The Lowdown On 401 Plan Audits

Have you ever had to endure a 401 Audit? For most plan sponsors, they are not a pleasant experience. We’re not referring to being audited by the DOL or IRS, we’re referring to the annual audit attached to Form 5500 that is required for large plans. Plan sponsors dread the annual audit because of the time, effort, energy, and cost required. But it doesnt have to be that way.

In an effort to alleviate the pain caused by the annual 401 audit, we have prepared a few pieces of information that you should know about these audits. If you take advantage of even a couple of these, you will have a better experience moving forward.

When Is A Plan Pursuant To The Securities And Exchange Commission Reporting Requirements

The SEC requires employee stock purchase, savings and similar plans with interests that constitute securities registered under the Securities Act of 1933 to file a Form 11-K pursuant to Section 15 of the Securities Exchange Act of 1934.

Plans that are required to file Form 11-K are deemed to be issuers under the Sarbanes-Oxley Act of 2002 and must submit to the SEC an audit in accordance with the auditing and related professional practice standards promulgated by the Public Company Accounting Oversight Board .

Although plans are audited in accordance with PCAOB standards for filing with the SEC, these plans are also required to be audited in accordance with generally accepted auditing standards for filing with the DOL.

If An Audit Of Your 401 Plan Is Required Betterment Can Help You Understand What To Expect And How To Prepare

The Employee Retirement Income Security Act of 1974 requires that certain 401 plans be audited annually by a qualified independent public accountant subject. The primary purpose of the audit is to ensure that the 401 plan is operating in accordance with Department of Labor and Internal Revenue Service rules and regulations as well as operating consistent with the plan document, and that the plan sponsor is fulfilling their fiduciary duty.

A 401 plan audit can be fairly broad in scope and usually includes a review of all of the transactions that took place throughout the plan year such as payroll uploads, distributions, corrective actions, and any earnings that were allocated to accounts. It will also include a review of administrative procedures and identify potential areas of concern or opportunities for improvement.

Don’t Miss: Can I Manage My Own 401k

The Complete Guide To A Fast Pain

If youre responsible for your companys 401 administration, you probably know that the annual 401 audit is not a fun process.

In fact, wed go as far as to say that it sucks .

We dont need to tell you how tough this can be to tackle – especially if this is your first time doing it. And as nice as it is to commiserate, thats not super helpful. So, in the interest of being super helpful, weve provided you with everything you need to know to get through your 401 audit as quickly and easily as possible.

In this guide, well cover:

The 401 plan audit can be a huge pain. Heres how to face this 401 administration challenge head-on:

What Considerations Are There When You Are Changing An Auditor

Selection of a plan auditor is a fiduciary function under ERISA, so it is important for the plan fiduciary to carefully document the reasons for switching auditors and the process used to select a new auditor. The Form 5500 also includes a field where you will need to explain the reason for switching.

To learn more, please refer to Plan Sponsor Guidelines Preparing for RFP.

Read Also: When Can You Take Out 401k

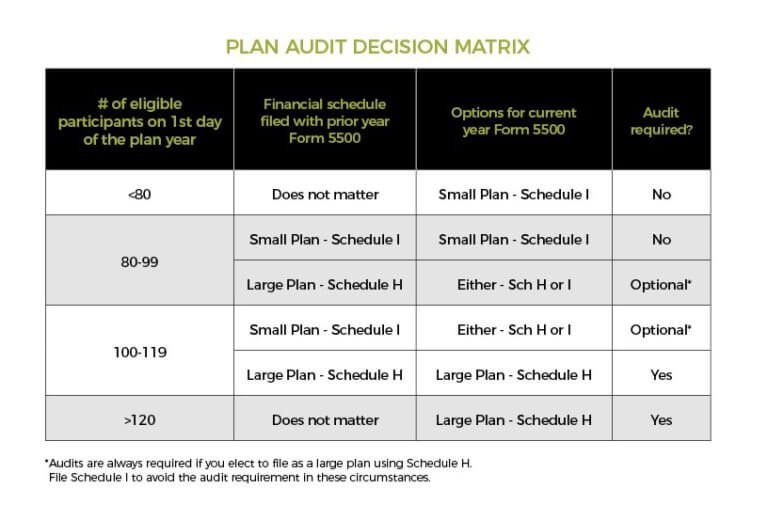

Does Your Company Fall Into The 80

There are some cases where an employer may have 100 or more eligible participants in their 401k plan, but they are not obligated to get an audit.

