What Does Vesting Mean

Even if your employer makes a matching contribution to your 401, that money may not be yours. Many employers use their 401s to retain talent, so they include a vesting period for matching contributions. Once the vesting period ends, the money becomes fully yours.

Any money your employer contributes is kept separate from your contributions. Depending on your 401 plan, employer contributions can vest all at once or slowly over time. Once youve finished the vesting period, all previous and future contributions are vested and become yours immediately.

When considering a job change, take into account any money you may be leaving behind because it has not vested yet check your employers vesting schedule for more details.

For more on 401 vesting, check out our article detailing how 401 vesting works.

When Can You Withdraw From Your 401k Without A Penalty

Wondering when can you withdraw from 401k? 59 and 1/2 is the current age when you can take money out of your 401k without incurring a penalty. However, the money you take out is still taxed as income. At the age of 70, you will be forced by the IRS to start taking distributions from your retirement accounts.

How Do 401 Matches Work

Every 401 plan is different, so youll have to check your employers plan for the details on exactly how yours works. But there are two common types of matches:

Partial matching

Your employer will match part of the money you put in, up to a certain amount. The most common partial match provided by employers is 50% of what you put in, up to 6% of your salary. In other words, your employer matches half of whatever you contribute but no more than 3% of your salary total. To get the maximum amount of match, you have to put in 6%. If you put in more, say 8%, they still only put in 3%, because thats their max.

Heads-up that you might see this written in a lot of different ways. 50 cents on the dollar up to 6%, 50% on the first 6%, 3% on 6% you get the picture. All various ways to describe a partial match.

Dollar-for-dollar matching

With a dollar-for-dollar match , your employer puts in the same amount of money you do again up to a certain amount. An example might be dollar-for-dollar up to 4% of your salary. In this case, if you put in 4%, they put in 4% if you put in 2%, they put in 2%. If you put in 6%, they still only put in 4%, because thats their max.

You May Like: How Do You Take Money Out Of 401k

What Happens To My 401k If I Change Jobs

You have a couple of options, but the one most would recommend is a 401k rollover. A 401k rollover is when you transfer your funds from your employer to an individual retirement account or to a 401k plan with your new employer. A much less popular option is to cash out your 401k, but this comes with massive penalties income tax, and an additional 10% withholding fee.

How Can I Take Advantage Of 401 Matching

401 matching is designed to be easy to take advantage of. All you have to do is make contributions to your 401 and youll get extra money from your employer automatically.

If you want to max out the benefit, make sure that youre contributing enough to get the full match that your employer offers. If you get a 50% match, thats like earning a 50% return on investment immediately and with no risk. Youll be hard-pressed to find a better deal elsewhere.

Even if your employers 401 has high fees, it is worth contributing up to the matching limit for the immediate return. Once youve hit the matching limit you can consider whether other savings strategies, such as opening an IRA may be better for you.

If youre concerned about how fees will affect your retirement plans, take a look at Personal Capitals Retirement Fee Analyzer.

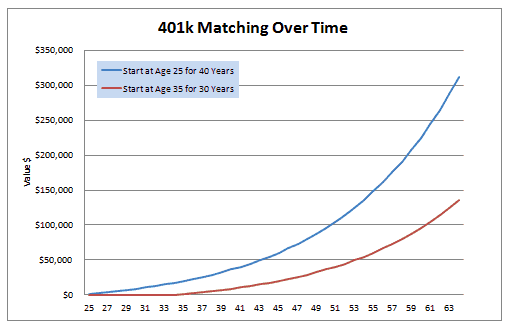

401 matching is like getting more money from your employer for free. Taking full advantage of this benefit can make a huge difference in the size of your nest egg and the security of your retirement.

You can run your own numbers on InvestmentZens 401 calculator to see how 401 matching can help your retirement.

Read Also: What Is Max 401k Contribution For 2021

Safe Harbor Matching Contributions

Safe harbor 401 plans are the most popular type of 401 plan used by small businesses today. They automatically pass annual ADP/ACP and top heavy tests and allow business owners to make salary deferrals up to the legal limit without the risk of corrective refunds or contributions. For a 401 plan to achieve safe harbor status, the employer must make a qualifying contribution to eligible employees.

For a matching contribution to meet safe harbor 401 requirements, it must use one of the following three formulas:

An employer may also make discretionary a matching contribution on top of these contributions and remain exempt from ADP/ACP and top heavy testing if the match meets both of the following two requirements:

- Its formula is not based on more than 6% of compensation.

