When Faced With A Sudden Cash Crunch It Can Be Tempting To Tap Your 401 More Than A Few Individuals Have Raided Their Retirement Account For Everything From Medical Emergencies To A Week

But if you’re under 59-1/2, keep in mind that an early withdrawal from your 401 will cost you dearly. You’re robbing your future piggy bank to solve problems in the present.

You’ll miss the compounded earnings you’d otherwise receive, you’ll likely get stuck with early withdrawal penalties, and you’ll certainly have to pay income tax on the amount withdrawn to Uncle Sam.

If you absolutely must draw from your 401 before 59-1/2, and emergencies do crop up, there are a few ways it can be done.

Hardship withdrawals

You are allowed to make withdrawals, for example, for certain qualified hardships — though you’ll probably still face a 10% early withdrawal penalty if you’re under 59-1/2, plus owe ordinary income taxes. Comb the fine print in your 401 plan prospectus. It will spell out what qualifies as a hardship.

Although every plan varies, that may include withdrawals after the onset of sudden disability, money for the purchase of a first home, money for burial or funeral costs, money for repair of damages to your principal residence, money for payment of higher education expenses, money for payments necessary to prevent eviction or foreclosure, and money for certain medical expenses that aren’t reimbursed by your insurer.

Loans

Most major companies also offer a loan provision on their 401 plans that allow you to borrow against your account and repay yourself with interest.

You then repay the loan with interest, through deductions taken directly from your paychecks.

Using Life Insurance For Sustainable Wealth

Many people like to fund whole life insurance during their career instead of maxing out 401 contributions. High cash values in life insurance can be valuable when opportunities arise where 401 funds are off-limit.

For example, my brothers run a metal fabrication business and recently had an opportunity to buy a machine shop for only $50,000 on a special liquidation deal. This equipment would have run close to $250,000 if they had to buy it piecemeal at used prices.

They were able to get a policy loan against their whole life insurance policies and take advantage of this deal quickly.

Some people like to fund whole life insurance with money from a 401, so they have a permanent death benefit and accessible cash values going into their golden years.

If they need more money during retirement 10-15+ years later, they can withdraw more than they paid for the policy or roll a policy to an annuity to create guaranteed passive income for the rest of their life. A high percentage of this income is usually tax-free.

Owning life insurance can also help with estate planning needs or as a volatility buffer where a policy owner can take a loan or withdrawal to cover lifestyle expenses in times when volatile market investments are down. This can allow time for the market to recover instead of further drawing down assets in an invested account.

Do You Get Your 401 If You Quit

Be aware of the following rules regarding your old 401 account:

-

If your 401 has a total investment of more than $5,000, your employer may allow you to leave the account with them even after you quit the job.

-

If your account has a balance of less than $1,000, your employer may force you out and pay the amount left in your account with a check.

-

If the total investment amount in your old 401 is between $1,000 and $5,000 and your employer wants to force you out, they must transfer the amount to your IRA.

Also Check: Why Choose A Roth Ira Over A 401k

The 4% Withdrawal Rule

The 4% rule says that you can withdraw 4% of your savings in the first year, and calculate subsequent yearâs withdrawals on the rate of inflation. This rule is based on the idea that you should withdraw 4% annually, and maintain the financial security in retirement for 30 years. This strategy is preferred because it is simple to compute, and gives retirees a predictable amount of income every year.

For example, if you have $1 million in retirement savings, 4% equals $40,000 in the first year. If the inflation rises by 2.5% in the second year, you should take out an additional 2.5% of the first yearâs withdrawal i.e. $1000. Therefore, the withdrawal for the second year will be $41,000.

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early-withdrawal penalties if you are under 59 1/2 .

Read Also: How Does A 401k Work When You Change Jobs

Understanding Early Withdrawal From A 401

The method and process of withdrawing money from your 401 will depend on your employer and the type of withdrawal you choose. Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It’s really a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available. If it is, then you should check the fine print of your plan to determine the type of withdrawals that are allowed or available.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay normal income taxes on the withdrawn funds. For a $10,000 withdrawal, once all taxes and penalties are paid, you will only receive approximately $6,300. There are some non-penalty options to consider, however.

Before deciding upon taking an early withdrawal from your 401, find out if your plan allows you to take a loan against it, as this allows you to eventually replace the funds. You may also want to consider alternative options for securing financing that could hurt you less in the long run, such as a small personal loan.