This exception allows plans with 80 to 120 participants to forego an audit if the plan fits the category of a small plan in the prior tax year. This exception can allow plans with more than 100 eligible participants to continue to file as a small plan indefinitely, provided that the number of plan participants does not rise above 120 participants.

So, for example, if your plan had 75 eligible participants in 2017, 105 participants at the beginning of the 2018 tax year, and 118 at the beginning of the 2019 tax year, you could continue to file as a small plan for 2019.

Can Small Businesses Afford To Offer 401s

That same Wakefield Research survey found that 23% of small business owners dont offer a 401 plan because they cant afford to match contributions, and 29% said they would consider offering one if plan costs fell. Traditionally, offering a 401 has been considered expensive for small businesses but not anymore. Its no longer necessary to spend thousands of dollars to implement a 401 plan.

Read Also: When Leaving A Job What To Do With 401k

How Often Do Retirement Plans Need To Be Audited

According to the DOL, Generally, Federal law requires employee benefit plans with 100 or more participants to have an audit as part of their obligation to file an annual return/report . If your employee benefit plan is required to have an audit, one of the most important duties of the plan administrator is to hire an independent qualified public accountant. The sponsor of the plan is the plan administrator under the law unless another individual or entity is specifically designated to assume this responsibility. The following material will assist you, as plan administrator, in selecting an auditor and reviewing the audit work and report.

The term generally is used due to a few situations in which an audit can be waived. According to the DOL:

There are some other conditions for an Audit Waiver, besides the participant count:

The qualifying assets referred to above are:

Understanding 401 Audits: Answers To Frequently Asked Questions

When a business reaches a certain number of eligible participants for their 401 plan, federal law requires an independent audit of that defined retirement plan. Larger companies are more accustomed to this annual requirement however, owners and managers of smaller businesses may never have experienced a 401 audit or don’t know nearly enough about it.

At what point is an employer required to complete a 401 audit? What is an “eligible participant” and why is it important? Who performs the audit and what documents do they need? We have the answers to these questions and more in our breakdown of 401 audits and how to determine if and when you should prepare for one.

Don’t Miss: How Does Taking Money Out Of 401k Work

What Comes After The Audit

Once your independent 401 audit is completed, you’ll attach the report to Form 5500. All businesses with 401 plans must file Form 5500, Annual Return/Report of Employee Benefit Plan. This annual report, registered with the Department of Labor and the Internal Revenue Service , provides information on your 401 or other benefit plan.

Information collected includes the type of plan, the plan sponsor’s information, plan administrator’s information if different, and number of participants. It is the source for determining whether your plan is considered small or large and whether you’ve crossed the eligible participant threshold and will be required to complete an annual audit going forward.

Form 5500 comes with a dizzying 28 pages of instructions. Luckily your 401 provider, along with your independent auditor, will take care of the heavy lifting to fulfill this annual requirement.

For more information on 401 audits and how they can work to enhance the plan you have, read What CFOs Should Know About Retirement Plan Audits from cfo.com.

Keep Your Documents In Good Order

The auditor is going to be asking for A LOT of documents – first during the Plan Document & Design Review, but then also during the 401 Deposit Review and Participant-Level Sampling. Having all your 401 documents – thats everything from plan documents to timestamped communications to payroll data – well-organized in one place can save you A TON of time.

