Substantally Equal Period Payments

Substantially equal period payments may be another option for withdrawing funds without paying the early distribution penalty. SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

Keeping Your 401 With Your Former Employer

If your former employer allows you to keep your funds in its retirement account after you leave, this may be a good option, but only in certain situations, says Colin F. Smith, president of The Retirement Company in Wilmington, N.C.

Staying in the old plan may make sense “if you like where you are and they may have investment options you can’t get in a new plan,” says Smith. “The other main advantage is that creditors cannot get to it.”

Additional advantages to keeping your 401 with your former employer include:

- Maintaining the money management services.

- Special tax advantages: If you leave your job in or after the year you reach age 55 and think you’ll start withdrawing funds before turning 59½, the withdrawals will be penalty free.

Some things to consider when leaving a 401 at a previous employer:

- If you plan on changing jobs a few more times before retirement, keeping track of all of the accounts may become cumbersome.

- You will no longer be able to contribute to the old plan and in some cases, may no longer be able to take a loan from the plan.

- Your investment options are more limited than in an IRA.

- You may not be able to make a partial withdrawal and may have to take the entire amount.

- If your assets are less than $5,000 you may have to proactively remain in the plan. If you don’t notify your plan administrator or former employer of your intent, they may automatically distribute the funds to you or to a rollover IRA.

What Qualifies As A Financialhardship

The following reasons qualify as a financialhardship as set forth in the plan document:

- Buying the participants primaryhome

- Post-secondary educational feesfor the next 12 months, including tuition, room and board, and other relatedcharges for the participant or the participants spouse, children ordependents, or the participants primary beneficiary* under the plan

- Unreimbursed medical expenses, forthe participant or the participants spouse, children or dependents, or theparticipants primary beneficiary* under the plan

- Preventing eviction from orforeclosure on the participants primary home

- Burial expenses for theparticipants deceased parent, spouse, children or dependents, or theparticipants primary beneficiary* under the plan

- Expenses to repair damages to theparticipants primary home that would qualify as a casualty deduction underSection 165 of the Internal Revenue Code .

*The primary beneficiary under the plan is theindividual who has an unconditional right to all or a portion of theparticipants account balance upon his or her death.

Because hardship withdrawals can only beapproved by the Plan Administrator, you will need to keep on file theapplicable documentation in the event your plan is audited.

Read Also: How To Invest In A 401k For Dummies

What Are The Risks Of Withdrawing 401k Money

If you’re using the Covid rules to withdraw cash from a 401k, keep in mind that you’ll need to pay tax on it or repay the withdrawal.

You also face a shortfall of cash in retirement, unless you already have enough money saved elsewhere.

In November, Fidelity said the average amount withdrawn of those who took advantage of the rule was $10,000.

It may seem small but it could eventually grow to be a significant amount if left untouched due to the benefits of compound interest.

For example, if youre 35, a $10,000 nest egg could grow to more than $100,000 by the time youre 70, assuming a 7% annual return.

Carrie Schwab-Pomerantz, a certified financial planner and president of the Charles Schwab Foundation, said: “Even if its possible to borrow from your 401k or take a distribution, consider this a last resort.

“While present circumstances may be difficult, Id counsel anyone to avoid jeopardizing their future retirement unless absolutely necessary.

“You may not appreciate the full consequences until much later.”

Dont Let Your Voya 401 Fees Get Out Of Hand

Even if yours are below average now, VOYAs revenue sharing and wrap fees can cause them to very quickly become excessive as assets grow. For this reason, its crucial that you compare your plans fees on a regular basis.

Too much trouble? Weve got a solution.

Simply switch to a 401 provider that charges fees based on headcount not assets – to the extent possible. Such a fee structure will make it easier for you to keep your 401 fees in check as your plan grows. You just might save some money while youre at it.

About Eric Droblyen

Eric Droblyen began his career as an ERISA compliance specialist with Charles Schwab in the mid-1990s. His keen grasp on 401k plan administration and compliance matters has made Eric a sought after speaker. He has delivered presentations at a number of events, including the American Society of Pension Professionals and Actuaries Annual Conference. As President and CEO of Employee Fiduciary, Eric is responsible for all aspects of the companys operations and service delivery.