- Its dollar amount doesnt exceed 4% of compensation.

Other safe harbor match requirements

Could You Invest Just 2 Percent More

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Even 2 percent more from your pay could make a big difference. Enter information about your current situation, your current and proposed new contribution rate, anticipated pay increases and how long the money might be invested, as well as your own assumptions about the growth rate of your investments, and see the difference for yourself*. For additional information, see How to use the Contribution Calculator.

*This calculator is intended to serve as an educational tool, not investment advice. It enables you to enter hypothetical data. The variables you choose are not meant to reflect the performance of any security or current economic conditions. The examples are intended for illustrative purposes only and are not a prediction of investment results.

Calculations are based on the values entered into the calculator and do not take into account any limits imposed by IRS or plan rules. Also, the calculations assume a steady rate of contribution for the number of years invested that is entered.

Recommended Reading: Can You Merge 401k Accounts

What Does Microsoft Excel Mean

Microsoft Excel is a software program produced by Microsoft that allows users to organize, format and calculate data with formulas using a spreadsheet system.This software is part of the Microsoft Office suite and is compatible with other applications in the Office suite. Like other Microsoft Office products, Microsoft Excel can now be purchased through the cloud on a subscription basis through Office 365.

Whats This Whole Employer Match Vesting Thing

A lot of employers use a vesting schedule for their 401 matches. Its a way to help them hedge their bets on you as an employee by reducing the amount of money theyd lose if you were to leave the company. Its also meant to give you a shiny incentive to stay.

A vesting schedule determines how much of your employers matching contributions you actually own, based on how long youve worked there. For example, if your employer contributions vest gradually over four years, then 25% of your employer contributions belongs to you after youve been there one year, 50% belongs to you after two years, 75% belongs to you after three years, and theyre all yours once you hit your fourth work anniversary.

Theres another type of vesting schedule, called cliff vesting. This ones more of an all-or-nothing scenario. With a four-year cliff, 0% of the contributions are yours until you hit your fourth workiversary, then 100% of them are all yours, all at once.

All the contributions made after your vesting schedule ends are usually fully vested right away. Oh, and dont worry: 100% of the money you put in yourself is always fully vested.

Also Check: How To Pull 401k Early

Irs Now Requires An Employer Discretionary Match To Be Definitely Determinable

Definitely Determinable is one of those pre-ERISA concepts that are still applicable. It means that in order for a retirement plan to be considered qualified , a participants retirement benefit had to be determined in accordance with a stipulated formula that is not subject to the discretion of the employer.

The purpose of which is, of course, to eliminate the possibility of benefits favoring the higher paid employees. Its long been required for defined benefit pension plans in which its a straightforward matter.

But what about those 401 plans that provided a discretionary employer discretionary match? Until recently, an employer matching contribution that was discretionary did not have to be stated in the plan document. But now the IRS has taken the position that a discretionary employer match must also be definitely determinable.

Here is what an employer needs to do if its match is discretionary.

The New Requirements

As part of the required Cycle 3 Restatement of 401 plans, employers must follow a three-step process to meet IRS requirements.

First, the employer must specify the amount and the allocation method for any matching contribution in a resolution of its governing body whether a Sole Proprietorship, Partnership, Limited Liability Partnership, Limited Liability Corporation, C corporation, or S corporation,

Second, the employer must provide written instructions to the Plan Administrator , that describes:

Best Practices

K Company Match Calculation

When an employee has a set dollar amount they contribute to each week and the company default is 3%, QuickBooks is not recognizing when the employee contribution is under that 3%. So the employer “match” is calculating at 3% which is often OVER the employee contribution. Thoughts?

Hi there, ShelleChristmasCPA.

Thanks for stopping by the Community for assistance. Your best bet at this point would be to reach out to our Support team for further assistance, this is because it sounds like there may be an error in the employee profile setup and our support team can dive into the account with you and see exactly where that error is occurring. To reach them, follow these steps.

Check our support hours and contact us. If you have any other questions or concerns, feel free to post them below. Thank you for your time and have a nice evening.

Don’t Miss: Can You Have A Solo 401k And An Employer 401k

When Does The Year End For A 401 Match

In terms of IRS contribution limits, the year resets on January 1. Any contributions and matches made during the year count toward your total contribution limit for the year. Your employer might choose to deposit its match each time you withhold your contribution from your paycheck, or it may deposit it at less frequent intervals, say, quarterly or yearly.

The Balance does not provide tax, investment, or financial services or advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.

