes in the moment.

It may seem counterintuitive, but during a stock market crash, the last thing you want to do is take money out of your 401. The reason is that you paid a price for the stocks, mutual funds, and index funds youâre invested in. If they lose value and you sell, you sold your investments for a loss. In fact, the best strategy is to invest even more money into the funds youâre invested in because youâll be paying a discount for the same funds because theyâre lower in value. And because time is on your side, the funds will recover long before youâll need to start taking distributions during retirement.

Changing Jobs Options For Your 401 Plan

Make the smartest decisions for your retirement plan as your career evolves.

- Employees who leave their companies have several options when it comes to their 401 plans, and each option has advantages and disadvantages.

- Options include keeping your existing plan where it is and starting a separate one at your new company, rolling it over to an IRA, or transferring it to your new companys plan.

- While its tempting to take a 401 distribution in cash to fund a dream vacation or other treat, it carries serious consequences and is not a good option for most people.

If you have a 401 plan, you are familiar with the benefits afforded by these popular retirement accounts. They are a great way to set aside pre-tax earnings and enjoy tax-deferred investments that can grow handsomely over the years, especially if your employer matches your contributions.

But what will happen to that nest egg if you leave your company to take another job? Maybe little or nothing at all, if you transfer the money to another qualified plan. Or, you might face a big tax bill and a government penalty if you prematurely withdraw funds. It depends on what you decide.

Employees who leave their companies have several options when it comes to their 401 plans, and each option has advantages and disadvantages.

Keep your old 401 where it is and start another one at your new job

Roll over existing 401 assets to an IRA and start another 401 at your new job

Take some or allof the money and run

Read Also: Should I Rollover 401k To New Employer

Vanguard Target Retirement Funds: Buy

- Rank among the top 401 funds: #11 #12 #15 #19 #23 , #25 , #29 #65 #82 #88

- Best for: Savers who want to make one investment decision and leave the rest to the experts.

Target-date funds hold stocks and bonds and are designed to help people invest appropriately for retirement. Experts make the investing decisions, rebalance the portfolio when needed and shift holdings to a more conservative mix as you age. When the fund hits its target year, the work doesn’t stop. Vanguard Target Retirement funds continue to shift its blend of stocks and bonds for seven years after the target year. At that point, the money in the fund automatically rolls into Vanguard Target Retirement Income, which holds a static allocation of roughly 30% stock and 70% bond.

A small change is ahead for Vanguard’s target-date funds. The firm actually has two target-date series: the Institutional Target Retirement funds and the Target Retirement funds. They are run with exactly the same strategy, same glide path . But Institutional Target Retirement was created for specifically for defined contribution plans Target Retirement is available to retail investors as well as in some defined contribution plans. Come February 2022, however, the Institutional series will be absorbed into the Target Retirement series and expense ratios across all target-year funds will fall to 0.08%.

Investment Choices Can Be Limited

When you open an IRA, you’re generally given the choice to hand-pick stocks for your retirement portfolio. Doing so could help you grow a lot of wealth in your retirement plan, especially if you know how to research companies well.

With a 401, you generally can’t invest in individual stocks. That limits your choices and may create a situation where the options you’re presented with don’t align with your personal strategy or goals.

Recommended Reading: How To Pull From 401k

What Is A Good Rate Of Return On A 401

How you define a good rate of return depends on your investment goals. Average 401 returns typically range between 5% and 10% depending on market conditions and risk profile. If you’re playing catch-up, you may want higher returns. If you have a long way until retirement and a low tolerance for risk, you might be comfortable with a lower return.

Moving Your Plan Into Your Trust

According to the IRS, changing the owner of your IRA or 401, even to the name of your trust, is equivalent to a 100% withdrawal from the account. It’s no different from retitling it in the name of your child or any other relative rather than naming them as a beneficiary.

You must report the entire value of the account on your tax return in the year you make the change. It will all be taxed as part of your income on that year’s tax return.

You May Like: What Is A Pension Vs 401k

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Use These Points To Decide Your 401k Asset Allocation And Where To Put Your 401k Money

The old rule for investing and asset allocation used to be to subtract your age from 100 for the percentage of your portfolio you should keep in stocks, putting the rest in bonds. The misguided advice has caused millions to miss their retirement goals and misallocate their 401k money.

Besides the fact that Americans are living longer, making the 100 rule obsolete, the rule is an oversimplification that misses out on some very important points.

Read Also: How To Take Out 401k Money For House

How Much Do You Need And At What Risk

A better start to retirement planning begins with an estimate of how much you will need in retirement. You dont have to be accurate down to the penny but should try to estimate your living expenses to the nearest $50,000 or so. Take your current expenses, deducting those that you wont have in retirement like education and retirement savings, and then add in new expenses for things like travel. The Department of Labor Consumer Expenditure survey can help you see how much people spend on average according to their age.

