Dont Overlook Your Beneficiary Designation Form

Anyone whos filled out a life insurance application is familiar with a beneficiary form. This is where you state who will receive your 401 money in the event of your death. If youre married and have kids, this probably wont be a tough decision.

However, this is one form people tend to truly fill out and forget. In many of cases, people have divorced and are remarried, but their 401 would go to their ex if they died. Other times, the investor may have had children, but neglected to add them to the form.

Your Action Step: If its been a while since you filled out your 401 beneficiary form, contact your 401 plan manager to make sure those funds end up where you want them.

Diversification And Asset Allocation

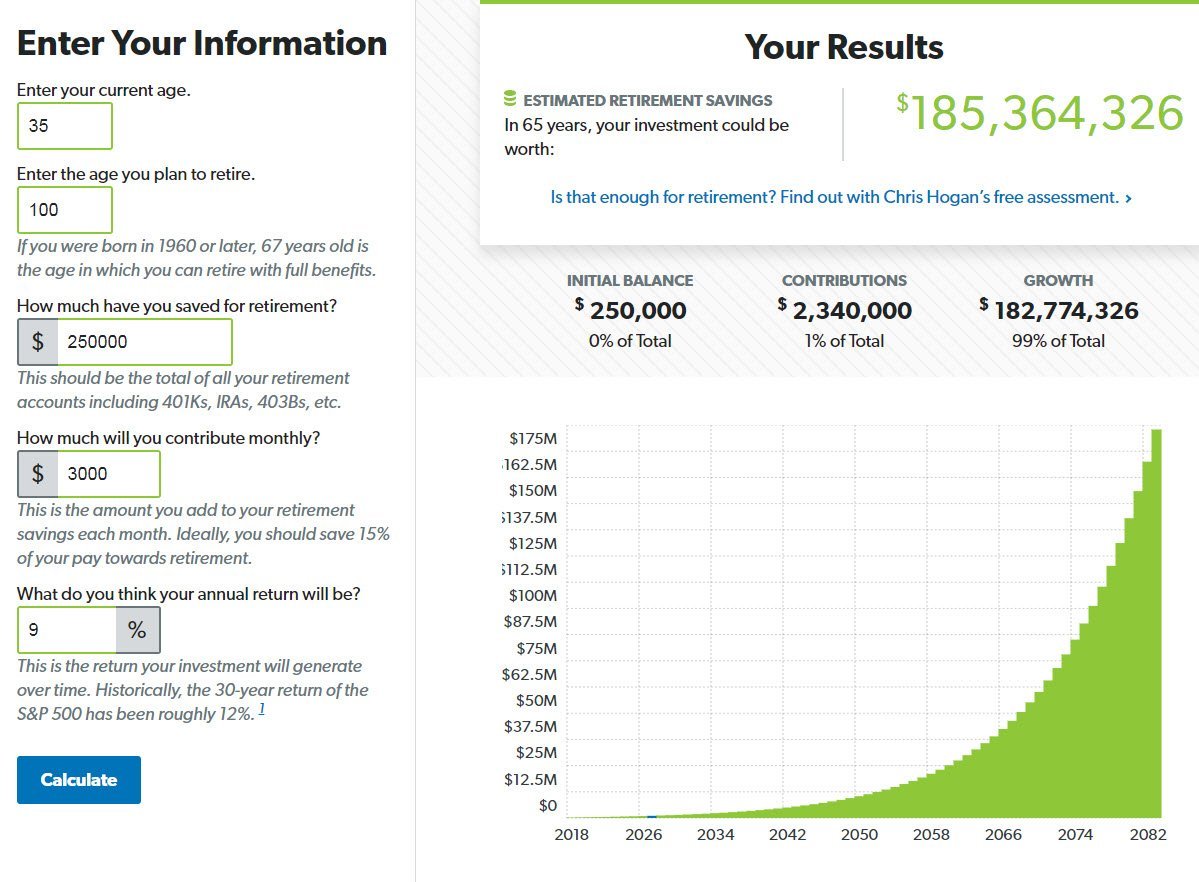

Trying to navigate uncertain times without setting financial goals and having a strategy can make volatile periods even more difficult to handle. If you dont know how much you will need to have in your nest egg for retirement, it becomes difficult to assess how you are tracking for retirement, and how your portfolio might handle bear markets and recessions.