How To Use The Contribution Calculator

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The Growth Chart and Estimated Future Account Totals box will update each time you select the “Calculate” or “Recalculate” button.

Pre-filled amountsBased on our records, the following information may be pre-filled:

Salary

- Pay period. If the information is not available, the default pay period is weekly.

Contribution

- Your contribution rate. Note that we will use 8% as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage.

Investment

- Years invested

- Your initial balance

You may change any of these values.

Using the calculator

In the following boxes, you’ll need to enter:

Salary

- Your expected annual pay increases, if any.

- How frequently you are paid by your employer.

Contribution

- The amount of your current contribution rate .

- The proposed new amount of your contribution rate. Be sure to verify the maximum contribution rate allowable under your plan. Also, pre-tax contributions are subject to the annual IRS dollar limit.

Pre-tax Contribution Limits 401, 403 and 457 plans |

|

|---|---|

| 2020 | |

| After 2020 | May be indexed annually in $500 increments |

Employer Match

Investment

- The length of time that you anticipate you will invest this money.

- The amount of your current account balance.

- Your hypothetical assumed annual rate of return.

Don’t Miss: How To Transfer 401k From Fidelity To Vanguard

How A 401 Match Works

Employees usually contribute a percentage of their salaries to their 401s, and most employers who offer matching also contribute a percentage of employees’ income. Some companies offer dollar-for-dollar matches, whereby the employer contributes $1 for every $1 the employee contributes to their 401, but more common are partial matching percentages. This means the company matches a portion of what the employee contributes, such as $0.50 for every $1 the employee puts into their 401.

Regardless of the matching structure, your employer will likely cap your match at a certain percentage of your income. For example, your employer may pay $0.50 for every $1 you contribute up to 6% of your salary. So if you make $50,000 per year, 6% of your salary is $3,000. If you contribute that much to your 401, your employer contributes half the amount $1,500 of free money as a match. If the company offered a dollar-for-dollar match instead of a partial match, it would give you $3,000 for the year. You’re free to contribute more than $3,000 if you want to, but you won’t get any additional match from your company.

Every company has its own matching methodology and vesting schedule, so talk to your employer if you’re not sure how your 401 match works.

Need More Information On Retirement Planning

Important Disclosures

1 Contribution limits change slightly each year and may vary by plan. For specific information about your employer-sponsored retirement plan, see your benefits website or contact your Human Resources department.

Withdrawals from an IRA or qualified retirement plan are subject to ordinary income tax. Prior to age 59 ½, they may also be subject to a 10% federal tax penalty.

Investing involves risk, including loss of principal. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

The information provided is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends that you consult with a qualified tax advisor, CPA, financial planner or investment manager.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Don’t Miss: Should You Always Rollover Your 401k

What Are The Rules For A Roth Ira

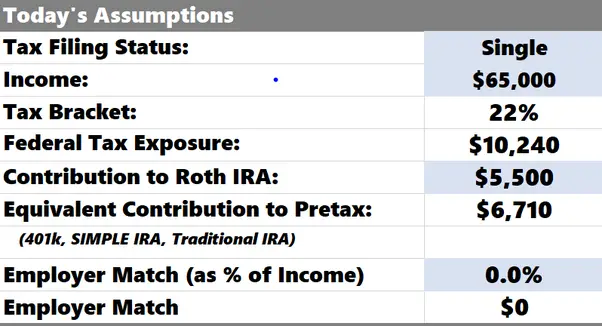

Roth IRAs are only available to people making less than $129,000 a year as an individual, or $191,000 for married couples. They have contribution limits of $5,500 a year, or $6,500 for those over 50. Unlike 401ks and traditional IRAs though, there’s no penalty for withdrawing part of your contribution early.

Timing Payments For The Most Money

Some employers will pay their match no matter how many paychecks it takes for you to reach your allowed amount for the year. But many companies will make a contribution only during the pay periods when 401 money is taken from your paycheck. You can avoid leaving employer money on the table by putting in smaller amounts each pay period. That way, your employer will put money into your account in every period.

Let’s say you’re paid twice a month, and your employer will only add money into your 401 when you do. If you reach your $19,500 limit at the end of November, you’ve missed out on two chances for your employer to make its match. In this case, you’d be earning much more than $50,000 a year, but this issue could apply no matter how much you earn if you put too much money into your 401 too soon.

Your plan manager can help you manage your 401 account to make the most of your employer match. You can also use an online calculator to figure out how much you should put in from each paycheck.

You May Like: What Happens To Your 401k When You Switch Jobs