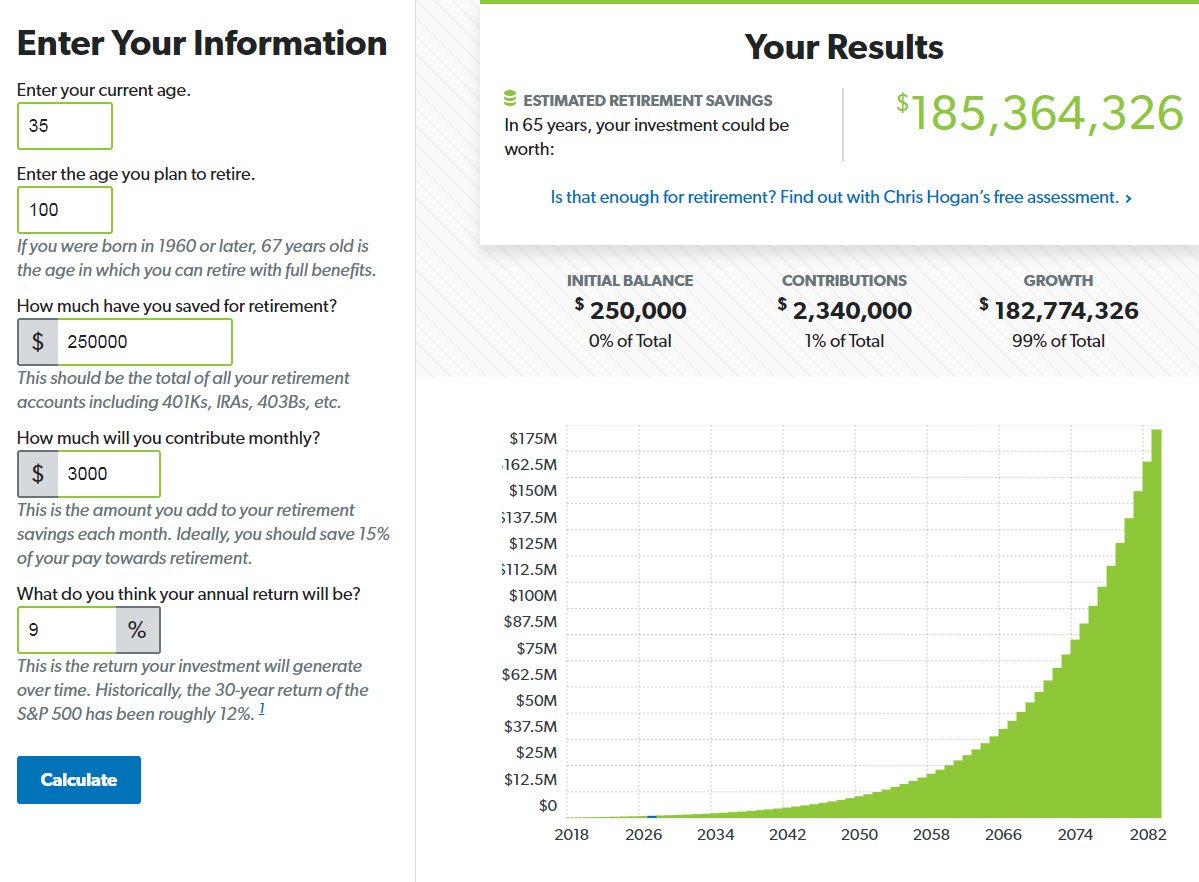

Any retirement calculator will show you the return needed on your investments to meet your future spending needs given things like age, annual savings and current investments. Your next step is to do a reality check on this number.

If you need a return of more than 10% annually on your investments to meet your retirement goals, you may need to rethink your savings rate or your goals. Aiming for such a high annual rate will force you into riskier investments and may cause you to panic-sell when the markets tumble. A return of between 4% and 6% for a blended portfolio of different assets is a more realistic goal.

Your own tolerance for risk will also play a part in your 401k investing plan. Theres nothing wrong with being a conservative investor, preferring stability to the possibility of higher returns. The biggest mistake you could make is chasing returns to the point that market volatility makes you nervous and leads you to commit bad investing behaviors.

Stay Calm And Disciplined

Market downturns can be reasons for anxiety and emotional panic for many, especially as it relates to their hard-earned money in their 401k retirement plans. While the fear around a volatile market may make you feel the need to do something, anything, sometimes the best thing to do is just stay calm and stick to your long-term strategy. In other words, if you have a solid financial plan, and your 401k is well-optimized, oftentimes the best thing to do in a market crash is to do nothing, especially if you are a younger investor with years until retirement.