To Meet Additional Essential Needs

Money for items such as medical expenses, prescriptions, food, or elder care add up fast. If you do decide pulling money from 401 or other retirement funds makes sense in a disaster scenario, consider taking out only what you need and set up a plan to pay back the amount no later than the three-year time frame.

You May Like: What Is The 401k Retirement Plan

What Are The Consequences Of Cashing Out A 401

When cashing out a 401, be prepared for the penalties and taxes. Penalties are usually easy to estimate when they apply, but potential taxes can be more elusive.

One assumed benefit implicit in any tax-deferred plan is that you will withdraw the money in a lower tax bracket than you deferred the tax when you made the contributions. This is not always the case, but taking an early withdrawal in a year when you have a high level of income ensures that you will never see this potential benefit on the amount withdrawn.

If you have existing income for the year, a big withdrawal might put you in a higher tax bracket or at least ensure youre paying taxes on most of the withdrawal at your current tax rate without the benefit of the lower rates in our graduated tax system. Lower tax rates may apply to at least a part of the distribution if you were to take a similar withdrawal in a year where you do not have as much other income.

Also, if you have a true emergency and pull money from a 401 to cover that emergency, then what about the taxes and penalties which are due next April 15th? Could your initial withdrawal start a chain reaction that may force taking another withdrawal to cover taxes?

Make sure you have a way to pay the taxes on 401 withdrawals.

Roll Your Money Into Your New Employer’s 401 Plan

Almost all 401 plans now accept rollovers from other retirement plans. You should certainly contribute to your new plan. But should you transfer your old account into it?

Advantages

- Consolidating your retirement money makes it easier to manage. When you’ve left a retirement account at a company you no longer work for, you may pay less attention to its performance or downplay its importance in your overall asset allocation.

- The new plan may offer more attractive investment options than the old one, as well as additional services, such as financial-planning advice.

Disadvantages

- The new plan may offer fewer investment options or investments that dont meet your needs.

Recommended Reading: Can I Keep My 401k After I Leave My Job

People May Have Different Reasons For Withdrawing Funds Early From A 401k

- Financial Hardship: People sometimes withdraw funds early due to financial hardship . Example include: medical care, expenses related to the purchase of a home, tuition, and funeral expenses

- Discretionary Spending: People may withdraw funds from a 401K because they prefer to have the money now rather than save it for retirement. In general, we do not recommend this strategy

- Early Retirement: Some people retire earlier than the standard retirement age. In this case, it is understandable why they may want to access funds early since they are no longer working

Penalties For Early Withdrawal

In general, if you pull funds out of your 401 before you turn 59 1/2, not only do you pay tax on the withdrawal, but you also incur a 10-percent penalty from Uncle Sam. There are exceptions to the penalty rule, including using the funds to pay medical expenses over 7.5 percent of your gross income, being required to withdraw due to a divorce settlement, or if you’re over 55 and quit your job. Thirty percent of your withdrawal is withheld by your employer and remitted to the IRS for taxes. When you claim the withdrawal as income, you get credit for the amount withheld on your personal tax return.

Also Check: Where Can I Find My 401k Balance

Should You Take A Distribution From Your 401 Or Ira

Like the CARES Act, the Consolidated Appropriations Act allows you to withdraw funds from both a 401 and an IRA, as long as the amount is up to $100,000 across all accounts. If you are deciding whether to take a distribution from either your IRA or a 401, think about factors such as each of the account’s typical rules around penalties and taxes. F

What Is The 4% Withdrawal Rule

The 4% rule is when you withdraw 4% of your retirement savings in your first year of retirement. In subsequent years, tack on an additional 2% to adjust for inflation.

For example, if you have $1 million saved under this strategy, you would withdraw $40,000 during your first year in retirement. The second year, you would take out $40,800 . The third year, you would withdraw $41,616 , and so on.

Potential advantages: This has been a longstanding retirement withdrawal strategy. Many retirees value this strategy because its simple to follow and gives you a predictable amount of income each year.

Potential disadvantages: Lately, this approach has been criticized for not considering the effects of rising interest rates and market volatility. Indeed, if you retire at the onset of a steep stock market decline, you risk depleting your savings early.

Recommended Reading: How To Roll Your 401k From Previous Employer

What Is A 401k Cares Act Withdrawal

Normally, participants who withdraw money from a tax-deferred retirement account before reaching age 59½, must pay a 10% early withdrawal penalty in addition to including the distribution in their taxable income for the year.