- Connect with Eric Droblyen

Recommended Reading: Can I Open A 401k Without An Employer

Be Ready When Your Rmds Kick In

The whole point of tax-deferred retirement accounts is to accumulate more money for retirement by not paying current taxes on contributions you make to the account, plus earnings. But when you take money out of these accounts, the amount you receive will be subject to federal income tax. Tax laws require you to begin taking minimum, annual withdrawals from your tax-deferred retirement accounts. If you turned 70½ in 2019 or earlier and still have a balance in the plan, you are required to take a Required Minimum Distribution by April 1 of the calendar year following the calendar year in which you reach 70½. Beginning in 2020 or later, if you have a balance in the plan, you are required to take a Required Minimum Distribution by April 1 of the calendar year following the calendar year in which you reach 72. You can withdraw as much as you want, but you must withdraw a required minimum amount, whether you need the money or not hence Required Minimum Distributions.

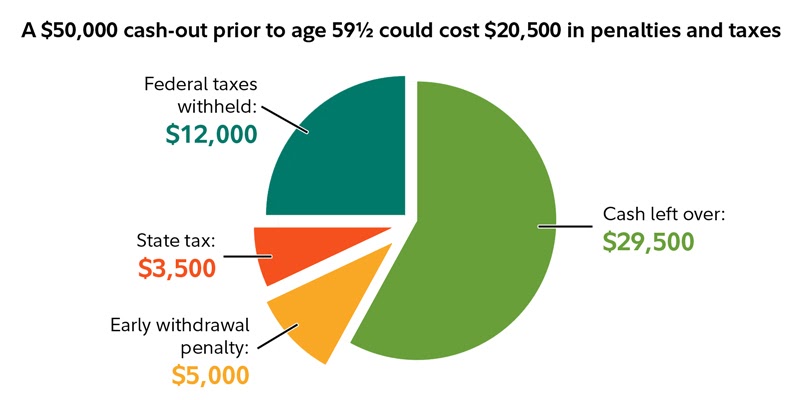

You can start taking withdrawals earlier too, but if you take a withdrawal prior to turning 59½ a 10% premature distribution penalty tax may apply. If you dont need to take withdrawals, you can leave your money in the accounts for continued growth potential.

Can Anybody Cash Out A 401 K Early

If you resign early, you might want to cash out your 401 k. However, you might face a financial penalty for doing so. If you haven’t reached retirement age, you can often expect to be charged 10% plus ordinary income tax on the amount in your 401 k for an early withdrawal. If you think you might want to take your 401 k money out of the IRA early, you should discuss this with your current employer.

You May Like: How To Convert 401k To A Roth Ira

How To Boost Your Retirement Savings

DON’T know where to start? Here are some tips on how to get going.

- Understand where you start: Before you consider your plans for tomorrow, you’ll need to understand where you stand today. Look into your current pension savings and research when youll be eligible for social security benefits, if at all.

- Take advantage of a 401k: The 401k plans are tax-effective accounts put you in a better place financially for your retirement. If you save, your employer may too.

- Take advantage of online planning tools: Financial provider Western & Southern Financial Group and comparison site Bankrate have tools that give you an idea of what your retirement income will be based on how much you’re saving.

- Find out if your workplace offers advice: Some employers offer sessions with financial advisers to help you plan for your future retirement.

With a Roth, employees make contributions with post-tax income but can make withdrawals tax-free.

Most employees can currently put in $19,500 a year of their own money in a 401k account, excluding employer contributions.

However, workers who are older than 50-years-old are eligible for an extra catch-up contribution of $6,500 in 2020 and 2021.

What You Need To Know To Avoid Costly Mistakes

In an ideal world, everybody would leave their 401 funds alone until they need the money for retirement. That might mean rolling your account over to an Individual Retirement Account , but it also means not cashing out the funds prior to reaching retirement age, to allow the money to grow to its maximum potential amount. In investing, time truly is your best asset. At some point though, you will begin taking distributions, and here’s what you need to know.

The best way to take money out of your 401 plan depends on three things:

Recommended Reading: Can You Invest In 401k And Roth Ira

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Changing Employers And A 401 K

A change of company might mean you change your 401 k too. Try to find out how long that company can hold your 401k after you leave. We encourage you to discuss this matter with your new employer. It’s important that you take your old 401 k into consideration when you look for a new place of work. You may also want to choose your new employer based on the kind of retirement plan is on offer.