Nearly 3 million individuals use Personal Capitals free tools to manage their money. From an investing standpoint, you can use the free tools to:

- Analyze your investments

If you are closer to retirement, market crashes can be even scarier. But being properly prepared is key. Make sure you stay in close communication with your financial advisor in the years leading up to your retirement to ensure that your risk tolerance and asset allocation reflects your shortening time horizon. Here are some questions to ask your advisor if you are retiring or about to retire in times of volatility.

You May Like: What Is A Robs 401k

How Does A 401k Work

A 401k plan is a benefit commonly offered by employers to ensure employees have dedicated retirement funds. A set percentage the employee chooses is automatically taken out of each paycheck and invested in a 401k account. They are made up of investments that the employee can pick themselves.

Depending on the details of the plan, the money invested may be tax-free and matching contributions may be made by the employer. If either of those benefits are included in your 401k plan, financial experts recommend contributing the maximum amount each year, or as close to it as you can manage.

Keep Contributing To Your 401 And Other Retirement Accounts

Steadily contributing to your 401 is another way to protect it from future market volatility. Cutting back on your contributions during a downturn may cost you the opportunity to invest in assets at discount prices. Meanwhile, maintaining your 401 contributions during a period of growth when your investments have exceeded expectations is equally important. The temptation to scale back your contributions may creep in. However, staying the course can bolster your retirement savings and help you weather future volatility.

Don’t Miss: How Much Can I Put In My 401k Per Year

What Is The Maximum 401k Contribution Amount

Starting in 2020 , you can contribute up to $19,500 each year to your 401k if you are under 50. If you are over the age of 50, you may be able to make catch-up contributions. This provision lets you invest up to an additional $6,500 in your 401k .

PRO TIP: You need to be behind in your 401k contributions to make catchup contributions.

When compared to a Roth IRA, where you can only contribute up to $6,000/year, this is an amazing opportunity especially since your pre-tax money is being compounded over time.

Understand What A 401 Is

While you sign up for your 401 through the company you work for, it is typically managed by a separate financial firm, such as Vanguard, Fidelity, Principal, Schwab, etc. This is the company you will receive important information and disclosures from about your account and investments.

If you leave your employer, in most cases your account will remain at the financial firm that originally managed it, unless you roll it over to a new company .

You can begin withdrawing money penalty-free at 59 ½ in most cases. If you withdraw money before that age, you will be hit with a 10% early withdrawal penalty and pay income taxes on the distributions. You can also take a 401 loan, which needs to be repaid, including interest. Learn more about that here.

Not every employer offers employees a 401. If that’s the case, you can open an IRA, which also offers tax advantages for those investing for retirement, on your own through a brokerage firm.

Read Also: Can You Roll Over 401k From One Company To Another

I’m In My Early 50s And Plan To Retire A Little Before I Hit Age 60 My Savings Are Now Invested In A Combination Of Stock Mutual Funds And Company Stock When And How Should I Start Allocating To A Safer Portfoliora

Whether you’re simply being prudent by doing some advance planning or you’re concerned that the recent market volatility is a prelude to an imminent crash, you’re right to start thinking about how to transition your portfolio to a more conservative stance well before you actually retire.

After all, investing heavily in stocks may be okay when you’re younger and more willing to take more risk for higher returns since you have plenty of time to rebound from market setbacks. But an overly aggressive investing strategy that leaves you vulnerable to severe market downturns as you near the end of your career can be dangerous.

A big drop in the value of your nest egg just prior to or soon after retiring can dramatically reduce the chances that your savings will be able to support you throughout a long retirement. The reason is that the combination of outsize investment losses plus withdrawals from your savings for retirement income can so deplete your portfolio’s value that it may not be able to recover sufficiently even after stock prices begin rising again.

So how can you get adequate protection against market setbacks while also providing enough long-term growth potential so your savings will be able to sustain you throughout a retirement that, given today’s long lifespans, could last 30 or more years ?

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

Recommended Reading: How To Take My Money Out Of 401k

Take Your 401 With You

Most people will change jobs more than half-a-dozen times over the course of a lifetime. Far too many of them will cash out of their 401 plans every time they move. This is a bad strategy. If you cash out every time, you will have nothing left when you need itespecially given that you’ll pay taxes on the funds, plus a 10% early withdrawal penalty if you’re under 59½. Even if your balance is too low to keep in the plan, you can roll that money over to an IRA and let it keep growing.

If you’re moving to a new job, you may also be able to roll over the money from your old 401 to your new employer’s plan, if the company permits this. Whichever choice you make, be sure to make a direct transfer from your 401 to the IRA or to the new company’s 401 to avoid risking tax penalties.