There are a few exceptions to the rule, including one for hardships, such as avoiding foreclosures, repairing your home after a disaster, or covering out-of-pocket medical expenses. However, these hardship withdrawals are normally limited to the amount needed to meet a limited list of hardships.

The CARES Act provided more flexibility for making emergency withdrawals from a tax-deferred retirement account by eliminating the 10% early withdrawal penalty. Participants are allowed to withdraw up to $100,000 per person without being subject to a tax penalty. Any early withdrawals above that amount dont qualify for special tax treatment.

It is important to note that the withdrawal is taxable income the special tax treatment waives the tax penalty but not the taxable event. However, the CARES Act allows people who take hardship distributions to elect to pay federal income taxes on the distribution over a three-year period or repay the distribution amount over a three-year period and avoid tax consequences entirely. The three-year repayment period starts on the day of the distribution.

When To Consider A Retirement Early Withdrawal

You should consider making withdrawals from a retirement account only under dire circumstances. Given the financial and emotional impact that situations such as the COVID-19 pandemic as well as national disasters have had on Americans, there are situations when it could make sense to withdraw early.

Also Check: How Much Can You Borrow From 401k

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

Cash Out Your Old Account

Think long and hard before you do this. Its almost never the best choiceand it triggers a big tax bill!

Advantage

- Its money you can use to pay bills or for another purpose. Also, if you left your job during or after the calendar year in which you turned 55, you wont owe an early-withdrawal penalty.

Disadvantages

- Youll owe income taxes on your money. If you’re in a 30% combined federal and state tax bracket, for example, and cash out a $50,000 account, you’ll have only $35,000 left after taxes.

- You will destroy your retirement nest egg.

The bottom line: For most people, the best option is to move your savings into an IRA, which gives you the most freedom and control over your money.

Also Check: Can You Transfer An Ira Into A 401k

How To Withdraw From A 401k When Leaving The Country

When you leave the United States, its easier to move your belongings and cash accounts than it is to tap into your 401k plan if youre under age 59 1/2. Even though youre leaving the country, IRS tax rules will follow your plan wherever you go. Because penalties for early access are high, you should explore less expensive options if you dont qualify for one of the exceptions available for persons under 59 1/2.

Review your situation. If youre over age 59 1/2, youll only pay income taxes as if you earned the money this year. Those under age 59 1/2 will pay a 10 percent penalty unless the withdrawal qualifies as a hardship, is used for unreimbursed medical expenses, health insurance premiums while unemployed for at least 12 weeks, a total disability or qualifying higher education expenses.

Complete paperwork if the 401k administrator wont allow telephone redemptions. To speed up the process, ask the company to email or fax the forms. Also, ask the 401k administrator if the company accepts faxed or emailed scans of the documents. If so, you may receive your funds more quickly.

File the receipt attached to your check after verifying your withdrawal was completed correctly. Review the withholding and any penalty withholding. If anything is incorrect, dont cash the check. Call the 401k provider and ask questions until youre satisfied that your withdrawal was successfully administered.

References

What If You Are The Beneficiary Of A 401 Plan

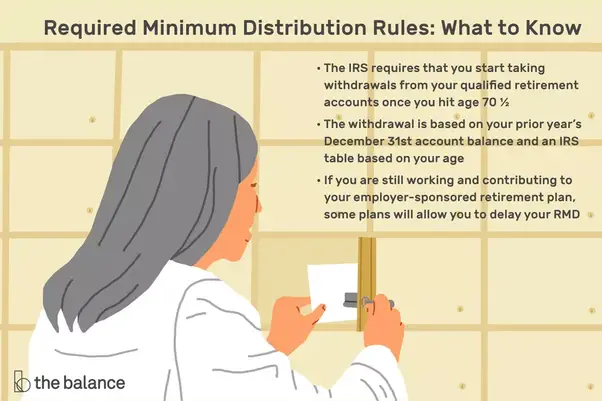

If you are the beneficiary of a 401 plan, you’ll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

If you or your spouse turned 70 1/2 before Jan. 1, 2020, the age for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or after Jan. 1, 2020, the age for RMDs is 72.

Also Check: How To Manage Your 401k Yourself

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be an expensive proposition because of the hefty penalties they carry under many circumstances.

The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72 . There are some exceptions to these rules for 401ks and other qualified plans.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement. The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, you can use this calculator to determine how much other people your age have saved.