Roll Over Your 401 To A Roth Ira

If you’re transitioning to a new job or heading into retirement, rolling over your 401 to a Roth IRA can help you continue to save for retirement while letting any earnings grow tax-free.2

- Cons

-

- You can’t borrow against a Roth IRA as you can with a 401.

- Any Traditional 401 assets that are rolled into a Roth IRA are subject to taxes at the time of conversion.

- You may pay annual fees or other fees for maintaining your Roth IRA at some companies, or you may face higher investing fees, pricing, and expenses than you did with your 401.

- Some investments offered in a 401 plan may not be offered in a Roth IRA.

- Your IRA assets are generally protected from creditors only in the case of bankruptcy.

- Rolling over company stock may have negative tax implications.

Reasons Not To Convert From 401 To Roth Ira

Unlike her dad, 27-year-old Samantha Morgan doesn’t benefit from a lot of tax deductions. She’s single, with no dependents and renting a one-bedroom apartment. After years of struggling as a low-paid medical resident with lots of student loans, she is finally debt-free and earning a doctor’s salary, which puts her firmly in the 35 percent tax bracket.

One of the big reasons Joe Morgan decided to convert to a Roth IRA was because he expected to be in a higher tax bracket when he retired. Samantha, on the other hand, has good reason to expect to be earning considerably less, and paying less in taxes, after she retires. For that reason, it makes more sense for Samantha to make tax-free contributions to a 401, because she will pay a lower tax rate when she withdraws the 401 funds after retirement.

The other benefit of Samantha’s 401 is that her employer, St. Jude’s Hospital, matches a percentage of Samantha’s 401 contributions. That’s free money! The standard arrangement is to match 50 percent of employee 401 contributions every pay period up to the first 6 percent of salary . But if Samantha wants to maximize the match, she needs to pace herself.

The best advice is to talk to your tax professional about whether a 401 to Roth IRA conversion is right for you. For lots more information, check out the related HowStuffWorks links on the next page.

The Benefits Of Rolling Over Your 401 When You Leave A Job

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Whenever you change jobs, you have several options with your 401 plan account. You can cash it out, leave it where it is, transfer it into your new employer’s 401 plan , or roll it over into an individual retirement account .

Forget about cashing it outtaxes and other penalties are likely to be staggering. For most people, rolling over a 401or the 403 cousin, for those in the public or nonprofit sectorinto an IRA is the best choice. Below are seven reasons why. Keep in mind these reasons assume that you are not on the verge of retirement or at an age when you must start taking required minimum distributions from a plan.

Don’t Miss: When Can I Move My 401k To An Ira

Roth Iras And Income Requirements

There is another key distinction between the two accounts. Anyone can contribute to a traditional IRA, but the IRS imposes an income cap on eligibility for a Roth IRA. Fundamentally, the IRS does not want high-earners benefiting from these tax-advantaged accounts.

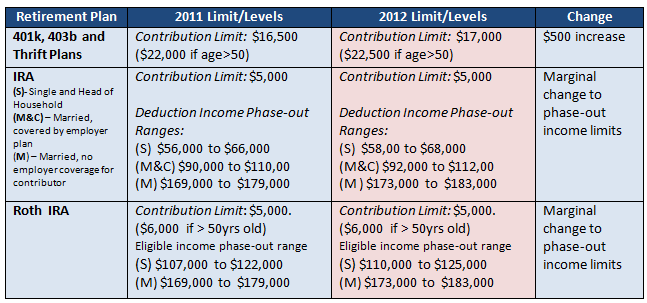

The income caps are adjusted annually to keep up with inflation. In 2021, the phase-out range for a full annual contribution for single filers is from $125,000 to $140,000 for a Roth IRA. For married couples filing jointly, the phase-out begins at $198,000 in annual gross income, with an overall limit of $208,000.

And that is why, if you have a high income, you have another reason to roll over your 401 to a Roth IRA. Roth income limitations do not apply to this type of conversion. Anyone with any income is allowed to fund a Roth IRA via a rolloverâin fact, it is one of the only ways.

401 funds are not the only company retirement plan assets eligible for rollover. The 403 and 457 plans for public-sector and nonprofit employees may also be converted into Roth IRAs.

Investors may choose to divide their investment dollars across traditional and Roth IRA accounts, as long as their income is below the Roth limits. However, the maximum allowable amount remains the same. That is, it may not exceed a total of $6,000 split among the accounts.

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fidicuary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Don’t Miss: Can You Merge 401k Accounts

Find Out If Youll Be Able To Convert Your 401

According to the IRS, in order to be eligible for a 401 conversion, the money must be vested .3 All the money you put into your 401 is immediately vested, but your employers contributions are usually vested over time. Depending on the vesting schedule set up by the company and how long youve been there, your existing 401 might not be fully vested yet.

Companies sometimes have their own additional restrictions on who can convert their 401, so ask your employer if you are eligible.

Talk To A Pro Before Converting Your 401

An experienced investing professional can help you figure out the best way to handle your investment accounts in order to keep you on track toward your retirement goals. If you dont understand something, ask questions. We dont ever want you to make a financial move you dont understand.

If youre looking for an investing pro in your area, use our SmartVestor program! Its a free way to connect with top-notch investing professionals who are ready to help you make the most of your retirement dollars.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

You May Like: Do I Have To Pay Taxes On 401k Rollover

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. Its also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, its a good way to save money, stay organized and make your money work harder.

What Are Roth 401 Contribution Limits

For 2021, the 401 contribution limit is $19,500. This contribution limit applies to your 401 contributions, whether theyre in a Roth or traditional 401. That means if youre contributing to both, the combined total of your contributions cant exceed that amount.6 And in case you were wondering, your employers contributions do not count toward the limit.