In order to plan for retirement and establish long-term financial goals, you should consider several factors, such as:

- How many years you anticipate working until you reach retirement

- Your risk tolerance level

- Key purchases or spending events

- When you might take Social Security benefits

- Other financial goals, such as funding a childs college education

A professional financial advisor preferably a fee-based fiduciary can assist you with building a financial strategy that will best position you to meet your long-term goals. Investors seeking a tool to help keep track of their retirement goals and progress can access the Retirement Planner by signing up for Personal Capitals free financial tools.

After developing long-term goals, you should be able to establish how much you will need in your 401k to support your lifestyle. You should also think about not only how much youll need, but where you should be saving with advice from either your financial advisor or help from Personal Capitals Savings Planner. How much cash should you have? Should you contribute to a 401k and an IRA?

Weigh Your Investment Options

401s tend to have a small investment selection thats curated by your plan provider and your employer. Youre not selecting individual stocks and bonds , but mutual funds ideally ETFs or index funds that pool your money along with that of other investors to buy small pieces of many related securities.

Stock funds are divided into categories. Your 401 will probably offer at least one fund in each of the following categories: U.S. large cap which refers to the value of the companies within U.S. small cap, international, emerging markets and, in some plans, alternatives such as natural resources or real estate. Diversify your portfolio by spreading the portion youve allocated to equities among these funds.

You want to allocate more to the biggest asset classes, like U.S. large caps and international. U.S. small cap, natural resources and real estate are not as prevalent asset classes, so youll take smaller bits of those, Walters says.

That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S. small cap fund and spreading the remainder among categories such as emerging markets and natural resources.

The bond selection in 401s tends to be even more narrow, but generally youll be offered a total bond market fund. If you have access to an international bond fund, you might put a bit of your savings in there to diversify globally.

Also Check: Can I Use My 401k To Purchase A Home

Want Your Money To Grow

See how I can help you to make your money work for you

Managed Investment Accounts unlock the power of professional asset management. Let me make you money while you enjoy your life.

Stock and Futures Market Research use my technical and fundamental analysis to pick up swing trades with the best risk/reward ratio.

The Downside: High Fees And An Imperfect Investment Mix

While target date funds may be convenient, they have their drawbacks. For one thing, you’ll often pay high fees when you keep your money in a target date fund. Those fees could eat away at your returns over time, leaving you with less money by the time your career wraps up.

Furthermore, when you invest in target date funds, you get no say in your investments. That may be OK with you, but it could also mean having your money invested in a manner that’s too aggressive or too conservative for your taste.

Also Check: Can I Use My 401k To Buy Stocks

Determine Your Asset Allocation

Asset allocation is the way you divide your money among groups of similar investments or “asset classes.” The three main asset classes are stocksTooltipStocks represent ownership in a company. They can provide both price appreciation and dividend income. Stocks are considered relatively risky, because the stock price may also decrease and there’s no guarantee you’ll be paid dividends. Stocks also tend to be more volatile than bonds. , bondsTooltip A bond represents a loan you make to a government, municipality or corporation . In return, that issuer promises to pay you a specified rate of interest and to repay the face value after a certain period of time, barring default. They can provide income and help balance the risks of stocks. As with any investment, bonds have risks such as default risk and reinvestment risk. and cash investmentsTooltip Cash and cash investments include bank deposits , money market funds and short-term investments . These can provide flexibility and stability. Shorter-term investments tend to have lower returns than longer-term investments. . In general, if you’re a conservative investor looking for income and stability, you may want to hold more bonds than stocks. But if you’re a long-term investor looking for high-growth potential and less concerned about immediate income, you may want to invest more aggressively by holding more stocks. See our model portfolios for sample asset allocation plans.

Avoid Making Premature Withdrawals

Most 401 plans offer a hardship withdrawal option, as well as a loan option if you find that you have to take money out of your plan before you retire. But there are limitations and downsides.

A withdrawal could cost you a 10% early withdrawal penalty on money you take out before age 59½, depending on what you spend the money on. You’ll have to pay it back with interest by a certain time if you take a loan from your 401.

NOTE: The Balance doesn’t provide tax or investment services or advice. This information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any one investor. It might not be right for all investors. Investing involves risk, including the loss of principal.