Here’s an example of how we do it at ForUsAll using our Fiduciary Vault:

Don’t Miss: What Is The Tax Rate On 401k Withdrawals

What Does The Audit Cover

While a service provider or an accountant may perform audits differently, there are general focal points they all emphasize:

- Reviewing of 401 plan documents provided by you to verify your plan is compliant with IRS and DOL rules

- Looking for any amendments made to the plan during the year

- Determining the accuracy of information reported on Form 5500, Annual Return/Report of Employee Benefit Plan, and 401 financial statements

- Assessing how your company maintains electronic 401 records

- Examining employee contributions to ensure money was remitted in a timely way

- Confirming distributions and rollovers were paid out properly

- Sampling specific participants transactions to further ensure compliance

- Interviewing upper management to vet any concerns

This extensive process can last anywhere from three to four months, depending on the quality and access to your data. Average sized businesses can see costs of $10,000 to $12,000 with Fortune 500 companies seeing much higher bills.

Our Team Has Over 25 Years Experience In Auditing 401k Plans Our Combined Knowledge And Experience Means You Wont Need To Re

For over 30 years, Maria has served clients in a variety of areas including financial statement audits, reviews and compilations as well as business and individual taxation. Maria excels working with clients in the real estate, and healthcare industries, along with employee benefit plans.

As an expert in the real estate industry Maria brings tax strategies such as Cost Segregation, 1031 exchanges, debt restructuring, capital financing and cash flow projections to the table. Maria manages LSLs Cost Segregation department and is responsible for the implementation and completion of all Cost Segregation studies. Maria is involved with Commercial Real Estate Women of Orange County , one of the leading commercial real estate organizations for executive women in Orange County.

Great Clients for Mariavalue a partner in their business to help guide them to greater success.LSL candidate tip Ask her about her kids and traveling and her big fat Cuban Family.Personal Her son, Kyle, was married in August 2018.

Don’t Miss: Can You Convert A Roth 401k To A Roth Ira

How Can I Minimize The Audit Workload

To do an audit, an independent auditor is required. Independence, in this case, means the auditor cannot have additional ties to your company or the plan. For example, if the auditor does the bookkeeping, accounting, financial statements, or other audits for you, they would not be considered independent. Most likely the auditor wont know much about your plan unless they audited your plan in a previous year. It is the auditors job to learn enough about your plan to be able to conduct a thorough audit. To do this requires work. But it doesnt necessarily have to require tons of work on your end. You may be able to get your service providers to help with some of that work. For example, a record-keeper or TPA may be able to provide plan documents, financials, payroll data, valuations, and more to the auditor. If they dont want to help you, you may want to find new service providers for the next plan year.

When Must A 401k Plan Be Audited

401 audits can be stressful for employers. Even hearing the word audit can be enough to induce panic. The truth is that 401 audits are a normal part of doing business and therefore, not as scary as they sound.

According to IRS rules, a 401 plan must be audited if it meets certain requirements as laid out by the Employee Retirement Income Security Act . There are three questions to ask to determine if your company plan requires an audit.

Don’t Miss: How To Find My Fidelity 401k Account Number

How Do You Prepare For An Audit

Keeping track of plan-related documents throughout the year is one of the simplest ways to prepare for an audit. In addition to your plan document, be sure to have your most recent Form 5500, W-2s, loan requests, loan repayments, distributions, and other information related to your employees and their 401 activity.

For smaller companies who are experiencing steady growth, its important to monitor how many eligible participants you have in your plan. Planning will prevent any surprises and give you a head start in tracking the necessary documents leading up to your first audit.

Regardless of the size of your plan, be sure to lean on your 401 provider for assistance in gathering the necessary information for your auditor. They can also work directly with your auditor to reduce the amount of time you have to be involved in the project. Its important to thoroughly research this service provider beforehand to ensure a seamless audit, according to the Chief Executive Officer of ERISA Consultants, Richard Phillips.

Vet your service provider. Make sure youve done your due diligence so that you know you have good support from them and know they can provide the documents and records that are needed to make it a smooth audit process, Phillips states.