You May Like: How Many Loans Can I Take From My 401k

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

How Do I Find My 401 Plan Administrator

All 401 plans involve several different parties.

The employer is the plan sponsor that established the plan and encouraged its employees to participate in it.

The custodian holds the funds that are contributed into the plan and keeps them safe.

And the administrator handles the day-to-day nuts and bolts operations of the plan.

The administrator handles tasks such as issuing loans from the plan, moving money around from one investment to another within the plan at the request of a participant and sending account statements to each participant, among other things.

Administrators have a long list of responsibilities related to administering the plan that typically go unnoticed by the vast majority of participants.

For this reason, many employers outsource this important function to a third-party administrator that is in the business of managing 401 plans.

Don’t Miss: How Do I Stop My 401k

Evaluate Your Admin Fees On A Per

After you have calculated your plan’s all-in fee, we recommend you take a quick look at VOYA’s administration fees on a per-capita basis.

The reason?

Excess administration fees basically, fees that outstretch your 401 providers level of service might not be readily apparent if theyre solely evaluated on an all-in basis with investment expenses. This is especially true if your plan has lots of assets.

To demonstrate the value of this evaluation, consider the Voya plan from our 2018 small business 401 fee study. While its $25,611.64 all-in fee was only a bit above the studys 1.40% average, its $2,521.81 per capita administration fee was about six times average!

To calculate your per-capita administration fees, simply divide the administration fee total from your spreadsheet by the number of participants in your plan. For our 17-participant example, this number is $1,316.34 which is quite a bit higher than participants could be paying with a low-cost 401 provider.

Withdrawing After Age 595

Recommended Reading: How To Know If You Have A 401k

Withdrawing From A 401 After Leaving The Company Without A Penalty

In any of the following situations, you may qualify for early withdrawal without being subjected to any penalty:

-

If you leave a company the same year you turn 55 years old

-

If you suffer from total or permanent disability

-

If you cash out in equal installments spread over an expected period of your remaining lifetime

-

If you need to pay for medical expenses, which are more than 10% of your income

-

If as a military reservist, you have been called to active duty

How Do I Get My Money Out Of My Retirement Plan

You retirement account is part of a retirement plan. Retirement plans operate according to the terms and features specific to the Plan Document which was adopted by the plan sponsor . To best understand how the plan operates, read the Summary Plan Description , and speak with your former employer or Third Party Administrator . The two most frequently asked questions are, How do I put money in to the plan? and How do I get money out of the plan? The most frequently asked questions below address questions related to how to get money out of the plan, after you no longer work for the company who sponsors the plan.

I NO LONGER WORK FOR THE COMPANY, HOW DO I GET MY MONEY OUT OF MY RETIREMENT PLAN?

- Your prior employer will forward the distribution paperwork to their Third Party Administrator who will prepare the paperwork required to close your account.

HOW LONG DO I HAVE TO WAIT FOR MY MONEY?

It may take several months to finalize your distribution. The reason for the lengthy process depends on:

DO I HAVE TO CLOSE MY ACCOUNT, ONCE I AM TERMINATED FROM EMPLOYMENT?

The answer to this question depends on the amount of your account balance and the terms of the Plan Document. Generally speaking, if your account balance is over $5,000, you may leave your account as is.

Don’t Miss: How To Transfer 401k From Fidelity To Vanguard

Should I Withdraw Money From My 401

Now hes worried about how hes going to make his monthly $2,300 mortgage payment.

Unemployment isnt going to cover my mortgage payment, Walstedter says. My wife and I have already talked about dipping into our 401s so that we can get by with our two kids.

Experts advise taking a look at your expenses to identify where you can cut costs if you’re facing unemployment.

To be sure, pulling funds from retirement accounts out of fear isnt the best immediate course of action, wealth advisors say. Its a case-by-case basis. Do you have emergency savings? Are there opportunities to refinance student loan debt, mortgage or car payments? Investors should take advantage of lower rates first before they tap into their retirement funds, experts say.

Once you pull funds out of your retirement accounts, it could take a while to replenish and it could be quite detrimental to long term savings goals, says Tim Bray, senior portfolio manager at GuideStone Capital Management. People should cut expenses and take advantage of the emergency checks coming from the governments stimulus package before withdrawing money from their 401s.