Read Also: What Happens With My 401k When I Quit

You Can Use It For Emergencies

In case of emergencies that cause financial distress, you have the option to take a hardship withdrawal from your 401k account. Most major employers allow hardship withdrawals for employees who meet specific guidelines. Some cases allow you to take funds not exceeding the amount you need out of your 401k plan without paying the 10% early withdrawal penalty even if you are not yet 59.5 years old.

Hardship withdrawals may be allowed for emergency reasons which include paying off medical bills, becoming totally and permanently disabled, or more. Such withdrawals may be allowed without charging you with early withdrawal penalty. You can also take a hardship withdrawal for things like the prevention of eviction/foreclosure or for funeral and burial expenses. However, you will be charged a 10% early withdrawal penalty for these types of withdrawals.

Mistake #: Underestimating The Cost And Length Of Retirement

Some crucial factors to take into account:

- Longevity: If you retire around age 65, you could spend a quarter century or more in retirement. Many advisors now urge clients to save enough to last 25 to 30 years.

- Inflation and taxes: Even with relatively mild inflation over the past 25 years, the cost of living has more than doubled. Also consider what taxes youll be paying on the money you distribute from your retirement account.

- Health care: Even with Medicare, you could have expenses for supplemental insurance, some prescription drugs, and nursing home care.

- Lifestyle sticker shock: People in retirement generally need at least 80 percent of their pre-retirement income.

You May Like: How Do I Cash Out My 401k With Fidelity

How To Invest In Real Estate With Your 401k

1- 401k Loans

There are a few options to consider that will allow using 401k to invest in real estate properties. The first one is to take out a loan against your 401k to access funds to finance buying rental properties. The IRS allows you to borrow as much as $50,000 or half of your balance including any outstanding loan balances. This money can be used as a down payment for your first rental property which you can find right here on Mashvisor and in just a matter of minutes! Our Property Finder is a must-have tool for anyone thinking of getting into real estate investing but doesnât know what makes for a profitable investment property for sale. All you have to do is set your criteria and our tool will provide a list of properties for sale that best match what youâre looking for.

Mashvisors Property Finder

To learn more about our tool and how to use it, read Rental Property Finder: A Revolutionary Tool for Investing in Real Estate.

401k loans used to buy a principal residence can be repaid over a long time period if your plan allows. However, if the loan is used to finance investment properties, then the real estate investor must repay the loan within 5 years if he/she wants to keep it tax-free. Remember, the interest you pay adds to your 401k savings. So with careful planning, you can invest your 401k in real estate and get access to investment property financing with little or no tax consequences.

2- 401k Rollover to a Roth IRA

3- Self-Directed 401k

I Want To Invest In Vanguard Mutual Funds & Etfs

Get a complete portfolio in a single, all-in-one fund

Based on your current age or years to retirement, you might consider a broadly diversified Vanguard Target Retirement Fund with a professionally managed investment mix. We also have online tools and resources to help guide you.

Once you’ve made your selection, each fund automatically rebalances itself and gradually reduces its stock exposure, adding more bonds to become more conservative as you near your retirement date.

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services or through another broker . See the Vanguard Brokerage Services commission and fee schedules for limits. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. ETFs are subject to market volatility. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value.

For new-issue agency and corporate bonds, we may receive a fee concession. Trading limits and minimum investments may apply. See the Vanguard Brokerage Services commission and fee schedules for full details.

Bond funds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because of rising interest rates or negative perceptions of an issuer’s ability to make payments.

Don’t Miss: Can I Roll A 401k Into A Roth Ira

Let The Government Protect Your Money As Warren Buffett Does

Another strategy Buffett uses is to let the government protect his money. For example, two of the five most significant investments Buffett lists in his 2019 Berkshire Hathaway shareholder letters are giant banks.

Those banks are Wells Fargo and Bank of America . Interestingly, Wells Fargo and Bank of America are two of the infamous too big to fail financial institutions. That means the U.S. federal government must bail those banks out in a crisis because their collapse could trigger a depression.

The federal government bailed Wells Fargo out with $25 billion during the 2008 financial crisis. Moreover, Wells Fargo paid a dividend of 45 on March 1, 2019. Therefore, Wells Fargo is a dividend stock that adds another layer of protection.

Hence, Buffett protects his money by investing in institutions the government is likely to rescue during a crisis. Therefore, Buffett lets the taxpayers protect his funds by investing in big banks.