If youre 50 or above, the contribution limit increases to $26,000.7

Read Also: What’s The Most You Can Contribute To A 401k

If You Have More Than One Ira: Ira Aggregation Rule And Pro Rata Rule

When it comes to conversions and distributions, the IRS views all of your traditional IRAs as one account. If you have 3 traditional IRAs and a rollover IRA spread across different financial institutions, the IRS would lump all of them together. It’s called the IRA aggregation rule and it can complicate your conversion to a Rothor make it more costly than you may have anticipated.

If you have existing IRAs, like a rollover, and also want to make nondeductible contributions and later convert them to a Roth, you won’t be able to convert only the after-tax balance. The conversion must be done pro rataor proportionally split between your after-tax and pre-tax balances, including contributions and earnings.

For instance, let’s say you have an existing traditional IRA worth $10,000. You’ve just made a nondeductible contribution to a new IRA in the amount of $5,000 and plan to convert it to a Roth IRA. You can convert $5,000 of your IRA dollars but you would have to pay taxes on about $3,333 of the money being converted.

Total IRA balance: $15,000 After-tax IRA balance: $5,000

$5,000 is one-third of your total IRA balance. That means that one-third of your conversion will be after-tax dollars and two-thirds will be pre-tax dollars.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: Can I Buy 401k Myself

Employer Matches Are Pre

One of the best features of a 401 is the match program. This is when an employer matches an employees 401 contributions up to a certain percentage.

Match programs vary, so youll need to speak with your employer to understand how their specific program works.

Your company may offer a dollar-for-dollar match up to a percentage of your gross income.

Once you hit this threshold, match contributions stop until the next year. Then again, your company may only offer a 50 percent match up to a percentage.

Lets assume you earn $40,000 a year and you contribute 5 percent of your income. If your employer offers a 50 percent match, theyll contribute $1,000 to your account annually.

This is free money that you shouldnt turn down, especially if youre a low income earner. When you cant contribute much, a match program helps grow your retirement savings faster.

Keep in mind that company matches are always made with pre-tax dollars.

This applies even with a Roth 401.

Interestingly, if you have a Roth, matching funds are put into a traditional 401.

These funds grow tax-deferred and youll owe income tax on these withdrawals in retirement.

You do not get to deduct the company match from your income. Your employer enjoys the tax benefits.

You Can Have A Roth Ira And A Roth 401

It is possible to have both a Roth IRA and a Roth 401 at the same time. However, keep in mind that a Roth 401 must be offered by your employer in order to participate. Meanwhile, anyone with earned income can open an IRA, given the stated income limits.

If you dont have enough money to max out contributions to both accounts, experts recommend maxing out the Roth 401 first to receive the benefit of a full employer match.

Also Check: How To Pull From 401k

Also Check: How Do I Withdraw Money From My 401k

Rollover Into A New Companys 401 Plan

A rollover into your new companys 401 plan may be the easiest option for you. Youll keep all the money in one place, and you may be able to access some professional advice as part of your new plan, too. So a rollover to a new 401 is a winner for convenience. Its a winner from a tax perspective, too, because you wont incur any new taxes as long as you transfer to the same type of 401 at your new employer.

In addition, having all your money in a 401 protects you from the pro-rata rule. This rule could really trip you up and limit the effectiveness of a backdoor Roth IRA, which is a useful strategy if you earn too much to contribute directly to a Roth IRA.

One downside, however, is that your new plan may not have particularly attractive investment choices, for example, offering expensive funds. So youll want to consider your investment options, too.

How Is A Roth Ira Different From A Traditional Ira

You cant convert a Roth IRA back to a traditional IRA. Hence, you should understand the difference between these two plans before converting your 401 account into a Roth IRA.

Traditional IRA:Contributions made to a traditional IRA are tax-free. You pay taxes only when you withdraw the money. From a taxation point of view, a traditional IRA resembles a 401 plan, where your employer deducts your contribution from your salary before you pay any taxes on it. In the case of an IRA, you need to claim a deduction while filing your tax return, since there is no employer involved. However, the end result is the same: Your taxable income gets reduced by your contribution amount.

The funds in your IRA keep growing without attracting any tax liability. After you reach the age of 59 ½, you can start withdrawing money from your IRA. The amount of withdrawal gets added to your taxable income. A traditional IRA is also subject to Required Minimum Distributions once you reach an age of 70 ½ years. You cannot continue making IRA contributions beyond this age.

Roth IRA: Unlike a traditional IRA, you cannot deduct contributions made to a Roth IRA from your taxable income. However, the distributions you receive from a Roth IRA are tax-free. A Roth IRA is not subject to RMDs. You can postpone taking distributions until the time you want. You can continue contributing to a Roth IRA without any age restriction. All the money you earn from your Roth IRA is completely tax-free.

Read Also: How Do I Find Out Where My Old 401k Is

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

How And Why To Transfer Your 401 To An Ira

posted on

By Justin Pritchard, CFP® in Montrose, CO

When you change jobs or retire, you have several options for the money in your 401. You can typically transfer that money to an IRA, leave it in the plan, move it to your new jobs retirement plan, or cash out. In many cases, its smart to move your savings into an IRA. Well cover the pros and cons here so you can decide whats best.

The process can be confusing and intimidating, so its easy to do nothing. But that might result in leaving your savings with an employer that you no longer have any connection to, and one you might even dislike or distrust.

Key takeaway:Read more below, or listen to the explanation .

Recommended Reading: What Is Qualified Domestic Relations Order 401k