When Is A 401k Audit Required In California

Understand when a 401k audit is required in California with Cook CPA Group. Our Roseville tax accountants discuss employee benefit plans audit regulations and when you have to perform a 401k audit in California.

Handling the 401 administration for several workers can be a heavy burden, especially when it is time to conduct a 401 audit. However, it is important that this process is done carefully and correctly to avoid an unwanted external audit. Companies that possess a well-organized 401 auditing system are more likely to attract valuable employees to their business. If your business needs assistance performing a 401 audit, you should consult with an experienced Roseville and Sacramento 401 auditor today. At Cook CPA Group, our business accountants would be proud to help you conduct a 401 audit for your business. Our firm is here to explain when a 401 audit is required in California.

You May Like: How Much To Invest In 401k To Be A Millionaire

Planning And Audit Requests

Like most audits, your auditor will likely start with a planning call or in person meeting to create an audit timeline similar to the one shown above. Once the timing and approach of the audit have been determined, your auditor will communicate an expectation on timing of deliverables. This is generally where new audit clients will require the most assistance and guidance as 401 audits are very administratively demanding. Preparing your HR or benefits departments to fulfill audit requests is crucial to a smooth and efficient audit. See the listing of commonly requested audit items below. Although this isnt a complete listing, it will help greatly to understand the wide range of requests youll see during your audit.

Having the auditors requests prepared for the beginning of fieldwork is the first step toward a successful 401 audit.

What Are The 401 Audit Requirements

Youre required to undergo an audit if you file your 401 plan as a large plan. Any plan with more than 100 eligible participants is regarded as a large plan. Theres an 80-to-120 participant rule stating that any plan that was considered a small in the previous year and still has less than 120 participants, can be filed as a small plan in the current year. Thus, it is not subject to a 401 large plan audit.

Also Check: Why Rollover Old 401k To Ira

Get Help From A Good 3 Fiduciary

Sometimes, the easiest way to solve a problem is just to make it someone elses. When you hire a 3 Fiduciary, they become legally responsible for administering your 401.

A good 3 will do ALL the heavy lifting when it comes to your 401 audit. Thats everything from assembling your fiduciary documents to putting together the 401 deposit report. When you have a good 3 by your side, pretty much all you have to do in an audit is dig up any of the HR documents they dont have access to – offer letters, HRIS screenshots, or those sorts of things.

Imagine that. The audit process, which takes some companies months to complete, might only take you two hours depending on how accessible your documents are.

How Are The Audit Results Used By Plan Sponsors

Audited financial statements, along with the auditors report, must be attached to the Form 5500 filing. Once the annual audit is complete, the plan administrator and those charged with governance receive various other communications. These communications can be used to help strengthen internal controls, correct any areas of noncompliance, improve processes and gain a deeper appreciation of its fiduciary responsibility.

Don’t Miss: How Can You Take Out Your 401k

What Is A Limited

Limited-Scope audit allows auditors to perform a full plan year audit on Plan operations and excludes auditing procedures with respect to investment information prepared and certified by a qualified bank or similar institution, or by an insurance carrier

To learn more, please refer to Limited Scope Primer

When Is A Plan Considered Audit Level

For first time filers, a companys 401 plan requires a plan audit when the plan has 100 eligible participants on the first day of the plan year. An eligible participant is anyone who is an employee of the company who meets the requirements of the companys 401 plan. Even if they decide not to participate in the plan, these individuals are still considered eligible participants. Terminated employees who have balances in the 401 plan on the first day of the plan year are also included.

Prior short-form filers, a companys 401 plan becomes audit level if the plan has 121 or more eligible participants on the first day of the plan year, an audit is required. Once an audit has occurred, the 401 plan must be audited every year thereafter until the eligible participant count drops below 80. Please refer to the 80/120 Rule question below.

To learn more, please refer to Plan Readiness & Common Mistakes

Don’t Miss: What To Do With Your 401k