Buffetts thinking is that banks can run to Washington for help during a major crisis. Furthermore, the politicians will have to bail the bankers out to keep the crisis from getting worse.

|

Liberated Stock Trader Pro Investing Course 16 Hours of Video Lessons + eBook Complete Fundamental Stock Analysis Lessons 2 Powerful Value Investing Strategies 4 Dividend/Income Investing Strategies |

Invest In High Cash Companies

Some companies are in a far better position to survive and thrive in a stock crash than others. In particular, companies with a lot of money grow and make more money in a crash.

For instance, Warren Buffetts Berkshire Hathaway expanded during the stock market crash of 2008. In fact, Berkshire Hathaway bought the Burlington Northern Santa Fe Railroad for $26 billion in cash and stock in 2009. Berkshire could buy them because it had lots of cash.

Hence, investing in companies with large amounts of cash on hand is a great way to protect your portfolio from a market crash. You can learn how much cash a company has by checking its balance sheet. Companies list cash as cash and equivalents, short-term investments, or cash and short-term investments in their balance sheets.

Currently, companies with a lot of cash include:

- Berkshire Hathaway

- Banks. Notably, big banks like Goldman Sachs

- Wells Fargo

Concentrating your investments in high-cash industries like finance and technology is one way to protect yourself from crash effects. Moreover, avoiding low cash companies like retailers is a good way to protect your funds.

Finally, a simple rule of thumb you can follow is to only invest in companies with at least $20 billion in cash. Such companies are more likely to profit and grow during a crisis. Stock Rover provides a 10-year history and cash forecasting data for all stocks on the USA and Canada stock exchanges.

Also Check: Can I Switch My 401k To A Roth Ira

Real Estate And/or Reits

Buying a property often requires upfront costs like down payment and fees for closing, on top of any renovations you choose to make. There are also ongoing costs, like maintenance, repairs, dealing with tenants, and vacancies if you decide to rent out the property.

If homeownership isnt for you, you can still invest in real estate through real estate investment trusts . REITs allow you to buy shares of a real estate portfolio with properties located across the country. Theyre publicly traded and have the potential for high dividends and long-term gains.

REITs have done superbly well this year. They dont usually do well with a pandemic, but surprisingly, they have, says Luis Strohmeier, certified financial planner, partner, and advisor at . Part of the reason is you get access to properties, such as commercial real estate and multi-family apartment complexes, that could be out-of-reach for an individual investor.

Where To Invest In 2021

Choosing what to invest in is one thing. You also have to choose what type of account to place your investments in.

IRAs are recommended by financial experts because they help shield investors from taxes when saving for retirement or other long-term goals. There are a few different types of IRAs, also known as Individual Retirement Arrangements.

Read Also: How Do I Cash Out My 401k Early

Open A Brokerage Account

If youve paid off your credit card debt, established an emergency fund, and exhausted all your tax-advantaged accounts, you can open a regular old brokerage account to squirrel away some more money.

A brokerage account is much like an IRA. Its more flexible in terms of investment choices and money withdrawal than 401s, but you dont get any tax breaks. It allows you to buy and sell a wide variety of securities, from stocks and bonds to mutual funds, currency, and futures and options contracts, through a brokerage firm.

You can open a brokerage account with any of the major investment firms like Vanguard,Charles Schwab, or Fidelity. Just like with other financial accounts, you deposit money and work with a broker to buy or sell securities. The broker will recommend investments depending on your personal financial situation and goals. But you have the final say on investment decisions. The brokerage firm takes a commission for executing your trades, and there are fees linked to the transactions, ranging from account maintenance fees and markups/markdowns to wire fees and account closing fees.

Best for: Aggressive investors with high-risk tolerance and extra savings.

Use Balanced Funds For A Middle

A balanced fund allocates your 401 contributions across both stocks and bonds, usually in a proportion of about 60% stocks and 40% bonds. The fund is said to be “balanced” because the more conservative bonds minimize the risk of the stocks. This means that when the stock market is quickly rising, a balanced fund usually will not rise as quickly as a fund with a higher portion of stock. When the stock market is falling, expect that a balanced fund will not fall as far as funds with a higher portion of bonds.

If you dont know when you might retire, and you want a solid approach that is not too conservative and not too aggressive, choosing a fund with balanced in its name is a good choice . This type of fund, like a target-date fund, does the work for you. You can put your entire 401 plan in a balanced fund, as it automatically maintains diversification and rebalances your money over time to maintain the original stock-bond mix).

Recommended Reading: Where Can I Get A 401k Plan